Fintech: CFPB takes aim at one of fintech’s most popular products, again

How will the CFPB's most recent proposed rule impact earned wage access services?

Hi Fintech Futurists —

Today’s agenda below.

FINTECH: CFPB's new rule takes aim at one of fintech’s most popular products

LONG TAKE: Europe cracks Apple's NFC payments and commerce monopoly (link here)

CURATED UPDATES: Paytech, Neobanks, Lending, Digital Investing

To support this writing and access our full archive of newsletters, analyses, and guides to building in Fintech & DeFi, subscribe below. We just adjusted the price to $12/mo.

Digital Investment & Banking Short Takes

CFPB's new rule takes aim at one of fintech’s most popular products

Earlier this year, we discussed the Consumer Financial Protection Bureau’s (CFPB) new interpretive rule that aligns Buy Now, Pay Later (BNPL) providers with credit card companies. We noted this move as part of a series of rapid decisions by the CFPB, a trend we expected to continue this election year.

True to form, the CFPB made headlines again last Thursday with a new proposed interpretive rule, this time targeting earned wage access (EWA) products. If approved, this rule would classify most EWA products as consumer loans, subjecting them to the Truth in Lending Act (TILA). Further, both the "tipping" and the "expedited funds delivery fee" features — both critical to the product's economics — would be considered finance charges, mandating providers to disclose more information to consumers, including fee breakdowns and annual percentage rates (APRs).

To understand the significance of the CFPB’s ruling, it is important to understand the journey leading up to it. Although Earned Wage Access (EWA) services have been available since the early 2010s, their popularity and the number of providers have surged in recent years. Despite this growth, EWA services have always operated in a legal gray area. Some people argue that EWA should be classified as a loan, while others believe it is a distinct product that warrants its own set of regulations.

The disagreement arises from the fundamental nature of the product.

The Earned Wage Access (EWA) product, often called "paycheck advance" by the CFPB, gives employees financial flexibility by allowing immediate access to wages they've already earned. For instance, an employee working 14 consecutive days accrues earned wages daily, but usually waits until the end of the pay cycle to receive payment. EWA enables employees to access a portion of these earned wages before the traditional payday.

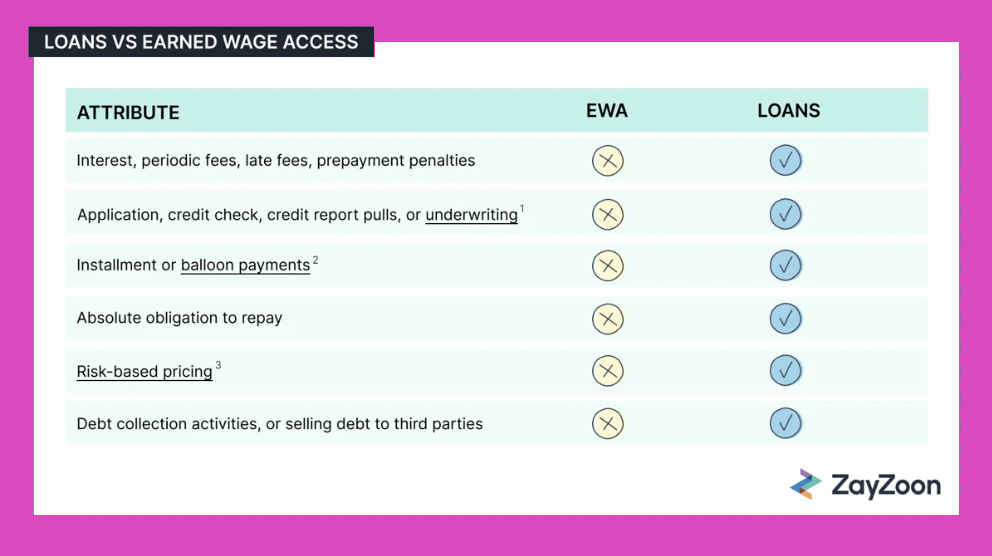

In this way, it resembles an extension of credit, as individuals receive money that will be repaid later. However, EWA products differ significantly from traditional loans. They are non-recourse, require no credit check, do not affect credit scores, involve no underwriting, charge no interest, and provide access to money that employees are legally entitled to.

From this perspective, it's easy to understand why many argue that EWA products are not loans.

So, if the product constructs mentioned above hold, how do Earned Wage Access (EWA) companies make money? They typically use one of two business models: Business-to-Business (B2B) and Business-to-Consumer (B2C). In the B2B model, EWA companies partner with employers, who pay the EWA company directly to offer the service as a benefit to their employees. Conversely, the B2C model is provided directly to individuals without employer involvement.

These programs use bank transaction data to estimate earned wages, allowing individuals to access a portion of their estimated earnings. Without employer compensation, B2C companies generate revenue through other means, such as charging membership fees, offering expedited delivery of funds for a fee, and requesting "tips" from users for the service (it should be noted that the B2B model can have these charges as well, although less common).

With this context in mind, we turn to the CFPB rule. By reclassifying EWA products as loans (contrary to an earlier advisory opinion released by the CFPB in 2020) and determining that “tips” and expedited fund delivery fees are finance charges, two major issues arise.

First, there is the added operational burden and cost of complying with the stringent TILA requirements. Second, when the flat per-transaction fee is recalculated as an annual percentage rate (APR), it is treated as if it were an interest payment on a loan. This calculated APR varies significantly depending on the length of the employee’s pay period and whether an employee takes a payout near the beginning or end of that pay period — even though the actual cost to the employee remains the same. While this aims to present a figure easily understandable by the consumer, one could argue it achieves the opposite.

So, what will the impact of this rule be? First, it is important to note that this is a proposed interpretive rule, open for comments until August 30th. Until then, nothing is finalized. However, as it stands, we believe the impact will vary, with some groups feeling the effects more acutely than others.

For EWA providers heavily reliant on tipping and expedited delivery fees, the repercussions could be significant. Take Dave Inc. as an example. Over the past four quarters, processing fees (expedited services) and tips consistently accounted for 79-81% of their operating revenue.

MoneyLion, while not providing numbers as detailed as Dave's, noted in their 2023 annual report that regulatory changes to earned wage access products pose a material risk:

...some of the products and services we offer, including our earned wage access product, Instacash, are relatively novel and have been and may in the future continue to be subject to regulatory scrutiny or interest and/or litigation. While we continue to respond to and cooperate with state regulators and will continue to do so in the future, as appropriate, any regulatory action in the future could have a material adverse effect on our business, financial condition, results of operations and cash flows.

For B2B providers who are paid directly from employers, the impact of the proposed rule should be minimal. However, even within the B2B space, the effect could be felt differently among participants.

Clair, for instance, operates with a unique model — they charge no fees to employers or employees. Instead, funds are deposited into a Clair account through a partner bank, and Clair earns revenue from the interchange fees on each debit card transaction. We think this ruling could benefit Clair, potentially driving more business their way.

The impact on customers varies depending on which camp you sit in. While there's potential for abuse of Earned Wage Access (EWA) products, as highlighted by CFPB's research, many view these programs as essential lifelines. A June 2023 report by the Harvard Kennedy School provided insightful data:

A key positive of EWA is that users like the service and view it positively, especially compared to alternative financial services. In a third-party survey initiated by ADP, 96% of employers offering EWA said that their employees like EWA and that it helps improve their sense of financial security. Wagestream cites 72% of users who felt an improved quality of life (compared to 37% for the global average for financial inclusion services). Research on Brigit, MoneyLion, and Earnin found that a majority of users said that EWA made them feel more in control of their finances and less stressed about their financial situation.

Looking at the larger picture, this whole situation is reminiscent of the CFPB's regulation of Buy Now, Pay Later (BNPL) products — another instance of trying to fit a square peg into a round hole. Technology has fundamentally transformed financial services, creating new products that don't always align with existing legislation. Instead of taking the path of least resistance by forcing these innovations into outdated frameworks, we should invest the effort to fully understand them and develop appropriate regulations.

Financial products need regulation, and consumer protection is crucial, but it must be done correctly.

👑 Related Coverage 👑

Blueprint Deep Dive

Long Take: Europe cracks Apple's NFC payments and commerce monopoly

Gm Fintech Architects — Today’s premium edition is food for thought, and open to all subscribers. We are diving into the following topics: Summary: We explore how technology acts as an extension of human thought and its implications for freedom, capitalism, and regulation. We delve into the importance of allowing financial innovation while balancing safet…

Curated Updates

Here are the rest of the updates hitting our radar.

Paytech

⭐Chase Is Changing How People Can Pay Credit Card Bills: What to Know - Newsweek

Block's Cash App to Exit UK Market, Stock Drops - Yahoo Finance

African remittance app Nala raises $40 million to go global - Finextra

Neobanks

Monzo unveils plans to offer a bank account for children - The Independent

Revolut Revenues Jump 95% With Addition of 12 Million Customers - PYMNTS

Why the Synapse Bankruptcy Has the Fintech World on Edge - The Wall Street Journal

Lending

Jifiti introduces tap now, pay later - The Paypers

Digital Investing

⭐Klarna Reportedly Prepping for Possible 2025 US IPO - PYMNTS

Warburg Pincus invests $100m in Matera to fuel growth in North America - FinTech Global

Major Stripe investor Sequoia confirms $70B valuation, offers its investors a payday - TechCrunch

Aven Reaches Unicorn Status with $142 Million Series D Investment - Fintech Finance News

Bain Capital to buy financial software vendor Envestnet in $4.5 bln deal - Reuters

🚀 Level Up

Join our Premium community and receive all the Fintech and Web3 intelligence you need to level up your career. Get access to Long Takes, archives, and special reports.