Long Take: Europe cracks Apple's NFC payments and commerce monopoly

Regulations push for more open access to Apple’s infrastructure, but only in Europe

Gm Fintech Architects —

Today’s premium edition is food for thought, and open to all subscribers.

We are diving into the following topics:

Summary: We explore how technology acts as an extension of human thought and its implications for freedom, capitalism, and regulation. We delve into the importance of allowing financial innovation while balancing safety and security, highlighting how open-source and blockchain technologies can address some market inefficiencies. The discussion includes Apple's vertical integration and monopoly power, with recent regulatory developments in Europe pushing for more open platforms and competition. These regulations aim to foster innovation by ensuring that large tech firms like Apple provide access to their infrastructure, potentially benefiting new fintech and crypto initiatives.

Topics: Stephen Wolfram, Apple, Steve Jobs, Epic Games, European Commission, Wells Fargo, Fifth Third Bank, Ethereum, Solana, Linux, Android, Republican Party, Democratic Party, SEC, OpenAI, Meta, Amazon, Switzerland, Lithuania.

To support this writing and access our full archive of newsletters, analyses, and guides to building in the Fintech & DeFi industries, see subscription options below.

In Partnership

Generative Ventures invests in the machine economy — the financial activity settled on blockchain protocols and accelerated by the machine labor of generative AI.

Long Take

Who Makes Technology?

Technology is an extension of human thought.

Fire is a technology that creates warmth, something a human may want in the cold. Cities are a technology that creates shelter, supporting primal human needs and desires. The Law is a technology for organizing individuals into societies and cooperatives in the face of selfishness and the drive to destruction. Language, arguably one of our most powerful technologies, is the medium for communication.

Each of these objects above is a mirror, an echo of neural activity within individuals. Those ideas found a home in some broader group, who formed teams and created outcomes in the real world. People die, but the reverb of their creativity lives on. We walk by street corners decorated in past fashions. We read books penned centuries ago, touching on the human condition we still experience today.

We live in the timeless waves of human thought, materialized into the physical world.

Those thoughts are often simple things, limited in shape and impact. But when they open up and begin to interact with the rest of the world, with other people and their ideas, complexity emerges. The simplest atomic rules combine to make a fabric of chaos that feels alive.

In this, Stephen Wolfram’s writings are an unparalleled resource. We merely try to rhyme.

So, what are we actually talking about?

Finding our Principles

One of the best basic rules for the human super-organism is freedom, especially at the level of the individual. We have some intuitive sense of what this means. But in reality, things are much more complex.

Freedom doesn’t hold meaning in the abstract, it is profoundly relational. Is it freedom to do anything you want to anyone else, without a State stopping you? Opening a business and having no regulation is freedom. Stealing from your customers is also freedom. Raising an army and conquering a territory, well, isn’t that freedom too?

Or maybe it is a freedom to be safe from what other people would do to you if left unhampered? Certainly, those with the least power would like that kind of freedom! But one can twist this too. If heavy protection is the only way to achieve freedom, then we define freedom by what others cannot do to you. Such negative space of constraint comes through social will and consensus — you are back to dealing with people and their arbitrary opinions.

As you change these definitions of what exactly you want freedom *from*, your outcomes in the grand cellular automata of life and society will shift as well. Certainly, much of the Western World is going through this transformation right now. The Republican Party of old is dead, long live the new national populism! Who would predict that union leaders would speak at the Republican convention? Unless you trace the history back and remember that Democrats actually used to be the party of the plantation owners.

Here’s what we know.

We want freedom for innovators and entrepreneurs to transform and experiment with the shape of financial services — not just tweaking distribution methods or the efficiency of risk engines. We want to lean out of orthodoxy and into creativity.

Not everyone in our industry wants this — you may instead want soundness and safety. A solid, static behemoth. These other principles are valid too! They just represent a freedom from shocks and unnecessary change. Chaos and stasis must always whisper to each other.

We want embedded finance to work. We want Fintechs to have access to our bank data, move our money, invest our change, and use AI to decide asset allocations and automatic rebalancing. We want the regulators to let go of ancient law, and for the explorers to explore.

We want crypto and open networks to prosper. Just like Linux overtook Windows and Apple in operating system relevance with the launch of Android, we want Ethereum and the Web3 financial rails to overtake the proprietary corporate payments, banking, and asset management rails.

Just like the Internet is free.

Capitalism is another basic element in the cellular automata. You set the rules of economic competition, and commerce and markets unfurl. Economies create businesses from the mana of consumer surplus. YouTube creates videos from the mana of human desire for attention. Wikipedia generates knowledge from the human want for authority and status.

How can we want freedom for financial innovation and not want capitalism? Of course we want capitalism! But capitalism is *only* a mechanism — one that becomes squishy and disorganized under close inspection.

Do we correct for unfair outcomes? Do we correct for an equal starting place across all small businesses?

Do we save the local coffee shop at the expense of Starbucks, or vice versa?

Do we penalize polluting companies for the negative externalities they create? Or do we subsidize the Teslas of the world?

The answers are detailed and complex. For every outcome that capitalism generates, humans can disagree on what is fair and just. Economic failures are common, and local maxima can trap us in equilibria that are simply unfair and unpleasant. Just like a machine learning algorithm can get struck optimizing the wrong thing, so can the machinery of markets. Just look at Gamestop or Solana.

There is a whole field of study in economics dedicated to efficiency, equilibria, and the best social outcomes. If you could incentivize an economy such that everyone is better off, surely you would do it! What if you could make one person better off, and make nobody else worse off (i.e., Pareto efficient)? Is that worth doing? And what if you make someone a little worse off, but someone else a lot better off?

These are complicated questions and reducing them to math can be misguided.

But the intuitions we develop from the questions are valuable.

Apple’s Monopoly

Open source and token networks address some of the endemic failures of capitalism — (1) a failure to provision public goods and (2) for-profit capture of community resources.

In the past, governments were the primary guarantors of public goods. This is why regulators stress the importance of minimizing externalities from corporate misbehavior. An orderly financial market and access to safe financial products is a public good — something that many companies try to attack for their own benefit.

See, for example, Fifth Third Bank paying $20 million in penalties to the Consumer Financial Protection Bureau for creating fake bank accounts and selling unneeded auto insurance policies. Or, the Wells Fargo scandal, where Wells paid $3 billion in fines for creating millions of fake accounts with unwanted financial products. These banks — any banks at scale — are in a position of power relative to customers and, systemically, they are incentivized to abuse it by the mere presence of custody.

However, protection from this harm can cut the other way, just as we highlighted in discussing the concept of freedom. By fearing the potential for fraud and abuse, regulators can weed beautiful new things from the garden of commerce. Only the old flowers will grow, and nothing new can flourish.

This is why we support the political and social change that has led to the SEC losing in the courts against blockchain entrepreneurs. Operation Chokepoint 2.0 was a profound mistake by the Democratic incumbents that may cost them the election.

On the other hand, there are times where regulation is the right sword. Take Apple.

Unlike the open source and crypto movements, which create software that can be permissionless and remixed or used by anyone, tech companies tend to integrate their value chains vertically. Apple manufactures its devices, writes the operating system and software, and heavily polices the financial tendrils in and out of the ecosystem. It appears it will also design and host its own foundational AI models and control the data servers that process the data.

This is fantastic from a user experience perspective, and terrible from a switching cost point of view.

The network effects keeping people in this wonderful bubble are extremely powerful — so powerful that new technologies like third party AI services (e.g., like OpenAI, which Apple is copying) or third party application and content platforms (e.g., like Amazon Kindle, which Apple has copied), or marketing providers (e.g., like Meta, which Apple has copied), or crypto wallets and app stores (which Apple has not copied *yet*) are unable to retain the value for their innovation.

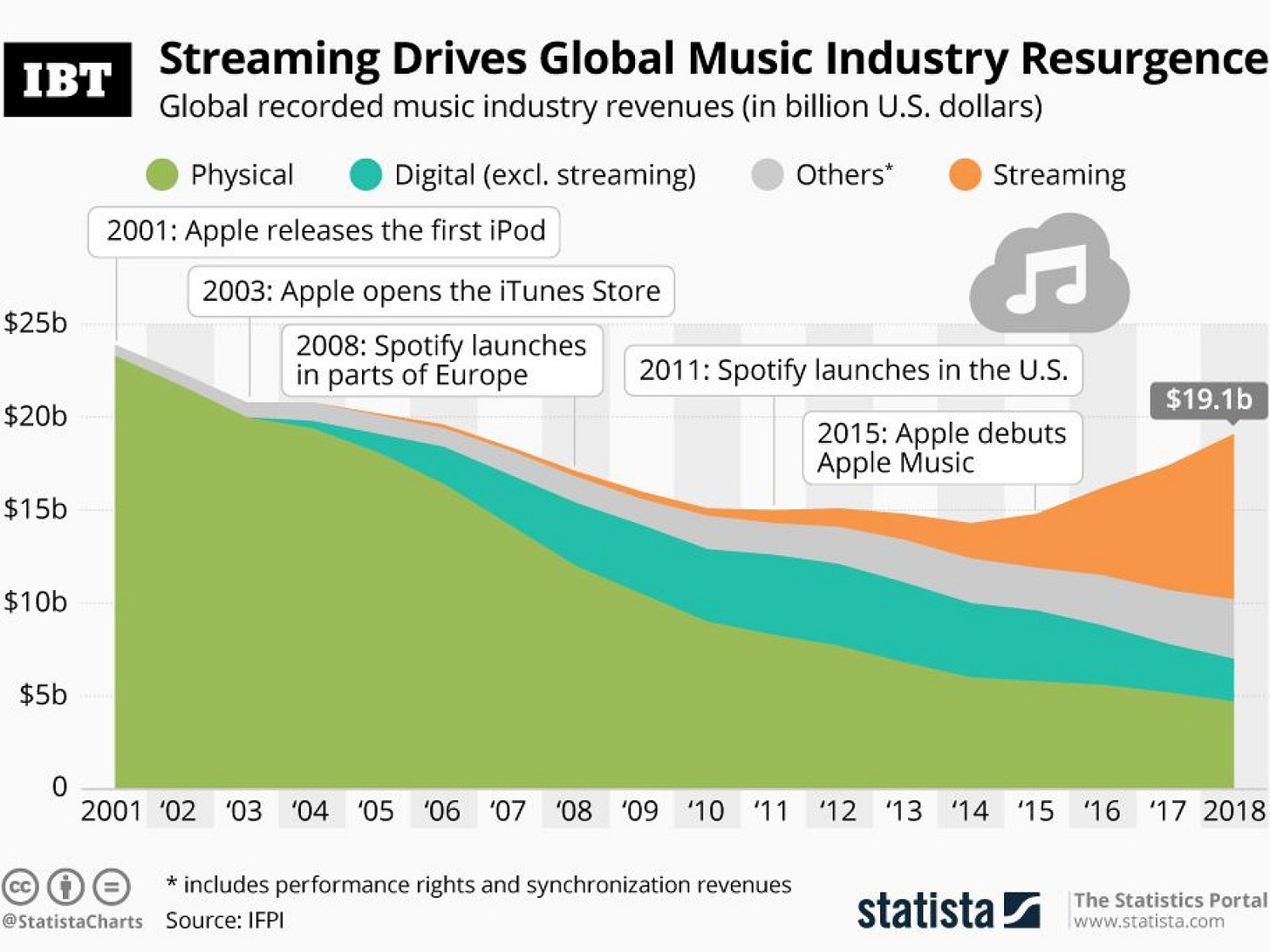

For the brightest example, let us remind you what Steve Jobs did to the music labels.

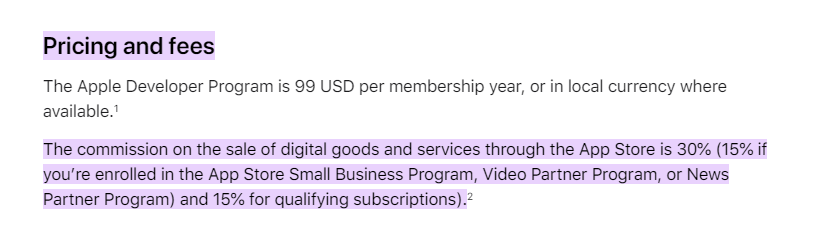

Distribution is leverage. Apple can use its monopoly power to platform or de-platform any business that uses its footprint. And of course, they take a 30% fee for the privilege.

Not 1.5% and a few cents, like in payment processing. Not a few cents or dollars paid by the customer, like the gas on the Ethereum or Solana network. But 30% — something akin to the tax rate you pay to the United States government for running the entire country.

So it is with this context that we are excited to see the following developments in Europe:

The Epic game store has been allowed back into Apple after a protracted multi-year fight. This is a large victory under the European Digital Markets Act, which in turn echoes the PSD2 legislation that pushed forward open banking and the requirement that banks have to make their data and execution capabilities accessible.

Failure to comply with the act carries the following punishment — up to 10% of the company’s total worldwide annual turnover, or up to 20% in the event of repeated infringements. For Apple, that’s 10% of $90B of revenue per year!

Apple has committed to the European Commission to grant rivals access to a standard technology used for contactless payments with iPhones in stores. Apple Pay has been a strong growth vector for Apple, and the NFC technology that powers proximity payments has benefitted the iPhone while undermining any payment device or point-of-sale terminal that is not an iPhone. The European Commission has pushed Apple to make its payment processing infrastructure available to third-party companies trying to build services on top of it.

European Advantage or Disadvantage?

Europe often gets ridiculed for its obsession with regulation.

Here’s the meme.

European regulation can be a stranglehold on the engine of commerce and capitalism. The region is far more conservative when it comes to new business creation and venture capital funding. As a result, there is less industrial creativity to show for it. And yet, Switzerland has been a safer home to crypto companies than New York, and Lithuania has been a better Fintech center than Delaware.

We are excited to see a requirement that guarantees open platforms, rather than closed ones. Europe’s data laws may be cumbersome, but its requirements for banks to open up APIs are visionary. Similarly, we think that forcing large tech firms to become better infrastructure for new, smaller businesses is a fantastic idea. We hope that Apple can be a home for many new fintech plays and platform companies as a result.

Perhaps it will also be Europe that pushes Apple to make crypto more free on the iPhone. Or perhaps the American politicians will finally see the importance that tech platforms play in the distribution of digital assets, and incentivize phone companies to build native crypto capabilities and open fintech rails. This is a necessary frontier if we are to see open finance flourish.

🚀 Postscript

Sponsor the Fintech Blueprint and reach over 200,000 professionals.

👉 Reach out here.Read our Disclaimer here — this newsletter does not provide investment advice

![Maximum and Minimum Values [11.7] Maximum and Minimum Values [11.7]](https://substackcdn.com/image/fetch/$s_!Gyb_!,w_1456,c_limit,f_auto,q_auto:good,fl_progressive:steep/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2F79a8c2e8-725e-43f5-bbd4-6f871c26fa1d_850x652.jpeg)