Fintech: CFPB rules BNPL = Credit Cards, must comply with Truth in Lending Act

Can BNPL providers successfully adapt to meet requirements of the Truth in Lending Act?

Hi Fintech Futurists —

Today’s agenda below.

FINTECH: How Will the CFPB’s New Ruling Change BNPL?

LONG TAKE: Despite Ethereum ETF approval, 🦄unicorn projects are in trouble (link here)

CURATED UPDATES: Paytech, Neobanks, Lending, Digital Investing

To support this writing and access our full archive of newsletters, analyses, and guides to building in Fintech & DeFi, subscribe below. We just adjusted the price to $12/mo.

Digital Investment & Banking Short Takes

How Will the CFPB’s New Ruling Change BNPL?

The Consumer Financial Protection Bureau (CFPB), the U.S. agency working on safeguarding consumers in the financial sector, issued an interpretive rule to clarify how Buy Now, Pay Later (BNPL) loans should be classified under the Truth in Lending Act (TILA). The ruling asserts that, in the eyes of the CFPB, BNPL providers are akin to credit card issuers and must extend the same legal rights and protections to consumers as traditional credit cards do.

Specifically, the rule will require BNPL providers to:

Investigate disputes raised by consumers and pause payments during the investigation

Credit refunds to the consumers' accounts when products are returned, or services are canceled

Provide consumers with periodic billing statements akin to those received for credit card accounts

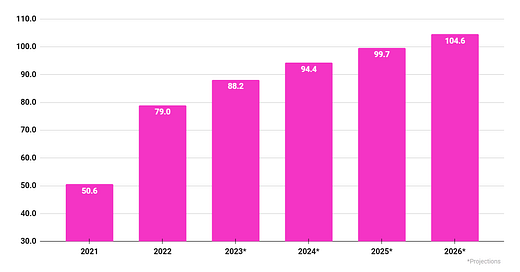

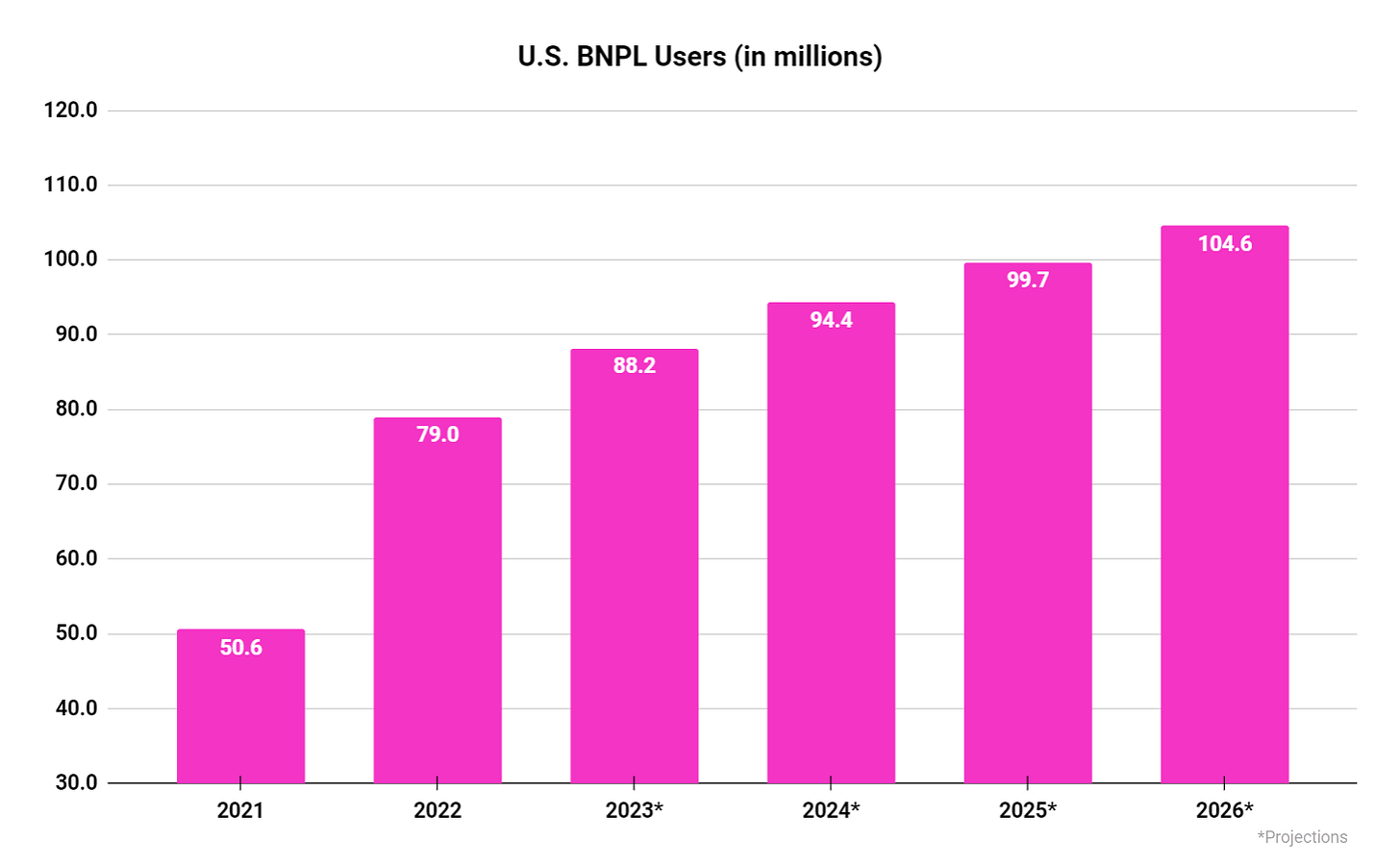

The CFPB's move to enhance BNPL regulation was expected. BNPL has experienced rapid growth in recent years, prompting the CFPB to begin studying the industry in 2021 and issuing reports in 2022 and 2023.

Let’s open up the context on how we got to this point.

The new interpretive rule is based on the Truth in Lending Act (TILA), a law enacted in 1968 to promote the informed use of consumer credit. Before TILA, the credit and lending industry lacked transparency, with hidden fees and unequal lending practices that made it difficult for borrowers to understand and compare loan terms. TILA addressed these issues by mandating clear, standardized disclosure of credit terms and costs, ensuring transparency, and enabling consumers to make more informed decisions.

Over the years, TILA and Regulation Z, which outlines the rules to enforce TILA, have undergone several updates. In the 1990s, changes addressed mortgage and home equity lines of credit (HELOCs) issues. In the early 2000s, updates focused on improving credit card transparency and tackling predatory lending practices. In 2010, as part of the Dodd-Frank Act, TILA was further strengthened, which led to the creation of the CFPB.

Now, without delving into the entire ruling — which you can read here — let’s consider what the CFPB did with the historical context in mind. Before this interpretive rule, BNPL primarily operated outside of TILA, while credit cards were regulated by it. The CFPB, through a series of interpretations, some more questionable than others, determined that Congress *intended* the term "Credit Card" in Regulation Z to include products like BNPL loans. As a result of this interpretation, BNPL companies are now classified as “card issuers” and became subject to the same rules as credit card companies.

There is some justified frustration with the CFPB's process in enacting this change as an interpretive rule rather than a formal amendment.

Interpretive rules are generally issued for smaller items and provide guidance on how to comply when there is ambiguity within a law. They do not require debate and often go into effect quickly — 60 days in this case. On the other hand, formal amendments go through a standard process involving proposal, debate, and enactment over extended periods, giving affected parties the time needed to comply. While the new ruling on BNPL is not on the scale of some of the major amendments like Dodd-Frank, it is still significant. We could argue that BNPL loans are unique enough to warrant an actual amendment or a new regulatory framework, as has been done in other countries.

Ironically, BNPL providers have always prided themselves on being more transparent than other forms of credit, and, in our opinion, this is true. Libor Michalek, Affirm’s president, touched on this in our podcast interview with him the other week.

Many BNPL providers already do what the interpretive rule outlines, and in some cases, they do more.

Despite this, enacting the interpretive rule means that once finalized, providers will need to become fully compliant within 60 days. Even if the provider largely meets the "letter of the law" (or, in this case, "rule"), adjustments to internal operational processes, technology infrastructure, and other areas will still be required. As anyone who has participated in such implementations knows, the process is complex and involves multiple steps. The reality is that 60 days is insufficient time to make such changes.

That said, this regulation is a positive step. While over-regulation can be problematic, the lack of regulation can be equally troubling, affecting both the end consumer and the provider. Operating in a legal gray area is challenging for firms, as anyone in the crypto space can attest.

So, where does this leave us, and what are the broader implications? For consumers, this interpretive rule could be seen as a win. Although much of what is outlined in the interpretive rule is already being implemented to varying degrees by BNPL providers, it offers a clearer framework and standardization across the industry.

For providers of BNPL services, the rule should level the playing field among providers when handling specific issues. However, it will almost certainly drive up operating expenses in both the short and long term. Overall, large industry participants seem generally supportive of the interpretive rule.

Affirm stated, “We are encouraged that the CFPB is promoting consistent industry standards, many of which already reflect how Affirm operates, to provide greater choice and transparency for consumers”.

Similarly, Klarna described the announcement as “...a significant step forward in getting BNPL regulation in place in the US…”...although caveated it by noting “It is baffling that the CFPB fails to acknowledge the fundamental differences between BNPL and credit cards”.

For the broader market, this situation once again highlights the ongoing issues around the classification of BNPL loans. While this specific case is tied to the CFPB's interpretation of BNPL loans in relation to TILA and Reg Z, the question of how to handle BNPL loans extends to other industries as well.

Credit bureaus, for instance, have faced challenges in establishing rules for the treatment of BNPL loans. Functionally, each transaction is underwritten separately and viewed as an installment loan, which does not align with the open-ended nature of lines of credit or credit cards. However, classifying them as individual loans is also problematic because the quick repayment cycle (short duration) can negatively impact credit scores.

These issues, among others, will likely lead to more specific guidelines for handling BNPL loans in the coming years, especially if the CFPB continues its rapid pace of rulings and announcements. In the meantime, we can expect the BNPL category to continue its growth — especially with companies like Apple and Google participating — which will sharpen the user experience.

👑 Related Coverage 👑

Blueprint Deep Dive

Long Take: Despite Ethereum ETF approval, 🦄unicorn projects are in trouble (link here)

We have just crossed the line into approval for the ETH ETF, driving prices up to new highs, as well as a political step change in the treatment of crypto in Washington.

In an unlikely turn of events, the winds have shifted towards innovation and digital assets are now a bi-partisan consensus. BlackRock and Fidelity will be the champions of mega-cap crypto assets, continuing to push forward this bull market. There is $2.5 trillion of digital assets — on par with the last cycle high — but a market with decreasing regulatory overhang, and many bad actors weeded out.

Curated Updates

Here are the rest of the updates hitting our radar.

Paytech

French P2P App Lydia Spins Off Digital Banking - PaymentsJournal

Startup neobank Mercury is taking on Brex and Ramp with new bill pay, spend management software - TechCrunch

Google Pay lets customers ditch CVVs for biometrics - Finextra

Visa seeks to “revolutionise the card” with array of new product launches - Fintech Futures

Neobanks

⭐Synapse, backed by a16z, has collapsed, and 10 million consumers could be hurt - TechCrunch

Brazil’s Nubank profit surges to nearly $400M in Q1 2024 - Fintech Nexus

MercadoLibre Kicks Off Talks to Apply for Mexico Banking License - Bloomberg

bunq’s GenAI assistant Finn is now fully conversational - Fintech Global

Lending

Mexican BNPL firm Aplazo raises $70 million - Finextra

Yendo Raises $165 Million for ‘Vehicle-Secured’ Credit Card - PYMNTS

Lawsuit Accuses SoLo Funds Of Hiding Loans’ True Cost - Forbes

Digital Investing

⭐US SEC approves exchange applications to list spot ether ETFs - Reuters

British neobank Monzo boosts funding round to $610 million to crack U.S. market, launch pensions - CNBC

🚀 Level Up

Join our Premium community and receive all the Fintech and Web3 intelligence you need to level up your career. Get access to Long Takes, archives, and special reports.