Fintech: How SoFi grew to $23B of deposits & 10 million members

Strong Q3 results highlight the power of SoFi’s dual focus on banking and technology.

Hi Fintech Futurists —

Today’s agenda below.

FINTECH: SoFi's Dual Role: How Banking and Fintech Infrastructure are Driving Record Growth

LONG TAKE: Policy recommendations in Crypto, Fintech, and AI for the new administration (link here)

CURATED UPDATES: Paytech, Neobanks, Lending, Regulation & Policy, Digital Investing

To support this writing, please check out today’s sponsor. We recommend their free eBook below, which covers case studies for Stripe, Revolut, and Mastercard.

In Partnership with Goodface Agency

It takes 50 milliseconds for a FinTech website visitor to make a first impression — faster than a blink of an eye! With 26,000 FinTech companies worldwide, your website must stand out to get the desired results.

If you want to learn how Stripe, Revolut and other FinTech leaders design their websites to convert, read the white paper “30 Conversion Hacks From Top FinTech Websites” by Goodface FinTech Design & Development Agency.

👉👉👉 Download this 57-page PDF now 👈👈👈

Digital Investment & Banking Short Takes

SoFi's Dual Role: How Banking and Fintech Infrastructure are Driving Record Growth

SoFi, the digital lending neobank, capped off a busy few months—marked by new product launches, key strategic agreements, and continued technology innovations—by reporting its third-quarter 2024 financial results.

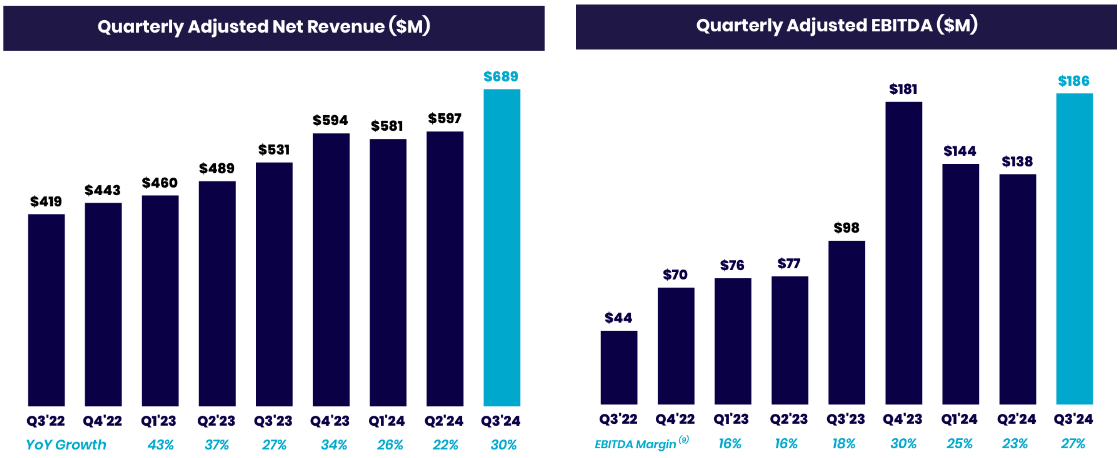

Across the board, the earnings were impressive, with both top-line and bottom-line numbers beating analyst expectations. In addition to its fourth consecutive quarter of profitability, SoFi reported record-high quarterly net adjusted revenue of $689 million (30% YoY growth) and adjusted EBITDA of $186 million (27% YoY growth).

Other key non-financial metrics were also impressive.

The company added a record 756,000 new members in the third quarter, bringing the total number of members added since the start of the year to over 2 million — a 17% increase compared to the same period the year before.

Ironically, despite these strong results, SoFi's stock experienced a drop immediately after earnings. In hindsight, this was not all that surprising — the stock had experienced a strong run-up before earnings, with many positive developments already priced in, leading to some profit-taking. However, much of the loss was quickly recovered in the following days.

While SoFi's core financial metrics are impressive, understanding the whole picture requires context about what SoFi is and does.

SoFi began as a student loan refinancing company in 2011. Over the years, they added various lending products and eventually expanded into a platform that offered deposit accounts and investment services.

While this might make SoFi seem like just another neobank, they are quite differentiated. Unlike other fintechs, SoFi does not rely on a third-party sponsor bank or embedded finance platform to extend its services. Rather, it has acquired its infrastructure — (1) buying Golden Pacific Bancorp, and (2) tech provider Galileo, and (3) banking platform Technisys.

This exposed the company to higher levels of regulatory oversight and capital requirements, but also provided more autonomy compared to currently beleaguered Banking-as-a-Service (BaaS) models. Becoming a bank allowed SoFi to directly accept deposits, creating a stable and low-cost funding source. With SoFi's deposits growing to nearly $23 billion in the latest quarter, the benefits of this strategy are evident, as noted by SoFi's CEO, Anthony Noto, in the company's Q3 earnings call:

We reduced our brokered deposits by $445 million as we continue to use our consumer deposits to replace higher cost parts of the funding stack. Currently, there is a 220 basis points difference between the interest we pay on deposits and the interest we pay on warehouse lines, which translates to more than $500 million in annualized interest expense savings given the size of our deposit base.

As mentioned, SoFi is also a fintech infrastructure provider, having bought Technisys and Galileo. At the time of acquisition in 2020, Galileo was a leading payments processing platform providing critical services such as card issuing and payments infrastructure, and SoFi was actually one of its customers.

In March 2022, SoFi acquired Technisys, a cloud-native core banking platform that enabled customizable and scalable financial products. Together, these acquisitions became crucial not only for powering SoFi's own services but also for allowing SoFi to offer the same infrastructure to other fintech companies.

This dual role — both a fintech and a fintech enabler — positions SoFi uniquely in the industry as a more vertically integrated player. They are not just competing for consumer deposits or loan originations, but also benefiting every time another fintech scales using Galileo's services. If SoFi’s fintech competitors do well, Galileo stands to benefit, and by extension, so does SoFi.

The strategy is paying off. The Galileo segment contributed a record $33 million to SoFi's Q3 profit, which is 32% of total profit. Additionally, Galileo accounts hit a new all-time high of 160 million.

While a full client list of Galileo's is unavailable, several key names are known and represent some of the world's largest fintechs. These include Robinhood, Dave, Monzo, MoneyLion, and Toast.

Looking ahead, SoFi appears well-positioned to sustain its operating growth as an index on the B2C fintech sector.

It has a multi-faceted business model that combines consumer banking services, a growing deposit base, and fintech infrastructure offerings, which power diversified revenue streams. As more fintechs enter the market and established players seek to modernize, demand for Galileo and Technisys capabilities will likely increase.

SoFi's ability to leverage its technology internally while offering it to other companies positions it as a leader in both consumer finance and fintech infrastructure. If SoFi can sustain its momentum, enhance profitability, and fully capitalize on its infrastructure advantage, it has the potential to become one of the more influential financial institutions of the next decade.

However, that does not always translate into capital gains. While recent stock performance has been impressive, we think investments around SoFi and its competitors should be evaluated on a relative basis. The game is about expectations, and the industry already prices SoFi as if it has won all the battles to come.

👑 Related Coverage 👑

Long Take

We highlight key policy recommendations and changes that could support the growth of financial innovation in the United States, particularly in fintech, crypto, and artificial intelligence. We advocate for clearer, supportive regulations for crypto companies, including easier access to banking and clear distinctions between securities and commodities, to prevent the exodus of blockchain development from the US.

We also emphasize the need for expanded open banking laws akin to Europe’s PSD2, better licensing for fintechs to create competitive financial services, and revitalized capital markets to encourage IPOs and acquisitions. Lastly, we call for a balanced, innovation-friendly regulatory approach to AI, avoiding preemptive constraints and supporting the integration of AI-driven economic activities.

Curated Updates

Here are the rest of the updates hitting our radar.

Paytech

⭐Stablecoins to become dominant payment instruments by 2029 - Finextra

MoneyLion Launches MoneyLion Checkout, Bringing E-Commerce Simplicity to Financial Services - Fintech Finance News

Apple adds another buy now, pay later service to Pay - The Verge

Marqeta to Embed BNPL in Payment Apps and Digital Wallets - Pymnts

Neobanks

⭐Revolut launches new study on legacy banks struggling to meet modern business needs - The Paypers

⭐Santander debuts digital bank in US - Banking Dive

Standard Chartered Partners With Wise For Money Transfers - Forbes

Lending

Upstart Stock Rockets Higher. CEO Says AI Lender Is ‘Back in Growth Mode.’ - Barron’s

Affirm launches in the UK as ‘buy now, pay later’ market faces regulatory overhaul - TechCruch

Dojo and YouLend Provide £1Billion in Flexible UK Business Funding, With Eyes on European Expansion - The Fintech Times

Regulation & Policy

⭐CFPB's Open Banking Data Access Controls Fall Short, Banks Say - Bloomberg Law

⭐FTC sues fintech Dave over alleged misleading marketing, undisclosed fees - Banking Dive

Financial Technology Association files suit challenging CFPB Buy Now Pay Later (BNPL) interpretive rule - Consumer Finance Monitor

Digital Investing

Mexican Fintech Klar Sets $500 Million Revenue Goal for 2026 IPO - Bloomberg

Fiserv, Capital One, others invest $150M in Melio - Payments Dive

🚀 Level Up

Join our Premium community and receive all the Fintech and Web3 intelligence you need to level up your career. Get access to Long Takes, archives, and special reports.