Long Take: Policy recommendations in Crypto, Fintech, and AI for the new administration

Policies That Could Ignite Fintech and Crypto Development in the US

Gm Fintech Architects —

Today we are diving into the following topics.

Summary: We highlight key policy recommendations and changes that could support the growth of financial innovation in the United States, particularly in fintech, crypto, and artificial intelligence. We advocate for clearer, supportive regulations for crypto companies, including easier access to banking and clear distinctions between securities and commodities, to prevent the exodus of blockchain development from the US. We also emphasize the need for expanded open banking laws akin to Europe’s PSD2, better licensing for fintechs to create competitive financial services, and revitalized capital markets to encourage IPOs and acquisitions. Lastly, we call for a balanced, innovation-friendly regulatory approach to AI, avoiding preemptive constraints and supporting the integration of AI-driven economic activities.

Topics: SEC, Gary Gensler, Liz Warren, Silicon Valley Bank, Signature, Silvergate, Biden administration, CFPB, Custodia, Column, Cross River, Synapse, Mercury, Stripe, Plaid, Visa, Revolut, JPMorgan, FTX, Arbitrum, Wyoming, Elon Musk, European Union, OpenAI.

This full Premium post is available to the entire audience today given the importance of these topics.

To support this writing and access our full archive of newsletters, analyses, and guides to building in the Fintech & DeFi industries, see subscription options below.

Long Take

The Election

We try to stay out of politics in this newsletter.

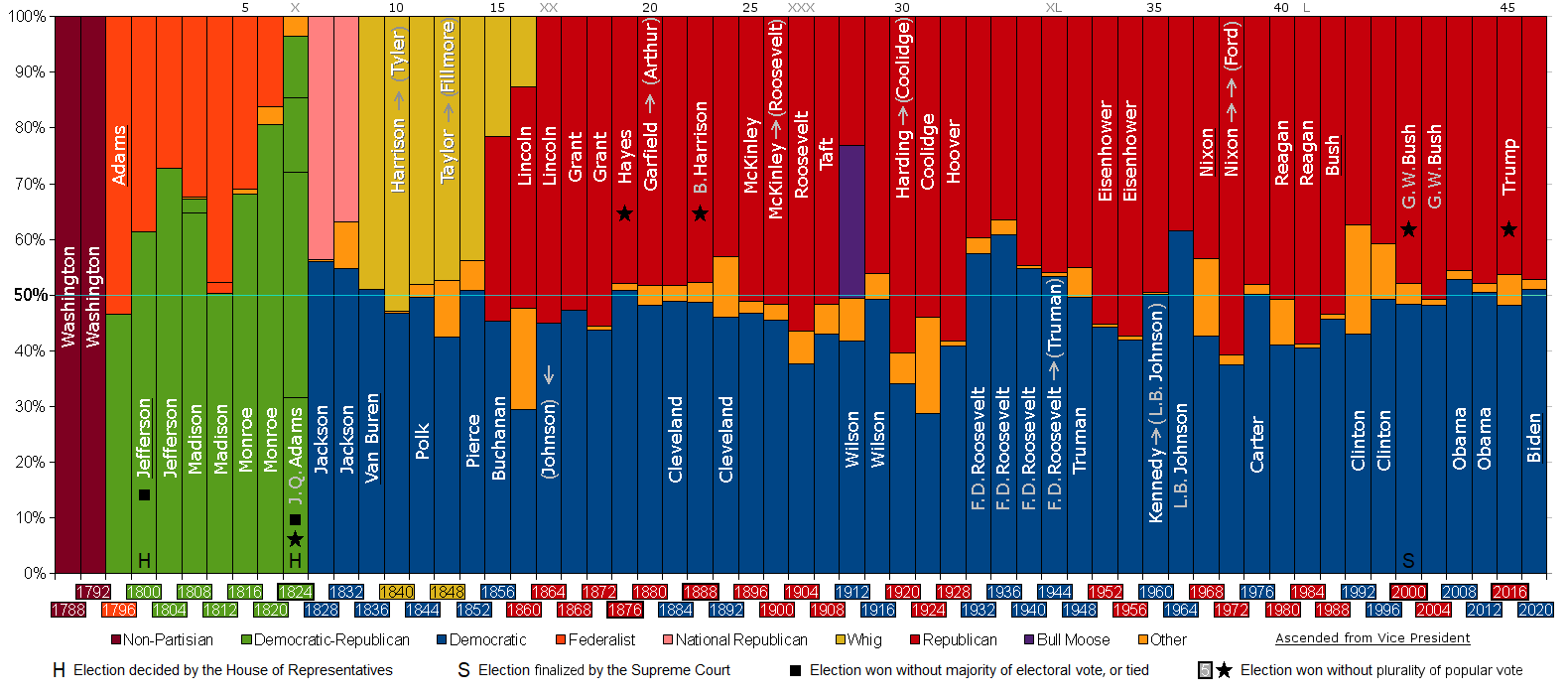

Pretty much every American election ends up as a coin flip. The electoral college creates a distorted view of how much support any candidate has received, while mostly reflecting the effectiveness of tactics about persuading swing voters, or the base, to get out and vote.

When everything balances on these razor-thin margins, how can we responsibly denigrate the other (winning / losing) side? How can we even say when an administration has a mandate? The pendulum inevitably will swing back and forth every four to eight years.

American politics has broken down from a collaborative game theoretical equilibrium — where both players recognize they are in a long-term game, and therefore collaboration is preferred — to a short-term calculation of the Prisoner’s Dilemma. If I cheat in this election and attack by adopting a destructive strategy, then my chances of winning are higher. But in a repeated game, that just means the other side will also adopt a destructive Tit-fot-Tat strategy, and we will yo-yo back and forth with a lower collective payoff. Thus identity politics.

The issues are of course far more polarized than this clinical view.

And the issues we care about in this space are those of financial innovation. One of the many Democrat mis-steps during this administration and election cycle has been the over-regulation and frivolous lawsuits against many innovative, high quality companies.

The amount of denigration, Kafka-esque bureaucracy, and other concerted tax-funded efforts to chase around Crypto that came from the Democrats burned out most people in the industry to the point they became single issue voters to get rid of SEC’s Chair Gensler and his political backer Liz Warren.

When you are doing something difficult, like building a business in a new sector, the last thing you need is a holier-than-though compliance officer telling you about everything you are doing wrong, and stopping you from opening bank accounts by colluding with banks, and occasionally bankrupting your customers or propping up fraudsters at your expense, and also you are paying for their salary out of your pocket. This shouldn't be a partisan issue, but is.

The last 4 years of financial policies directly radicalized an opposition and created a counterforce. You might think that Crypto is small as a political group, but it is the same cultural force as Elon Musk and the emerging Republican-leaning venture capitalists, who have great leverage.

This is the input.

And this is the output.

And the SEC isn’t the only example.

There is going to be a reckoning across the administrative state — in part wildly dangerous, in part potentially productive. Government isn’t Twitter, and the public sector has many considerations beyond commercial sustainability. But we expect Elon to give it the Founder Mode treatment. There are some realities which are politically untenable but must be dealt with — lower birthrates and an older age pyramid implies lower entitlement spending, high interest rates and a large debt burden suggesting the potential of sovereign defaults, and so on.

Here are the changes we would like to see that impact our industry.

Crypto

While some are excited about a Bitcoin reserve in the US Treasury to pump up BTC prices, the real gains are not in the prices of assets but in the ability of entrepreneurs to build new things that can grow the economic pie.

Crypto economic activity is largely denominated in the US dollar, and it should be a strategic priority for the country to support this trend with friendly and clear regulation. Given the continued importance of US borrowing (since the country keeps overspending) in the face of growing expense and global pushback to USD hegemony, more should be done to accelerate the growth of crypto dollars. Instead we have this:

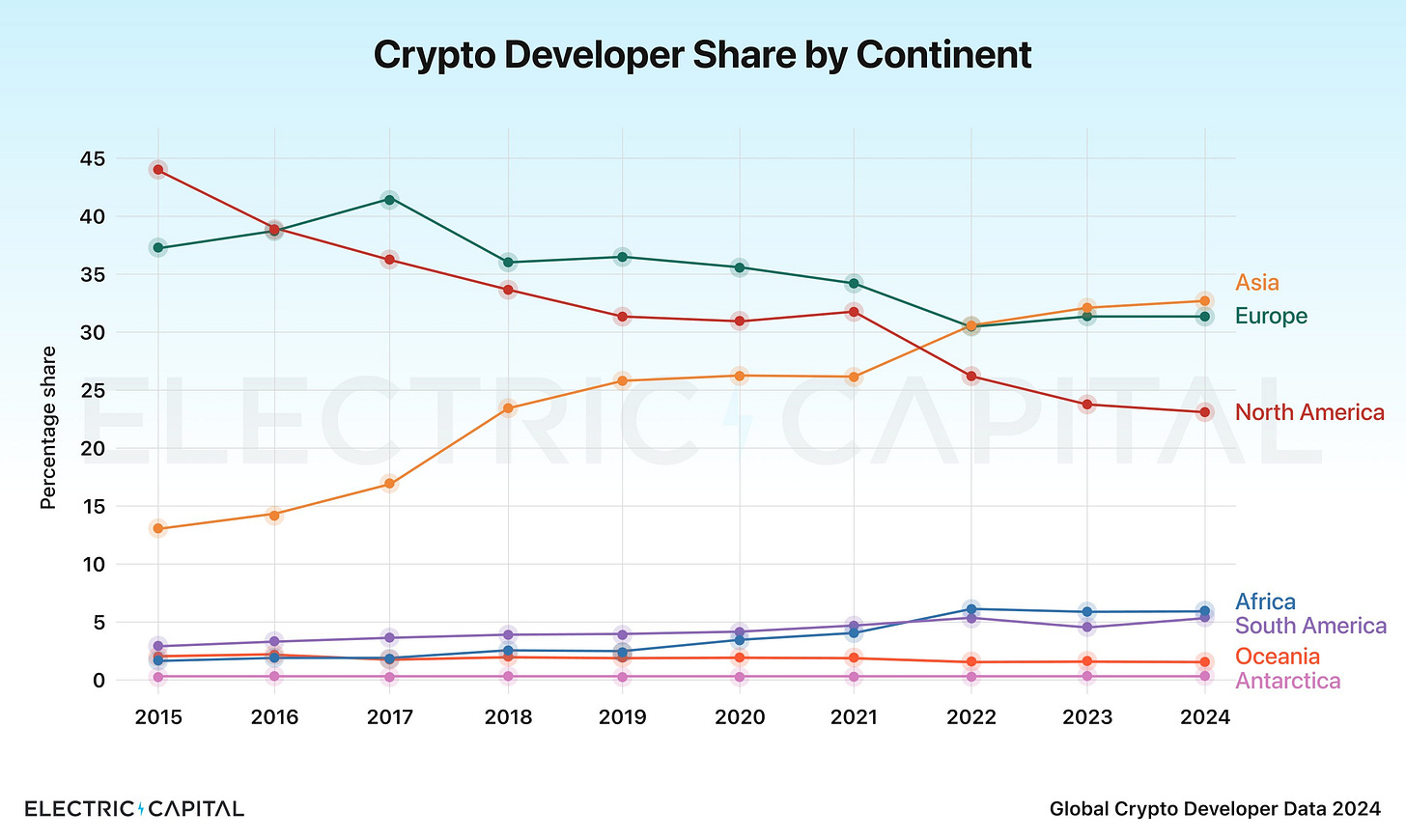

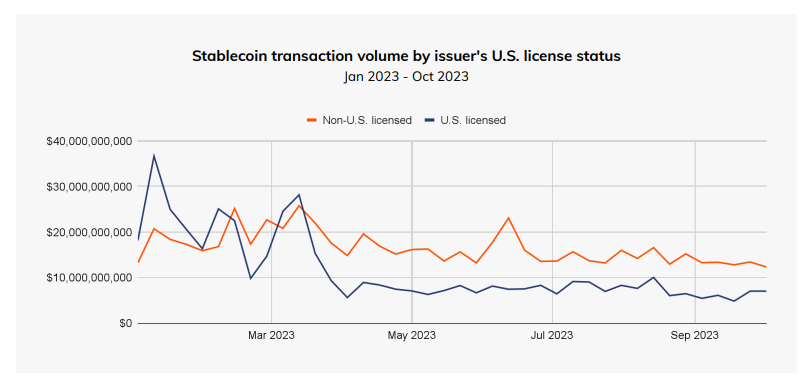

American share of global blockchain development is going down. The transaction volume of stablecoins from unlicensed entities is going up. We think both are reversible trends.

Here are a few wishlist ideas.

Access to Financial Infrastructure.

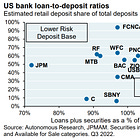

It is still highly difficult for companies that touch digital assets to get bank accounts. That doesn’t only mean asset issuers, but service providers, investors, developers, and technology companies. As a result, most of these players go to a select few banks that are smaller and more likely to generate concentration risk. As a reminder, consider Silicon Valley Bank, Signature, and Silvergate.More broadly, the government needs to immediately stop all tentacles of Operation Chokepoint 2.0 — the collective effort of the federal regulators to starve companies of financial resource in a prejudicial and capricious manner.

SVB shows the danger of forcing an entire industry into a niche provider. Perhaps start-ups would have still chosen to bank with SVB, but they would have had an easier time switching out to a larger national footprint like JPM if that was available. In the case of crypto companies, such choice was literally unavailable.

Support for protocols, their tokens, and value accrual.

The Biden administration now infamously pre-emptively vetoed a bill that would have addressed one of the SEC’s over-reach positions on custody. There are many other such positions — from simpler issues like what constitutes a security or a commodity and therefore whose jurisdiction matters (SEC vs. CFTC), to more complex ones like what constitutes an exchange (e.g., Uniswap) and how to treat staking of tokens into a protocol (e.g., ETH).Underneath these issues is a refusal to acknowledge that legislation from 1933 is not fit for purpose in analysis of technology from 2024. While many of the same *ends* do come about in the modern world, the *means* to get there are wildly different. We have cryptographic privacy, decentralization of workloads and governance, completely global access on both distribution and manufacturing, programmatic usage of capital, and many other innovations that suggest we should be respecting the shape of technology. You do not regulate the Internet like you would Books or the Printing Press.

As a result, we suggest building competence in understanding how financial protocols work, and then creating treatment of the artifacts that protocols produce — tokens — that is consistent with the medium.Further, the industry must be able to use project revenues as an economic primitive. Companies have profits and those accrue to shareholders. Token projects have avoided sending revenues to tokenholders in order to avoid compliance with securities laws. This hurts consumers, who participate in these token projects regardless. Tokens trade not on fundamentals but on narratives — which is clearly the wrong outcome in principle. Registering with the SEC or getting some sort of carve-out has not been an option to date, and therefore the failure state continues.

Support of DeFi and DAOs.

If we want resilient, transparent, and open systems, then acceptance and promotion of DeFi-shaped fintech companies is important. Another way to put it, if we don’t want another version of Synapse, where multiple ledgers built during different decades drift apart because somebody didn’t export the right CSV document, then we need to use onchain finance.In order to regulate and support such companies, a number of different issues have to be opened up and addressed. For example, KYC has to be reconfigured from being physical or paper-based, or even identity based, and towards being fully digital and transaction-focused. Counterparties in DeFi operate in a highly automated, and often anonymous manner relative to the financial machinery with which they engage. The vending machine does not keep asking questions about who is eating its sandwiches.

Another issue is the ability to contract. You will find most Web3 projects with a Labs company full of developers, and an off-shore Foundation holding assets so that those developers avoid liability for the protocol. Perhaps there is also a DAO that votes on the things that the Foundation then funds. Various entities have to be spun up in order to do basic things in the traditional world. A solution has been proposed in Wyoming to address this:Recognition of these entities and an effort to normalize global, Internet-native businesses with the ability to spend capital will only help grow GDP.

There are three large platform shifts that touch financial services — blockchain, AI, and the digitization of the physical world (AR/VR). Making it easier for companies exploring these platform shifts to access or build financial products in the United States, would lead to an explosion of innovation, investment, and new opportunities.

Fintech

For over a decade, Fintech has been attempting to modernize the enormous incumbent web of software and market networks that constitute the traditional financial services industry. Most of what has been accomplished is the repackaging of our existing services into various middleware and distribution layers. Whether we transform a sponsor bank into Lending Club, or a bank data set into Plaid, or a Visa network message into Stripe, we are working with the constraints of the current foundation.

To that end, we need to recognize the importance of banks, broker/dealers, exchanges, and custodian not only in providing services to people, but to software and robots. Software should be the primary consumer served by these licensed shells. Today, most are either vertically integrated serving their own software (see the mega-banks), or sit horizontally in some large set of middleware solutions. But notably, much more distribution has become digital.

And yet, it is extremely difficult for a fintech to connect to a bank, get information out of a bank, move capital in and out on behalf of a customer, or generate any novel financial product. To that end, here’s what we would like to see.

US Open Banking.

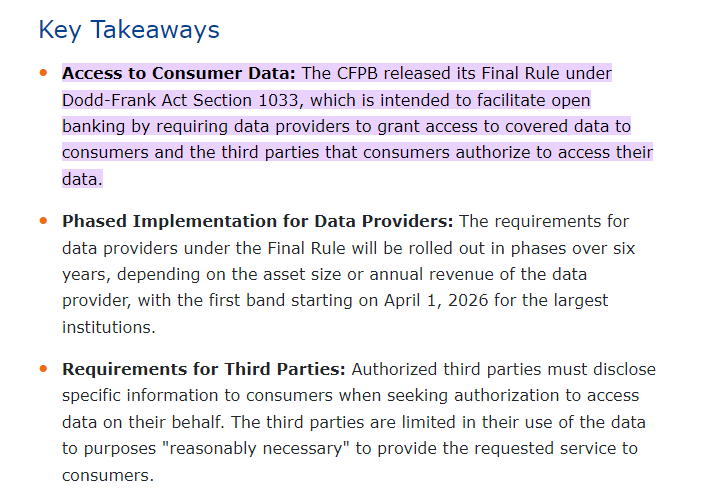

We are encouraged by the CFPB rule 1033, which mirrors the PSD2 regulation of Europe that forces banks to create APIs such that third parties are able to access client data in a permissioned way.When the large tech companies all have to be compliant with GDPR and make your data portable, surely banks can find a way to package transaction data into structured API formats. It has been over 15 years since Yodlee and Mint.com, and since then Plaid, have had to crowbar this data out of the finance oligopoly. In having to take this project head on, perhaps the banks can solve their own objections to privacy and security.

There is a close corollary. Opening up data is not enough. We must also have the ability to move money, like being able to switch accounts in a frictionless way. This means read and write access to financial infrastructure. Digital footprints and their various software tools — from mobile apps, to automated web services, to eventually AI agents — are the most relevant new consumer of financial services on behalf of users. Banks are no always the best entities to create the user experience around the financial infrastructure that they host. We should prepare for this world.Fintechs Licensing and Special Bank Entities.

Another factors in the fragility of the various fintech plays is the lack of access to the Fed and the inability to run a licensed entity. We have seem a number of players, like Custodia, Column, or Cross River, attempt to create the right type of entity in the regulatory regime. But it’s a nightmare.

Thinking back a few years, digital lenders had to rely on various sponsor banks for the underwriting they were selling to the masses. This creates a principal / agent problem, where the distributor is not exposed to the underwriting portfolio. What we have found in our research is that neobanks struggle when they are not able to build out a lending portfolio. Take for example Revolut’s journey, which quickly turned towards profitability once the neobank was able to start doing underwriting.

We should celebrate any and all Fintech company that wants to become a licensed entity — a bank, a consumer reporting agency, a broker/dealer, a Utah industrial loan company. What have we gained by stopping Square or Walmart from launching their own entities? Does Evolve Bank & Trust really have a better balance sheet than what Synapse or Mercury could have raised from VCs?

So we say, open up the window to the money and let the tech players put pressure on the market by having the right licensed entities.OCC supporting Bank stablecoins.

In the case of “for it” before “against it”, we would like to see the return of the OCC’s friendly stance towards stablecoins. As a reminder, the OCC pivoted from setting up the US banking system as home to a variety of stablecoins to be custodied by the long tail of regional banks (first link below), to preventing this activity by intimidation (second link).Stablecoins are like money market funds, and are backed primarily by the US dollar and US treasuries. Instead of wrapping those assets into a number on a Fiserv core banking ledger or in a money market fund accounting system, they account for the underlying collateral on a blockchain. Given they are cash equivalents, enabling banks to think about how to integrate these assets gives a new lease of life to depositories that are becoming increasingly more like commodities.

It’s not that we want the banking system to sell everyone crypto. Rather, we want to see it incorporate modern versions of payments and savings products. Those are not just mortgage lending. Stablecoins are the entry point into a far more diverse set of opportunities around risk transformation and yield generation on a modern chassis.

Looser Capital Markets — Acquisitions and IPOs.

Since the crash in 2022, the IPO markets have been stuck. As a result, venture fundraising and venture funding is at a low.

With lower interest rates and more liquidity in the system, we expect the IPO window to open up and for some money to be returned to LPs. That will kickstart the cycle anew.

However, there are a number of other ways of going public that we saw as experiments in the past: (1) direct listings, (2) SPACs, (3) token launches. Today, direct listings are reserved for weirdo tech companies. SPACs are effectively dead given their performance track record. And token launches are geography-gated to non-US founders.

One step is to make crowdfunding and token launches much more easily available to US citizens, who are currently being frozen out of airdrops or exchange launches. Another step is to continue to bring the private markets closer to the public markets in terms of liquidy and secondary trading.

Since venture investors are stuck there, many have been using private markets to exit their positions prior to any IPOs. That means that public market investors do not get to see high quality growth assets at an earlier stage. It also means that public markets are not serving their purpose.

Finally, acquisitions are the last exit path for investors.

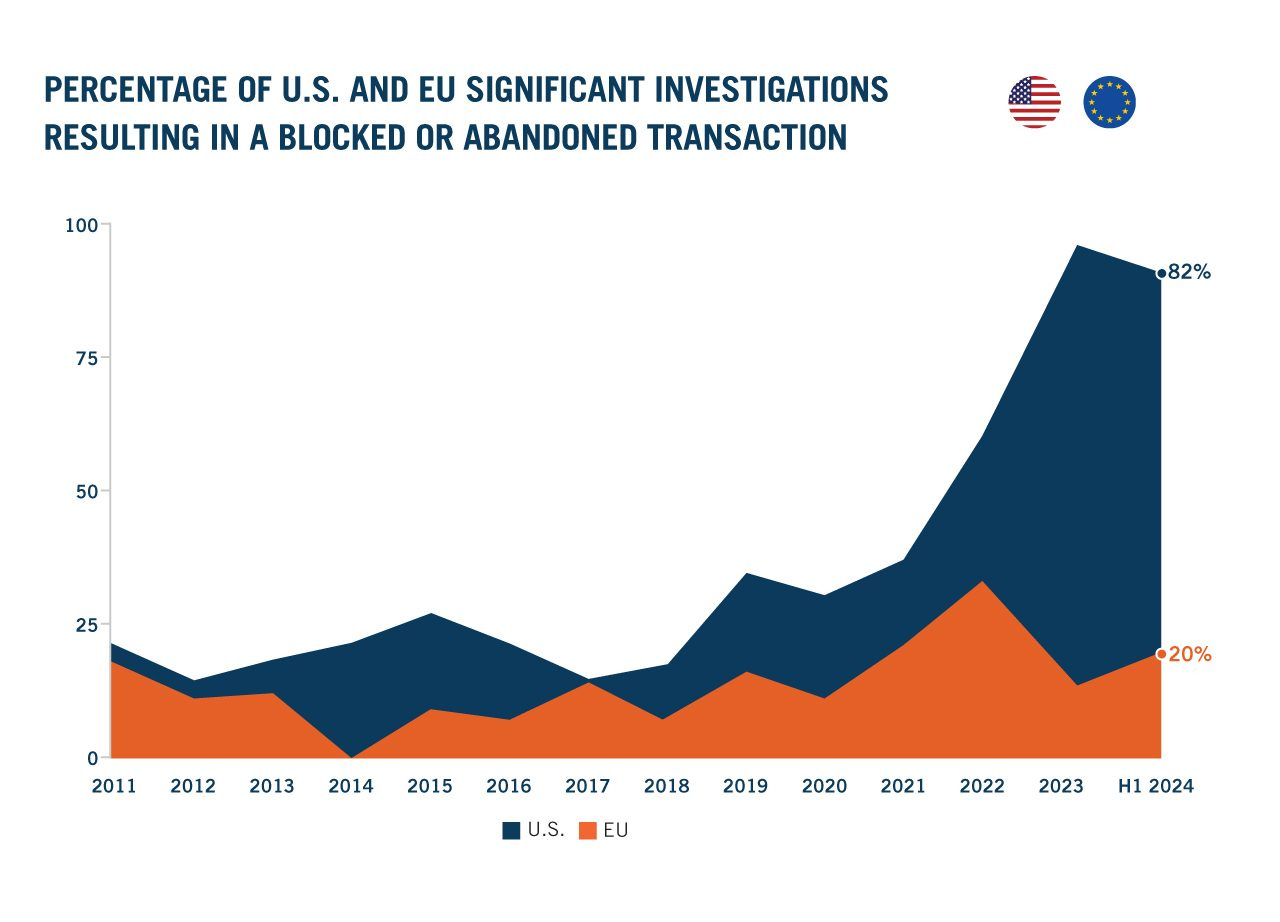

However, this path has been increasingly getting blocked for large mergers as well. Not only can a deal get rejected (think Plaid/Visa), but the investigations period may take an entire year before a company knows whether or not its plans will go through. We don’t know whether this is a phenomenon attributable to the post-Covid market compression, but we hope to see a return to normalcy.

Artificial Intelligence

To conclude, let’s sketch out a few ideas around AI. With Musk and the VC cohort coming into close contact with the new administration, we are optimistic about an informed approach to AI policy.

The European Union has already — preemptively — put in place a regulatory framework around AI systems, which we see it as a stranglehold on new business and innovation. Putting friction on companies before those companies have even found a product-market fit is complete nonsense and makes it impossible to experiment and build things people may want and benefit from.

Time is necessary to see how AI-based labor will actually be developed and applied to the world. So far, we have had 2 years of ChatGPT and a decade of machine learning. We expect there to be two different categories of AI productivity. The first is about integrating AI into existing business process. The second is about autonomous AI agents that function independently, on behalf of their principals.

We are particularly interested in the financial treatment of the second category. How will AI agents be treated from a legal perspective? Can they be self-organized as DAOs, or corporations? Can they contract with other humans, either formally or informally? What are their banking relationships going to look like, and will those assets sit within the traditional banking industry or in onchain wallets?

While this all sounds far-fetched, one place the US could take a leading step is by creating a framework for AI agent-led economic activity and by reducing friction for the above questions.

🚀 Postscript

Sponsor the Fintech Blueprint and reach over 200,000 professionals.

👉 Reach out here.Check out our AI newsletter, the Future Blueprint, here.

Read our Disclaimer here — this newsletter does not provide investment advice