Fintech: Mercury Expands Orbit with Launch of Personal Banking

Can Mercury successfully convert its business users to consumer users?

Hi Fintech Futurists —

Today’s agenda below.

FINTECH: Mercury Expands Orbit with Launch of Personal Banking

LONG TAKE: Synapse Bankruptcy vs. Stripe Expansion & $10B at risk in Ethereum LRT derivatives (link here)

CURATED UPDATES: Paytech, Neobanks, Lending, Digital Investing

To support this writing and access our full archive of newsletters, analyses, and guides to building in Fintech & DeFi, subscribe below. We just adjusted the price to $12/mo.

Digital Investment & Banking Short Takes

Mercury Expands Orbit with Launch of Personal Banking

Mercury, the San Francisco-based neobank best known for its startup-centric banking solutions, recently announced the launch of consumer banking by introducing "Mercury Personal."

The new service — available to the general public later this year (waitlist here) — is targeted at entrepreneurs and investors, offering features like customizable debit card limits, no-fee transfers, worldwide ATM reimbursements, and a 5% APY high yield-savings account with up to $5 million in FDIC insurance. However, unlike other players in the space, the service is not free and has a $240 annual fee.

Before delving into the implications for the company and broader industry, let’s revisit Mercury's background, offerings, and business model.

While not as universally known as some of its peers in the neobanking sector, Mercury has successfully established itself by catering to the financial needs of startups. Valued at about $1.6 billion, Mercury serves over 100,000 customers across more than 180 countries. Notably, it has maintained profitability for seven consecutive quarters, a real achievement during a challenging five-year period for the industry.

Foundational History & Model

Launched in 2017 by Immad Akhund, a seasoned entrepreneur, Mercury was designed to meet the banking demands of startup founders, drawing from Akhund's own experiences. Instead of a wide range of services initially, Mercury focused on perfecting a single core product — a business bank account.

This product took two years to develop, which is a long period in the startup world, reflecting a meticulous, product-first strategy. Such an approach focuses on building one thing at a time with purpose, and doing it exceptionally well — from the functionality and user interface to technical design and architecture. Mercury's execution of these principles distinguishes it in the field.

Since launch, Mercury has expanded its offerings to include a variety of services tailored to meet the needs of startups and their teams like Treasury services, the Raise investment platform, Virtual Cards, Partner Perks, IO Credit Cards, Venture Debt products, and the “Vault”, among others.

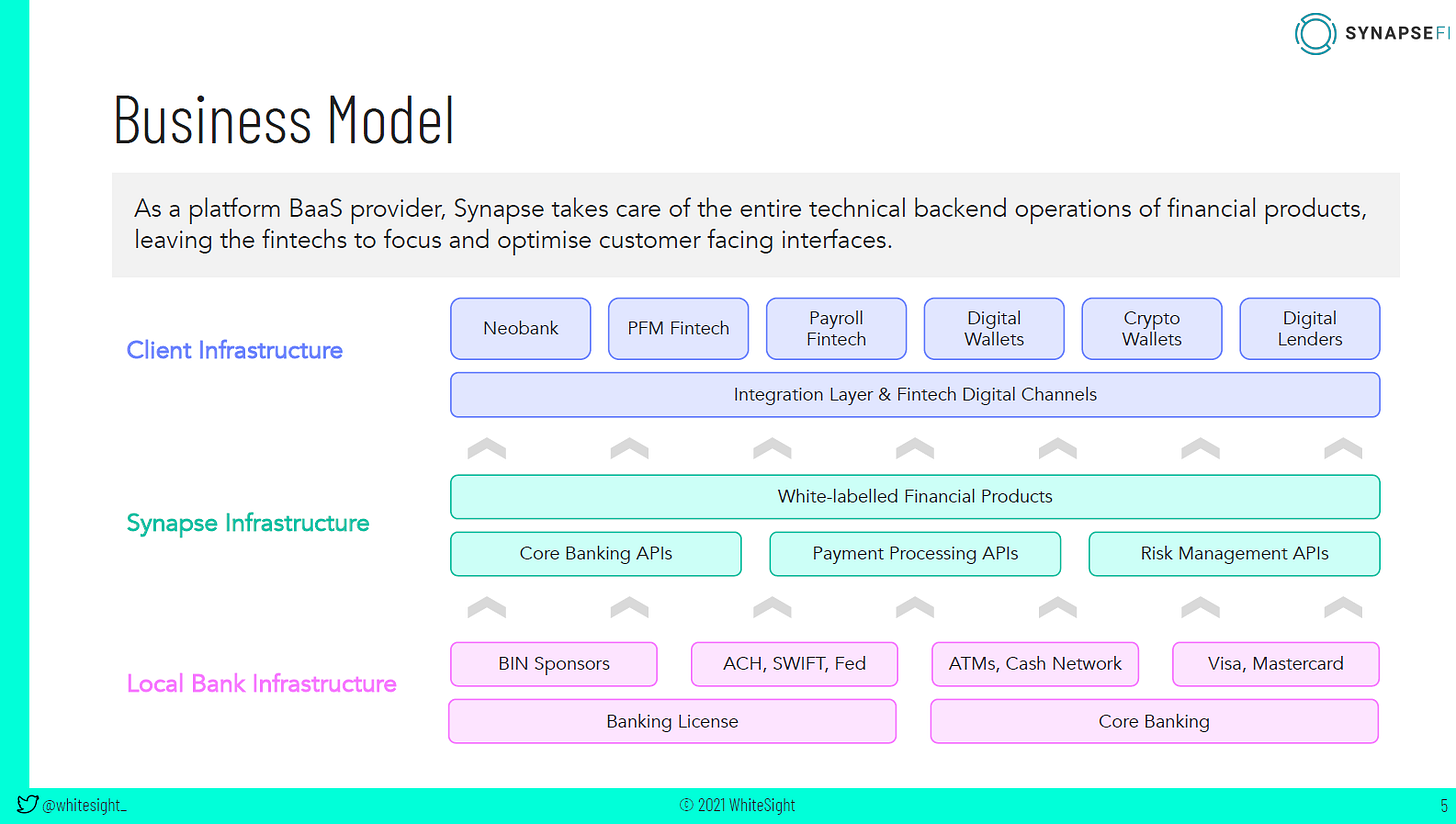

Unlike traditional banks, Mercury does not possess a banking license. Instead, it operates under a Banking-as-a-Service (BaaS) model, which allows it to offer banking services through partnerships with established financial entities. For primary banking functions, Mercury works with Choice Financial and Evolve Bank & Trust. Its treasury services are supported by Apex Clearing Corp, Vanguard, and Morgan Stanley. The credit card services are facilitated through Patriot Bank.

Back to "Mercury Personal"

With all that context in mind, let's revisit "Mercury Personal". This foray into the consumer sector marks a significant shift from the company’s core focus. Yet, the CEO Immad Akhund suggests it also represents "by far the most requested feature from our customers."

Transitioning from business to consumer banking is not straightforward. Technology aside, the consumer sector has its own rules and regulations, and adherence to them will necessitate changes to the company’s operating processes and procedures. This opens Mercury and its banking partners up to more risk and oversight — an issue that has been garnering more and more attention as of late.

From the perspective of a neobank, the consumer sector is more saturated compared to the business sector, creating less opportunity for newcomers. Mercury argues that, unlike existing players who primarily offer basic services to lower-income individuals and the underbanked, it will differentiate by targeting the specific niche of founders and investors. This raises a critical question — is the market large and underserved enough to justify such a specialized focus?

Moreover, will people be willing to pay $240 a year for the services offered?

While once unique, much of what Mercury intends to offer is now commonplace and offered for free. Sofi, Wealthfront, Betterment, and Robinhood all offer high 5% savings rates. Even Apple is in the game! Although Mercury provides substantially higher FDIC insurance than most, early-stage founders are unlikely to have large cash reserves.

Is the convenience of integrating business and personal banking, along with Mercury’s sleek user interface and advanced tooling, worth the cost? We are skeptical at this stage, although we applaud a company actually charging people for the services they provide, instead of hiding them in interchange or net interest.

An Alternative Perspective

On the other hand, when looking at Mercury’s existing infrastructure and consumer roll-out, a more optimistic perspective is possible.

The technology and features needed for Mercury Personal are already being used in business banking operations. The company is partnering with Choice Financial Group, leveraging established interfaces, advanced analytics, and extended FDIC coverage. This makes the transition seem less risky, and more like a strategic expansion to cater to an adjacent user segment that has demonstrated demand.

We can also see Mercury's evolution into a financial super-app over the longer term. Future expansions could include brokerage accounts or features related to equity and ownership management, like Carta. Mercury might not just be diversifying, but gathering a deeper share of wallet from their target market. This may be a calculated strategy towards building a more integrated financial services ecosystem for entrepreneurs and their companies.

👑 Related Coverage 👑

Blueprint Deep Dive

Long Take: Synapse bankruptcy bearish on BaaS, while Stripe is bullish (link here)

Synapse, one of the original middleware banking-as-a-service companies, goes into bankruptcy and is sold off for about $10MM to TabaPay, a payments company. Everyone says BaaS is dead, and that regulators have killed middleware platforms — those connecting neobank apps and underlying banks — through their risk requirements.

Stripe, one of the largest payments companies with over $1 trillion in volume, decouples its payment processing product from its embedded finance platform, so that customers can use its banking-as-a-service and other fintech features while also being able to use PayPal or Adyen.

Which one is it? Is the idea of tech footprints and merchants launching underlying financial services pointless and dead, or is it the growth engine for one of the largest fintech unicorns?

Curated Updates

Here are the rest of the updates hitting our radar.

Paytech

⭐Report Signals CFPB Taking Aim at Video Game and Virtual Worlds Industries - The National Law Review

⭐UK to Issue New Crypto, Stablecoin Legislation by July, Minister Says - CoinDesk

Mastercard invests in Hello Alice - Finextra

JPMorgan and Codat Team to Drive Virtual Card Adoption - PYMNTS

Senators Unveil Bipartisan Bill Outlawing Algorithmic Stablecoins - PYMNTS

Neobanks

⭐Fintech Revolut receives Mexican banking authorization, eyes expansion - Reuters

Monzo set to finalise new £500m fundraising in deal with top tech investor - Yahoo Finance

Bunq Raises $31 Million After Quadrupling User Deposits in 2023 - PYMNTS

Neobanks triumph in user growth with 18 million more downloads than legacy banks in 2023 - Fintech Global

N26 Further Strengthens Offer in Germany With Launch of Stocks and ETFs Trading, and 4% Interest on Savings for Metal Customers - Fintech Finance News

Lending

⭐These banks are nearing $100B of assets. What did they learn from NYCB? - American Banker

⭐Embedded FinTech Parafin boosts infrastructure with $125m warehouse facility - Fintech Global

Ex-N26 staffers raise €35m for embedded finance startup - Finextra

Temenos rejects Hindenburg claims after probe completed - Finextra

Digital Investing

⭐Brim Financial Closes $85 Million Series C / Brim Financial CEO: Fundraising More Rigorous Now - Bloomberg

‘Send now, pay later’ startup Pomelo lands $35M Series A from secretive Vy Capital, Founders Fund - TechCrunch

Ramp sees valuation bounce back on $150 million raise - Finextra

🚀 Level Up

Join our Premium community and receive all the Fintech and Web3 intelligence you need to level up your career. Get access to Long Takes, archives, and special reports.

Obrigado 📊🤗⚖️🤭🫂🫡🚀💘