Fintech: TruStage launches Payment Guard Insurance

An insurance product for digital lenders. Plus, Bunq's expansion into the US/UK.

The Fintech Blueprint is a newsletter authored by me, Lex Sokolin, and a small group of brilliant researchers who focus on frontier technologies impacting the future of financial services. I am glad you are here. Was this email forwarded to you? You deserve your own:

👉subscribe here.

Hi Fintech Futurists —

Here is today’s agenda:

INSURTECH: TruStage launch Payment Guard Insurance (link here)

LONG TAKE: Can Bunq, the $1.9B profitable European neobank, crack US consumer banking? (link here)

PODCAST CONVERSATION: Deconstructing fintech innovations, valuations, and exit strategies,with Royal Park Partners Managing Partner Aman Behzad (link here)

CURATED UPDATES

Digital Investment & Banking Short Takes

INSURTECH: TruStage launches Payment Guard Insurance (link here)

TruStage™, formerly known as CUNA Mutual Group, has launched an insurance product for digital lenders. The company has been operating for over 85 years and serving over 30 million US customers. The new insurance product is called Payment Guard Insurance and covers the digital lender against unexpected events that may cause loss of income by a borrower.

The latest partner to use Payment Guard is Zirtue, a relationship-based, peer-to-peer lending application that simplifies loans between friends, family, and trusted relationships.

Payment Guard is designed to increase lending capacity for institutions like fintechs, banks, and credit unions by adding a layer of protection to lending portfolios against the leading causes for default. The insurance product is paid for by the digital lender, and approved claim payments go directly to that lender, thereby reducing defaults.

Insuring against the leading causes of consumer default should result in more resilient loan portfolios. Effectively, lenders taking the insurance will accept a lower overall yield in exchange for lower default risk. Theoretically, this makes lending through the Zirtue platform less risky, and therefore expands the lending capacity of the individual lenders on its platform.

When asked for comment, Dennis Cail, CEO of Zirtue, said, “TruStage allows us to provide an innovative solution that acts as a safety net for lenders, underscoring our commitment to driving financial security and inclusion.”

Financial distress due to unemployment rises during recessions. In addition, post-pandemic mental health burdens have led to the Great Resignation, with employees choosing to leave employers when given the choice. Still, despite recent interest rate pressure on the capital markets, overall unemployment remains low. Whether the labor shock is yet to come is up for debate, but it is generally believed that unemployment risks are material.

The consumer balance sheet is also under pressure, with savings at historic lows. This suggests that people may have less of a buffer to repay their obligations. As a result, digital lenders may not wish to face the full brunt of this credit cycle, and hedge out the down risk with a product like Payment Guard.

Relevant disclosures can be found here.

In Partnership: Webinar for Product Leaders

Fraud prevention and CX: The power of phone numbers in Latin America

👉 Aug 30 at 4PM ET

How do you balance managing risk with ensuring an exceptional customer experience?

This interactive roundtable will explore some of the most fundamental topics in fraud prevention today. Join Javier Covarrubias, CMO, Kubo.financiero, Luis Carrillo, COO, Klar, Sahari Cabello, VP Credit Risk, Kueski, and Tarek Osman, Telesign as they discuss:

Preparing for emerging and prominent fraud schemes

Prevention strategies for synthetic identity fraud, account takeovers, and bots

The right balance between security and a scalable, seamless, user experience

Blueprint Deep Dives

LONG TAKE: Can Bunq, the $1.9B profitable European neobank, crack US consumer banking? (link here)

Following its fresh $111M fundraise, Dutch neobank bunq recently announced plans to expand into the US and UK markets.

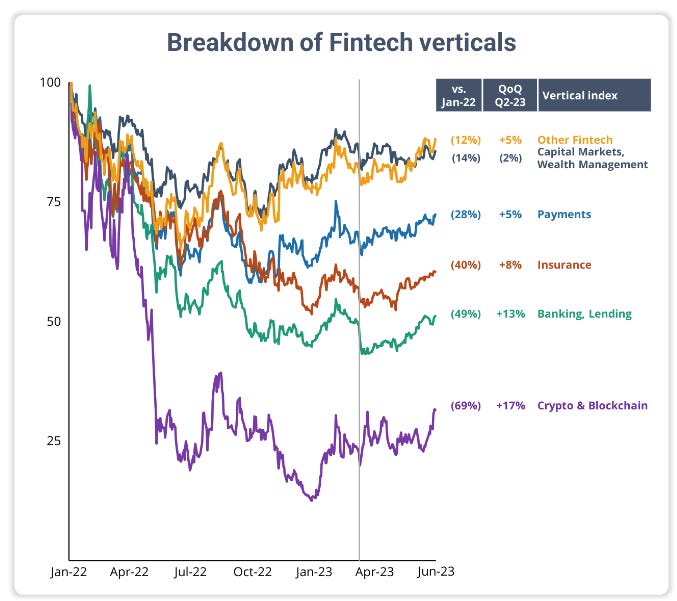

We benchmark the bank’s strategy against key EU competitors and challenge bunq’s stable valuation of $1.9B during the driest quarter of fintech funding since 2017. In addition, we discuss how bunq plans to extract value from a market where Goldman Sachs has recently begun to retreat consumer banking.

Podcast Conversation: Deconstructing fintech innovations, valuations, and exit strategies,with Royal Park Partners Managing Partner Aman Behzad (link here)

In this conversation, we chat with Aman Behzad - founder and managing partner of fintech-focused corporate finance advisory firm, Royal Park Partners. Providing the expertise needed to enable entrepreneurs, founders and funds to build the future of finance.

Aman is a corporate finance professional with over 15 years experience, having started his banking career and interest in fintech at Citigroup. Aman left to help establish the fintech team at Arma Partners, spending six years there before being hired by FT Partners to help build their European operations.

Interested in Sponsorship?

To support the Fintech Blueprint and reach our 185,000+ Substack and LinkedIn audience of builders and investors, contact us here.

Curated Updates

Here are the rest of the updates hitting our radar.

Payments

Neobanks

⭐ Brazil fintech Nomad raises $61 million in Tiger-led round - Reuters

⭐ LemFi raises $33m for immigrant-focused payments platform - Finextra

Klar secures $100m debt facility from Victory Park Capital - Fintech Global

Financial Infrastructure

⭐ Citi buys stake in Peruvian foreign exchange fintech - Reuters

Standard Chartered global head leaves to found fintech start-up - Fintech Futures

Korea Credit Data raises $75.7 million from Morgan Stanley - The Korea Economic Daily

Lending

⭐ Zanifu raises $11.2M to scale its inventory financing offering in Kenya - TechCrunch

⭐ Better.com’s public market debut was Miserable.com - TechCrunch

AI

💡 Insights Report

We would like to highlight an Insights Report from Fintech Nexus and Brighterion, a Mastercard company. In their survey of 100 financial institutions, they explore how financial institutions are using artificial intelligence for transaction fraud monitoring in the dynamic digital landscape.

⭐ Shape your Future

Curious about what is shaping the future of Fintech andDeFi?

At the Fintech Blueprint, we go down the rabbit hole to help you innovate and compete.

Sign up to the Premium Fintech Blueprint newsletter and get access to:

Wednesday’s Long Takes on Fintech and Web3 topics with a deep, comprehensive analysis

Office Hours, monthly digital roundtable discussions with industry insiders

‘Building Company Playbook’ series, offering insider tips and advice on constructing successful fintech ventures

Enhanced Podcasts with industry leaders, accompanied with annotated transcripts

Archive Access to an array of in-depth write-ups, spanning across 15+ topics and encompassing over 50 Fintech and DeFi brands