Hi Fintech Futurists —

Welcome back to our podcast series! For those that want to subscribe in your app of choice, you can now find us at Apple, Spotify, or on RSS.

In this conversation, we chat with Aman Behzad - founder and managing partner of fintech-focused corporate finance advisory firm, Royal Park Partners. Providing the expertise needed to enable entrepreneurs, founders and funds to build the future of finance.

Aman is a corporate finance professional with over 15 years experience, having started his banking career and interest in fintech at Citigroup. Aman left to help establish the fintech team at Arma Partners, spending six years there before being hired by FT Partners to help build their European operations.

Topics: fintech, corporate advisory, crypto, SPAC, IPO, Investment banking, capital markets, M&A, venture capital, private equity

Tags: Royal Park Partners, Marco Polo Partners

👑See related coverage👑

Fintech: Splitit raising to go private; Securitize acquires Onramp Invest

[PREMIUM]: Long Take: The fundamentals of Circle's $4.5B SPAC, Robinhood's IPO, and the $30B of fintech venture capital

[PREMIUM]: Building Company Playbook #7: Planning and executing your exit strategy

Timestamp

1’19”: Exploring the banking journey: Early experiences and focus on financial institutions

4’11”: Deconstructing investment banking: Balance of financial analysis, strategy, and sales

6’09”: Fintech investment banking: Success vectors at Financial Technology Partners and Founding Royal Park

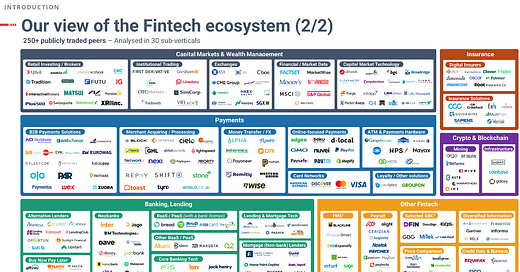

11’35”: Reimagining Fintech: The Evolution of Capital Markets and Ongoing Innovations

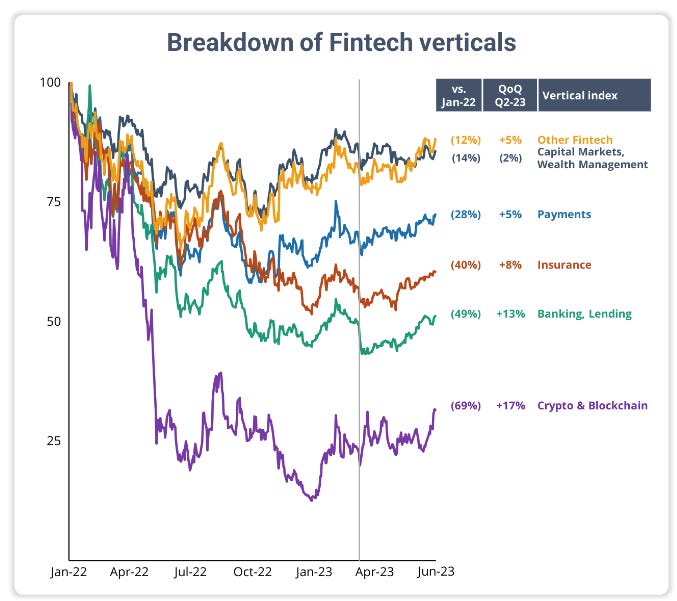

18’39”: Analyzing Fintech's Performance: Volatility, Beta, and Idiosyncratic Factors

23’25”: Shifting Valuation Dynamics: From Blitzscaling to Rationality in Fintech Multiples

28’58”: Navigating Exit Strategies: M&A, IPOs, and SPACs in Fintech

34’41”: Unraveling the SPAC Market: Dynamics, Performance, and Factors Influencing Value

37’09”: The channels used to connect with Aman & learn more about Royal Park Partners

Sneak Peek:

Aman Behzad:

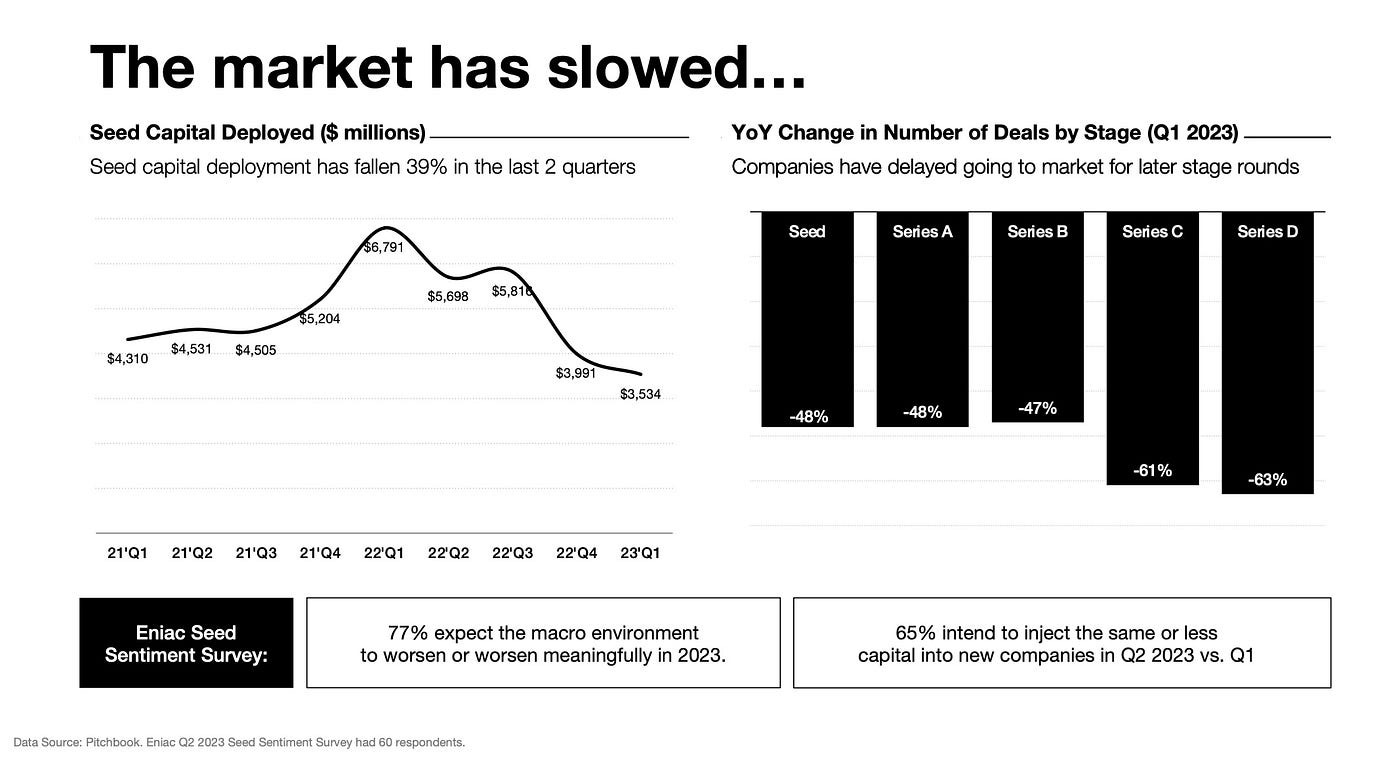

…so, we went from a world where let's say, as you said, 2014 before, investing was very much still based on fundamentals. Now, it depends on what stage of investing it was. Seed, Series A and to a certain extent, Series B was hyper-local, local teams, local people being on the ground, doing reference checks on management teams, seeing what else they've done in the past. Really getting to know the ecosystem, the community, the customers, and getting a deep under the skin feel for a business and then making a bet into that company. And then, as that company showed signs of positive progression with that bit of funding, they'd look to scale their positions very quickly and take as large an amount of money as they could into the business at the Series A and potentially into the B. And that's what very much the early-stage VC scene was all about.The late-stage scene was less prevalent because there wasn't that kind of money around, people writing 100 to 200 million check in a Series C, D E. By the time a business got to Series C, Series D, it typically needed to look more like a private equity profile business. And you had the more traditional private equity tech investors coming in like a TPG, a General Atlantic, a KKR, those are the ones who were coming in and participating. As you said, we didn't have the Tigers and the SoftBanks of this world to then continue this blitzscaling, hyper light speed approach to growing your business.

The availability of capital is what dictated how companies set their stall out, their strategy and their growth trajectory. That availability of capital has gone through a massive drought for the last, call it 18 months. I would say, immediately post the summer of 2021 is when things really started to dry up, and that really accelerated in '22.

And from 2014, sorry, we went from the world of fundamental, hyper-local, really reference-based investing to investing that was much more based on momentum. So, who led the last round? Who was in there, what's the profile of the CEO? What are his media appearances and his media coverage like? Who else is coming in on the next round? Can I get a ticket? Can I get an allocation?

And the vast majority of funds, especially when they were rising smaller funds, didn't want to have to go through the rigmarole of doing real fundamental work, and wanted to tag along to rounds that were being written by others. And the problem was that when the entirety of the market became momentum driven is where prices started to get driven up. And you had a situation where you had auctions for Series A, Series B businesses. Which was pretty much unheard of before that time, because …

If you would like to access the full transcript, subscribe below.

Shape Your Future

Wondering what’s shaping the future of Fintech and DeFi?

At the Fintech Blueprint, we go down the rabbit hole in the DeFi and Fintech world to help you make better investment decisions, innovate and compete in the industry.

Sign up to the Premium Fintech Blueprint newsletter and get access to:

Blueprint Short Takes, with weekly coverage of the latest Fintech and DeFi news via expert curation and in-depth analysis

Web3 Short Takes, with weekly analysis of developments in the crypto space, including digital assets, DAOs, NFTs, and institutional adoption

Full Library of Long Takes on Fintech and Web3 topics with a deep, comprehensive, and insightful analysis without shilling or marketing narratives

Digital Wealth, a weekly aggregation of digital investing, asset management, and wealthtech news

Access to Podcasts, with industry insiders along with annotated transcripts

Full Access to the Fintech Blueprint Archive, covering consumer fintech, institutional fintech, crypto/blockchain, artificial intelligence, and AR/VR

Read our Disclaimer here — this newsletter does not provide investment advice and represents solely the views and opinions of FINTECH BLUEPRINT LTD.

Want to discuss? Stop by our Discord and reach out here with questions