Fintech: Why Capital One Chose Brex in a $5B Deal

Behind the largest fintech-bank deal in history

Hi Fintech Futurists —

It’s not often we get a Fintech exit like this one. Capital One recently confirmed it is acquiring corporate card and expense management platform Brex for $5.15B, in what is the largest Fintech exit to a Bank in history.

Despite the size and practical success, the acquisition is still a significant haircut to the $12B valuation Brex raised at just four years prior. This week, we uncover the drivers behind the deal, what this means for Capital One, and how Brex is positioned against competitors Ramp and Mercury.

Today’s agenda below.

FINTECH: Why Brex sold at $5B while Ramp grew to $35B

ANALYSIS: Our 3 Trends to Watch in Fintech and AI for 2026 (link here)

CURATED UPDATES: Paytech, Neobanks, Lending, Digital Investing

To support this writing and access our full archive of newsletters, analyses, and guides to building in Fintech & DeFi, subscribe below (if you haven’t yet).

Our Ecosystem: AI Venture Fund | AI Research | Lex Linkedin & Twitter | Sponsors

Digital Investment & Banking Short Takes

Why Brex sold at $5B while Ramp grew to $35B

Brex was founded in 2017 by Brazilian co-founders Pedro Franceschi and Henrique Dubugras. The pair exited their first payments processing unicorn, Pagar.me, a year earlier, before starting their freshman year at Stanford; then shortly after, dropped out to join Y-Combinator’s winter batch.

This is an unusually talented and effective team.

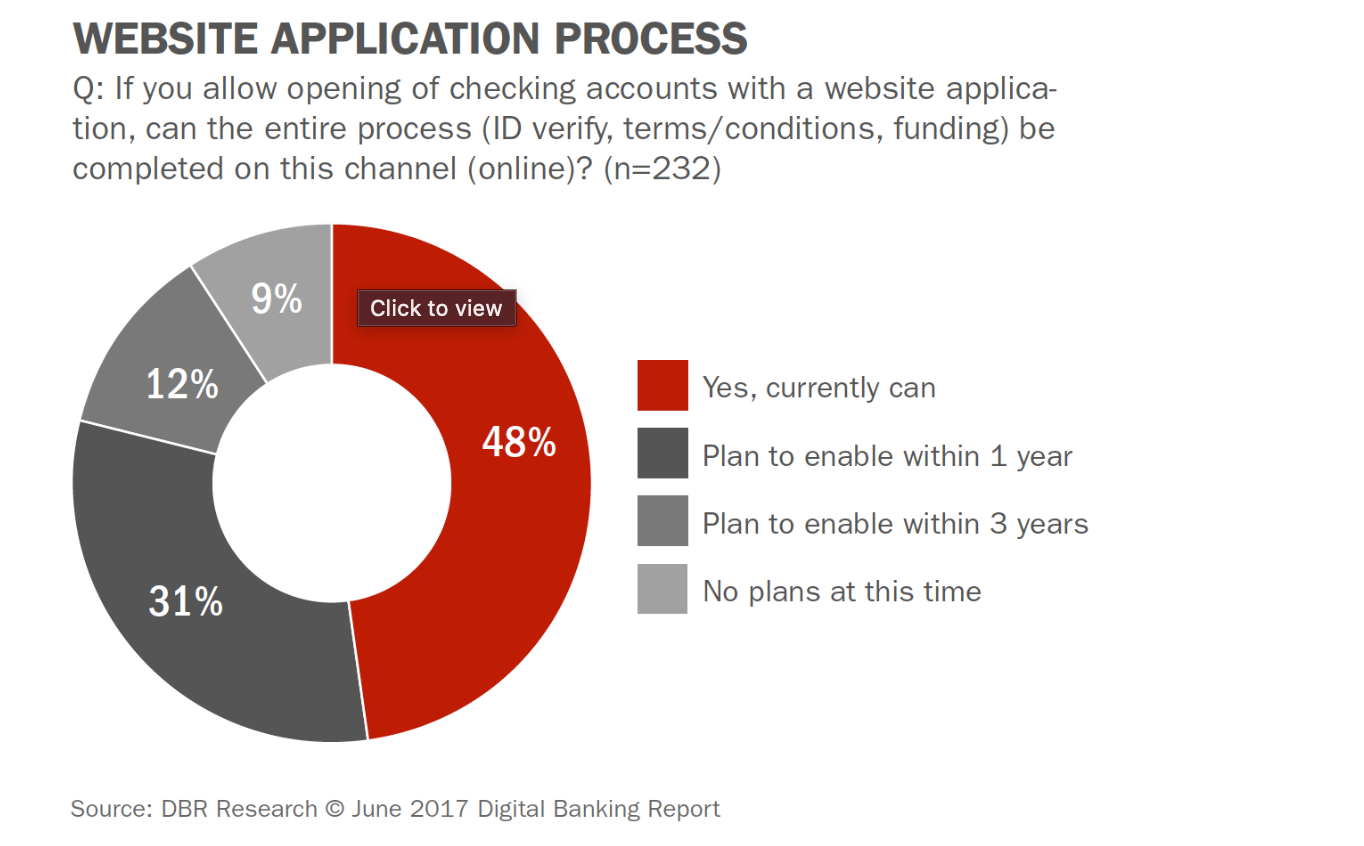

The YC application was for a virtual reality project, but in setting up their business they discovered significant friction with the traditional business banking system. It wasn’t meeting the needs of a fast-moving startup ecosystem. Onboarding took weeks, credit limits were low and required personal guarantees, and expense management was typically unbundled. A 2017 banking survey revealed that less than 47% of high street banks enabled users to open an account digitally at all.

Brex set out to offer a modern corporate credit card that promised faster and better terms. The platform and underwriting engine were built from scratch to replace traditional risk assessment, which relied on paper-based back and forth KYC processes and personal credit scores. It instantly underwrites 10-20x higher credit limits, without requiring personal guarantees, using real-time operating metrics from clients like cash flows, funding, and transaction data.

Note that lots of companies at this stage would settle for just selling “data” to banks. But revenues come from doing the financial work.

Under the hood, the company secures large revolving credit facilities from major banks like Barclays and Credit Suisse (now UBS), which it in turn extends to its clients. Brex makes money on the net interest rate it charges customers, as well as interchange fees on card payments.

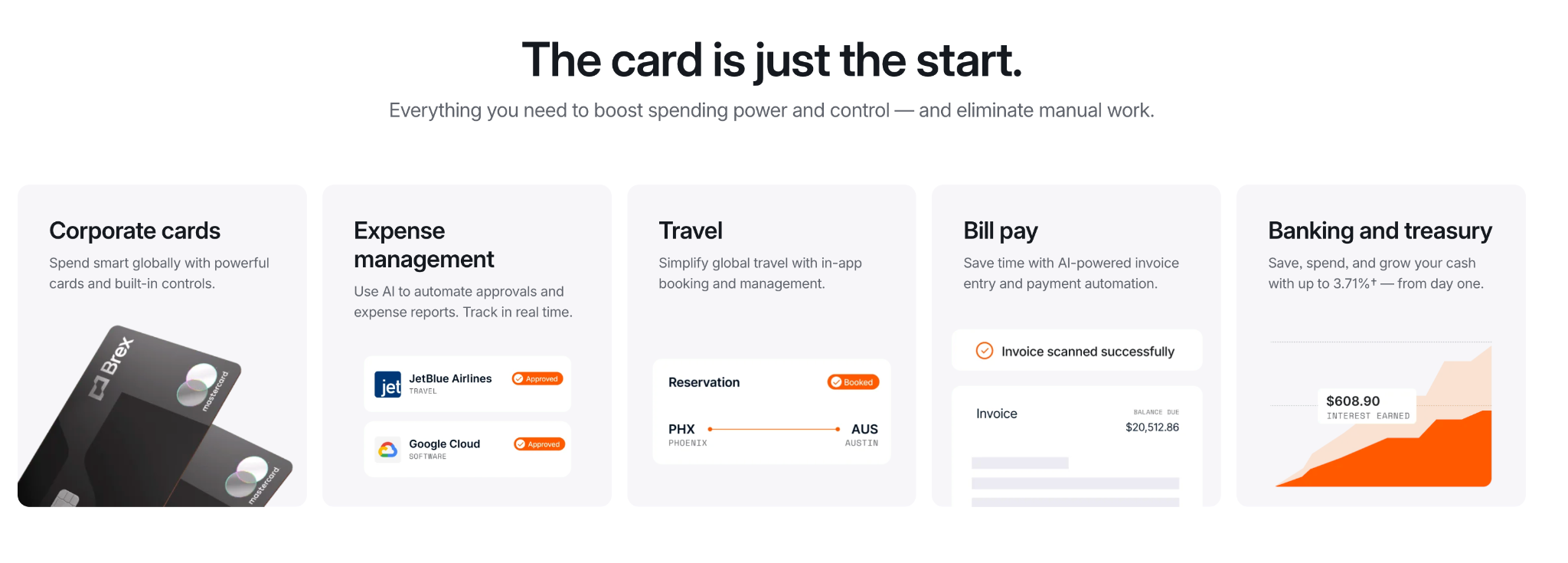

The product suite today goes beyond the card offering to offer high-yield treasury solutions, automated expense management, ERP integrations, and business travel booking. Clients choose a tier depending on the depth of service they require.

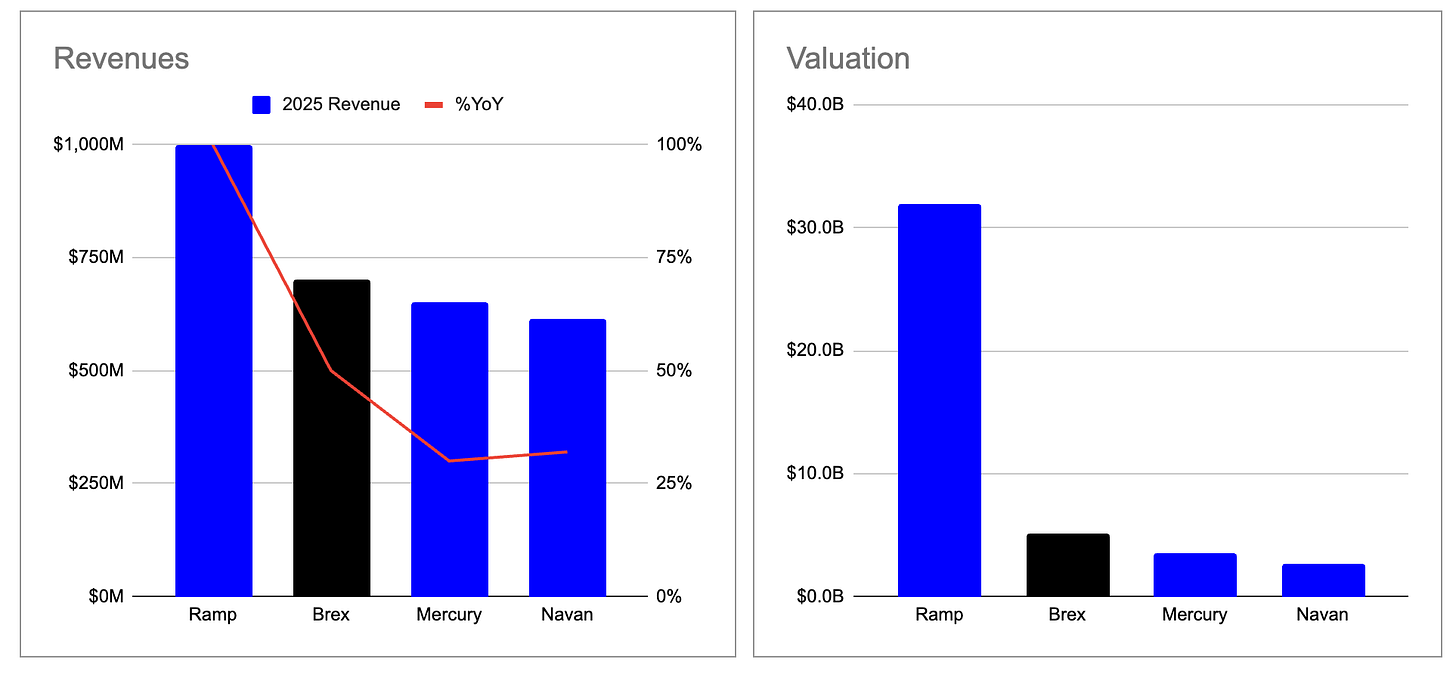

Since launch, Brex has amassed 35,000+ corporate clients, including OpenAI, Robinhood, and Coinbase, which contribute to a reported $700MM in ARR and approaching profitability. This suggests a 7x revenue multiple for the acquisition.

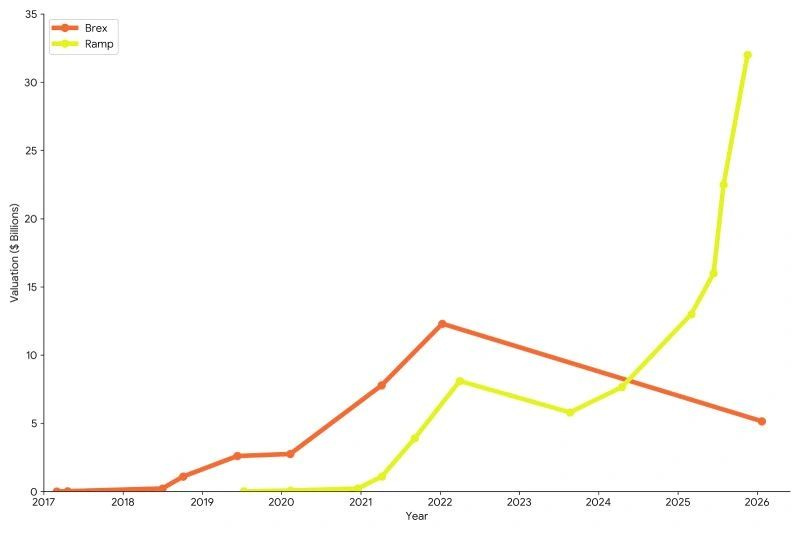

But the journey has been rocky. In 2022, the firm raised at a valuation of $12B, while the sale to Capital One prices it 60% lower at $5B, though investors will get paid back through their liquidation preference. During the same period, Brex’s largest competitor, Ramp, grew from an $8B valuation to a whopping $32B. Sometimes it is better to stay private!

We covered Ramp in detail last Summer.

The diverging valuations between the two competitors is highlighed below.

We see two root causes.

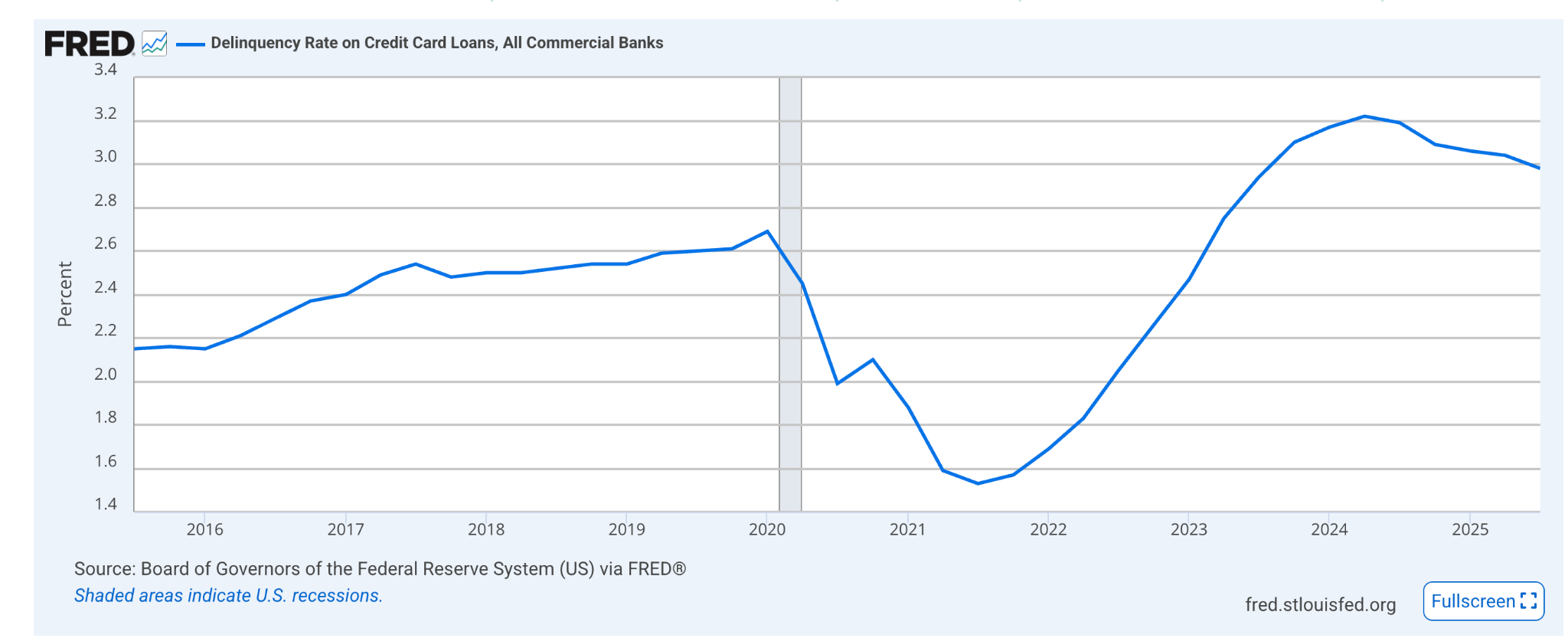

The first is that Brex’s focus on startups led to widening losses as interest rates turned. The company’s capacity to absorb losses was higher when funding was cheap. But as rates increased and VC funding dried up, its sources of credit from banks got more expensive and the likelihood of losses grew.

In 2022, the firm announced “Brex 2.0” — cutting services to smaller clients and shifting towards only serving growth companies with VC backing. We estimate Brex cut at least 15,000 clients during this time. Last year, it reported that enterprise customers had a total estimated market cap of >$2.9T, compared to $200B a few years earlier. This highlights a shift towards larger companies and a higher credit quality.

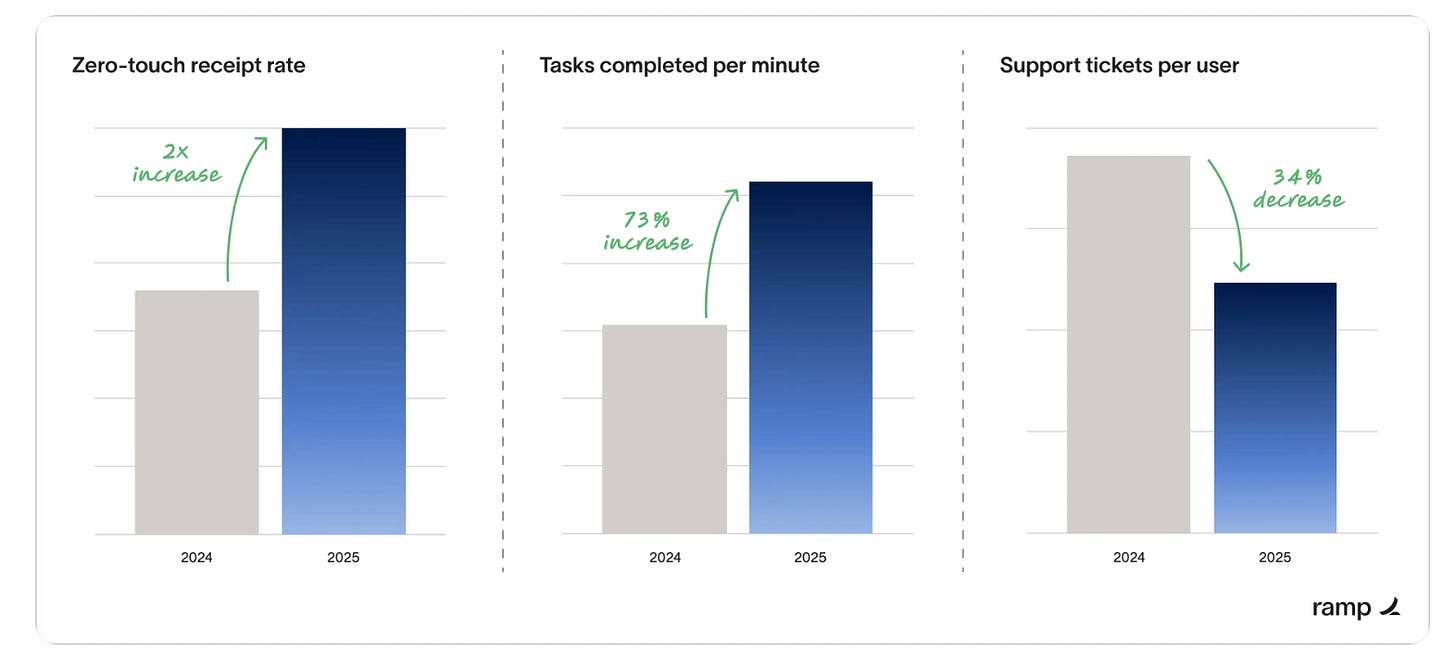

The second is that fintech lenders began pursuing more non-cyclical sources of revenue. In the corporate card segment, this meant a focus on AI-powered software tools and expense management. Firms began competing on their ability to save clients time and streamline finance ops. The challenge became regularly shipping new features while preserving a simple UX, and Brex struggled to keep up.

In 2024, Franceschi wrote:

“In Brex 2.0, many teams worked on many products, shipped many things, measured a lot of metrics. But as time passed, I didn’t feel our product experience improving as a customer.” — Ramp Blog (2024)

This resulted in Brex 3.0. The company cut 20% of its workforce and restructured its product and design teams to pursue a single unified roadmap. Last year, the company started seeing improvements in its Net Promoter Score.

These transitions, while successful, have no doubt led to slower growth for Brex relative to Ramp. Compared to competitors, Brex is ahead of both Mercury and Navan on revenue, growth, and valuation, but consistently behind Ramp.

Ramp is the category leader and an extremely well-oiled machine. The company prides itself on shipping velocity. Last year, it shipped 270 features by mid-year, surpassing the 207 total for 2024, with notable efficiency gains passed to users.

We believe the Capital One deal could now boost growth at a critical time for Brex.

Aside from Ramp, the company is facing growing competition from both incumbents and new fintechs. American Express acquired expense management platform Center last year in an effort to bolster its SME services, with the CEO re-iterating their focus on B2B payments.

Meanwhile, business banking platform Slash recently announced $150M in ARR after just two years in operation. The company is optimizing for modern money flows with a comprehensive stablecoin payments offering.

Capital One gives Brex a large balance sheet to supercharge underwriting and product development.

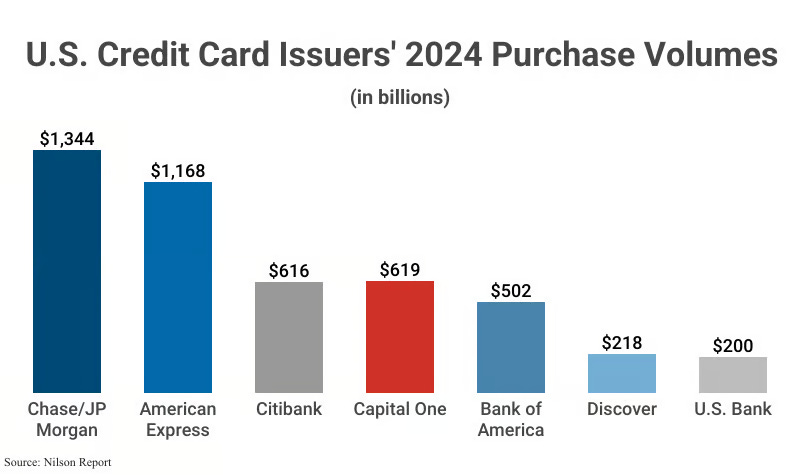

The bank, which also acquired Discover Financial last year, is now the third largest credit card issuer in the US, processing a combined $830B in annual volumes with roughly $400B in customer deposits. As part of the deal, Capital One is investing $950MM in the Brex platform alone. In exchange, the bank receives a world-class software platform for its existing large clients, a roster of new SMEs, and accelerated access to the EU via Brex’s recently obtained EMI license.

The primary risk in our view is that an integration into a regulated incumbent slows down the company’s agility. Ironically, the founders of Ramp sold their previous software business to Capital One in 2016 and shortly left out of frustration with the higher levels of bureaucracy and slower shipping times at regulated institutions.

Maintaining momentum with Brex will be key for retaining market share and leadership.

Of course, all of this is just Fintech nitpicking talk. Building a company to $5B and then monetizing an actual exit is an incredible outcome, and shows the art of the possible for our industry. While so much is built on hopium and empty promises, Brex was able to build out a materially important company and do right by its teams — an incredibly rare feat to be celebrated.

👑 Related Coverage 👑

Long Take: 1.6 Million Lobster AIs Are Talking, Trading, and Paying

We explore the rise of locally run, identity-bearing AI agents through experiments like OpenClaw and Moltbook, which have spawned over 1.6 million autonomous agents interacting in their own social network. We contrast centralized AI “skyscrapers” such as OpenAI and Google with this emerging vision of embodied or sovereign agents that operate on personal machines, hold credentials, and increasingly participate in economic activity.

While similar agent frameworks like Autonolas ($2B to ~$10MM market cap) and Virtuals ($5B to ~$400MM) show how hype cycles collapse, each iteration moves closer to persistent AI identity and autonomy.

Curated Updates

Here are the rest of the updates hitting our radar.

Paytech

⭐ Stripe eyes tender at more than $140B - Axios

PayPal’s New CEO Announced After Q4 Results Released - Fintech Magazine

Fidelity’s stablecoin FIDD goes live - The Blcok

Neobanks

⭐MrBeast buys youth-focused financial services app Step - CNBC

Erebor Bank receives national bank charter - Banking Dive

Mercury report $650MM in annualised revenue in 2025 - Mercury Blog

Lending

⭐Affirm submits applications to establish industrial loan company - BusinessWire

Revolut Business launches full-suite merchant acquiring product - Finextra

Digital Investing

Crypto exchange Coincheck to buy digital asset manager 3iQ - Finextra

Anthropic opens Claude’s improved Excel integration to all Pro subscribers - Decoder

NYSE to launch new venue for tokenized stocks - Ledger Insights

🚀 Level Up

Join our Premium community and receive all the Fintech and Web3 intelligence you need to level up your career. Get access to Long Takes, archives, and special reports.

Sponsor the Fintech Blueprint and reach over 200,000 professionals.

👉 Reach out here.Check out our AI newsletter, the Future Blueprint, 👉 here.

Read our Disclaimer here — this newsletter does not provide investment advice