Fintech: Can Ramp at $16B become the Revolut for the CFO Suite?

An ecosystem growth story behind the humble corporate card

Hi Fintech Futurists —

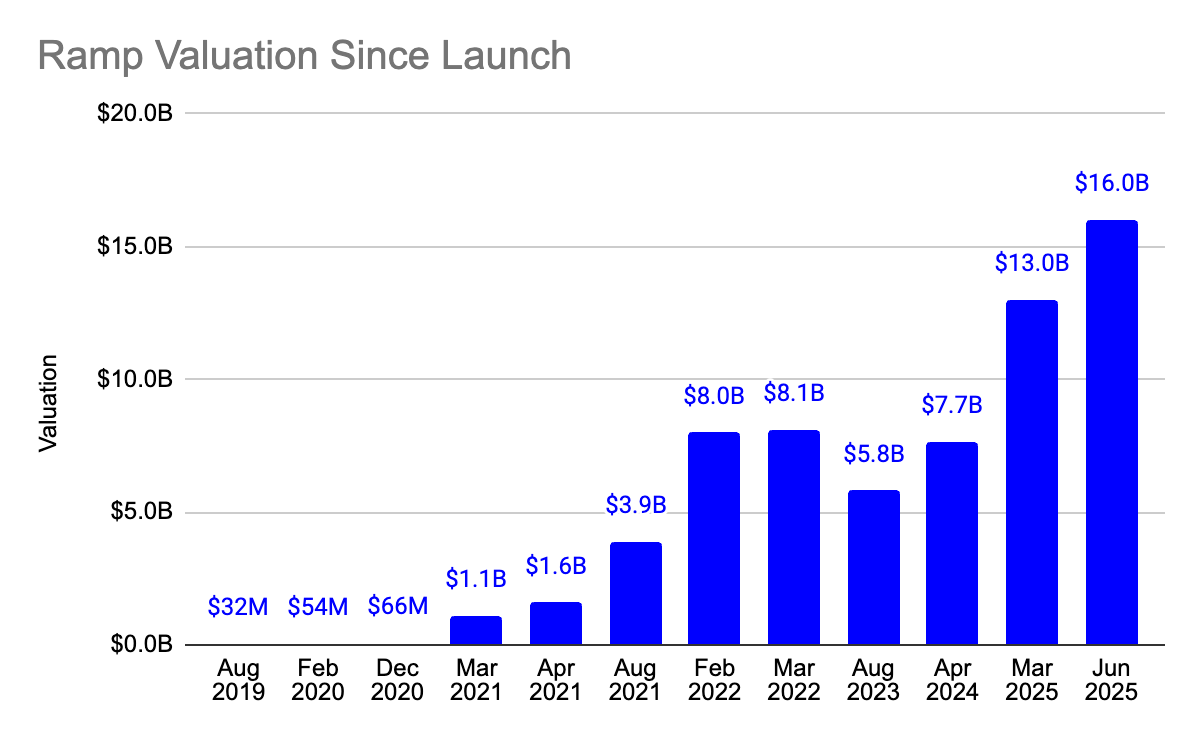

Expense management platform Ramp recently raised $200M at a $16B valuation; up from $13B in a secondary sale three months earlier, and doubling from its Series D round last year. We dig into what’s driving the B2B fintech’s rapid growth, how it stacks up against competitors, and what parallels we see in Ramp’s growth story compared to its counterparts in neobanking.

Today’s agenda below.

FINTECH: Can Ramp at $16B become the Revolut for the CFO Suite?

ANALYSIS: Hyperliquid prints $550MM revenue and $40B valuation with no VCs (link here)

CURATED UPDATES: Paytech, Neobanks, Lending, Digital Investing

To support this writing and access our full archive of newsletters, analyses, and guides to building in Fintech & DeFi, subscribe below (if you haven’t yet). Prices will be going up soon, so lock it in now.

Digital Investment & Banking Short Takes

Can Ramp at $16B become the Revolut for the CFO Suite?

First some background.

Eric Glyman and Karim Atiyeh studied together at Harvard before founding their first venture: a spend management tool Paribus, which helped users identify and capture refunds when overspending on stuff online. The product gained around 700k users and Capital One acquired the company in 2016, integrating it into their credit card division.

A few years into their journey at Capital One, the pair reportedly grew frustrated with the higher levels of bureaucracy and slower shipping times at highly-regulated incumbents compared to fast-moving startup culture. At the same time, they spotted an opportunity. There was a misalignment between the incentives of corporate credit card companies, who want their customers to spend more, and businesses who prefer to save cash versus receive points as rewards.

In 2019, together with their third cofounder Gene Lee, the trio launched expense management software Ramp with the mantra of “helping companies save time and money”. The core offering is a corporate credit card for employee and department finances.

Behind the scenes, Ramp parses and analyses spending data to spot patterns and find clever ways of saving money, e.g. identifying duplicate spending on productivity software or flagging costlier monthly subscriptions that work out cheaper if purchased annually.

The MVP product suite came to life quickly via an integration with Marqeta for card issuance, a 1.5% cash back promotion, and light-weight integrations with accounting software like Quickbooks for added value.

Growth has been remarkable.

The company reached a $1.1B valuation after just over 12 months of official launch. About a year later, the company was doing $100M ARR and closing on a substantially higher $8B valuation. Ramp was growing revenues faster than many other high-growth SaaS comps at the time like Slack and Shopify.

Today, AI and crypto projects are achieving $100M revenues in less than 12 months (see Cursor and pump.fun) but we suppose those were simpler times.

Today, Ramp’s annual revenue is reportedly closer to $700M. The company claims 30K+ customers, spanning Shopify and Stripe, that have saved over $1.1B in expenses by using the platform. That implies companies achieve an average of 2% in cost savings across their combined $50B in total processed payments volumes. That’s an attractive value proposition.

The company’s valuation has meanwhile doubled to $16B since 2022 despite a -28% downround amidst a broader sector repricing. What’s particularly striking is the level of conviction with existing investors, particularly Peter Thiel’s Founders Fund. The VC not only participated but has led at least five of Ramp’s funding rounds.

What’s behind the excitement?

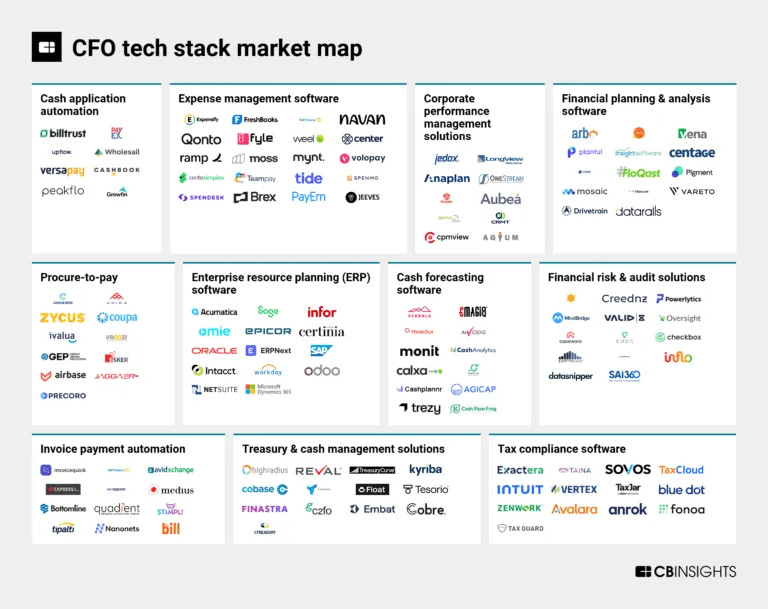

Firstly, Ramp has managed to build a deep financial management ecosystem around the core credit card offering. Similar to many fintechs, the company started by building a superior experience around payments, before leveraging related data and analytics to incrementally add value with adjacent products.

For neobanks, these are personal finance products like lending and wealth management, but for Ramp it’s their corporate finance counterparts like accounting, accounts payables, and travel. Enabling clients to do more of their day-to-day inside the Ramp ecosystem grows their stickiness and diversifies revenue.

Ramp primarily earns its income on interchange fees when customers make card payments, we suspect this has been partially shifting to subscription income on its Plus offering, FX income on international money movement, and affiliate fees when booking travel through its partners.

The second reason is the rate of change of this ecosystem, or its shipping velocity. In a Forbes interview from late 2022, CEO Eric Glyman mentioned Ramp prioritises hiring talent where they see significant potential rather than past successes:

“we try to find people with super steep slope and spiky personalities and prioritize that over intercept.”

Employees are then broadly split between those who (1) move fast and ship quickly and (2) those who spend time perfecting code. The latter is assigned to build the infrastructure of more sensitive products like underwriting and treasury systems, while the former focuses on building new products on top.

The balance between growth and security standards is a difficult but crucial part of the fintech journey. Not all have cracked it (see Revolut’s recent €3.5M fine), but Ramp appears to have found the sweet spot. The company has shipped 270 features in 2025 so far, and compared to last year is doubling the number of expense reports filed automatically, halving the time spent by users to complete routine tasks, and lowering the number of support tickets by 34%. As a result, customers rate the Ramp product highly, with 30% of new clients being acquired via word of mouth at some point.

Ramp is also slightly ahead of most competitors in terms of revenue, outpacing both Brex and Mercury in 2025 ARR. However, it trails BILL — which at nearly $1.5B in revenue guidance for 2025 has built a strong foothold specializing in invoice automation. The firm went public in 2019 and has traded between 3-7x forward revenues this year, despite 22% revenue growth YoY in 2024.

Ramp’s latest round values it at a whopping 22x, which is likely being justified by nearly twice the revenue growth: an average of 38% YoY for the last 6 years. The firm also has ample room for expansion. Ramp estimates that it penetrates just 1.5% of the U.S expense management market, which remains dominated by incumbents like AMEX and JPM.

On the other hand, incumbents are mobilising to improve their offering. AMEX made a strategic investment in Airbase back in 2022 to improve its expense management software among SMBs, but Ramp is likely banking on progress being slow. Its business model is also arguably stronger, with AMEX spending $4.4B, or 35% of its total expenses, on their Points payouts across consumer and commercial card programs — a cost Ramp doesn’t incur.

Moving forward, Ramp will likely continue expanding horizontally across the CFO tech stack in areas like tax, risk, and its newly launched Treasury business. It has also recently announced a stablecoin partnership with Stripe to offer faster payment settlements. Its main challenge is to retain its moat in product and engineering as competition from Brex and Navan heats up and both head for a potential public debut.

👑 Related Coverage 👑

Long Take

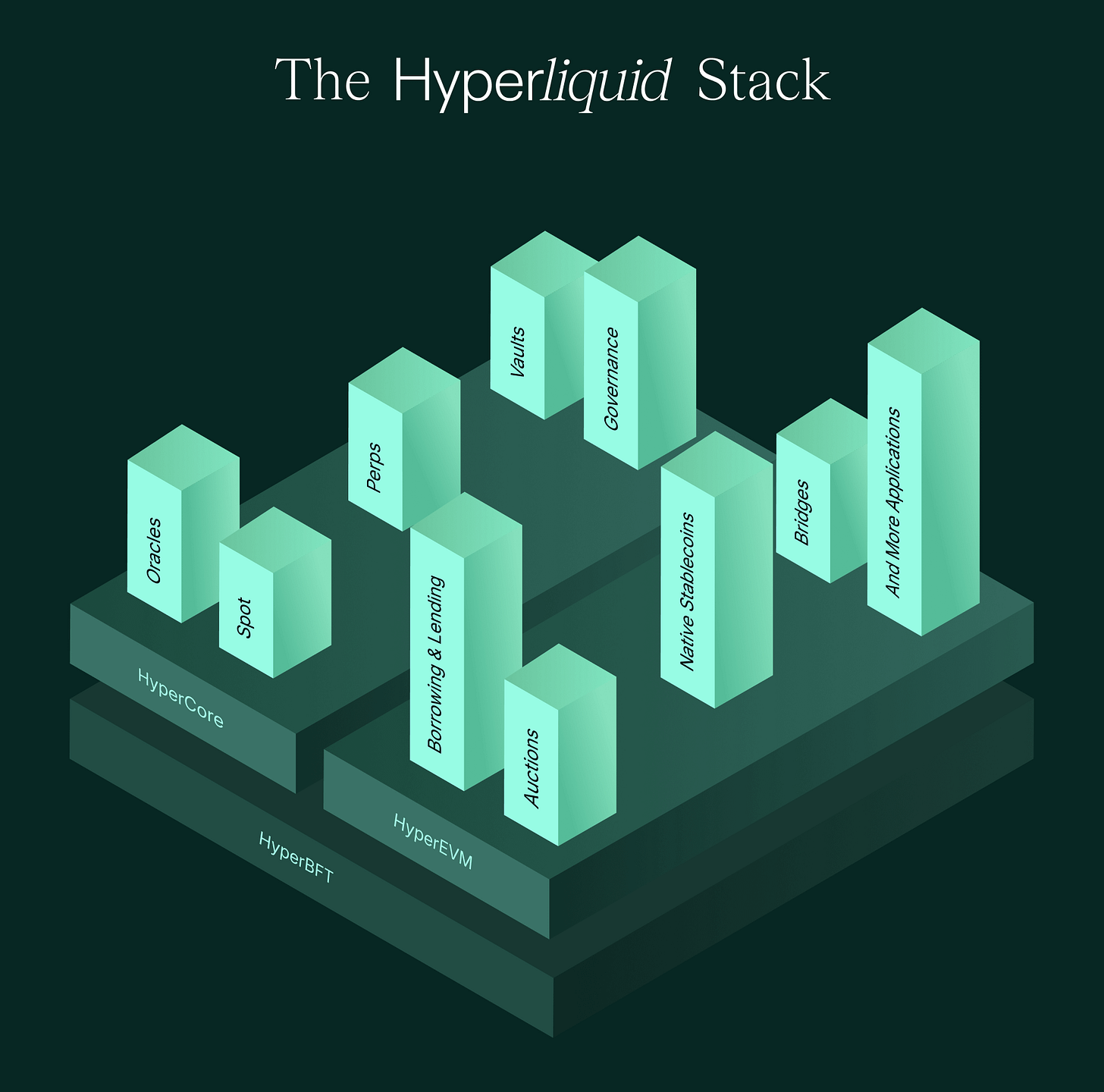

We discuss the meteoric rise of Hyperliquid, a decentralized perpetuals exchange that has reached a $40B valuation within two years and generates $550M in annualized revenue.

Built on its own high-speed Layer 1 chain (HyperCore), the exchange dominates decentralized derivatives with over 60% market share, processing $300B in volume per month and offering leveraged trading across 100+ assets. Its HYPE token is reinforced by strong tokenomics, including daily buybacks and a 31% user airdrop, without any VC funding or private sales.

Compared to Uniswap and public fintechs like Coinbase and Robinhood, Hyperliquid trades at a lofty 72x revenue multiple, supported by rapid user growth and product-market fit. With public companies like Eyenovia and Lion Group now allocating treasury funds into HYPE, Hyperliquid may be the first decentralized exchange to fully bridge DeFi and public capital markets—unless it crashes under the weight of its ambition.

Curated Updates

Here are the rest of the updates hitting our radar.

Paytech

⭐JPMorgan moves further into crypto with stablecoin-like token JPMD - CNBC

Fiserv plans to launch a stablecoin platform to its more than 3,000 community banks- WSJ

Neobank Revolut Actively Exploring Launching Its Own Stablecoin - Decrypt

Neobanks

British challenger bank Monzo's profit soars, revenue tops $1.35 billion - Reuters

Lithuania imposes largest fine on Revolut for compliance failure- Fintech Global

Coinbase beefs up subscription plan by offering it with American Express credit card - CNBC

Lending

⭐Klarna CEO wants to turn the platform into a ‘super app’ with help from AI - CNBC

Unicredit invests €10 million in embedded lending platform Banxware - Finextra

Digital Investing

⭐SEC Decides Staking Is Not (Always) A Securities Offering After All - Winston & Strawn

Coinbase Debuts Stablecoin Payment Stack Following Shopify Partnership - Coindesk

Kraken launches tokens to offer 24/7 trading of U.S. equities - Reuters

🚀 Level Up

Join our Premium community and receive all the Fintech and Web3 intelligence you need to level up your career. Get access to Long Takes, archives, and special reports.

Sponsor the Fintech Blueprint and reach over 200,000 professionals.

👉 Reach out here.Check out our AI newsletter, the Future Blueprint, 👉 here.

Read our Disclaimer here — this newsletter does not provide investment advice