Fintech: WhatsApp in-chat payments launching in India; $131MM valuation for Wealthtech Farther

The world’s most popular messaging application is bringing in-chat payments to the world’s most populous country.

The Fintech Blueprint is a newsletter authored by me, Lex Sokolin, and a small group of brilliant researchers who focus on frontier technologies impacting the future of financial services. I am glad you are here. Was this email forwarded to you? You deserve your own:

👉subscribe here.

Hi Fintech Futurists —

You’re the best, today’s agenda below.

PAYTECH: WhatsApp launches in-chat payments service for businesses in India (link here)

WEALTHTECH: Farther closes Series B funding round to gain $131MM valuation (link here)

LONG TAKE: How Decentralized Physical Infrastructure (DePIN) impacts finance and the machine economy (link here)

PODCAST CONVERSATION: How to build a $60B volume global payments platform, with Rapyd CEO Arik Shtilman (link here)

CURATED UPDATES

To support this writing and access our full archive of newsletters, analyses, and guides to building in the Fintech & DeFi industries, subscribe below.

Fintech Meetup Delivers Results! Fintech Meetup (March 3-6) is the best place to find new business, partnerships and opportunities. Attendees & sponsors say Fintech Meetup is “the highest ROI event” with reasonably priced sponsorships, tickets, and rooms. Meet everyone for any reason across every use case over 45,000+ double opt-in meetings, and Network with 5,000+ attendees.

Digital Investment & Banking Short Takes

PAYTECH: WhatsApp launches in-chat payments service for businesses in India (link here)

The world’s most popular messaging application, WhatsApp, owned by one of the world’s most powerful tech companies, Meta, is bringing in-chat payments to the world’s most populous country, India.

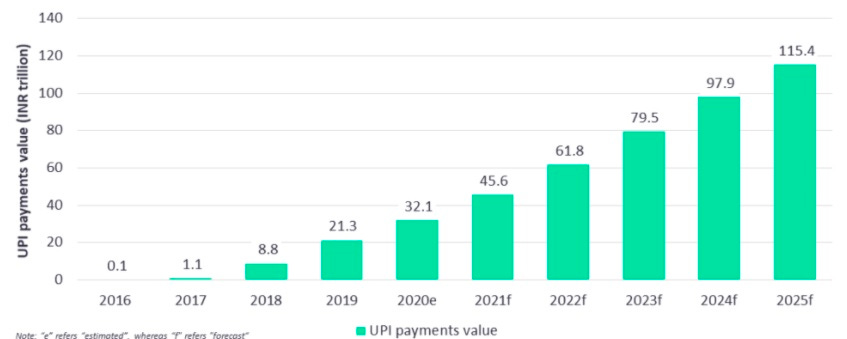

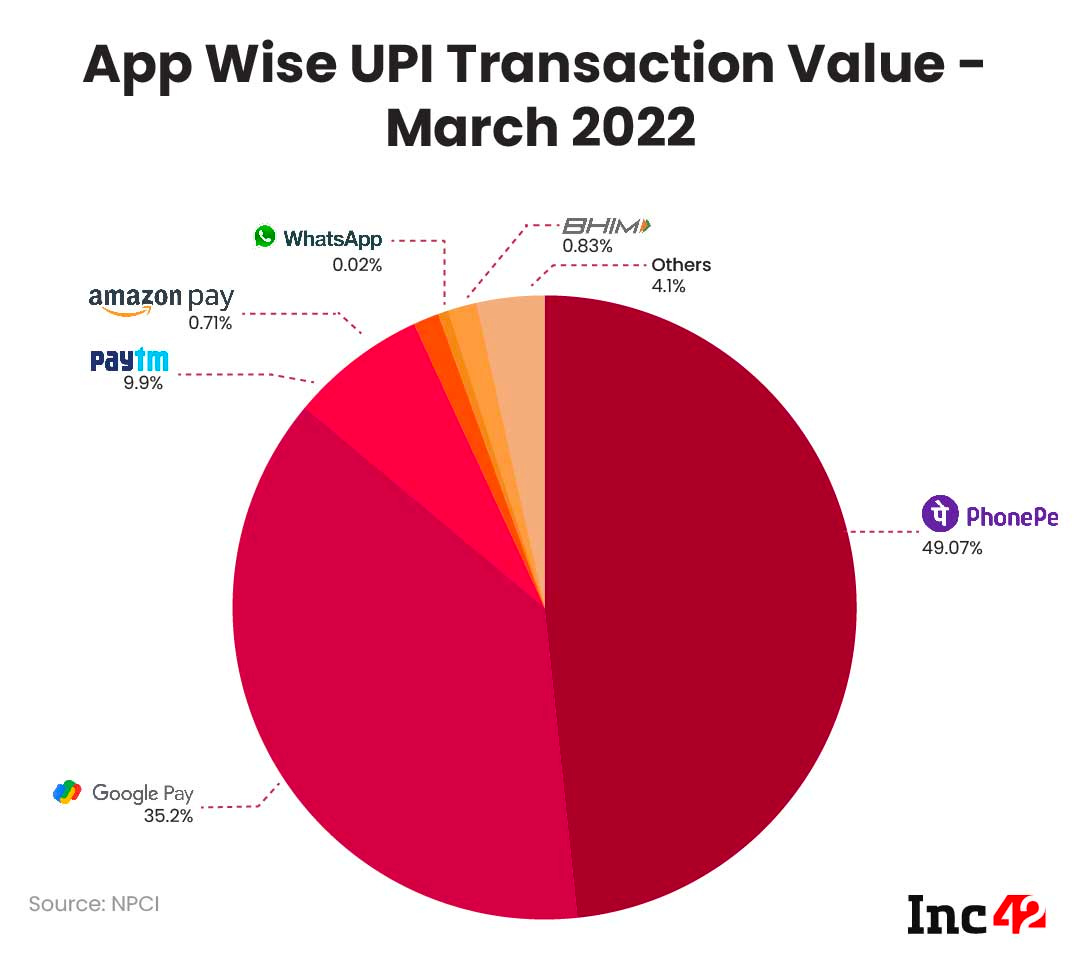

The feature enables users to pay for products and services directly from within the application using WhatsApp Pay, their debit or credit card, or India’s Unified Payments Interface. While consumers and businesses transact in-app without fees, the revenue model leans into a traditional Meta motion — businesses pay to message their customers. It is a model that has been tried and tested by WhatsApp in Singapore and Brazil and is now coming to its biggest market.

With over 400MM WhatsApp users in India, this feature could turn the app into the country’s leading e-commerce application. Already, businesses using Meta’s click-to-message ads have led to a $10B revenue run-rate. This move not only lays the groundwork for diversifying revenue, but also adds significant financial data to better customize and target advertising. For businesses using the application, in-message transactions make it easier to close sales, while consumers benefit from fewer steps in the checkout process.

One example of customer success so far is JioMart, the e-commerce offering of Jio, in which Meta invested $5.8B in in 2020. Since enabling in-app payments, customers using the company’s WhatsApp have grown by 900%.

This move allows WhatsApp to take one step closer to super-app status, which WeChat famously achieved nearly a decade ago as it integrated its instant messaging service with digital wallet functionality. WeChat itself has 1.6B monthly active users and annual revenue of $17.5B -- over 20x more than WhatsApp’s $790MM in 2021.

While efforts to build this chat payments functionality started in 2018, regulatory uncertainty in India halted progression. With this launch, we see India as a significant revenue opportunity and an ideal — if massive — testbed. Once these features spread west, there may be a future in which WhatsApp has everything you need on your phone.

Note, of course, the importance of the Unified Payments Interface here, and compare notes to the CBDCs in China and Nigeria, as well as Brazil’s Pix payments.

👑 Related Coverage 👑

In Partnership

Trends in Digital Lending for 2024: AI, Automation, Embedded Finance and more

👉October 10 at 2pm BST (9am ET)

As we begin to look to 2024, we can expect new technology to continue to have a profound impact on digital lending. This webinar features a panel of leading experts who will discuss some of the major trends for the next year.

Topics include:

Why AI/ML models will become more important and how to deploy them quickly

How open banking can help drive underwriting efficiencies

How innovative lenders are using automation in their credit decisions

What new opportunities are provided by embedded lending

How to navigate the new normal of high cost of capital

WEALTHTECH: Farther closes Series B funding round to gain $131MM valuation (link here)

Digital RIA Farther closed a $31MM series B round this week at a $131MM valuation, with participation from Lightspeed Venture Partners. Since its founding in 2019, the firm has grown its clientele to 3,600 accounts and AUM to $675MM, according to its latest ADV filing in June. While the pathway to $1B+ in AUM is likely in the not-so-distant future, it is a drop in the bucket for the scale investors hope the firm can achieve.

Success in the RIA sector is still fundamentally benchmarked against the scale of AUM. Traditional asset managers are worth about 2% of assets (e.g., $700MM AUM = $14MM valuation), while roboadvisors can be comped to Wealthfront’s aborted $1.4B acquisition at $30B in AUM, or about 5% of AUM. Farther is growing fast, but is expensive relative to the market, likely at 10% of AUM.

For now, Farther appears to be deploying its funds, $53MM to date, to improve inefficiencies across the RIA tech stack — a common approach undertaken by independent RIAs with a hybrid tech/advisor business model. (See our related coverage of Savvy Wealth). Sixty-five percent of advisors lost business due to outdated wealth management technology. To solve for this, Farther has hired aggressively for tech, product and engineering positions.

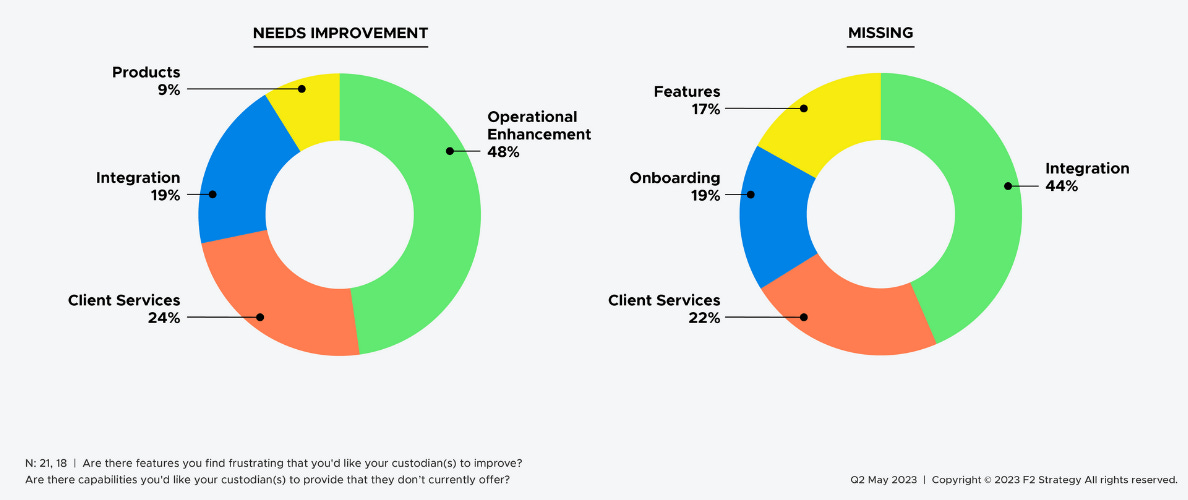

A lot of advisor work is not done in front of the client, and is wrapped up in admin and ops. Farther can improve the onboarding process and unlock digital client engagement. According to a poll done by F2, less than 50% of RIAs are satisfied with the native tools provided by their existing custodian, and 44% said their custodian does not offer necessary integrations.

Farther also hopes to challenge the advisor compensation structure. Currently, it hires in-house advisors using a model that pays them 50% for the first $500,000 in production and up to 75% over that. All advisors work remotely and receive equity as part of their compensation package. Farther charges up to 1.5% of all assets including cash and $1,000 per hour for planning. We note that 89% of RIAs still generate revenue via wrap fee programs (charging for the % of all AUM), though this figure has been declining.

As the fundraising environment remains subdued, it is encouraging to see investor activity in wealthtech. We believe AI-powered financial guidance will bring a new era of financial advisory, making it clear that firms like Farther have a lot of white space to grow into.

On the flip-side, there is no shortage of technology to serve RIAs, so the company would do well to remember that technological innovation is but one lever of success. There are plenty of TAMPs and portfolio management systems building software. Striking the right balance between automation and maintaining an engaging and human-centred service that can drive AUM growth will likely be the litmus test for enduring success in this sector. Put another way, focus on the go-to-market.

👑 Related Coverage 👑

Reach an Audience of Builders and Investors

To support The Fintech Blueprint and reach our 185,000+ Substack and LinkedIn subscribers, contact us here.

Blueprint Deep Dives

Long Take: How Decentralized Physical Infrastructure (DePIN) impacts finance and the machine economy (link here)

We dive further into the concept of a machine economy, and how it intertwines the Internet of Things (IoT), the Metaverse's economic structure, and visionary sci-fi narratives.

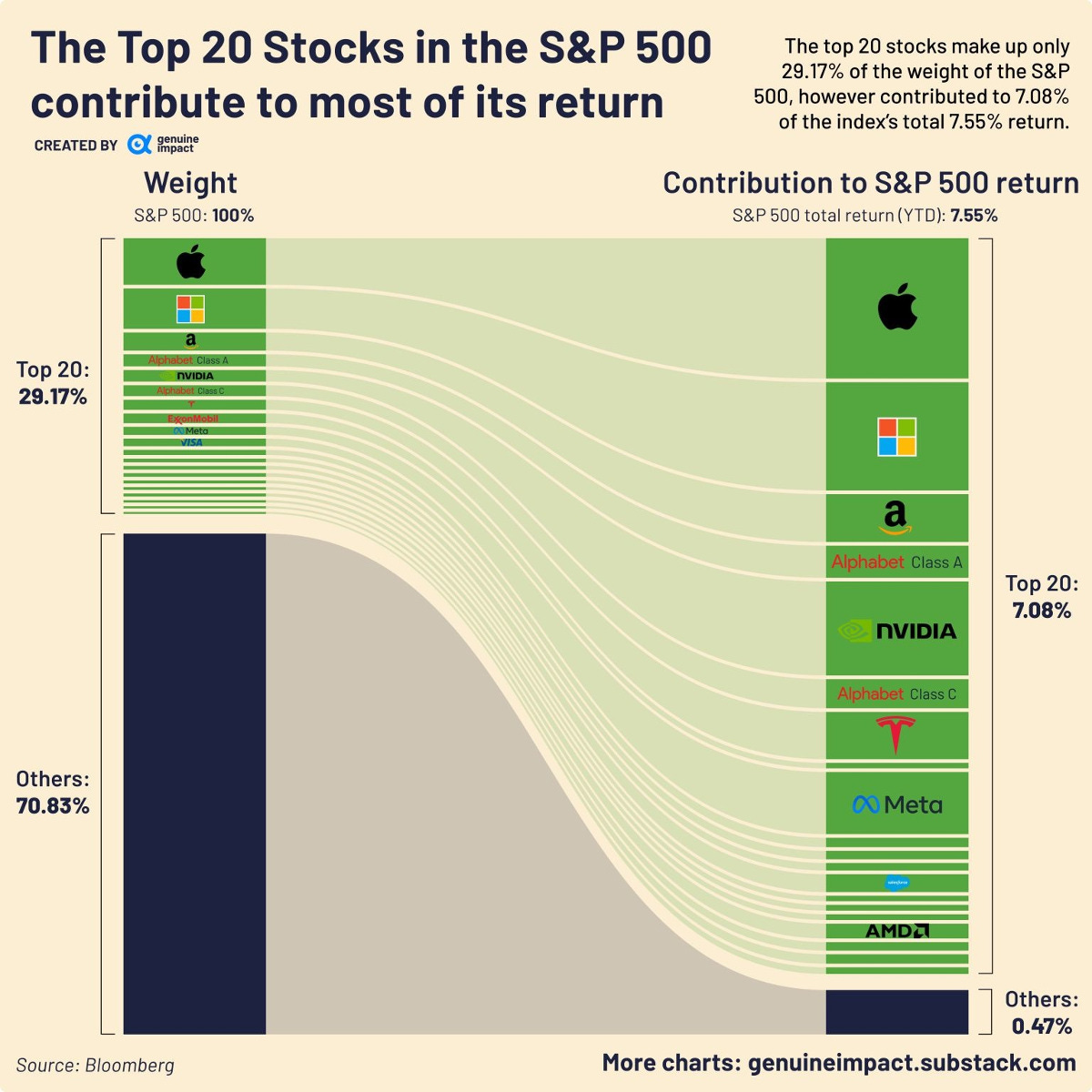

Current data from Goldman reveals a shift in the S&P 500, where top tech companies dominate, indicating their increasing influence in the digital realm. The DePIN (Decentralized Physical Infrastructure Networks) sector is emerging in Web3, aiming to anchor digital twins and commerce avatars into decentralized platforms. As finance evolves, we're not just observing hardware devices interacting financially; we're witnessing the birth of self-driving money, where software representations of real-world entities play pivotal roles in our digital economic future.

Podcast Conversation: How to build a $60B volume global payments platform, with Rapyd CEO Arik Shtilman (link here)

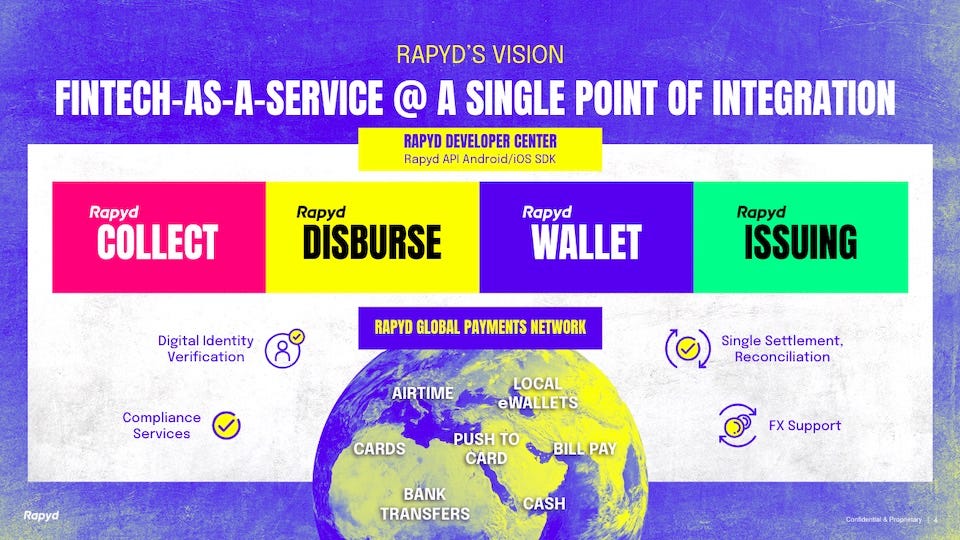

In this conversation, we chat with Arik Shtilman - CEO and co-founder of Rapyd, a leading fintech-as-a-service platform. Arik founded Rapyd in 2016 with a singular goal in mind: to provide all the tools businesses need to create payment, payout and fintech experiences anywhere in the world.

Prior to starting Rapyd, Arik realized there was a massive need to create a way for fintech applications to scale globally so businesses could invest in expansion – not spend critical time attempting to build complex payments infrastructure. To solve this glaring challenge hindering growth in the payments space, Arik launched Rapyd as the first “Fintech-as-a-Service” product in the industry, the category-leading full stack of integrated payments, commerce and financial services capabilities that can be seamlessly embedded into any application

Curated Updates

Here are the rest of the updates hitting our radar.

Neobanks

⭐ Varo Bank launches no fee payments feature “Varo for Everyone” - Finextra Africa

Payments

⭐ Sibos 2023: Visa and Swift collaborate to streamline cross-border payments - Fintech Futures

Lloyds Bank takes on business spend management with Visa Commercial Pay - Finextra

Wealthtech

⭐ Wealthtech startup Vega emerges from stealth with $8 million equity investment - Finextra

Traydstream secures $21 million Series B - Finextra

Financial Operations

⭐ Apple soft launches UK open banking integration for iPhone Wallet - Finextra

Series, which aims to replace ERP systems, lands $25M - TechCrunch

Former Revolut and Square exec raises $15 million for invoice platform Apron - Finextra

Shape your Future

Curious about what is shaping the future of Fintech and DeFi?

At the Fintech Blueprint, we go down the rabbit hole to help you innovate and compete.

Sign up to the Premium Fintech Blueprint newsletter and get access to:

Wednesday’s Long Takes on Fintech and Web3 topics with a deep, comprehensive analysis

Office Hours, monthly digital roundtable discussions with industry insiders

‘Building Company Playbook’ series, offering insider tips and advice on constructing successful fintech ventures

Enhanced Podcasts with industry leaders, accompanied with annotated transcripts

Archive Access to an array of in-depth write-ups, spanning across 15+ topics and encompassing over 50 Fintech and DeFi brands