Guide: Navigating the Build vs. Buy decision for Fintechs

And the difference between white label, source code, and product licenses

Hi Fintech Futurists —

We are excited to share with you a guest opinion today on how to bootstrap a fintech software product in the early days of a company’s lifecycle. Today’s agenda is below.

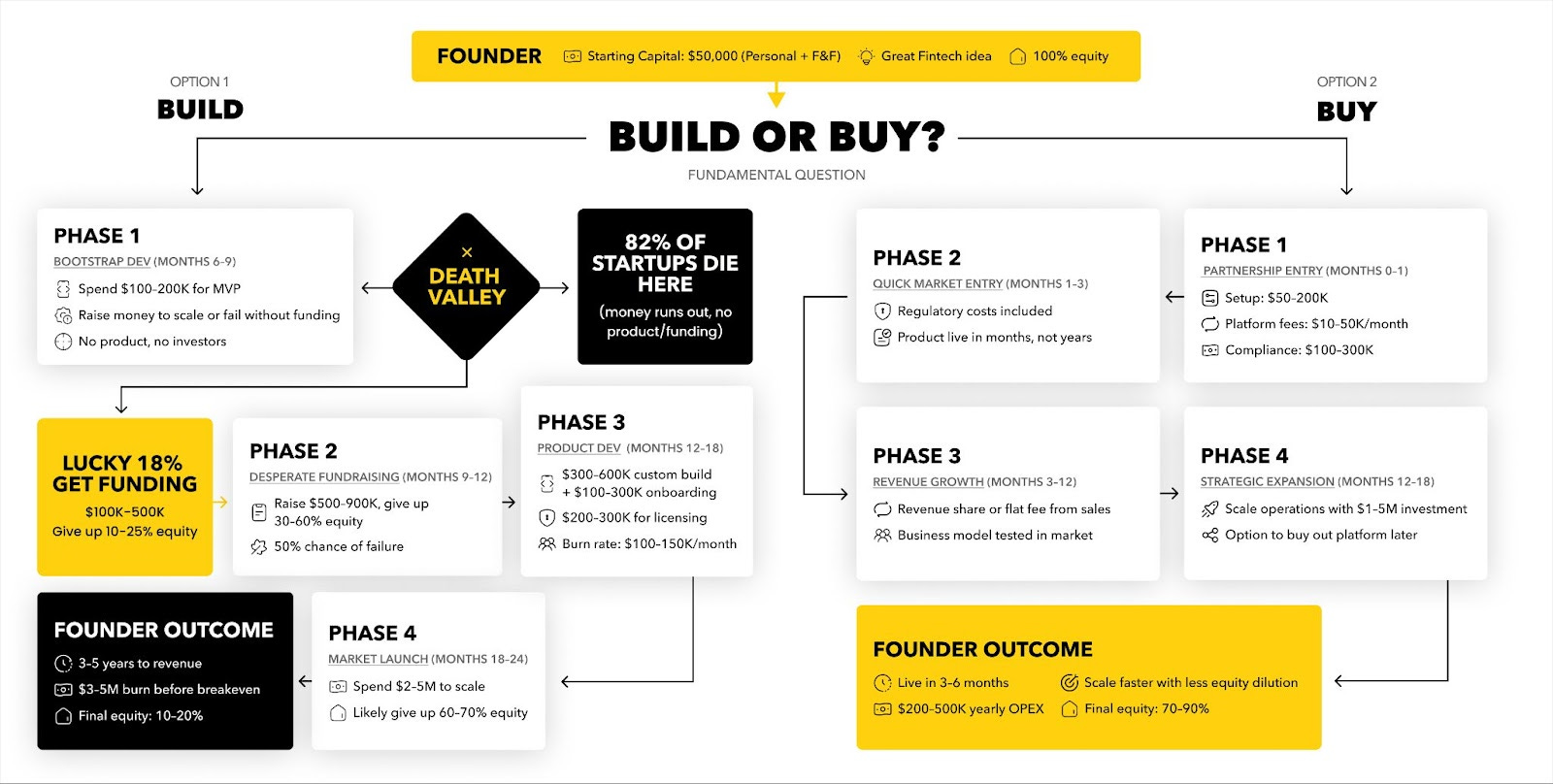

OPINION: Buy now, build later: the formula of successful fintech launches

HOW TO BUILD A COMPANY: Full 8 part set of company-building playbooks

To support this writing, check out our sponsor — your engagement helps us immensely.

In Parthership with DashDevs

Fintech Core by DashDevs gives you speed, customization, compliance, and cost-control in one product license. Launch in just three months with ready-made modules for KYC, card issuing, account management, and AML. Customize front and back ends to match your operating model, validate demand fast, and scale with confidence.

Our Ecosystem: AI Venture Fund | AI Research | Lex Linkedin & Twitter | Sponsors

Opinion

This article is written by DashDevs, a developer of fintech software behind several successful app launches for different clients. We share their view to help financial services operators and entrepreneurs understand different ways of building companies and getting off the ground.

Buy now, build later: The formula of successful fintech launches

There’s an open secret in fintech: many of the “from scratch” disruptors didn’t start from scratch at all. They launched on borrowed rails.

Chime, Current, and SoFi built on top of Galileo’s platform (with SoFi then buying out the company). AngelList, HoneyBook, and Wix chose Unit’s platform to integrate financial products into their core businesses.

But not all rails are created equal. Some offer speed with little control. Others promise full ownership but at a steep cost.

So which route should you pick?

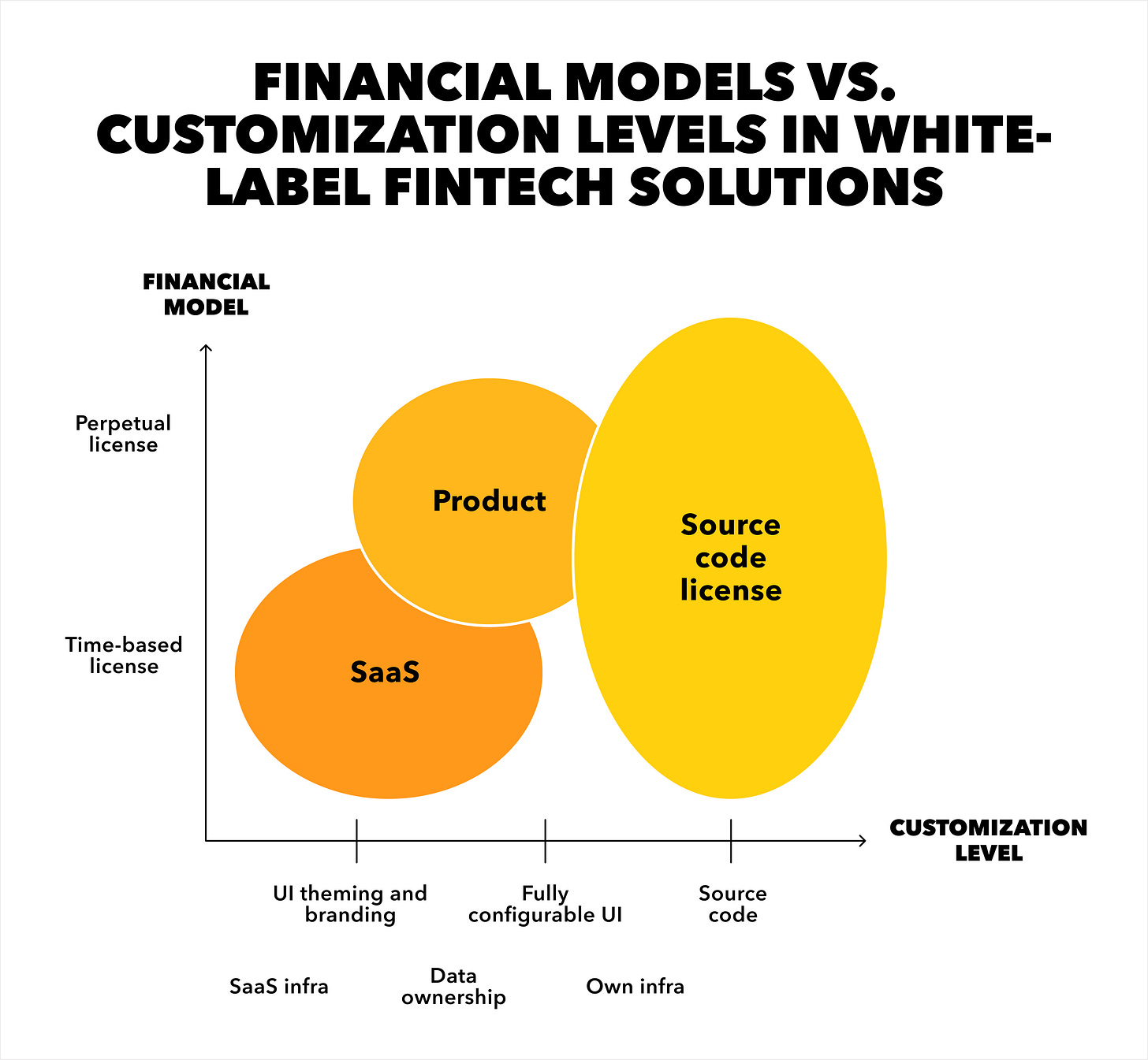

The 3 types of fintech white-label solutions

For context: white-label means licensing a ready-made fintech platform that you can run under your own brand.

But licenses differ greatly in what you're actually buying:

SaaS white-label hooks you up with all the necessary infrastructure from the vendor, pre-made UIs, and some extra product features. You are effectively renting the rails for an ongoing fee (with no prospects of buying).

Product license gives you greater control over where the backend gets deployed and how the pre-built modules can be customized. The price is an ongoing subscription or a perpetual license, with costs scaling according to usage rates.

Source code licensing means you’re buying out the exclusive code usage

rights, and can change it in any way you see fit in the future. But that means hefty upfront cost and often a full compliance burden to boot.

SaaS white-label

SaaS white-label is the most common starting point for new market entrants. For a monthly subscription fee, you get vendor-hosted infrastructure and pre-built sub-products (e.g., wallets, checking account, card management, and more).

The appeal is simple: you can get to market in record time, with minimal upfront investment, often without a large technical team.

Advantages:

Fastest GTM, thanks to pre-built modules and optimized infrastructure

Low upfront cost, leaving more cash for user acquisition

Done-for-you infrastructure management

Built-in compliance often included

However, speed comes with tradeoffs. SaaS platforms typically limit how much you can customize user experiences, product workflows, or even data storage. You have to settle for features and integrations that are currently available, and wait for the vendor to build out anything you might also want to have.

Since your data lives with the vendor, you are also more dependent on their compliance posture, which has recently become a target for regulators. If the vendor falls short or changes their pricing model, your business is directly exposed. The Synapse situation comes to mind.

SaaS white-label makes sense when you need results fast, e.g., to show traction to investors or prevent revenue erosion due to a new competitor. You can validate your hunch without committing too many resources and pivot to something else should the stakes call for that.

Yet, the very advantages of SaaS can later become constraints when you try to scale, differentiate, or satisfy more rigorous regulatory expectations.

Source code license

In full contrast to SaaS, a source code license is the maximum ownership of a white-label solution. Effectively, you buy out the full source code of the vendor-supplied solution and can run it as you see fit onward — extend, upgrade, and re-architect.

Advantages:

Complete IP ownership and limitless customization possibilities

No reliance on vendor infrastructure or roadmaps

Full visibility and control over compliance posture

No caps on differentiation in subsequent product development

A source code license is the equivalent of owning the land, not just renting the house (as you do with SaaS). You control every extension and remodel along the way.

But with full ownership also comes full responsibility: security, compliance audits, and ongoing maintenance fall on your team. Without sufficient operational and technical expertise, you risk getting burned by high operating costs and unforeseen compliance fines. It’s also not the model to choose if you have a limited startup budget or prioritize speed above all else.

For these reasons, source code licensing is best suited for enterprise-stage fintechs or established financial institutions that are feeling the gravity of their ‘legacy’ choices. These players have the budget, in-house expertise, and regulatory standing to shoulder the responsibilities.

It is also the model you can switch to later on if your goal is to build a highly differentiated product suite and maintain a technology portfolio with maximum control.

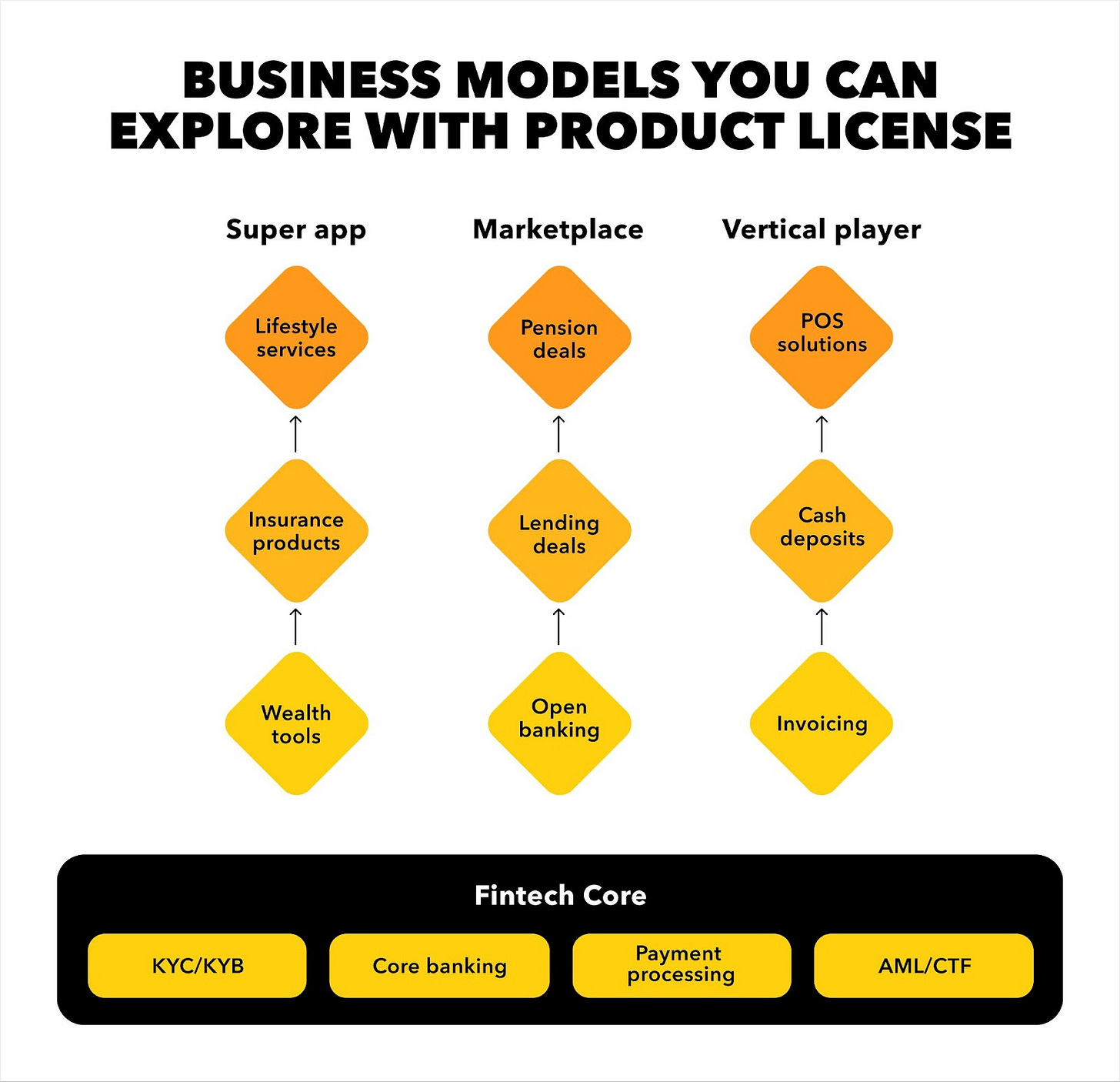

Product license

A product license sits between the speed of SaaS and the full control of source code. In this case, you license a platform from a vendor but can choose where and how to run it — on your cloud or their infrastructure, with the team’s support or on your own.

You also get more freedom to tailor the offering to your target business model. Platforms like Fintech Core even come with integrations to third-party providers, letting you pick pre-built modules and integrations like Lego blocks. Likewise, you get compliance sorted upfront.

This balance allows you to move quickly without sacrificing future scalability.

Advantages:

Configurable and flexible core infrastructure

Balanced economics with usage-based licensing fees.

Full data ownership and control over customer experience

Greater compliance posture and lower dependency risk

The tradeoffs of product licensing are more moderate, too. You take on more operational responsibility than with SaaS, but without the heavy upfront burden of a source code license. Customization has limits compared to full IP ownership, yet the flexibility is still significant.

You can launch faster, while keeping the option to extend and differentiate later. This makes product licensing the sweet spot for fintech founders: a 3-4 months time-to-market with prebuilt modules plus ownership over infrastructure, data, and future roadmap. Costs scale with usage, so you avoid both the endless SaaS tax and the massive upfront outlay of source code.

In practice, this model lets you validate fast, scale smart, and differentiate later without rewriting your entire stack. It is the essence of the “buy now, build later” philosophy.

Product License as a launchpad

Product licensing gets you into the market quickly and at the same time creates an extendible foundation. Since you control the core infrastructure, user interface, and workflows, adding new capabilities is far smoother than in a rigid SaaS environment. You’re not stuck waiting for a vendor’s roadmap either.

To evolve your value prop, you can plug in differentiating features: data-driven loyalty programs, advanced fraud detection, wealth, crypto, and cross-border modules that open entirely new revenue streams. With Fintech Core, each of these can be integrated without re-engineering the entire stack, because the base framework is designed for modular expansion.

Of course, there are tradeoffs. Compared to SaaS, you’ll take a more proactive role in product engineering. And while not as costly as a full source code license, there are still ongoing licensing fees.

For many fintech founders, this makes the product license a strong strategic option. It allows you to validate an MVP at near-SaaS speed while protecting against the long-term risks of dependency. It gives investors confidence that you control your roadmap and compliance. And, it positions you to differentiate later without having to rip out and rebuild your foundations.

By standing on a stable, scalable base, fintech founders can stop wasting years reinventing infrastructure and instead focus on winning customers and markets. You’re buying time — literally.

Buy now, build later.

👉👉👉 Learn more about Fintech Core here

🔨 How To Build a Company

Below you will find our full series of guides on how to build a successful company. This is one of our cornerstone content guides, which we hope you enjoy.

🚀 Level Up

Join our Premium community and receive all the Fintech and Web3 intelligence you need to level up your career. Get access to Long Takes, archives, and special reports.

Sponsor the Fintech Blueprint and reach over 200,000 professionals.

👉 Reach out here.Check out our AI newsletter, the Future Blueprint, 👉 here.

Read our Disclaimer here — this newsletter does not provide investment advice