Long Take: Can the $35B mega-merger of Capital One and Discover succeed?

Where FIS and Worldpay failed

Gm Fintech Architects —

Today we are diving into the following topics:

Summary: In this article, we discuss Capital One's proposed acquisition of Discover for $35 billion. We explore how such mega deals allow us to understand industry economics, revealing that growth often plateaus as companies mature and face increased competition — with a move towards consolidation as companies seek new growth avenues in adjacent markets. Capital One, with a market cap of around $50 billion and annual net revenues of $37 billion, is a credit card disruptor, while Discover, valued at $31 billion, offers a complementary digital banking and payment services portfolio. The merger promises significant potential for growth and market repositioning, despite the challenges and skepticism surrounding the integration of such large-scale operations.

Topics: payments technology, mergers and acquisitions, Capital One, Discover, BlackRock, JPMorgan, Bank of America, Citigroup, Wells Fargo, SoFi, Tinkoff, Visa, Mastercard, American Express, Circle, PNC, Goldman Sachs, Elizabeth Warren, Varo, Revolut, FIS, Worldpay, Fiserv, First Data, Global Payments, TSYS.

If you got value from this article, let us know your thoughts! And to recommend new topics and companies for coverage, leave a note below.

Long Take

Why Mega Deals

A titanic deal is coming through the fintech waters, as Capital One attempts to acquire Discover for $35 billion.

Deals like this are always fun to parse. First, it gives us an opportunity to re-acquaint ourselves with industry-level economics. When staring too closely at early stage projects, you can get used to 10x or 50x revenue multiples as normal. In reality, growth does not stay parabolic, but tends to even out, like this —

Once you get to the “slowing down” phase, it is likely that the company has penetrated its niche or market, and is bumping up against competitors. The choices thereafter are to exit, or to try and get up another S-curve slope in some other adjacent market.

Every time the company switches to a new market or platform, there is large execution and strategic risk. While it is true that some of the start-up variables, like distribution or supply chains, might be de-risked, other variables are actually worse off. For example, it is difficult to attract the type of talent that wants to build new things. There are operational solutions — like the Amazon product management culture — but pulling that off is an exception.

The second reason we like mega deals is to understand the macro trends within a market. What can we learn about payments and banking as sectors when their underlying players begin to consolidate and cry synergy? Are there no better opportunities?

So lets get introduced to the players.

Capital One

Capital One is a financial disruptor founded on bringing better tech and marketing to the banking industry, starting with credit cards. The company evolved from a startup in 1988 to one of the ten largest banks in America and one of the 100 largest companies in the country. The firm has used strategic acquisitions across retail and direct banking, credit cards, auto lending, and technology, to grow the business and expand into new markets.

It is a profoundly impressive story.

The market capitalization of the company is around $50 billion, with annual net revenues of about $37 billion and earnings of $5B. Roughly, we are looking at 1.2x on revenue and 10x on net income. The core products are banking and lending, with deposits of $348 billion, most of which come from consumers. Net interest margin — the difference between what the firm pays out in interest to funding sources and what it retains for itself — is a whopping 6.63%.

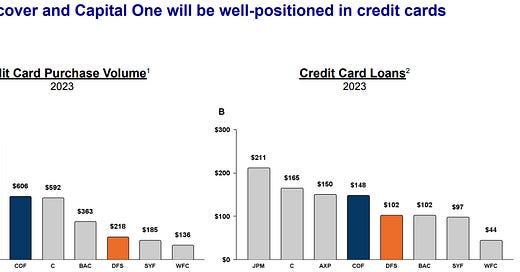

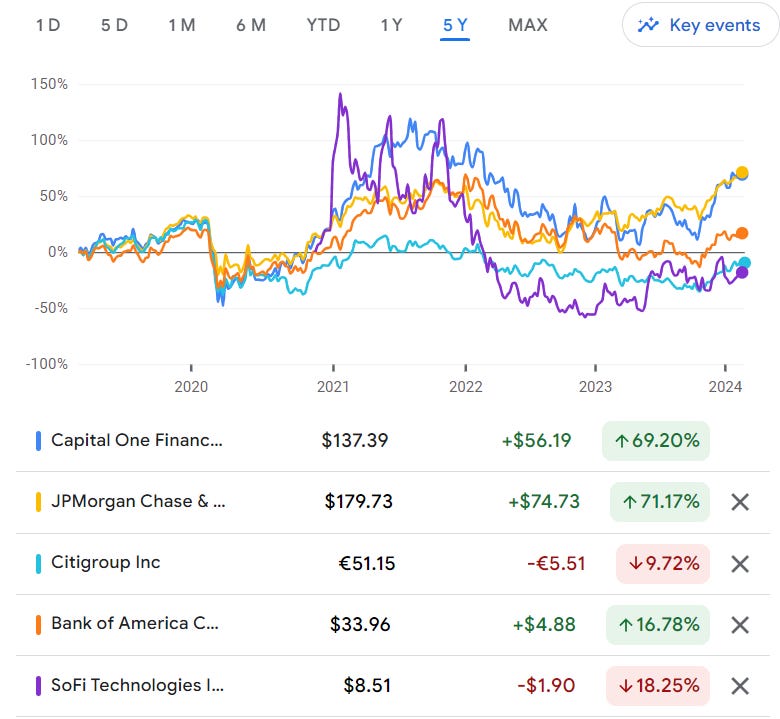

Certainly the interest rate environment helped. But Capital One is also extremely capable at execution. Its market performance reflects this, and has been in line with best-in-class JP Morgan.

Meanwhile, Bank of America, Citigroup, and Wells Fargo have struggled to keep up. Wells has been caught up in multiple scandals, leading to limits on its growth. The law of large numbers is going to make it more difficult for these larger companies to grow at the pace of Capital One. But when looking at some of the favored fintechs targeting both banking and credit markets, we can use SoFi as a proxy. The fintech has also seen mixed performance.

If we had to really simplify the Capital One business — which isn’t fair since it has multiple business lines and growth curves — it would be as (1) a marketing-first bank, (2) focused on regular retails consumers concerned with their credit, (3) running on pretty modern but not-the-very-latest technical infrastructure. As long as they can keep the customer acquisition machine working productively, while keeping loan losses in check through good risk management, the machine will grow.

In a way, it reminds us of our conversation with Tinkoff.

Now let’s switch to the target.