Long Take: How Monzo, Revolut, and Starling get to break-even, and comparison with WeChat and Facebook

Hi Fintech futurists --

This week, we look at:

The financial model behind Monzo, and comparisons to Revolut and Starling

How the Eastern super apps inspired the marketplace model, and why that success is hard for neobanks to replicate

Paths from losing $100 million per year to break-even and enabling digital assets and other financial products

Facebook Financial forming to take over payments and commerce

For more analysis parsing 12 frontier technology developments every week, a podcast conversation on operating fintechs, and novel food-for-thought essays, become a Blueprint member below.

Long Take

We've had a bit of time to digest the annual results of the largest UK neobanks. The results say more about consumer Fintech investing than about any company in particular. Grab the financial model we built for this analysis here.

First came the gut reaction -- sticker shock about the $50 to 100 million per year losses for Revolut, Monzo, and Starling. Next came the arithmetic of how much these companies raised, and how together they have 15 million users and $10 billion of European Fintech unicorn enterprise value. Could these companies follow the success of Transferwise in creating a global player, or will Goldman's Marcus eat everyone's lunch? Did their B2C customer acquisition catalyze banking-as-a-service and push the incumbents to do more with existing systems? And finally, how well does the marketplace banking idea really compare with the Eastern super apps? Our initial take is in last week's podcast and this week's Sifted.

But we can get sharper. Let's provide some larger context for why this stuff matters, and then dig in one layer deeper into the numbers. Neobanks grew up out of three themes. The first was a dissatisfaction with British banks, whose customer experiences were poor and expensive (while being seen as prestigious). The second was the Economist's claim that "data" was the "new oil". This led to the Web 2.0 claim of growing a massive user base, like Facebook or Amazon did, and monetizing it later. Throw in a narrative around financial data aggregation and artificial intelligence for personalized financial product placement, and you Visa will acquire you for $4 billion (I kid!).

The logic of data being more valuable than money suggests that having data on people and their financial lives gives you the embedded option of selling them financial products. As an example -- would you rather have $100 in fees per year, or potentially $1,000 per year at some probability of you selling me a mortgage? To a venture capital investor, the embedded option is more attractive given a portfolio structure that requires unicorns. Nobody wants ordinary success. And given the regulatory barrier that prevented neobanks from actually doing banking between 2015 and 2017, the embedded options looked like a gold pot. Now, in 2020, with a few years of licensed banking operations, we can take a sober look at what the data is really worth today.

Lastly, around this time the Eastern superapps like WeChat and AliPay started to enter the Western consciousness. Chinese tourists came to Europe to spend, and asked for QR codes from merchants in order to do transactions. The massive digital payments volumes figures and money market amounts eclipsed all expectations. And so the neobanks adopted the outward appearance of superapps -- to be a marketplace of digital products and services powered by a core, modern financial experience. While this sounds good, we now see that the math is a real struggle.

In China, Ant Financial has over 1 billion users. In American terms, you should think of Visa or MasterCard as a comparison, or maybe American Express. That would be a payment rail that is required for anyone to buy pretty much anything, especially online and via proximity payments. Nearly each one of the billion users is using the app to pay, therefore growing the commerce apps embedded within the payments ecosystem, and generating fees. For someone like Monzo, however, you have the dual problem of (1) converting a much smaller 65 million UK population into a new bank that competes with large incumbents, and (2) trying to bootstrap a meaningful marketplace which will see some additional conversion drop-off. Even at a 10% conversion rate following a 10% conversion rate, we see only 1% of users touching captive marketplace services. For all purposes, Monzo is competing with both Barclays for banking and Apple for the operating system of apps. Ouch.

Take the counter example. If WeChat is "outlawed" or somehow "blocked" by the Trump administration (a prospect that, we think, sets an awful precedent and helps no one), 95% of Chinese users would get a new phone to keep WeChat. Pretty sure the UK neobanks do not garner the same level of loyalty.

We don't need to belabor this point. In a world where Facebook is creating a paytech unit focused on global commerce under David Marcus (former president at PayPal, head of Facebook Messenger for 4 years, and of course the face of Facebook's cryptocurrency effort Libra) tells you enough about how much space will be left for B2C banking. People just might switch phone brands for Facebook.

The Financial Model

We modeled Monzo's economics, and use that as a reference point against which Revolut and Starling are compared. Arguably, Monzo is the most fragile of the three players despite having a banking license for 2 years and having converted 94% of its prepaid card customers into current accounts for deposits and lending. But it is also the most straight-forward in applying neobank strategy to the consumer space and trying the marketplace idea.

Starling leans towards small business banking and larger average accounts, which we think creates more complex math once at scale. It is also funded by more price-sensitive investors. Whereas Monzo benefits from the powers of the community on Crowdcube and Revolut has the endless pockets of DST behind it, Starling affiliates with more traditional banks and high-net-worth investors, keeping its valuations private. Revolut has the added complexity of other business lines including crypto trading, holding nearly $100 million in digital assets that experience price fluctuation. So Monzo is a good place to get grounded.

If you are interested in these numbers, we would also recommend you check out these analytics from Sanjeev Kumar (PwC) and Marc Rubinstein (Net Interest), which are even more granular than our quick and dirty annual assumptions.

Monzo does two main things for money now that it is a bank. It (1) takes deposits, and (2) powers payments. On GBP 1.3 billion of deposits, it lends out about 10% at a 15 to 20% interest rate, and it also takes customer assets and parks them in a central bank to earn about 45 basis points of return. Those activities yield GBP 25 million of net interest income. Note however that this year there is about GBP 20 million of expected credit losses, which suggests that 15% to 20% of the loans are written off. That's really high -- lending is hard during a global pandemic!

The payment side of the equation generates GBP 29 million of net fee and commission income. That's 25 basis points of interchange on GBP 10 billion of transaction volume. Notably, the firm includes the expenses it pays out as part of interchange as part of revenue. It's a bit rich in the sense that an additional GBP 10 million of expenses are baked into a revenue number, and those expenses cannot proportionately go down. They are baked in. But that in turn yields better venture capital metrics, i.e., revenue multiples that look like 30x. We built the revenue back up below.

As you can see, marketplace commissions are not a very large part of the business yet. The revenue tops a GBP million but is netted out by various expenses for services, despite a user base of 4 million customers -- a little bit less than 10% of the entire UK market. All this good stuff comes at a steep cost. Once you net the credit losses and commission expenses from revenue, and then subtract GBP 150 million of cost, you are left with a GBP 115 million loss. Revolut has a comparable loss, but generates almost GBP 100 million more in revenue.

Can these numbers get turned around? We think so. The model shows an expected 2020 case reflecting the company's recent downsizing and increasing transaction volume. That got us to a GBP 125 million revenue line, nearly doubling from last year, while still printing a GBP 100 million loss. You would need about 20 million users who tripled spending from last year, while staying at the current cost base, to break even. It's not impossible. It's just super hard with Revolut and Starling needing to do the same.

Comparisons and Takeaways

There's some blowback in the Fintech social media saying that we should not be critical of these results, but rather champion the innovation and change they have brought about. We agree about the vector of change, but disagree about the takeaway. It is important to understand how to get out of this particular outcome financially. And even more importantly, if this analysis tells us that the high-tech companies or banks will outperform Fintech on Fintech, that is a valuable conclusion about where to focus energy and build bridges.

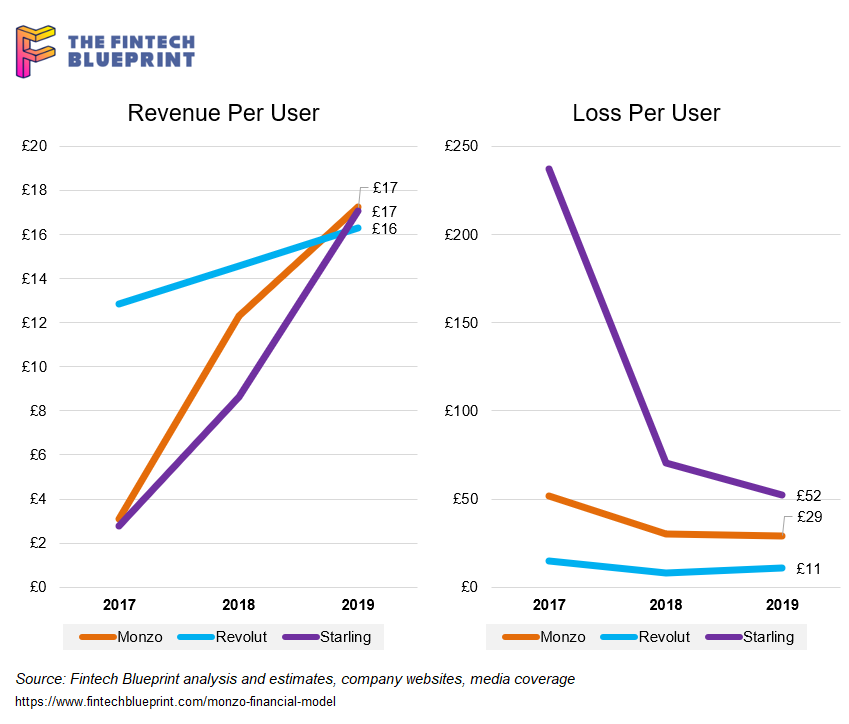

Currently, the neobanks generate about GBP 20 per user across all three brands. Revolut is scrappier about its revenue streams (e.g., subscription, trading) and has a much larger 10 million userbase. But the numbers are holding pretty steady across the board. It has the smallest financial loss per user, which implies that incremental improvements in per-user economics can really drive the needle in getting it to profitability. Starling has the largest average deposits of nearly GBP 2,000 per the mix of retail and business users, but the smallest scale to date, which you can see reflected in the loss numbers.

The task at hand is to bridge that revenue to the enterprise valuation per user of GBP 300 to 600, depending on your time period. We backed into the Starling number through a series of assumptions, but it should be directionally correct. Marketplaces and data were an interesting shot, but they are not the embedded mobile operating system of the Eastern super apps. They will not swing these economics. Organic deposit growth will certainly help, but the financial incumbents will not let those go easily. Expect to see battles over direct deposits and account switching. That leaves payments and alternative financial products.

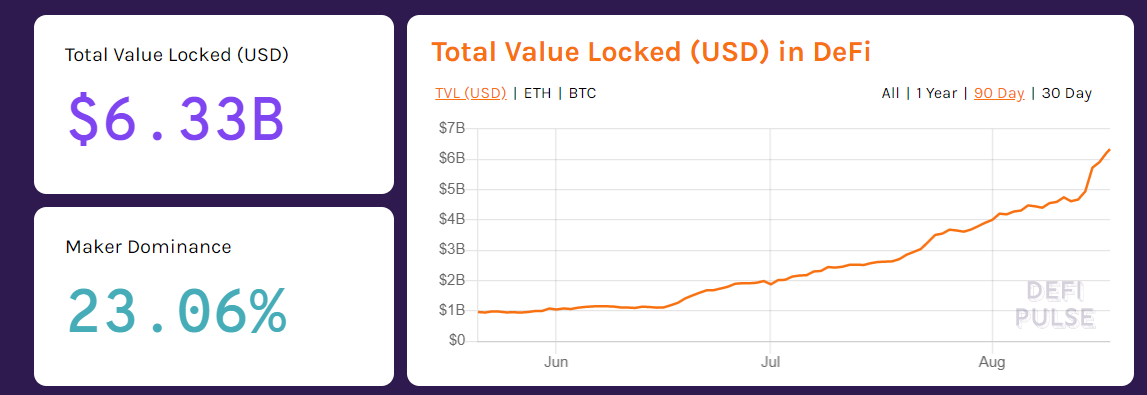

Revolut generated about GBP 20 million of revenue, or about 13% of total, from "other" activities, doubling from last year. We think this could be a code word for crypto trading. As a benchmark, Square's Cash App has 25 million users and saw about $17 million of profit on $875 million in gross crypto trading. So it is certainly possible that a meaningful portion of economics from these alternatives. If decentralized finance growth is incorporated into the footprints of Revolut, SoFi, Square and the other B2C fintech apps, we could see revenues increase 10% to 50% in the short term. And DeFi is large enough now at $6 billion in locked value to absorb a few hundred million in assets per Fintech app.

Alternately, these apps could go more deeply into trading and look to get payments for order flow. Such a business model has put Robinhood on a path for a $600 million revenue year. But that would mean chasing a retail trading perfect storm that arose from Covid, may not be permanent, and is full of competition from the world's best brokers (Schwab and Morgan Stanley) in the United States. In Europe, the whole thing is frowned on by regulators and would likely be shut down.

So what else can a neobank do?

We recommend looking to Cash App, SoFi, and Curve for answers. Cash App has taken the payments flow approach over the mobile banking approach, and has been rewarded with incredible growth and a clear business model. SoFi has diversified from student lending broadly into mortgages, wealth management, trading (crypto and otherwise), cash accounts, and integrations with high tech hardware firms. While adding bad underwriting to the mix today is painful, larger ticket size products like mortgages do deepen the relationship between digital bank and customer, opening up the door to becoming the primary banking relationship. Underwriting quality can be improved with better hiring and algorithms, but also just surviving the current macro-economic cycle.

And finally, we bring up Curve as a card aggregator that doesn't require account switching to generate interchange fees. If the neobanks can tap into a broader commerce ecosystem without having to also win deposits, conversion rates go up and the marketplace idea may yet live on. And if it doesn't work out? Sell to Facebook.

For more analysis parsing 12 frontier technology developments every week, a podcast conversation on operating fintechs, and novel food-for-thought essays, become a Blueprint member below.

White-label Neobank. Turnkey solution.

Our technology - your brand. Learn more - https://optherium.com/digital-banking/