Long Take: Google banking shows that tech giants are the storefront for everything, and other distributors will fade away

Hi Fintech futurists --

This week, we look at:

Google’s bank account plans in Google Pay

Apple buying Mobeewave to create a Square competitor

How technology has 25% of the S&P500 marketcap

Why all distribution will be owned by the tech giants

For more analysis parsing 12 frontier technology developments every week, a podcast conversation on operating fintechs, and novel food-for-thought essays, become a Blueprint member below.

Long Take

It's time to rethink the relationship of the large tech companies to financial services.

I used to echo that the Western tech companies are powering the "attention economy", pulling in users into a walled garden that competes for hours in the day with other tech companies. The core of this thesis is that media consumption is the hook into people's lives, and that addiction to techno-dopamine keeps them engaged with Instagram, WhatsApp, and TikTok. Thus Trump swiping at TikTok in a nationalist zeal.

The core chart for the thesis is below:

It says, welcome to your smartphone for 4 hours a day. More than television consumption, and certainly far beyond radio or gaming.

But I don't think it's right anymore to say that media is how we drive commerce. It is a drug in the mix for sure, but it is not the main cocktail.

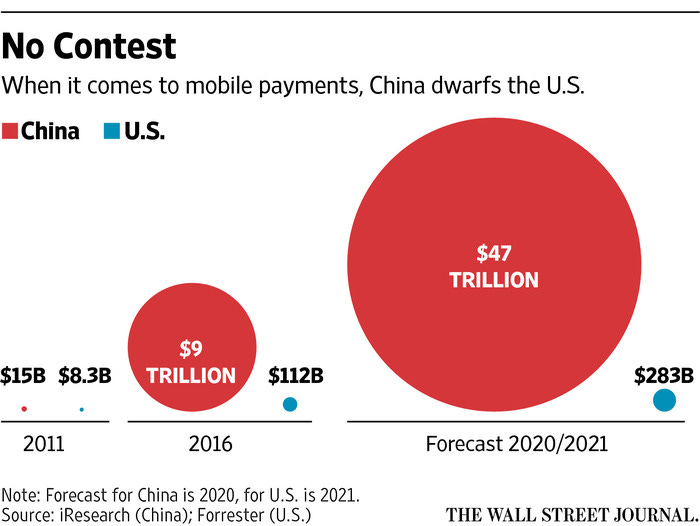

What we learn from Eastern tech companies is that finance can be at the center. Is Tencent, the owner of TikTok (almost banned in the US) and WeChat (banned in India), a video gaming company, a social media company, or a payments company? Or a digital yuen company? Or a national blockchain infrastructure provider company? The same can be asked of Alibaba, Tencent's alpha competitor.

While there are plenty of drugs -- in the form of games and speculation -- in these Eastern systems, they are underpinned by other themes. Those can be commerce and shopping, like Amazon. Or they can be payments, like Square and PayPal. Or micro-credit and business lending, like Affirm. And further, they can be wrapped into the geopolitical narrative of de-dollarization that has now become a necessary survival tactic. See below for an example of Russian/Chinese trade settlement decreasing form 90% USD-based settlement in 2015 to <50% by 2020. The CBDC efforts we see China exploring are reportedly part of the same economic logic.

Ok. So it isn't about "attention economy", per se, if you can recreate the massive tech growth on the basis of financial and economic services. Maybe it is about platforms, data, and the network effects that accrue to building multi-sided marketplaces? As you have more users, you can generate demand for more products, which then attracts more service providers, which increases the quality of goods, and therefore attracts more users, and more adjacent products, until you are Amazon.

For technology, this is often packaged as aggregation theory, canonized by Ben Thompson. The theory suggests that marketplaces will expand to all goods, period, and the hard problem is actually of curation rather than supply/demand generation. Note the illustration below implies cross-industry monopoly, with vertical integration having become far less important for industry players. Instead, the question is how you get some good into a platform, and then get it ranked higher by the algorithm. The answer for the ranking question is to get lots and lots of personal data, and then use machine learning to personalize at scale for things that people click on.

But it has always been hard for tech companies to aggregate financial services products, and deliver them to consumers. Instead, they have sold Fintech mobile apps. It is not a coincidence that Thompson's stream of products looks like an iPhone home screen full of logos. If you do consider apps as products, Apple has been a finance re-seller for ages.

But when people say "Oh no, tech companies are getting into Finance!" they don't really mean that there are a bunch of apps in an operating system. What they mean is that the app itself is manufactured by the tech company, and that this app is better than the one made by Wells Fargo or Goldman Sachs or whoever, and that rational people will stop banking with financial incumbents and start banking with Google.

What they really mean is when Google starts offering bank accounts through Google Pay, layering on top financial insights, budgeting tools, and payments functionality (click for source). Google becomes the bank to the consumer, and the actual depository institution becomes the extension of a core banking system into a licensing regime. Reminder, the core banking systems will also run on Google cloud and eventually be subsumed from underneath.

What they mean is when Apple puts down $100 million to buy Mobeewave, a company that turns any phone into a point of sale payments system, which can be turned into a native iPhone feature. Today, FIS and Fiserv are $50-100 billion market capitalization companies, while Apple and Google are each worth over $1.5 trillion. That's a nice snack for Apple to digest and integrate. Hungry hungry hippo!

You can extend this logic to when Amazon offers auto insurance, or when Facebook launches a digital currency, or when WhatsApp offers lending products, and so on. This isn't just the curation problem of aggregation theory.

This is the vertical integration of the financial industry into the tech industry value chain.

A reorientation of our preferences to digital

What I think is really going on with the tech companies actually has less and less to do with the tech companies themselves, or the platforms they've built. It has more to do with what is going on with us as a species, as humanity. We are shifting from the physical world to the digital one, and as we do this re-orientation, we are reformatting our brains and livelihood.

The transition from farm life to factory life wasn't a walk in the park. It was not a ten year "innovation cycle". It was a global grinder, throwing flesh and bone into industry by the millions. It built massive cities, melted down nations, and birthed two atrocious World Wars. And boy, did we industrialize!

Look at what COVID has done to expectations of work, play, and commerce. We have been atomized into home offices behind a Zoom panopticon, turning this into the new normal.

In this abstracted, virtual world, of course TikTok is a key political asset! It's the collection of all 1980s malls turned into one giant robot superstore full of teenagers. This is where we hang out. This is where we transact. This is where we socialize. Why would you ever buy something anywhere else?

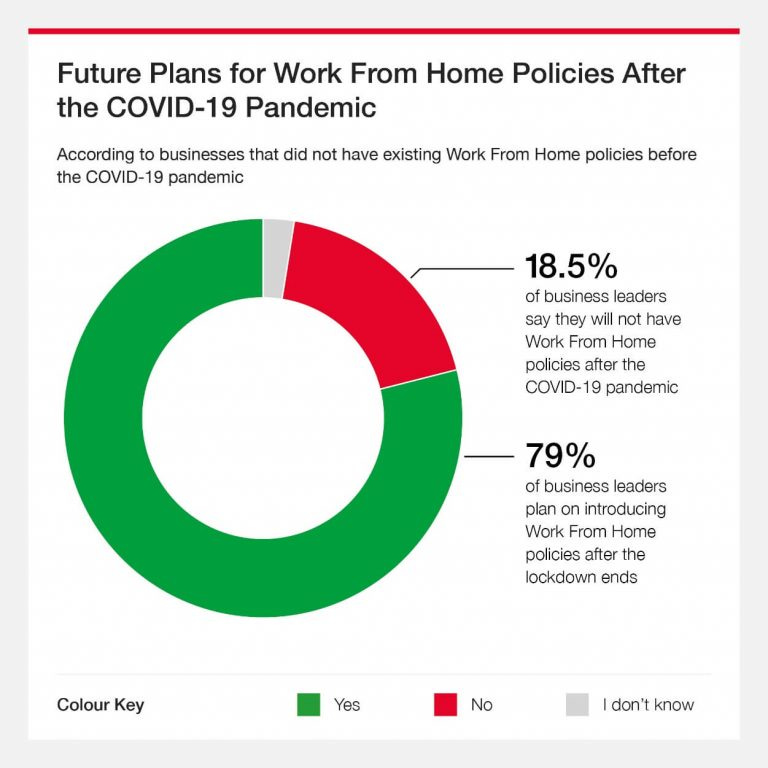

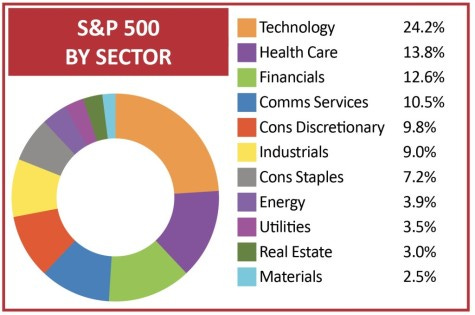

It is then no surprise that the technology sector has been completely dominating the rest of the S&P 500. At the end of last year, tech companies constituted 23% of all public market sectors, up from less than 10% in 1995. The next largest sector was at 14%. This is happening not just because these companies have network effects or superior business models or cheaper ways of doing things, but because we are all turning into the types of people that ONLY shop from our phones, and ONLY order from Amazon, and get mad at anyone without a good mobile app.

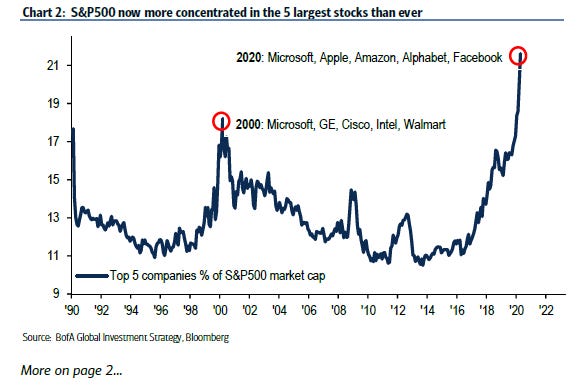

When you look at the concentration of marketcap share for the top 5 companies, it gets even more nuts. Well into 2020, Microsoft, Apple, Amazon, Alphabet, and Facebook now have 21% of the S&P500. That's more than the entire Energy, Materials, Utilities, Real Estate, and Telecom sectors combined. Given the state of the world, we all continue to be in some form of Kafkaesque lock-down. This is turn reinforces the digital way of life.

One last general point. We often hear the comment that finance is an institutional industry. However, our economy, and that of many other countries, is primarily driven by consumer spending as you can see below. For the US, continental Europe, the UK, Japan, India, and Brazil, retail spending is what disproportionately matters for GDP. Consumer preferences can re-form the wholesale value-chains that inevitably exist to serve them (e.g., a pension fund still has an end-client). Furthermore, consumers are the employees of the institutional industry, and bring expectations from their personal life into the work environment. See, for example, the consumerization of enterprise software.

Let's take the data points discussed so far. Google is launching an aggregator for bank accounts native to its operating system. Apple dominates American mobile proximity payments, making up 5% of global card transactions. Amazon has about 5% of all retail in the US, and 50% of all e-Commerce. We are in still in the very beginning of the digital shift. These trillion dollar companies have far more than 5% of our attention, and they will work to expand and monetize until everything is incorporated. Alternately, we will make them do it and pay them for the privilege.

Implications for Finance

The tech companies will become the storefront to absolutely everything.

There is no Internet, there is only Google.

There is no commerce, there is only Amazon.

There is no finance, there is only WeChat / Tencent?

I don't know about you, but I cannot pay for anything in cash in London anymore. COVID has made the city go cashless. For China, QR codes have long replaced the need for paper money. And if there is no cash, what is the point of ATMs, and ATM fees, and bank branches, and bank branch staff? Financial firms no longer need to be the place where you shop for financial product.

Financial firms do still need to manufacture the financial products. They do need to deploy balance sheet and lend it out, or choose investments to package into a fund, or underwrite insurance. And then they need to fight really hard to make sure that the tech company algorithms rank highly whatever it is that they have to sell.

This leaves us to consider fintech and crypto firms. First, what are Robinhood and Revolut? Which flank should they protect -- manufacturing or distribution? On distribution, they can effortlessly get squeezed by the tech incumbents. To acquire a customer, the fintech firm pays a fee to the tech company for advertising, hosting, and many other pleasures. On manufacturing, the licensed handling of money is the entire business model. The reason Robinhood can get paid hundreds of million of dollars in trade order flow is because it is a broker/dealer. If you rent your regulated infrastructure -- for banking or payments -- there are barely any economics left in the business.

Crypto firms, on the other hand, have some advantages. First, they are much earlier in the market adoption lifecycle, and as a result the probability spread of outcomes is broader. There is a high possibility of being worth nothing at all, but also a reasonable chance of carving out a new, defensible footprint. No company building the internet of value (e.g., Web3, blockchain-based finance) has an impenetrable network effect yet. And further, entrepreneurs are much more oriented towards open-source solutions and the prevention of Internet monopoly outcomes. As an example, the most valuable blockchain technology today -- Ethereum -- is an entirely open, decentralized protocol beyond singular ownership. This implies that if value accrues to the network, it can accrue to the token holders broadly, and to the builders that make the network better.

For crypto companies to leapfrog banking incumbents, the right partner is the large tech firm to provide distribution to the consumer market. Some companies, like Coinbase, have built this footprint organically. But there is much more to come.

For more analysis parsing 12 frontier technology developments every week, a podcast conversation on operating fintechs, and novel food-for-thought essays, become a Blueprint member below.

Great read

Once more, great views and insights. Thanks for that!

Just one remark re financial tech vendors FIS and Fiserv and their $50-100 billion market capitalizations. I am not sure, if Apple and Google have an interest to take over those conglomorates of legacy tech (same logic applies to incumbent banks; GAFA have most probably no appetite to buy one of the global banks of which many are available for less than $50B market).