Long Take: JPMorgan's bank branch expansion mirrors Apple's retail magic

JPMorgan to add 500 branches and renovate 1,700 locations; 80,000 branches closed in Europe between 2008 and 2019

Gm Fintech Architects —

Today we are diving into the following topics:

Summary: In this article, we delve into the contrasting trends of digitalization in banking and the strategic expansion of physical bank branches by JPMorgan Chase, despite the industry's push towards online and mobile banking. While Bank of America and Wells Fargo have reduced their branch footprint, JPMorgan plans to add 500 more branches and renovate 1,700 locations, betting on the value of physical presence in an increasingly digital world. Comparing JPMorgan's approach to Apple's investment in retail stores, we suggest that both companies see physical locations as a key part of their brand experience and customer engagement strategy. The discussion also touches on the role of Bitcoin ATMs and the importance of considering demographic factors like age and income in banking strategies, highlighting the potential impact on older and lower-income populations.

Topics: banking, payments, JPMorgan Chase, Bank of America, Wells Fargo, Goldman Sachs, Marcus, Apple, Microsoft, Bitcoin ATMs

If you got value from this article, let us know your thoughts! And to recommend new topics and companies for coverage, leave a note below.

Long Take

The Inverse of Digital

The growth of neo-everything has been the prevailing theme of Fintech, Crypto, and the socio-cultural techno optimism that has turned capitalism into entrepreneurship porn. Neobanks. Neobrokers. Neomoney.

In that context, it can be downright refreshing to read about private equity cash-flow roll-up strategies, traditional services and consulting businesses, and boring financial products. The Orthodoxy is incumbent for a reason. With this view of the financial craft, we take a pause to appreciate the trends in banking branches.

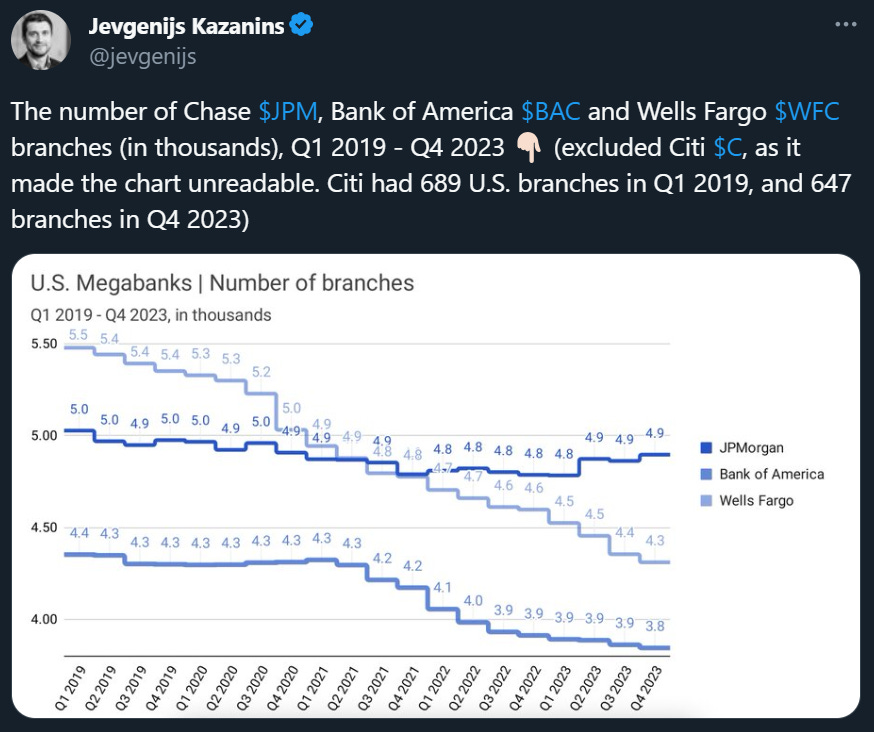

This chart in particular that has really struck a nerve.

Who is this JP Morgan Chase and why do they get away with going backwards in time? They should be betting on VR and spatial computing and Phygital.

Not — just more bank branches.

While Bank of America and Well Fargo have reduced their terrestrial footprint by 500-1,000 branches since 2019, JPM has held the ship steady at 5,000 — becoming the leading bank by real estate. Over the next 3 years, the bank will add 500 more branches and renovate 1,700 other locations.

It's not entirely surprising that they can afford it, as stock performance has heavily favored JPM over its other megabank competitors. The company has also been able to outperform many of the nimbler investment banks, avoiding the Goldman Sachs Marcus and Apple over-reach and the generally shrinking fee pools of intermediated capital markets.

But look, Chase is clearly swimming against the current here.

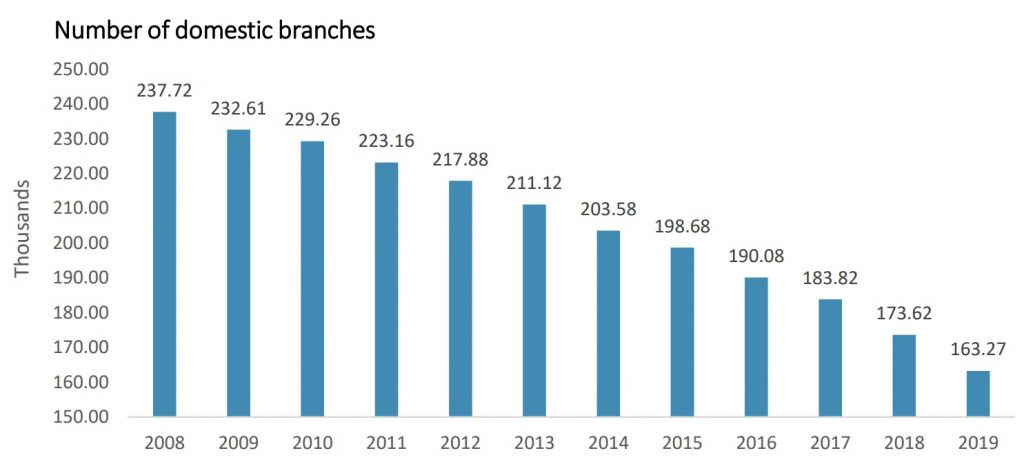

While everyone else is buying Google ads and launching fintechs, they are simultaneously closing down bank branches. In the US, net closings were as sharp as 3,000 across the industry in 2021. The same trend can be seen in Europe, with a decrease of 80,000 branches between 2008 and 2019.

Other banks like TSB are restructuring, shutting down branches and cutting jobs ahead of the AI knowledge worker apocalypse. This is in line with changing consumer behavior.

Obviously, the usage of banking branches is down, while digital app usage is up into the many millions. It no longer makes sense to track the neobank or roboadvisor launches by traditional finance companies. Of course they all have a digital channel, and that is the primary way by which consumers access their services.

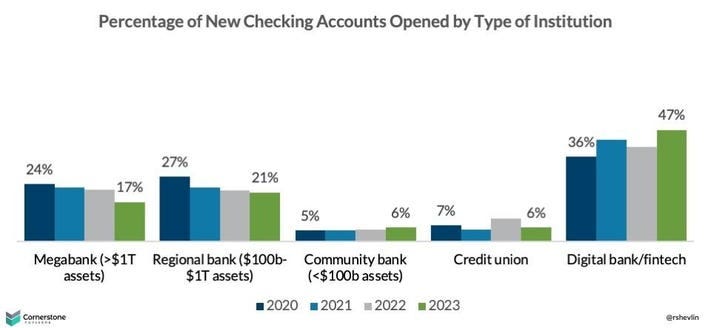

Younger generations are shifting new accounts to where they live — in the phone, in social media, or on video streams. The best financial advisor is a YouTube personality or Twitter celebrity. Cornerstone Research presents the data above, showing that digital channels are accounting for 47% of new checking accounts, relative to 36% in 2020. This is happening despite all the investment analysts trying to complain about how unprofitable the digital bank models are.

Which, you know, now that rates are up, they are not.

Know Your Client

Here's the thing with Chase though. It banks the whole country, pretty literally. It does not need to niche, because it is in *every* niche.

And so it can both spend $15 billion every year on its tech budget and digital distribution, and it can win the physical branch experiences for the remnants of those who want it.

If we dig lightly into the research others have done on this topic, the answer seems to be that the branches are a channel for a particular group of users who have more complex needs. Those users also have higher spend potential — business checking accounts, branded credit cards, mortgages. Chase has also been concentrating the location of branches to match these types of consumers, perhaps shifting towards urban density.

Whenever you run a go-to-market function, the key question is cost of customer acquisition as compared to your marginal costs. And it appears that for Chase, they are able to arbitrage their terrestrial presence like the digital players are able to optimize SEO and digital advertising. You increase the number of leads in the channel with physical placement in dense areas. You drive productivity within the branches by targeting high value products. You invest in the experience to grow conversions.

You can see the numbers above from the Financial Brand, and how deposits per branch have grown. This is highly productive real estate. When other banks are driving $165MM per branch, and Chase increased branch productivity from $120MM to $230MM, something in the marketing department is clearly working.

Everyone has these different channels available to them, but not everyone can execute well.

Apple of My Eye

This differentiated outcome reminds us of another industry leader that has gone into retail in world focused on digital — Apple.