Fintech: Why is Goldman Sachs leaving the Apple credit card partnership?

Goldman's consumer banking business has lost approximately $4B since 2020.

Hi Fintech Futurists —

You’re the best, today’s agenda below.

DIGITAL BANKING: Apple’s Credit Card Partnership With Goldman Sachs Could Be Over. Why Apple Pay Will Still Thrive (link here)

LONG TAKE: Can Affirm beat Klarna in the BNPL market? (link here)

PODCAST CONVERSATION: Bringing MetaMask to the next billion users, with Agoric CEO Dean Tribble and MetaMask Co-Founder Daniel Finlay (link here)

CURATED UPDATES: Payments, Lending, Digital Investing

To support this writing and access our full archive of newsletters, analyses, and guides to building in the Fintech & DeFi industries, subscribe below.

In Partnership

Join Fintech Meetup (March 3-6), the new BIG event with “the highest ROI” for attendees & sponsors with reasonably priced sponsorships, tickets, and rooms. Join 45,000+ double opt-in meetings, and Network with 5,000+ attendees.

👉 Get tickets Now!

Digital Investment & Banking Short Takes

DIGITAL BANKING: Apple’s Credit Card Partnership With Goldman Sachs Could Be Over. Why Apple Pay Will Still Thrive (link here)

Apple and Goldman Sachs have decided to end their Apple Card partnership, with Apple offering Goldman Sachs an out. Given that Goldman and Apple extended the partnership until 2029 just last year, it is surprising that Apple is offering Goldman an early exit, and suggests that a new partner has already been found. Goldman Sachs is also pulling the plug on its credit card partnership with General Motors. Consumer lending is not Wall Street business after all.

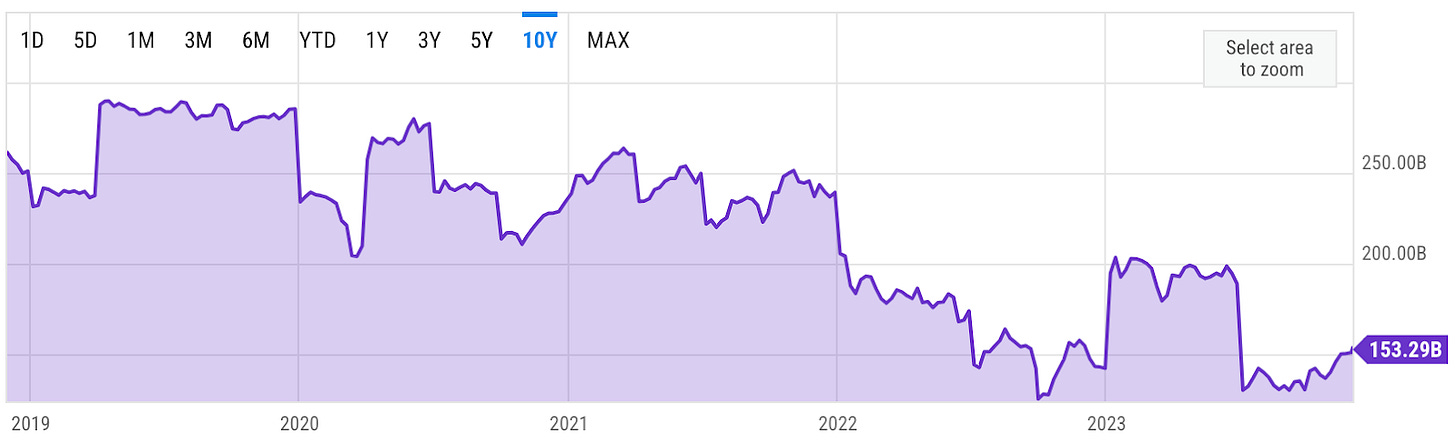

Goldman Sachs has a difficult consumer banking history, relevant to the end of the Apple Card partnership. Lloyd Blankfein, former CEO of Goldman Sachs, believed that the bank's enterprise value trailed behind its rivals due to a lack of established consumer infrastructure — at this time, financial firms wanted to be seen as tech companies, were launching neobanks and roboadvisors, and looking for higher multiples. To address this, Goldman ventured into the consumer business in 2016 and acquired GE Capital Bank's US online deposit platform, bringing in $16B in deposits. Shortly after, they launched Marcus, Goldman Sachs’s digital bank.

From there, Goldman embarked on a series of mergers and acquisitions, targeting consumer-focused fintech companies and integrating their engineering and product teams. Notable deals included Honest Dollar in 2016, and hiring 20 employees from SMB lender Bond Street Marketplace in 2017. In January 2018, Goldman Sachs acquired the team behind credit card startup Final, with the expectation that they would contribute to the development of the Apple credit card.

They also purchased personal finance startup Clarity Money for $100MM in April 2018, although it was later shut down in 2021. Then, in 2019, Goldman Sachs partnered with Apple to launch the Apple Card, and acquired RIA company United Capital for $750MM. Fast forward a few more acquisitions, and Goldman Sachs acquired BNPL lender GreenSky for $2.24B.

Overconfidence in temporary market condictions, from zero-interest rate policy to fintech public market overvaluation drove the M&A activity. Take, for instance, the J-curve presented by Goldman Sachs to investors in January 2020. It projected short-term losses in consumer banking, followed by breaking even in 2022 and subsequent profitability. The reality proved to be more harsh for all of us.

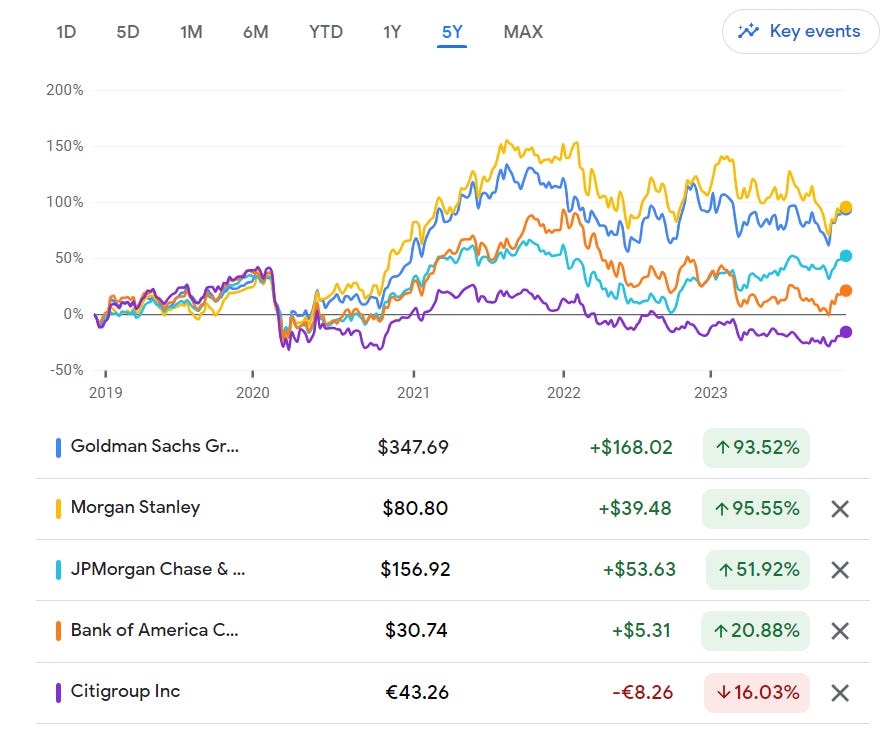

As we approach the end of 2023, the impact becomes apparent. Goldman's consumer banking business has lost approximately $4B since 2020, and potentially $5+ billion since 2016. The company recently decided to sell off a significant portion of its Marcus loan portfolio at major losses, GreenSky for a $500MM+ loss, and Creative Planning, which emerged from the $750MM United Capital acquisition.

We thought that the embedded lending technology services would survive. But perhaps there is less tolerance for tech-forward loss leaders, and now Goldman is terminating its credit card partnerships.

As for Apple, given its vertical integration into Apple Pay, it is unlikely that the Apple card will be shut down. The company has been shifting its focus towards generating more revenue from services, which includes payments and banking. The deal between Apple and Goldman strongly benefitted the tech company, similar to how record labels were subsumed by the iTunes distribution deals in the early 2000s.

Further, Apple held the pen to approve applicants, resulting in higher loan losses that outweighed the income generated from the savings account. Last year, the Apple Card faced unexpected challenges with subprime borrowers, resulting in Goldman experiencing a significantly higher net charge-off rate (2.93%) compared to JPMorgan and Bank of America. Even Capital One, the largest subprime player among major banks, had a lower charge-off rate. Furthermore, over a quarter of Goldman Sachs' card loans were granted to subprime consumers with FICO scores below 660.

When considering potential partners for Apple, two names emerge: Synchrony Financial and American Express. Synchrony, being the largest issuer of store credit cards in America, has experience working with big tech companies like Amazon. Many of their users fall into the subprime category with lower credit scores. Meanwhile, American Express has expressed concerns about the loss rates associated with the Apple Card. At the end of 2022, American Express had the lowest loss rate among major banks. If an Amex-Apple deal were to happen, which feels unlikely, American Express would probably lower credit limits, especially for subprime customers, close accounts that are at risk of defaulting, and revise the approval process.

Looking at the bigger picture, the choice of Apple’s partner, whether it's Goldman Sachs or another provider, is not the crucial factor. The fact is that Apple has proven that tech companies are becoming the storefront of everything to everyone.

👑 Related Coverage 👑

Live Panel by Canopy: Personalizing Commercial Lending Products at Scale - Thu, Dec. 7th at 1pm EST. Learn from top lending operators from Flexport and Canopy about what drives predictable growth, when and how to launch a new personalized digital finance product, and some of the top challenges that come with scaling.

Blueprint Deep Dive

Long Take: Can Affirm beat Klarna in the BNPL market? (link here)

Earlier this year we wrote on the ~80% drawdown in valuations of BNPL providers. At the time, we highlighted an uncertain macro environment and increased interest rates as key threats to the sector. Many of the same challenges persist today, yet both Affirm and Klarna exceeded investor expectations in the latest quarter after posting a narrowing loss and growth in revenues and customer spending.

Affirm’s share price gained 14% on the news, partially recovering the decline over the past year. This week we take a peek under the hood of the Affirm model, analyzing its performance under higher interest rates and identifying why it trails other BNPL providers. We touch on Affirm’s renewed strategy with the Affirm Card and expansion to the SMB segment, and discuss whether it can win in an increasingly crowded US market.

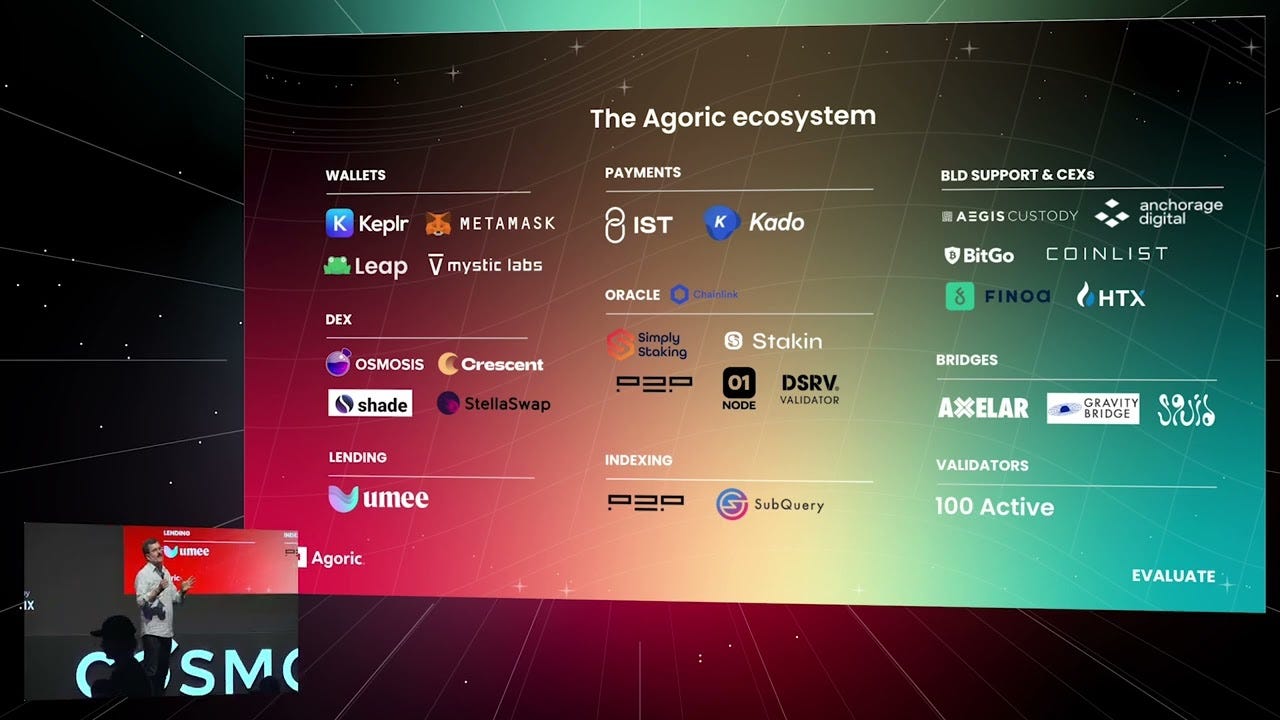

🎙️ Podcast Conversation: Bringing MetaMask to the next billion users, with Agoric CEO Dean Tribble and MetaMask Co-Founder Daniel Finlay (link here)

In this conversation, we chat with Daniel Finlay - Co-Founder of MetaMask, and Dean Tribble - Co-Founder and CEO of Agoric. a non-custodial Ethereum wallet, allowing users to store Ether and other ERC-20 tokens and make transactions. Further. With the growth of DeFi and NFTs over the past year, MetaMask has increased in prominence as an entry point for novice users. So much so that its user base is now over 20 million monthly active users.

Agoric is a Proof-of-Stake chain utilizing secure JavaScript smart contracts to rapidly build and deploy DeFi, comprised of a team who are experts in smart contracts. Agoric was founded on open-source principles which look to build a public economy.

Curated Updates

Here are the rest of the updates hitting our radar.

Paytech

⭐ Paysend Raises $65MM In Latest Funding Round, Including Strategic Investment From Mastercard

Swift Connects Instant Payment Systems To Bring 24/7 Processing Across Borders - Finextra

ECB Further Delays Deadline For Launch Of Unified Collateral Management Platform - Finextra

Visa Joins €8.5MM Funding Round In Enfuce - Finextra

CBA Rolls Out Payment Orchestration Platform - Finextra

Lending

⭐ LendInvest Completes £410MM BTL Mortgage Securitisation, Its Largest Ever - Altfi

Rich Data Co Raises $17.5MM In Series B Round To Expand In North America - IBS Intelligence

Nucleus Commercial Finance Lands £200MM Funding From NatWest - Altfi

Digital Investing

⭐ Robinhood Brings Its Stock-trading Platform To The UK, Its First International Market - TechCrunch

Plum: The AI-based Fintech App Announces Partnership With Eurobank, Snaps €10MM Funding - Tech Funding News

🚀 Level Up

At the Fintech Blueprint, we go down the rabbit hole to help you innovate and compete.

Sign up to the Premium Fintech Blueprint newsletter and in addition to receiving our free newsletters on Fintech, DeFi and AI, get access to:

Wednesday’s Long Takes with a deep, comprehensive analysis.

Office Hours, monthly digital roundtable discussions with industry insiders.

Next up: Lex’s quarterly report.‘Building Company Playbook’ series, offering insider tips and advice on constructing successful fintech ventures.

Enhanced Podcasts with industry leaders, accompanied with annotated transcripts.

Archive Access to an array of in-depth write-ups covering the hottest fintech and DeFi companies.

Join our Premium community and receive all the Fintech and Web3 intelligence you need to level up your career.

Reach 200,000 Fintech Professionals

With a 35% open rate and 1 million post views per month, we have an engaged audience of Fintech, DeFi, and AI enthusiasts receptive to your messaging.

Contact us to learn more about our custom opportunities.