Long Take: The links between tech, commerce, and finance behind Klarna's $45B valuation and Pinduoduo's $150B marketcap

Hi Fintech futurists --

This week, we cover these ideas:

Klarna’s $640 million raise and its $45 billion valuation, and how its business model arbitrages the payments revenue pool to build a lending business

Pinduoduo’s growth path to a $150B marketcap, and the links between shopping, media, and financial mechanisms that help it compete with Alibaba

A comparison of approaches to growth and economics

Implications for crypto assets for capturing “the real economy”

For more analysis parsing frontier developments every week, podcast conversations on operating fintechs, and new mental models, become a Blueprint member below.

Cover Art this Week

Long Take

Klarna is raising $640 million on a $45 billion private valuation, with over $1 billion in net operating income. The buy-now-pay-later company has over 90 million active customers and 250,000 merchants. It was founded in Sweden in 2005.

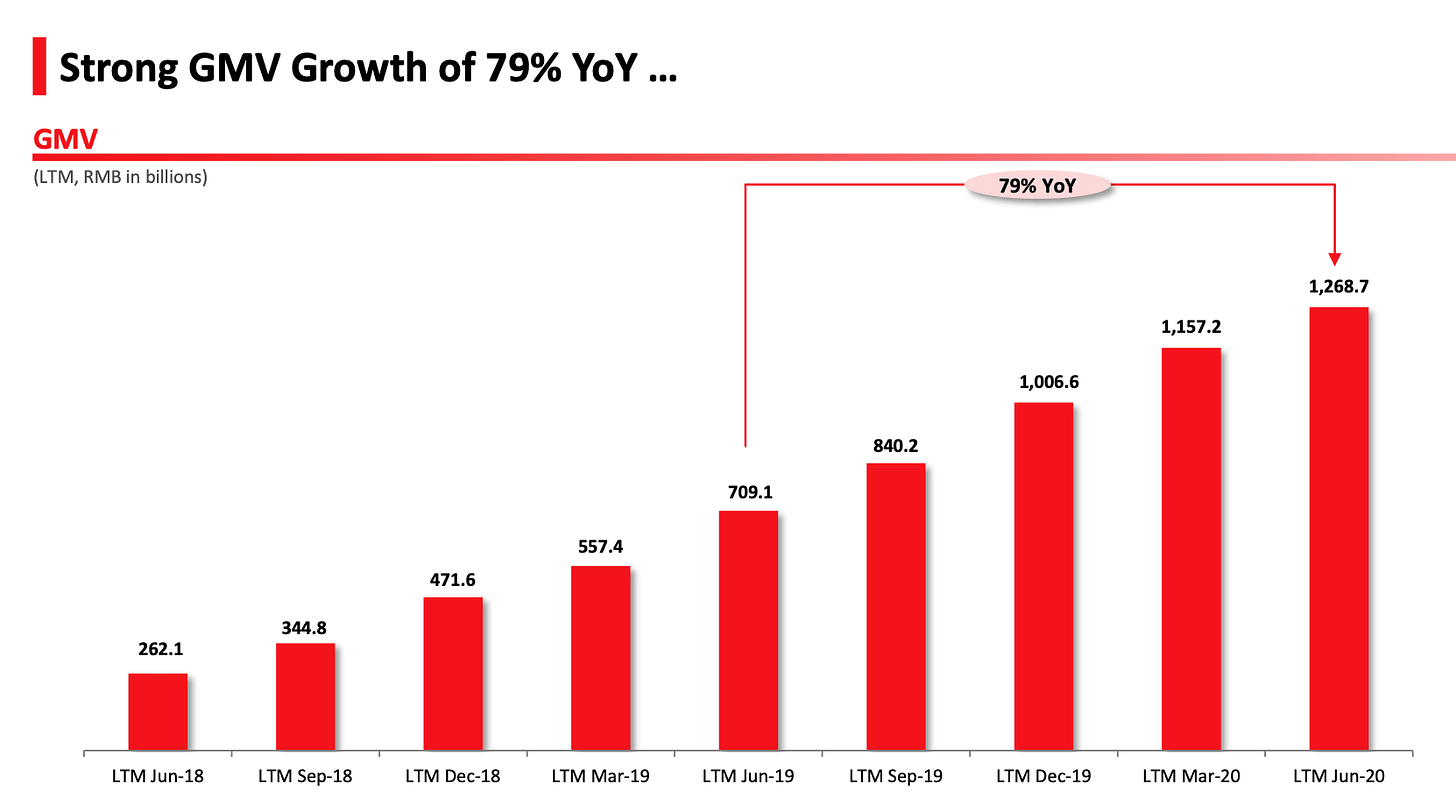

On the other side of the ocean, Chinese ecommerce company Pinduoduo is beating Alibaba with 820 million active buyers, generates over $3 billion in revenue per quarter, connects buyers to 12 million farmers, and has a market capitalization of $150 billion. It was founded in China in 2015.

Though Chinese ecommerce stocks have been recently hit by both the US/China tensions and CCP regulatory actions, the company continues to put up incredible operating performance against large scale, strong competitors.

Let’s lightly sketch out a framework between commerce and finance connected to these two symptoms, and extend it to the crypto games.

But first, imagine yourself a squirrel.

In our toy squirrel universe, the squirrel does two things.

The first thing is to go out and collect nuts. This is done through a nut collecting value chain, where the squirrel performs a variety of evolution-optimizing nut search functions. In interacting with its squirrel brethren, our individual practices social signaling, barter and exchange, displays a variety of political and rhetorical lies, and otherwise engages in social intrigue in order to gather resources. The squirrel also has to watch out for predators, evade lawyers and tax collectors, and maintain good physical fitness.

Let’s call this “the real economy”.

The second thing the squirrel does is hide the nuts so acquired through its exercise of squirrel judgment. Putting aside the internal reasoning for why it is important to amass and save its treasure, let’s just say that the squirrel body thus compels our protagonist to hoard for an ever-imagined “winter”. To hide resources becomes quite difficult, especially once squirrel society creates governing bodies, philosophies of ethics and fairness, and various data-driven police states monitoring all channels of social and physical interaction. Abstractions and designs must be created as derivatives to stand in for the physical fruit, streaming endlessly as bits and bytes into an electronic squirrel nuts account on some manifested distributed ledger.

Let’s call this “the financial economy”.

Anyway.

Our hypothetical society becomes so large, advanced, and specialized that some squirrels only know of the financial economy. They are preoccupied with the abstractions of storage, savings, and investment. Centuries of advanced technological evolution have opened up large conceptual spaces for manipulating the representations of imagined value. This, dear reader, is the type of squirrel that we are.

Still, once in a while, we are reminded of the nut gathering work that our less fortunate society members perform. Written elsewhere, we have described the financial entertainment work of the affluent as “the endgame”. If you manage to look out from the end-game, and its self-reflexive mirrored meme money, swirling along the axis of the Internet like some profound Borg DNA — after some severe squinting and disorientation of course — you can see a Walmart shopping cart and an Amazon warehouse.

And in the case of Pinduoduo, you might see 12 million farmers bringing fresh fruit to 900 million people.

We tell this parable to remind you that it is not from finance the economy comes, though it is catalyzed by it, but from commerce.

The Comparison

There are very big differences between Klarna and Pinduoduo, and we won’t pretend otherwise. But! At the core of both is a financial mechanism and a social game, and from this we can learn, and potentially expand some logic to the larger games played together by monetary systems and societies. Or maybe just your startup.

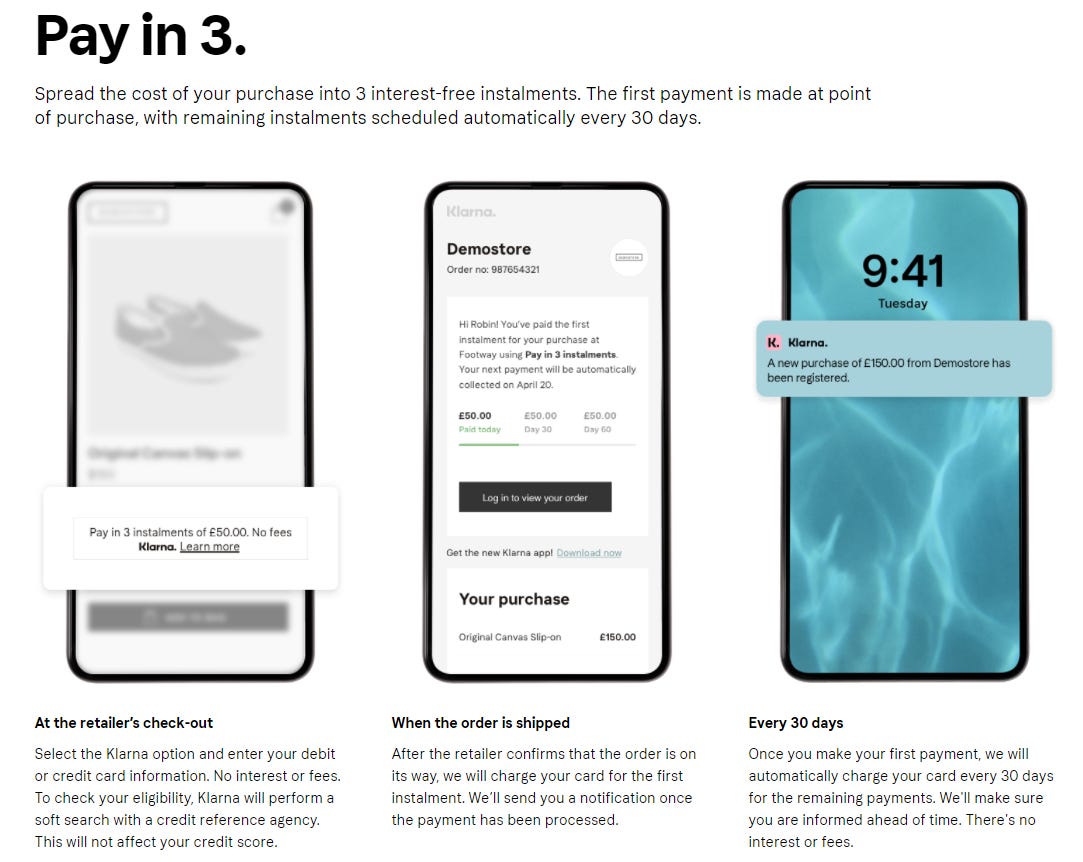

At the core of Klarna is mechanism that allows buyers to purchase things they cannot, or do not want to, immediately afford. We can call this BNPL, or we can call it credit.

A couple of things. Unlike a narrow view of credit, where you get credit based on who you are for some amount (i.e., you need $10,000 borrowed against a credit score like a credit card), Klarna provides credit against specific purchases. This isn’t necessarily new in the sense that the local RadioShack provided installment payment options for buying air conditioners since the dawn of air conditioner time. But it is new in the sense that it is provided by Klarna against pretty much any item you may want to purchase at an online retailer. We can point to this as an attribute called “embedded finance” (our prior analysis here).

Another point is that for short term repayment options, you are not charged an interest rate. Thus, as Klarna, you are exposed to credit losses because you are in essence subsidizing the consumption preferences of your users. But, you are not trying to offset this primarily from net interest income. Rather, you are making money as a payment processor by competing as a checkout option with payments companies.

See above financials showing net interest income comprising less than 30% of total revenues. There is still a product line financing purchases for a longer time frame, like 6 to 36 months at a 19% interest rate. But most of the money is coming from fees like those that Stripe and PayPal are charging in their checkout options, around 3% of the transaction to merchants with some flat fees thrown in for good measure.

Yep, a credit company competing with the credit card industry using a payments company revenue pool.

You might be reminded of Chime (our analysis here), which is using a payments revenue pool of interchange to subsidize checking and payday lending to its customers. This is because payments revenue is both large and invisible to consumers, and merchants are willing to both (1) charge it and (2) can do so by embedding the markup in price.

The other compelling part about Klarna’s offering to merchants is that customers are more likely to buy on credit. Therefore, they convert at a higher rate, generating more purchases for the stores. It’s free growth juice, with the credit risk neatly packaged away. Maybe, you can see how this is absolutely terrible news for banks who would like to provide some generic credit lines to some generic people. How many shopping carts exactly embed directly into Bank of America or Wells Fargo? This is partly why Deutsche Bank’s market cap is $25 billion and Klarna is $20 billion more than that.

If you are a provider of financial products, you may want to upgrade your distribution footprint to include integration into modern commerce. In a sense, this is like Square also owning Cash App, just on the merchant side of the equation. What is even more interesting is the emerging face of the Klarna shopping app, which lifts out the checkout experience into its own shopping experience.

This is a similar move to Shopify providing small business infrastructure, to eventually create a centralized Shopify app aggregating the commerce across the small businesses that it powers. Here, Klarna allows you to pool together multiple purchases that are then underwritten into a single virtual card, plugged into the Klarna BNPL engine.

Pinduoduo is a different beast. The company has been able to collapse the supply chain between farmers and the Chinese populace, starting in the fruit category and since expanding to compete with Alibaba across multiple fronts. That in turn has led to a 70%+ cheaper price in certain consumer goods. A stellar write up on its history is available here from Turner Novak.

The startup was able to sprint into existence by (1) riding the social distribution and payment rails of WeChat, which intermediated customer research and acquisition, (2) by corollary getting financial and operating backing from Tencent (e.g., imagine Amazon investing into its largest wholesale distributor), and (3) targeting an overlooked long-tail demographic in the lowest tier of Chinese cities.

The financial mechanism employed in the current version of the app is a perfected take on social buying. It combines the discount approach of Groupon with a pooling mechanism that makes wholesale prices reasonable to merchants. The app manages to generate enough information about supply and demand that manufacturers — from farmers to industrialists — can plan their production schedules far in advance. The market is mediated by a data hive mind.

In purchasing a good, you get a discount by creating a “Team Purchase” and getting your network to participate in commerce with you. If you don’t have a network of family and friends to pull in, you can ally with strangers on the Internet waiting for others to join their purchases. This reminds us of video games mechanics for joining a “raid”, where you have to get a certain number of people to commit before opening up a special area.

It is no surprise then that Pinduoduo embeds gaming mechanics into its actual social shopping experience. Not only do you see people popping up with shopping actions, but you have an entire Farmville-like system to get people to log in, take certain in-app actions, thereby earning social capital, status, and dopamine addiction.

Could Klarna use these types of mechanism in its shopping app? Maybe. End of the day, credit is just about buying something you can’t afford. Cutting the price of the good you want by 80% is way better than splitting 100% of the higher price into 5 separate installments.

Pinduoduo does more work than Klarna because it actually changes the economics of the real economy by repackaging the value chain, such that consumers can go direct to manufacturers and bargain through pooled demand. Klarna — fantastic as it may be — is arbitraging payments and lending on ecommerce platforms in order to outperform both payments and lending companies. But it is that second description of the squirrel that we provided at play for Klarna, while Pinduoduo reaches into the first.

The other thing to say about Klarna’s strategy is that it starts out in the “transaction” part of the value chain, and through its app, is trying to expand into the “commerce” part. Whereas Pinduoduo starts in commerce, and rides WeChat for the financial rails. Once big enough, we would not be surprised to see more banking, savings, and investing start to appear within the commerce platform. It is harder to go the other way — just ask any bank that’s tried to sell fresh fruit.

Key Takeaway

For extra credit, let’s turn to crypto.

How often do people exclaim — show me what it’s good for! Where is the real economy! Wake me up when you can buy a sandwich with it.

And how often we reply — do you buy sandwiches with your APPL stock!? This is financial infrastructure we are talking about! Markets, banks, asset managers, and insurance companies, turned to open source code in a sneeze.

But some of the conclusions from this analysis and its mental frameworks are giving us pause. Is crypto living entirely in the “how to save the nuts” part of the value chain? Are we the out-of-touch squirrel wizards, droning about squirrel techno-futures? If you want a billion users, it helps to anchor to commerce — creation, exchange, consumption — in the real economy. What is being produced? What is being consumed?

Here’s the answer. It’s a “real digital economy”.

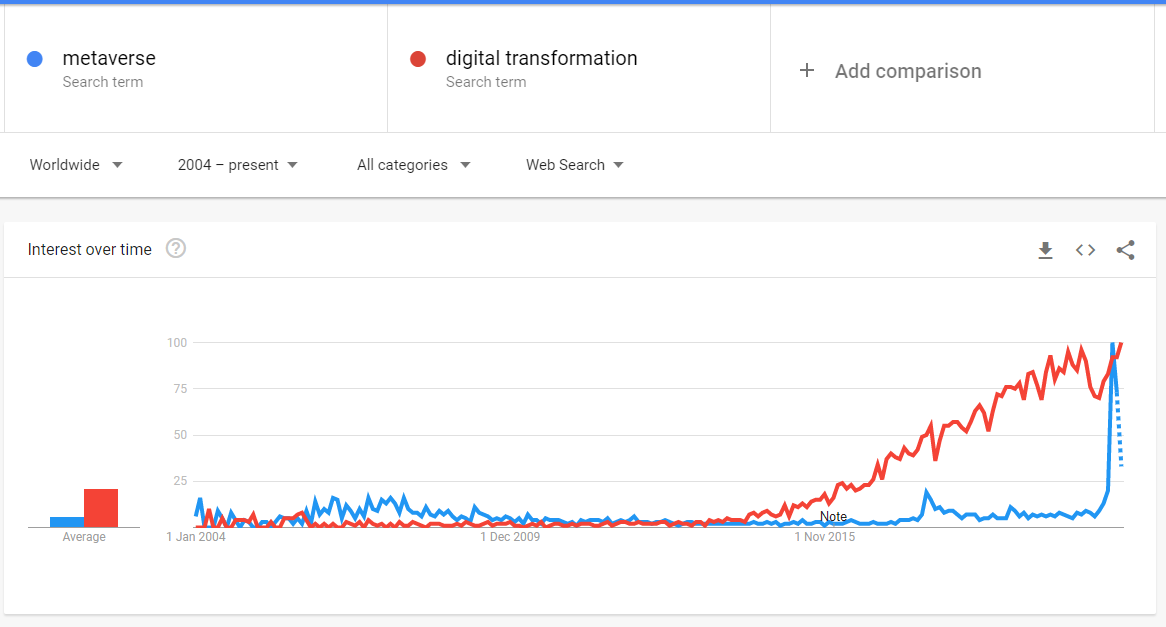

People are born, live, and die now in the virtual world. Their identities and objects of craftsmanship are rendered into virtual existence. We non-ironically use the word Metaverse to describe the digital existence. “Digital transformation” is part of the popular lexicon. What if it’s working?

If it’s working, you would see symptoms like millions of digital objects being generated on blockchains for exchange, or digital world builders being acquired by large technology companies, and these two things coming together over time. Don’t say you weren’t warned.

For more analysis parsing 12 frontier technology developments every week, a podcast conversation on fintechs, and food-for-thought essays, become a Blueprint member. Our NFTs, embedded with premium subscription access, are also available for purchase.