Long Take: The system versus the individual -- a meditation on the American election, Alibaba's dethroning, and Fintech theater

Hi Fintech futurists --

This week, we look at:

The relationship between an individual and a system, and how that applies to the power games of politics and economics. Did Trump change the system, or did the system generate Trump?

The difference between fighting and signalling, and what creates fragility and flexibility in governance structures

Why the Communist Party stopped Ant Financial's IPO, and how Jack Ma bears a resemblance to Mikhail Gorbachev

For more analysis parsing 12 frontier technology developments every week, a podcast conversation on operating fintechs, and novel food-for-thought essays, become a Blueprint member below.

Announcements

Want even more tech news? Check out this fantastic newsletter from The Grapevine! Louis Sutton and Nick Daley's newsletter covers 10 hot tech and start-up stories every week in just 3 minutes. Snappy, humorous and informative - well worth a few minutes of your Friday.

Check out open job roles at ConsenSys here, across Sales, Marketing, and Product.

Also flagging roles at Lambda Labs, friends of ours focused on machine learning hardware here.

Long Take

What matters more -- people, or systems?

We could get lost in a discussion of free will and determinism. Is all life in the universe programmed according to some basic rule, like Stephen Wolfram posits, expanding in a fractal of computation? Or, do we as individuals have the grace of agency and choice in our daily lives? Do people make *important* decisions?

Our recent thinking on the matter has been that we do have functional free will, i.e., the ability to make a choice, but that is still a matter of cause and effect. The feeling that self-aware intelligence creates, that feeling of being conscious and in charge, is a model of a self navigating a model of the world, birthed biologically and trained through systemic, cultural forces.

Systems matter, because they shape people. People matter, because they shape systems.

As a system, capitalism and the American legal system are quite similar. We assume an adversarial environment, where individual agents are driven by dog-eat-dog, fixed pie dynamics. If my lawyer wins, you lose. Therefore, as consumer of lawyers, we want our lawyers to be ruthlessly destructive of the other side. If my company wins, your company loses. Therefore, as consumers of shareholder equity, we want our economic entities to drift into sovereign monopolies.

By this logic, artificially intelligent murder bots that overthrow the US government are the natural desire of a rational shareholder holding on to Amazon and Facebook stock. There is nothing more valuable than access to a state's sovereign monopoly on violence and money ...

We jest. Somewhat. At least a few crypto bots here and there are trying to nick monetary authority from the sovereign.

Yet it is obviously false that the underlying fabric of our reality is only about lethal economic competition. While there is certainly a lot of war and destruction going around, when liberated from the mode of life where survival is scarce, the human animal is largely cooperative.

Like insects and other hive-minded critters, we build super-organisms in the shape of families, companies, communities, countries, and cultures. We feed these greater abstractions with our labor and dedication. Brick by brick, we construct social machines that persist in populations, and thereby derive their power from a social footprint. Not an individual one.

It does not mean anything to be President, unless there is some polity of which you can be President. In the modern world, power derives from the particular system. Systems have a self-preservation complex too, via a pseudo DNA woven together from ideas! If a system does not favor self-preservation ideas, it dissolves and is forgotten. The American constitutional system may be quite loose in terms of accepting types of change, but it is strict in the establishment of the constitutional order. The fashions of politics may change, but the underlying democratic republic must remain.

As a result, the American system is more anti-fragile than that of the Chinese Communist Party, despite the CCP holding more direct control. In being easier to reform and in redirecting destructive energy, the American system has to spend less calories on implementing strength. In being more difficult to reform, and in not having the theater of adversarial multi-party debate, the CCP must spend more calories on penetrating society and generating control technologies targeted at speech and the Internet.

The Purpose of Signalling

For a moment, let's think about natural selection and what it is like to be a dangerous animal. Power games for food, position, and mating are constant. However, it is rare for tigers (for example) to fight to the death over territory. Instead, they will size each other up, roar, posture, and spar. It is too expensive to fight to the death. Signalling, and competition around proxies for strength, are the mechanism by which individuals can be defeated, but the species is unharmed.

It is important to have sports and politics in order to not have wars. But sometimes, we can get so caught up in our theater that we miss the fact that real violence is at our doorstep. We misremember what violence really is. It is a grave error for a sitting President of the United States to inspire the use of violence and to break the cooperative political equilibrium. The individual is defeated, and the species must remain unharmed.

Without going down the slippery slope, let's get back to the point that individuals are products of the system in which they participate, and that they in turn transform the system through their actions. Trump broke through the Republican ranks in 2016 with a message that was massively differentiated from neoliberal conservatives, and in doing so cut deeply into the blue-collar Democratic base, which was poorly represented by neoliberal progressives. In many ways, Trump is a product of the tech-enabled media environment, which facilitated his rise to reality TV celebrity and social media lightning rod. When you intersect such a shift in media with a staid political game, the systemic overlap generates black swans that destabilize the system.

Do we credit the black swans for their feathers, or their environment? And now the system, and the political axis around which it revolves, has changed again. The progressive wing on the left feeds on the volume of the far right.

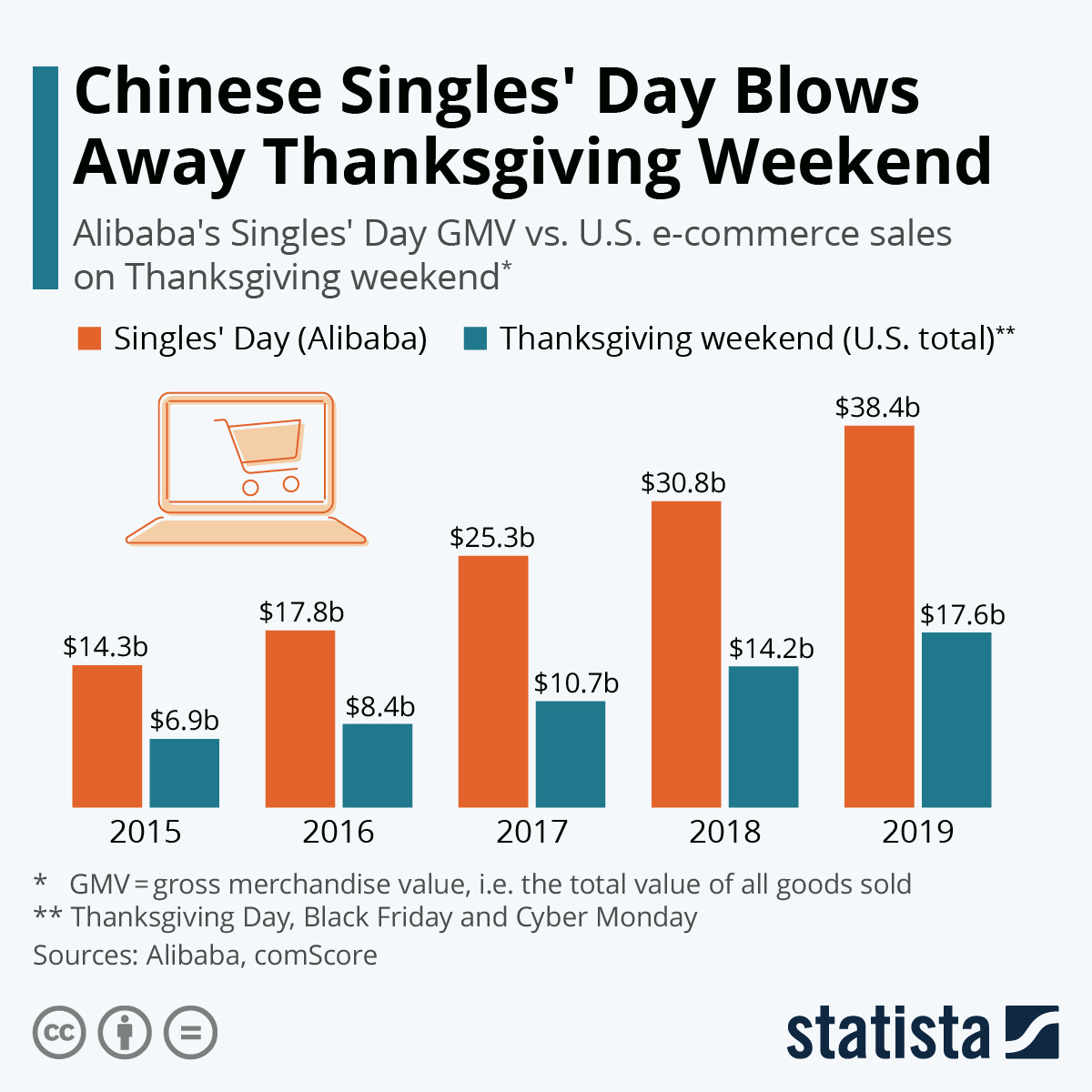

Switching to China, let's look again at Alibaba and Ant Financial. The tech giant has grown up from the systemic transformation of the Chinese economy as its markets modernized. At the same time, it was pulled into existence by the individual effort of Jack Ma, himself a personification of the Westernization of Chinese entrepreneurs. Alibaba's Singles Day sales figure alone this year was $74 billion. Reminder that Amazon has about $350 billion of gross merchandise value per year.

Ant Financial, the payments arm of Alibaba, was going to be the largest IPO in the history of offerings. And it was happening on the Shanghai Stock exchange -- a reaction to the American nonsense related to TikTok, and a display of the shifting financial fortunes. And yet, Ant's IPO was reportedly halted directly by Chinese President Xi Jinping. Why? Below we excerpt the China Macro Reporter.

Jack Ma is a product of his environment, creating wealth and technology from unexplored ground. He is loved in the West. As another analogy, Mikhail Gorbachev of the USSR was also a product of his moment, inheriting the bloody history of Stalinism and choosing to forfeit the Soviet Union. He was loved in the West! But locally, the governing system rejects dissidence. Gorbachev's legacy is reviled in Russia.

Ma is not nearly as powerful as Gorbachev -- being a billionaire is no match for being a sovereign. He lives in a constructed social machine which has provide him paths for wealth creation, rather than being an individual heroic entrepreneur overcoming some economic adversary. Xi Jinping, representing that social machine, has effectively stripped Ant Financial of its technology company status. A new regulation was put into effect requiring digital lenders to finance at least 30% of loans with their own capital (rather than just 2%), a regulation to which Ant must now adhere. This alters the nature of the company's economics, and likely the licenses it will need to extract from the government to continue to function. We believe that empowering the Central Bank Digital Currency will be a key provision of continuing to do business.

Yet Jack Ma is highly productive for the Chinese state. Ant, Tencent, and the rest of the Asian tech champions are global economic vectors that are too powerful to shackle. What we see now is that signalling theater between politics and economics, rather than applied hard power.

Finance Industry Key Takeaways

In this analysis, we look at the role of individuals in systems, and the role of systems in generating individuals. This cycle is recursive.

When applied to more practical Fintech questions, our conclusion is that shifting the entire structure of a system is far more difficult than implementing some point solution within that structure. To create a new financial advisory practice when there are 10,000 RIAs, or to launch a community bank when there are 5,000 community banks is less difficult than to force into being a category of digital lenders, roboadvisors, and neobanks. The latter requires the normalization of a social contruct and technology environment where everyone has adopted the behavior of interacting with financial products on smart phones.

The creation of smart phones is a much larger context shift still, and that is why it is Apple is worth $2 trillion in enterprise value. You can call this "vision" if you like.

If we glide along the rails of the economy today, the tech giants are on a path to own finance. This is the work of individuals like Elon Musk, Peter Thiel, Mark Zuckerberg, Steve Jobs, and Sergei Brin. Their collective shifting of our underlying reality has created the environment in which banks find themselves on the back foot, creating all sorts of noise, theater, and signal to assert that they are on the same ground. But they are not. Banks comes from a different part of the fractal entirely.

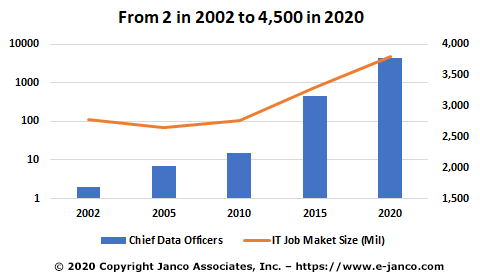

Here is a fun reflection of the high tech reality hitting our job markets, and bouncing back between people and systems -- see the growth of "Chief Data Officer" positions over the last twenty years. The shape of the system has changed.

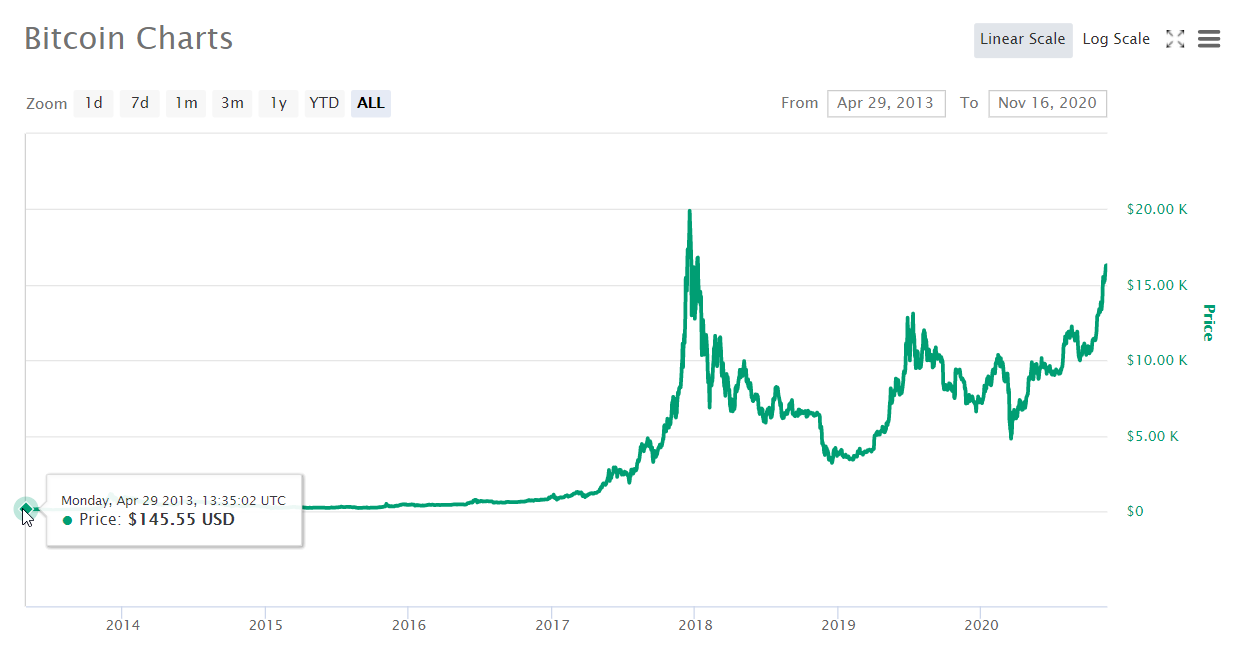

A similar dynamic, at least to us, is captured in the price of Bitcoin. The reason that crypto currencies are such a dramatic value creation opportunity, is that their socio-economic structure is so far apart from the current system, regardless of where you live. That creates a pull and drag that then generates opportunities for individuals to carve out value in bridging the divide. This in turn legitimizes and reinforces the value of a new system. If we were to search for "Head of Digital Assets" job postings in 2030, it will look a lot like the "Chief Data Officer" graph above. As more and more individuals are flipped into the crypto paradigm, the prior equilibrium is lost, like neoliberalism under Trumpian Republicans.

All you explorers, search for new fields and pastures.

All you architects, invent new styles and build grand houses.

All you warriors, put down your arms and enjoy life in the fields that the explorers found, and in the houses that the architects build. Maybe play some sports.

For more analysis parsing 12 frontier technology developments every week, a podcast conversation on operating fintechs, and novel food-for-thought essays, become a Blueprint member below.

Very good read. No matter what we still need strong leaders. Like a CEO like MD, FD or CFO and even influencers too.....what ever. Help lead people the right way. Fighting is stupid and doesn’t really get you any where. Working together and helping each other out does.

All men are brothers and all women are sisters !

🗣🎶🎶🎶🎶🌎

🎶⏰...................😌

Have a good day everyone.

All the best!

✨✨✨✨✨✨✨✨✨✨✨