Gm Fintech Architects —

Today we are diving into the following topics:

Summary: The sudden increase in Bitcoin's market cap has raised questions about its role in the investment management industry. BlackRock's filing for a Bitcoin ETF signals a shift, yet the industry's universal adoption of crypto remains slow, necessitating derivatives-based instruments to date. However, these often underperform, pointing to systemic inefficiencies. The potential for massive reduction in transaction friction through ETF standardization could unlock new opportunities in the investment management value chain and adoption of the asset class.

Topics: Bitcoin, BlackRock, Fidelity, capital markets, investment management, ETFs

If you got value from this article, let us know your thoughts! And to recommend new topics and companies for coverage, leave a note below.

Long Take

The Story of Institutional Bitcoin

Are we really opening up an email with the price of Bitcoin?

Yes, because it gives us a reason to talk about investment management industry structure.

Over the last week or so, the price of Bitcoin added about $40 billion of value to the marketcap. What drove that change? Perhaps the occult volatility octopus gods controlling the market with their mathematical tentacles. Or, alternately, the news that BlackRock had filed for a spot Bitcoin ETF, meaning a fund that holds actual BTC instead of trying to bundle out comparable returns from futures on the asset.

For the basic facts, see our coverage below.

DeFi: BlackRock files for Bitcoin ETF testing the SEC; Ethereum restaking goes live with EigenLayer

Gm Fintech Futurists — Today we highlight the following: PROTOCOLS: Ethereum ‘Restaking’ Protocol EigenLayer Launches On Mainnet (link here) INSTITUTIONAL ADOPTION: BlackRock Joins Ranks Of US Bitcoin ETF Hopefuls (link here) CURATED UPDATES To support this writing and access our full archive of newsletters, analyses, and guides to building in the Fintech & DeFi industries, subscribe below.

BlackRock is not the first to file, nor will they be the last, given that crypto is still far from universally adopted in the investment management industry, but retail demand is surprisingly resilient. As a result, we’ve had to live with a number of these derivatives-based instruments, as well as the fundamentally broken Grayscale Bitcoin Trust (GBTC).

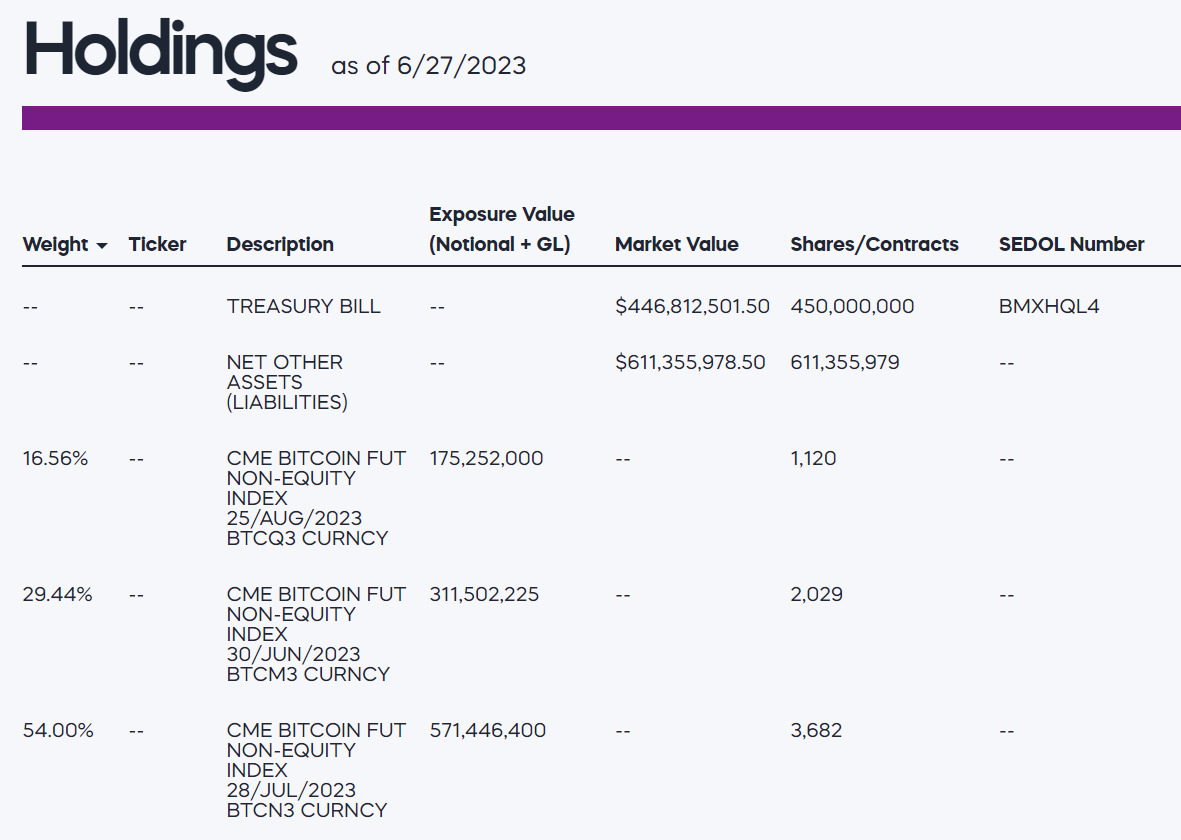

ProShares is a good brand — let’s take a look at what’s inside this cool $1 billion.

Why are these the things one would want to hold instead of holding the asset directly? Consider owning an ETF that contains all the stocks of the SP500, or one that contains 3 futures contracts on each of the stocks of the SP500. For this pleasure, you also pay 95 basis points.

Let’s look at performance. Does the index track the underlying?

To our eye, those wiggly lines all look a little bit different. Bitcoin is in the light blue in the middle, and the futures-based product is underperforming it by about 14% this year. GBTC is outperforming. But you can also tell that while there is correlation, something fishy is going on. That something fishy is the fact that there are traders who are targeting the idiosyncratic problems (e.g., insolvency) of the issuer (i.e., Digital Currency Group) and the machinations of redemptions, rather than the actual underlying asset.

Here’s a terrible chart —

It shows the premium and discount to Net Asset Value that GBTC has experienced since inception. Many of the institutional market makers and arbitrageurs played around with this particular number, rather than focusing on BTC, which then translates into the vehicle performance. In the before times, the trust had a nearly 150% premium, and now trades at a 50% discount. And again, you pay 200 bps for the privilege of holding the instrument.

Why are these instruments so bad, when they could easily be much better? A BlackRock or Fidelity ETF with a 25 basis points fee and $50B in assets sounds pretty feasible to us as a destination. Well, the reason we don’t have it is due to the obstructionism of the SEC, which has been on a spree trying to blow up key pieces of crypto capital markets infrastructure, while having missed the bigger problem of FTX.

Instead of preventing the problem above, the SEC is post-facto prosecuting an American company which it allowed to go public after a fully compliant IPO that included a detailed set of disclosures of their business activities. But we digress.

Even before the current set of enforcement actions, and the resulting litigation came to the forefront, we thought the focus was on the wrong things. See our 2019 piece below.

How the SEC is wrong about the Internet and the Bitcoin ETF, plus 14 short takes on top developments

Hi Fintech futurists -- Today, a longer take on understanding why the SEC postponed its decision on the VanEck Bitcoin product, and why its concerns betray a misunderstanding of the culture of the 21st century. The latest short takes on the Fintech bundles, Crypto and Blockchain, Artificial Intelligence, and Augmented and Virtual Reality are below.

The agency categorized the markets as if they were somehow uniquely fraudulent or unprofessional, and used that as an excuse to block an ETF filing. We argued that this was mistaking the characteristics of some industry participants for all industry participants, and that digital environments naturally generate immense bot activity and misdirection. That will never go away, but it is feasible though hard to separate truth from simulation online. Just watch what happens with generative AI and our content farms.

So why is the story of an ETF even a story? What is so important about taking a digital asset you could just own on Coinbase, and wrapping it in legal documentation and additional fees? Let’s open that up.

Market Standards

Humans and our society is built on mental models — let’s call them stereotypes, ideas, abstractions, culture, standards, or memes. These are all imaginations that our minds have rendered as the essence of some truth about the world, and then distilled into pieces of knowledge that we spread to each other, and agree to believe together.