Long Take: Why is FIS spinning out Worldpay after 4 years and a $17B writedown?

Was fintech payment processing the wrong valuation arbitrage?

Hi Fintech Architects — Our agenda is below.

Summary: We look at the news that FIS is spinning out Worldpay and taking a $17B write down on the $43B acquisition price. The failure of industry consolidation to drive shareholder value is an interesting and complex story that arises out of multiple issues. Is it a problem of Strategy? Operations? Product? Or the broader industry context changing its valuation metrics for comparable businesses? The analysis looks back at the rationales at the beginning of the acquisition, and assesses the current situation.

Topics: payments, capital markets, banking, fintech, M&A

Tags: FIS, Fiserv, Worldpay, Worldline, SoFi, Ingenico

If you got value from this article, please share it. Long Takes are premium only, and we need your help to spread the word about how awesome they are!

Long Take

A few years ago, in a galaxy far far away

Just a few short years ago, it was a time of payments industry consolidation. Nation scale payments technology companies were facing price compression from fintech new entrants, and saw slow growth in their public company revenues. The only choice ahead was acquisition and consolidation. Multiples on “technology” companies floated to 50x revenue, while poor old payments companies had to settle for 2.5x on their hundreds of millions of free cashflow.

We covered this period with immense interest. It had felt like the end of an era, with core banking systems merging into payment processors, adding point of sale capability to grow their merchant networks and create pathways to sell cards and credit into retail commerce and small business financial functions. See:

It was a simpler time.

FIS had acquired Worldpay for $43 billion in 2019, and is now spinning out that same company for an estimated $25 billion, taking a $17 billion write-down. That’s a lot of value destroyed — you could buy three SoFis for the price! Here’s the 2019 version of the story —

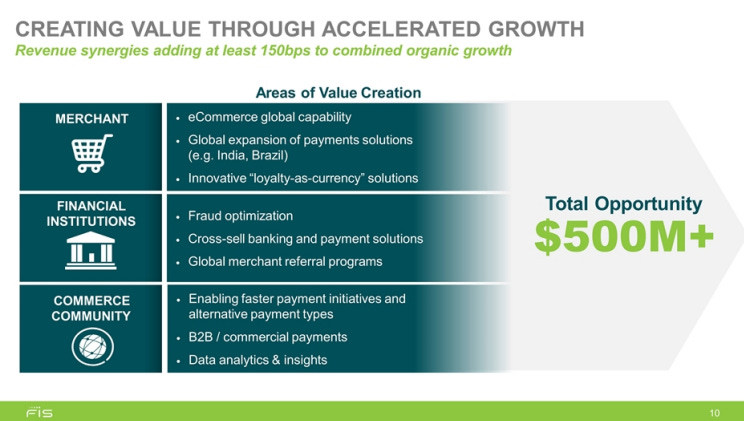

Looking at the deck now, the rationale is a bit … generic. But the concept of vertical integration, synergy creation for companies of this size, and achieving scale to remain competitive did make sense.

Fintechs and Market Share

We’ve come across some fantastic coverage of the payments space

of on the topic.

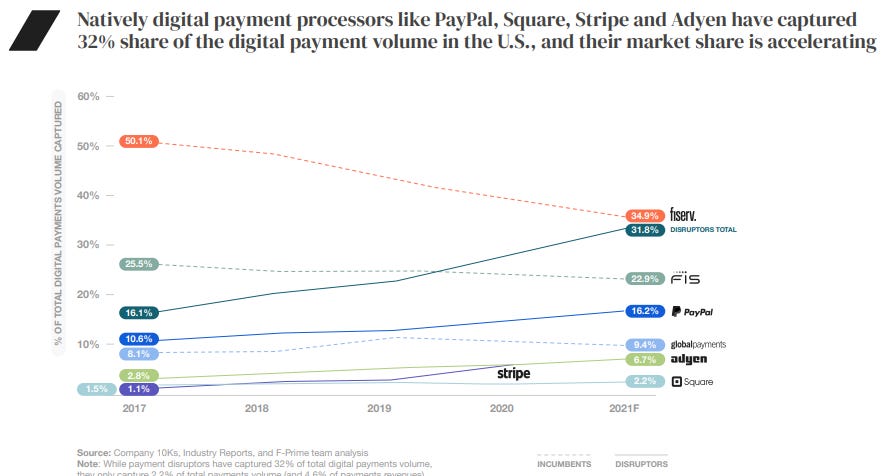

Let's pull up some key charts from his analysis of Stripe and the F-Prime 2021 industry overview. In particular, we are interested in the narrative that market share in payment processing has been a growth game for modern entrants, and a losing game for old technology companies like Worldpay. Here are the 2021 numbers.

At the end of the pandemic, with digital adoption at its historic peak, it appeared that fintech payment processors had reached 32% market share, up from 16% in 2017. Meanwhile, FIS had fallen from 25% to 22%, despite its expensive acquisition. If we look at the absolute numbers, Block, Stripe, Adyen, PayPal together add up to $2.3 trillion in volume, $600B more than FIS alone.

One thing to note, however, is the footnote in the above chart, saying “While payment disruptors have captured 32% of total digital payments volume, they only capture 2.2% of total payments volume (and 4.6% of payments revenues)”. We would expect digital payments to include things like powering eCommerce, mobile commerce, and perhaps mobile point of sale. But the careful reader should beware of definitions.

Still, digital payments are the reason that FIS and Worldpay would merge, right? Is it about market share or about playing valuation arbitrage?