Web3: Curve's goes from stablecoin AMM to stablecoin issuer; Ledger's crypto debit cards; Multi-chain transaction orchestrator t3rn raises $6.5MM

The Curve stablecoin is a beautiful machine of computational complexity

Gm Fintech Futurists —

Welcome to our Web3 newsletter, covering DeFi, digital assets, NFTs, and the emergence of the financial metaverse. Today we highlight the following:

DEFI & DIGITAL ASSETS: Curve Releases Whitepaper for crvUSD Stablecoin

CRYPTOECONOMICS & PROTOCOLS: Polkadot-Based Protocol t3rn Raises $6.5MM

FINTECH & INSTITUTIONAL ADOPTION: Ledger Rolls Out ‘Crypto Life’ Debit Card Across UK And Europe

This content is premium only — give it a share, and leave suggestions in the comments!

DeFi Protocols And Digital Assets

⭐ Curve Releases Whitepaper for crvUSD Stablecoin - The Defiant

1/ The new Curve stablecoin whitepaper is not an easy read, but I think I got through it. Let me share my first thoughts; caveat emptor applies. At the center of the mechanism lies a new AMM called LLAMMA. I'll discuss only this component for now...Decentralized exchange Curve released a whitepaper proposing a USD pegged stablecoin, crvUSD. There are various types of stablecoins out there — (1) over-collateralized stablecoins generate a synthetically pegged asset backed by a certain level of collateral locked into a smart contract on-chain, and (2) algorithmic stablecoins are pegged currencies that attempt to tranche risk and function like a structured product, where the top tranche is pegged, and the other tranches are equity buffers.

These products are popular and more are being launched, especially as MakerDAO governance promotes new business models. Lending protocol Aave is releasing its stablecoin, GHO, and Emurgo, the commercial arm of the Cardano blockchain, plans to launch USDA, a fiat-backed stablecoin in the Cardano ecosystem. Users like stablecoins, because they support commerce and savings. At least, until they don’t (e.g., Terra/Luna, also Bank of England).

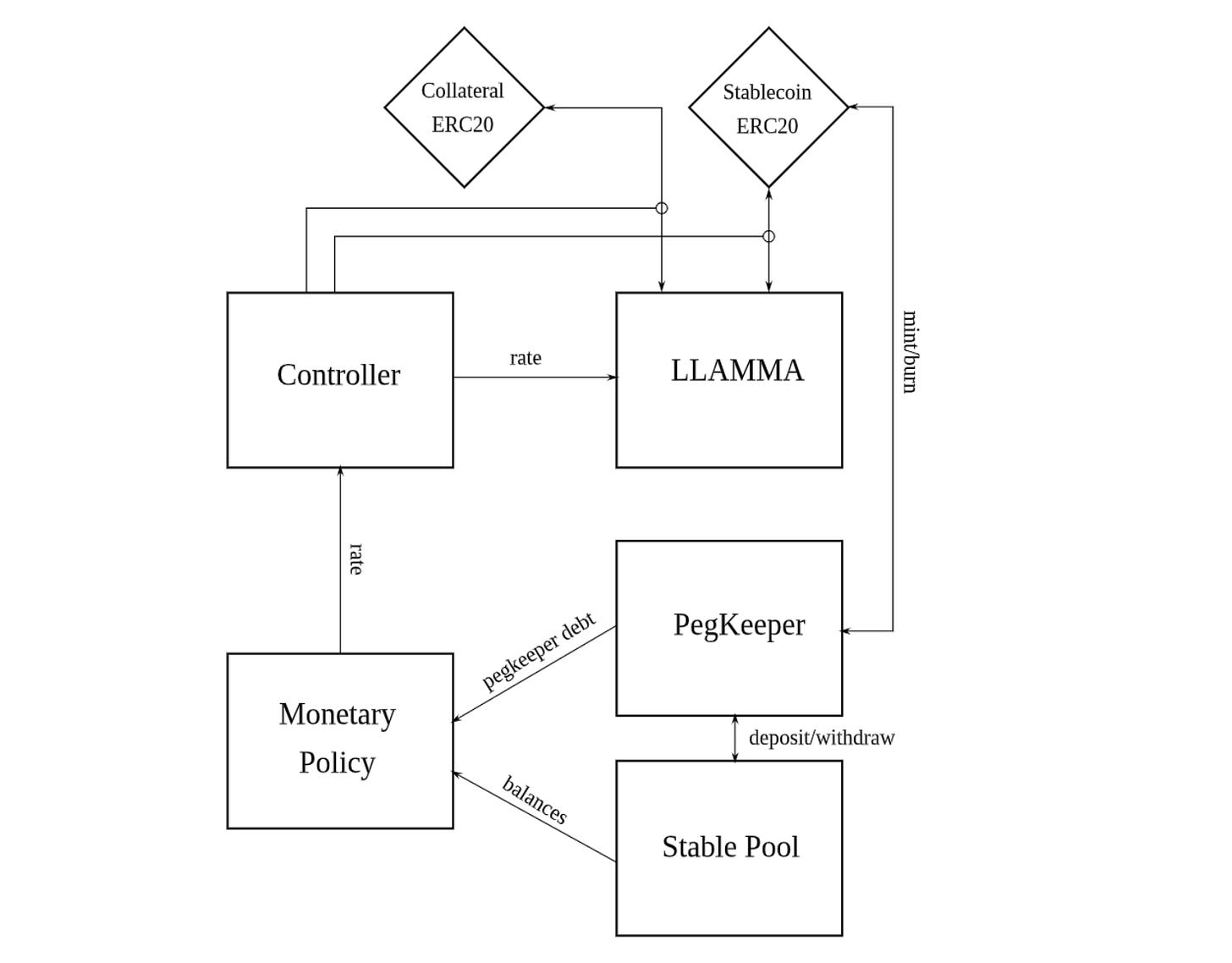

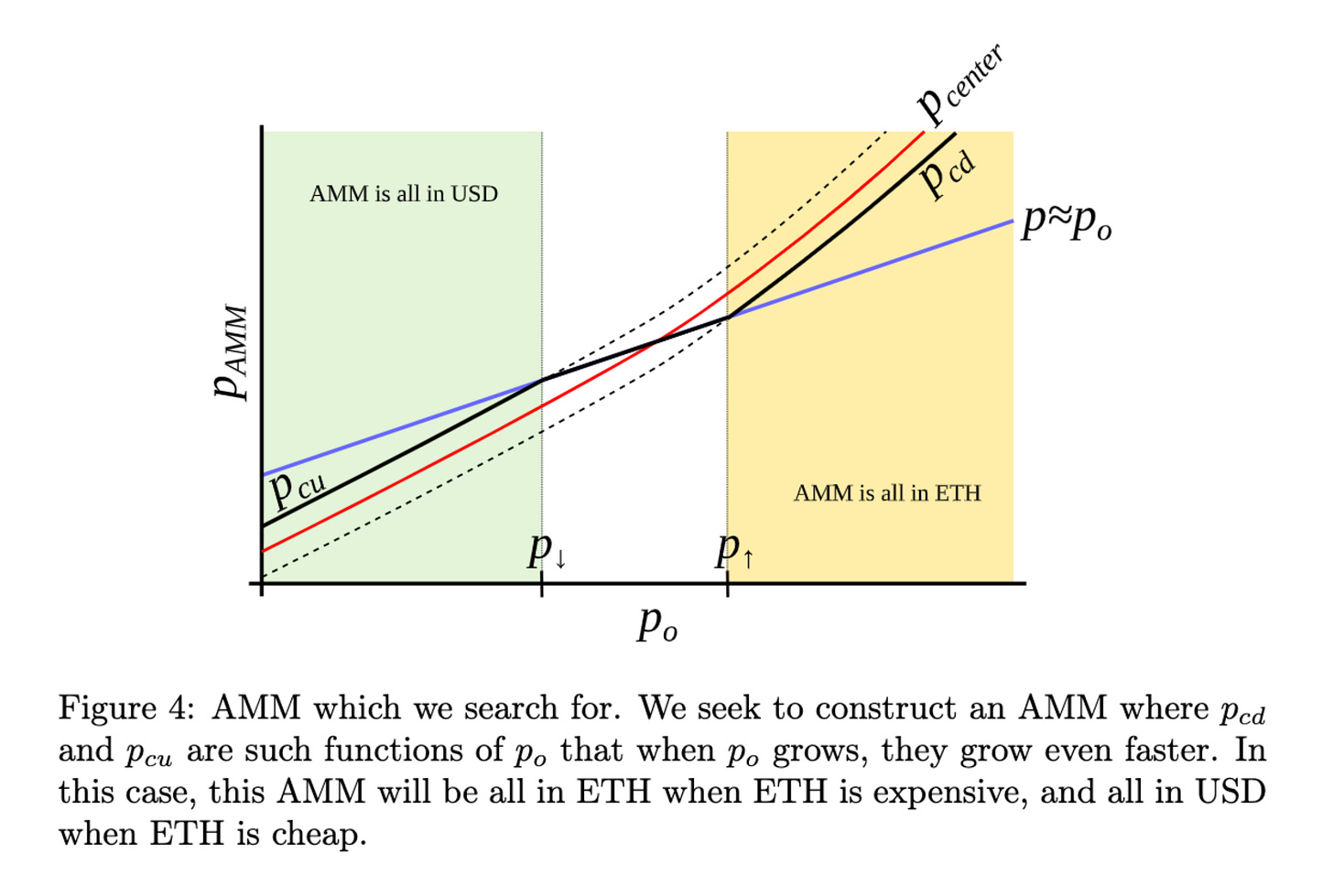

crvUSD will use a novel lending-liquidating AMM algorithm (LLAMMA) to protect borrowers whose collateral drops below the liquidation price. AMMs, Automated Market Makers, allow digital assets to be traded permissionlessly via liquidity pools — such that an order book is not necessary, and a bonding curve sets the price. Within crvUSD, once you commit your collateral, the portfolio has a balance of 100% of this collateral. If LLAMMA observes a collateral price drop, it automatically liquidates parts of the portfolio into crvUSD, i.e., “cash”. If the price goes back up, the collateral gets repurchased. The crvUSD protocol also allows for self-liquidation. To read about Curve's liquidity band approach, see here.

Another feature of LLAMMA is that each form of collateral serves as its publicly tradable AMM — e.g., if you use ETH as collateral for crvUSD, this will automatically create an $ETH / $crvUSD liquidity pool that traders can support through arbitrage. Every token eventually listed as collateral ends up creating another trading pair.

This is an interesting evolution of Curve from an AMM focused on stablecoins in particular, such that the trading spreads are particularly low between USD equivalents, and therefore impermanent loss is less of a factor, to the integration of new, more volatile assets into the ecosystem.

👑 See related coverage 👑

⭐ Mango Market Hacker Loses Millions In Failed Aave Scheme - Decrypt

See here to read our short take on this.

⭐ Leading Cardano Stablecoin Project Shuts Down After Excruciating Launch Delays - Cointelegraph

Turns out building a stablecoin on #Cardano is not possible. "Development on Cardano has been difficult [...] the underlying network on #ADA is currently not ideal for any protocol dealing with liquidations [...] best course of action is halting development." Investors REKT.Last week we talked about Emurgo, the commercial arm of the Cardano blockchain, planning to launch USDA in the Cardano ecosystem. This week there is more evidence about how difficult it is to actually develop things there.

MakerDAO Community Rejects CoinShares Proposal To Invest Up To $500MM In Bonds- CoinDesk

Cosmos-Based DeFi Protocol Onomy Raises $10MM - The Block

Proximity Labs Unveils $10MM Developer Fund For Trading Protocols On Near - The Block

WBTC Depeg Has DeFi Community On Edge - The Defiant

Cryptoeconomics And Blockchain Protocols

⭐ Polkadot-Based Protocol t3rn Raises $6.5MM - The Block

Polkadot-based blockchain interoperability protocol t3rn has raised $6.5MM in a strategic funding round via a simple agreement for future tokens (SAFT), bringing total funding to about $8MM. The round was led by Polychain Capital. t3rn is targeting going live as a Polkadot parachain early next year, although becoming a Polkadot parachain was initially scheduled to happen in Q4 2021 according to t3rn’s old roadmap.