Why Facebook's Libra needs to change course, Ethereum's Fintech promise, and a look at JP Morgan's blockchain analysis

Hi Fintech futurists --

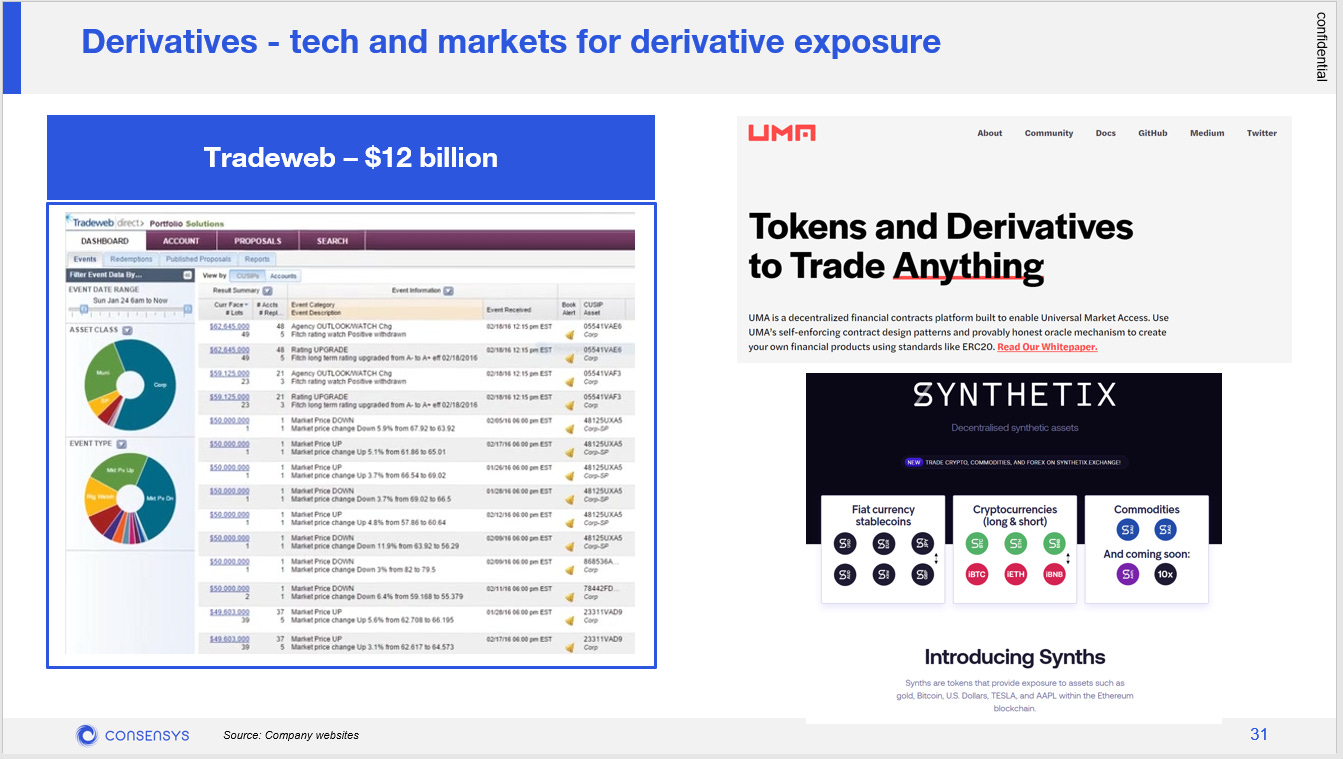

In the long take this week, I anchor around the issues Libra is seeing in trying to develop a money, and what alternate strategies are available. We also analyze elements of a JP Morgan 2020 blockchain report, which highlights the differences between running a financial products (like a money) and a financial software (like a payments processor). In light of this necessary pivot for the regulated Facebook, we look again at Ethereum's decentralized finance ecosystem and the types of challengers it has created for Jack Henry, Finastra, Envestnet, TradeWeb, and other infrastructure providers.

These opinions are personal and do not reflect any views of ConsenSys or other parties. Still, you should check out ConsenSys Codefi for software powering digital assets, financial enterprise blockchains, decentralized finance, and crypto payments here.

Thanks for reading and let me know your thoughts here!

Weekly Fintech & Crypto Developments

If you’ve found value over the years from my newsletter, now is the time to give back. I have added a premium subscription option.

A free "Futurist" tier will continue to include the weekly Long Take. Nothing lost!

A premium “Architect” tier will include an additional 12 key weekly updates with graphs and analysis on Fintech bundles, Crypto and Blockchain, Artificial Intelligence, and Augmented and Virtual Reality. You can see an example here: https://lex.substack.com/p/weekly-fintech-and-crypto-analysis

If you subscribe over the next two weeks, you can get a 25% discount for the next 12 months. Click below to subscribe.

Long Take

As I write this, Facebook is worth about $500 billion in market capitalization. The other members of the Calibra Association (and the 1,500 other organizations interested in connecting to it) are probably worth another few $ trillion. Ethereum, on the other hand, is only about $20 billion in value. And yet -- there are profound reasons why we should be paying attention not to regulatory movement around Libra, but to decentralized finance brewing on the open source network.

The key mainstream piece of news is that Libra's approach to building its currency and payments network is likely to change as a result of governmental pressure. What started out as a desire to build a multi-currency portfolio of dollars, euros, and other Facebook-selected moneys, ended up running into the wall of sovereign opposition. While Bitcoin faces a similar wall, it is permissionless and therefore too squiggly to shut down. Not so with Facebook -- we know exactly where its shareholders and operators are. As a result, we observe that you cannot create a new money without a new nation (e.g., Anon or 4chan nation). And if you live within another nation subject to its laws (e.g., the US), well, you are subject to its laws.

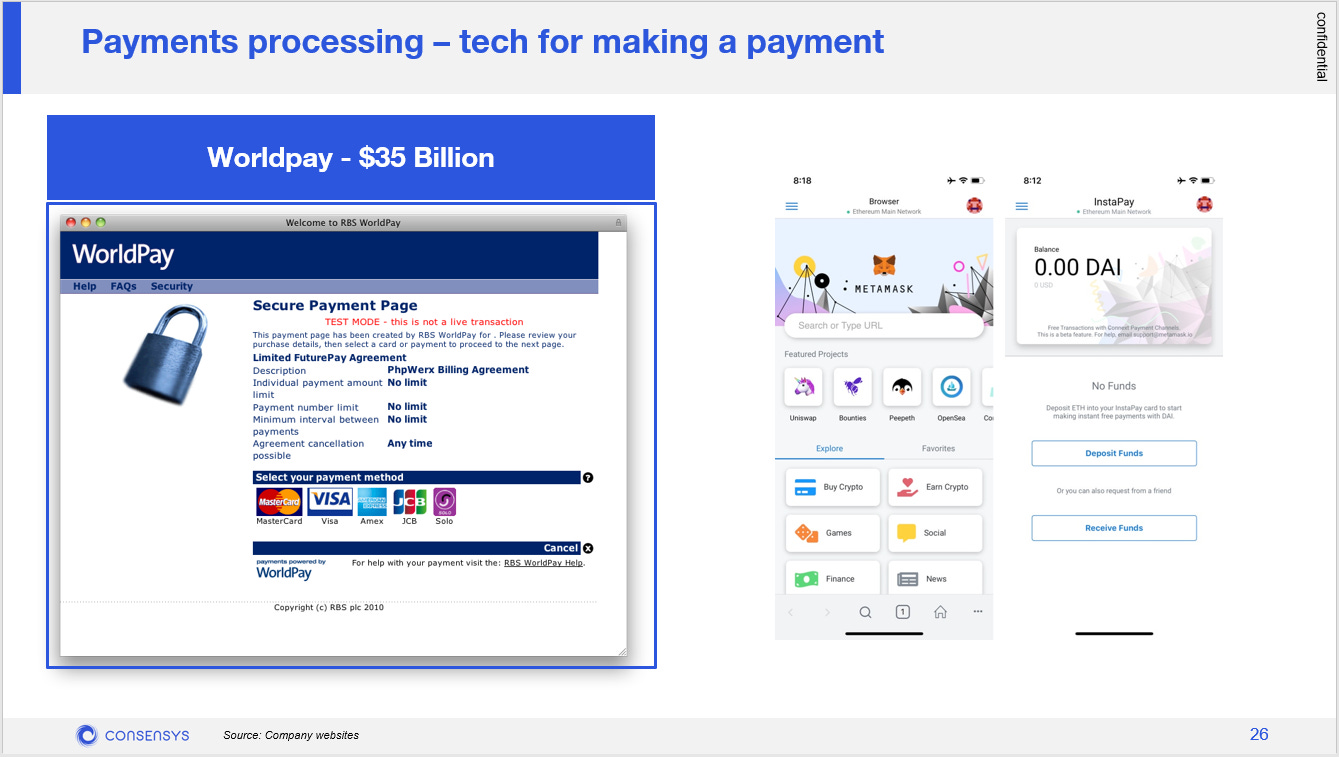

There continues to be a deep confusion about (1) an asset itself, and (2) the operating infrastructure on which it travels. These are two entirely different propositions, and the difference cannot be hand-waved away. The nature of holding some investment and the exposure it gives you to the investment class is very different from the software on which it runs. The Dollar and Sterling may go up and down in value relative to each other -- but that doesn't have much implication for the quality of the venue on which the trading occurs. Facebook was trying to do the former activity -- re-build the actual dollar in a regulated, controlled environment.

Instead, it shold be re-building the payment rails, which is why it is no surprise that the Calibra Association quitters are the companies that make payment rails: Stripe, PayPal, Visa, and Mastercard. Those players are probably open to channeling new units of value across their super highways, but they shouldn't want to build competing ones. Once it becomes clear that the new unit of value ain't happening, what's the point of eating your own tail?

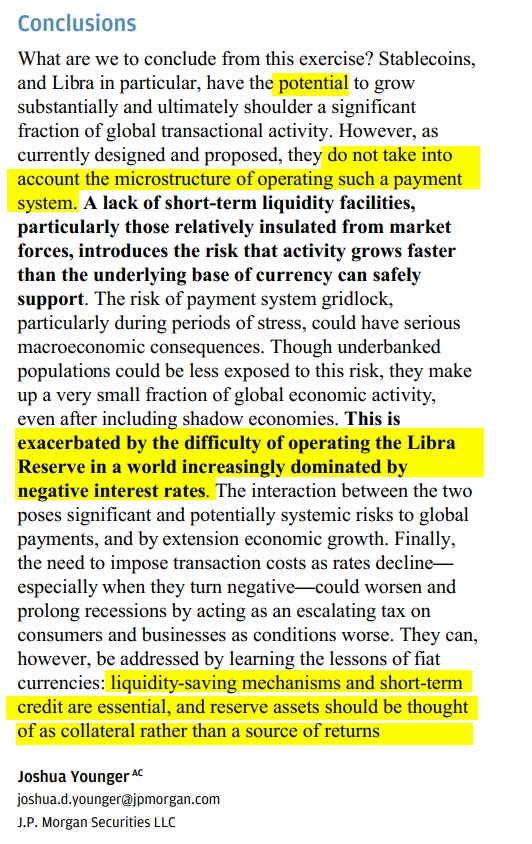

JP Morgan recently published a fantastic equity-research style report on 2020 blockchain (the chart above and a few below are from that source.) There are a few connected, worthwhile points on the idea of cryptocurrency as an asset class worth referencing. First, if you are building the money itself, you are in the finance business and are taking economic exposure. That means, for example, that global yield curves become a problem. If 33% of global debt has negative interest rates, it might be hard for you to earn net interest income to sustain operations, which in turn may require customers to pay transaction fees on transfers, which gets you back to the existing banking/payments system already in place. To fix the math, you would need to build out a real capital markets business, which has at-scale liquidity networks, counterparties that can provide credit, and the buy-in of all the central banks in the system. That's a tough one for Facebook today.

Another conclusion I found compelling is the ongoing discussion about the diversification usefulness of digital assets. On the one hand, many people still hold the view that Bitcoin is an apocalypse hedge and should go up when the entire world burns down. Hoard the digital gold next to your video game guns! However, the track record on this claim is not particularly clear as of yet, and correlations tend to creep up with global markets as shocks become more systemic. In the chart below, you can see that the S&P 500 and Gold both get to a correlation of 30% towards the end of 2019.

The JP Morgan takeaway is that crypto assets can be country fragility hedges, rather than general hedges. They do represent novel and different idiosyncratic risks -- technology adoption curves, Internet meme virality, the mood of various Federal Reserve and FCA officials. But the clearest value still holds in relation to nations with challenged economic and financial infrastructure. Which gets me back to the core point -- stop thinking about the asset, and start thinking about its gears and engines.

While these power politics are shifting influence around, Ethereum is where the experiment is already happening. There are 88 million unique addresses (i.e., accounts), over 40 million smart contract calls in February (i.e., a request to/from a software), and nearly a million smart contracts created in the same month. Check out more growth statistics about it here. An increasing amount of capital is being used as collateral -- "locked" in the parlance of the industry -- to power new financial machines.

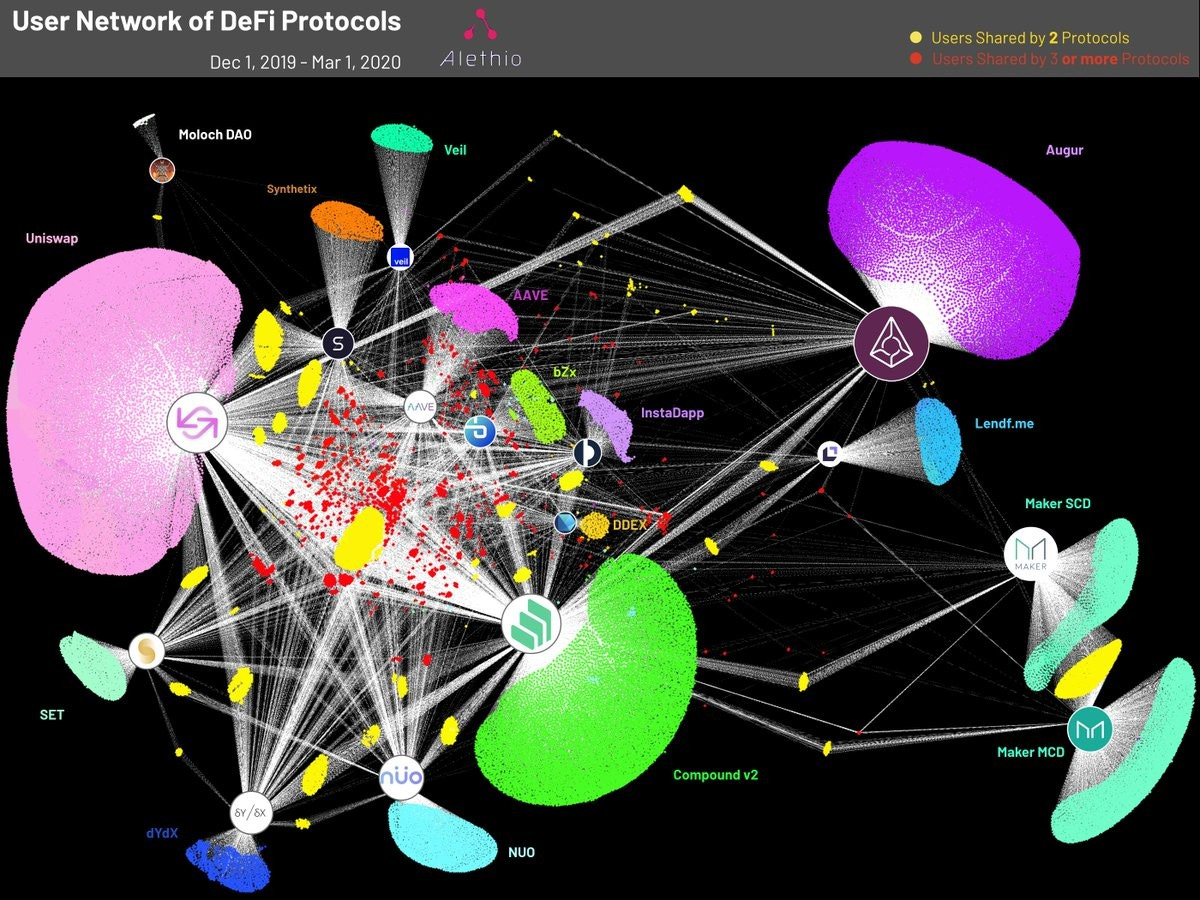

Further, the two charts above show you the user growth, evolution, and interconnectedness between an emerging blockchain-based financial software industry (i.e., DeFi) between 2018 and 2020. Digital currency is collateralized on the right, invested across lending products in the middle, and then sent to multiple trading and derivative exchanges on the left. There is growth in the number of services providers, their specialization, and their users. There is also growth in the connection between these services, and the economic activity between them. This is both a strength and weakness. Systemic risk comes from too much interdependence. But so do network effects and a community.

As more activity from real world economies is able to shift to public blockchains, this snapshot could be the seed from which the financial machine emerges. Of course, that transition is a massive assumption, and to date much of the economic activity of the digital world remains digital and aloof. However, there is evidence of movement. EY, Microsoft, and ConsenSys recently announced the launch of a protocol that allows for private transactions on Ethereum, packaged in a way that large technology integrators can use for their own engagements with corporate clients. If big consultancies can get around scalability and privacy challenges, and deploy core infrastructure on the Ethereum network, this will bring the necessary mana for DeFi to flourish.

We are getting a bit far in the weeds, but I want to make one last point. As you research these issues more deeply and think about the new software providers, do not treat them as investment managers, creating streams of return. The mistake would be to evaluate the investment quality of some particular subscale network token as unattractive and miss the bigger picture. You might spend too much time thinking about the Ethereum token, and not about its ability to power an asset allocation software like TokenSets (social trading) or PieDAO (roboadvisor). To that end, the visualizations below give you the directionally correct comparison of a technology enabler, rather than the asset itself.

The stunning thing about each of these offerings is not just that they are targeting a familiar use-case. Of course they are! Human nature does not change. Rather, it is that they target these use-cases while running on a common software infrastructure, being interoperable, and open source.

To repeat -- we are a stone's throw away from the global financial industry running on a common software infrastructure across asset classes, being natively interoperable, and open source. Sounds good to me!

Looking for more?

Check out ConsenSys Codefi for software powering digital assets, financial enterprise blockchains, decentralized finance, and crypto payments.

Want to send me a note? Reach out here anytime.