AI: BNY Mellon deploys AI super-computer from NVIDIA

NVIDIA also left its competitors in the dust with the launch of the Blackwell GPU

Hi Fintech Futurists —

Today we highlight the following:

AI: NVIDIA's Transformative Role In Finance, With BNY Mellon Incorporating The DGX SuperPOD

LONG TAKE: Stripe's $1 Trillion volume, and the promise of Internet GDP

PODCAST: How NVIDIA is accelerating financial services into the AI age, with NVIDIA Global Head of Financial Services Industry Malcom deMayo

CURATED UPDATES: Machine Models, AI Applications in Finace, Infrastructure & Middleware

To support this writing and access our full archive of newsletters, analyses, and guides to building in the Fintech & DeFi industries, subscribe below.

AI: NVIDIA's Transformative Role In Finance, With BNY Mellon Incorporating The DGX SuperPOD

Over the last decade, the volume of data, particularly alternative data, has skyrocketed. Companies have transitioned from managing gigabytes to petabytes, with exabytes on the horizon. And now super computers are back at financial custodians like BNY Mellon.

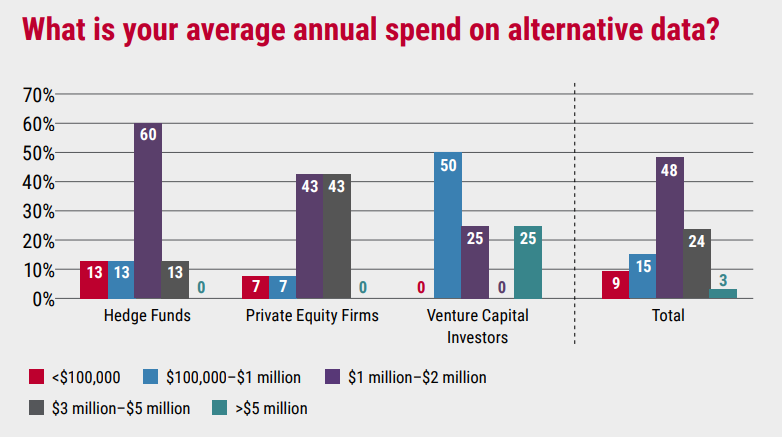

As reference, JP Morgan allocates $15B annually to technology, has 500 petabytes of data, and invests in companies like Quantinuum, which could potentially enhance its data processing capabilities. Banks and hedge funds compete on using data by deploying Machine Learning and Deep Learning techniques to extract actionable insights. There are two separate tasks: (1) acquiring datasets, often costing millions per year (sometimes per dataset), and (2) processing and leveraging datasets more efficiently and effectively than competitors. Companies failing to do so find themselves at an information disadvantage.

The current financial AI era has shifted from merely deploying the "best" Machine Learning algorithm (fortunately, applying ML algorithms has become more accessible and easier nowadays) to running a superior hardware infrastructure. Computing technologies from companies like NVIDIA, Intel, and AMD come into play. And recently, BNY Mellon became the first major bank to deploy an NVIDIA DGX SuperPOD with DGX H100 systems.

We won't delve deep into technical details, but the DGX H100 system, part of the DGX SuperPOD, is an AI infrastructure solution designed to handle massive compute requirements. In finance, the DGX SuperPOD can be used for large-scale data analysis, fraud detection, portfolio optimization, risk modeling, and developing LLMs.

Think of BNY Mellon's use of the SuperPOD as a way to process enormous amounts of data even faster and with greater accuracy — crucial when your competitors are also acquiring the same datasets. And we are not referring to neatly organized, structured, and standardized data confined to Excel sheets, but unstructured data like satellite images, social media posts, geolocation, news feeds, and communications metadata. These types of datasets have become increasingly popular, especially after the 2007 quant crash, and they differ from the traditional structured data typically used by investment management firms.

Besides dealing with Big Data, banks, especially in Europe, face another layer of complexity — strict regulations surrounding customer data protection. As custodians of customer information, they must ensure regulatory compliance, which can create severe usage limitations of the data in AI models. Ironically, the countries with a more relaxed stance on customer data protection, which tend to be regarded as less developed, will likely improve the accuracy of their algorithms at a much faster rate than other countries.

For instance, a few years ago, WeChat revealed plans to assign credit ratings to 600MM users using its AI system. This AI analyzes your habits to determine if you're deemed "trustworthy." Yes, it means your chat logs are scrutinized, and speaking against the state could lower your credit score. Imagine that in the West! The whole thing is reminiscent of the surveillance-heavy world depicted in Dave Eggers' "The Circle."

Dystopia aside, if you are curious about how NVIDIA speeds up computing, we recently had a podcast featuring NVIDIA’s Global Head of Financial Services Industry, Malcom deMayo. He breaks down how their accelerated computing platform operates like a three-layer cake for data processing.

Before we conclude, we note that NVIDIA dominates the GPU market with an 80% share compared to chipmakers Intel and AMD. It’s not like competition is standing still. Intel has a colossal R&D budget, double that of NVIDIA, and recent $8.5B funding under the CHIPS Act, while AMD shows impressive investment, doubling its R&D investment from $2.85B in 2021 to $5.9B in 2023.

In 2023, the rivalry escalated as AMD challenged NVIDIA's data center GPU dominance with its Instinct MI300 series, claiming superior efficiency and cost-effectiveness for Large Language Models (LLMs) compared to NVIDIA's H100. However, AMD's projection of $3.5B in sales for its MI300-series AI GPUs in 2024 hinted at limited demand, unlike NVIDIA, which grapples with perpetual shortages.

The recent introduction of the Blackwell B200 GPU and GB200 superchip has allowed NVIDIA to further distance itself from competitors. The B200 GPU promises a 25x reduction in cost and energy consumption compared to the H100. According to NVIDIA, training a 1.8T parameter model once required 8,000 Hopper GPUs and 15 megawatts, but can now be done with just 2,000 Blackwell GPUs and four megawatts.

This is the robot body on which the mind of artificial intelligence will sit. Financial firms are paying for capacity just like the rest of the world. Whether they can generate the requisite value from all this machine thinking remains to be seen.

👑 Related Coverage 👑

Blueprint Deep Dive

Long Take: Stripe's $1 Trillion volume, and the promise of Internet GDP (link here)

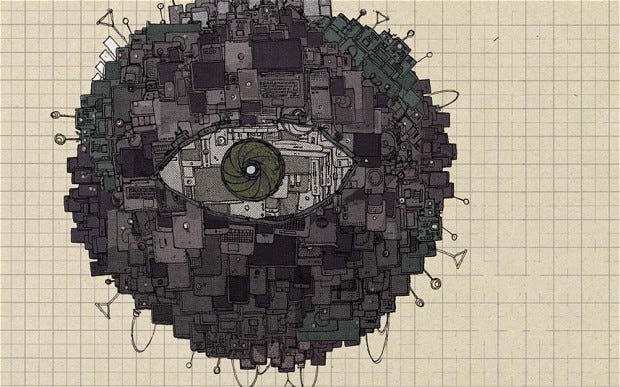

In today's discussion, we dive into the impressive growth of Stripe, a key player in the fintech sector, which processed over $1 trillion in payments volume in 2023, reflecting its pivotal role in powering the internet's GDP.

We compare Stripe's performance with peers like PayPal and Adyen, highlighting their roles in the evolving landscape of online commerce and the shift from physical to digital transaction methods. Despite the competitive space, Stripe's remarkable growth, along with its strategic positioning and potential public offering, positions it as a key winner of Web2 fintech. Moreover, we explore the future of payments, speculating on Stripe's ability to adapt to the advances in AI and Web3, and the potential for new transactional frameworks beyond traditional APIs and banking networks.

🎙️ Podcast Conversation: How NVIDIA is accelerating financial services into the AI age, with NVIDIA Global Head of Financial Services Industry Malcom deMayo (link here)

In this conversation, we chat with Malcolm deMayo - global head of NVIDIA’s Financial Services Industry (FSI), a vertical business unit that is working to accelerate the adoption of AI.

NVIDIA FSI is the leader in accelerating and modernizing critical industry use cases such as fraud, document and process automation, customer service, risk management and much more.

Curated Updates

Here are the rest of the updates hitting our radar.

Machine Models

⭐ Gemma: Introducing New State-of-the-art Open Models - Google

⭐ Google DeepMind Introduces Two Unique Machine Learning Models, Hawk And Griffin, Combining Gated Linear Recurrences With Local Attention For Efficient Language Models - Mark Tech Post

⭐ Heterogeneous-Agent Reinforcement Learning - Yifan Zhong, Jakub Grudzien, Xidong Feng, Siyi Hu, Jiaming Ji and Yaodong Yang

Trained Transformers Learn Linear Models In-Context - Ruiqi Zhang, Spencer Frei and Peter L. Bartlett

Over 100 Malicious AI/ML Models Found on Hugging Face Platform - The Hacker News

Sparse NMF With Archetypal Regularization: Computational And Robustness Properties - Kayhan Behdin and Rahul Mazumder

Deep Network Approximation: Beyond ReLU To Diverse Activation Functions - Shijun Zhang, Jianfeng Lu and Hongkai Zhao

Researchers Enhance Peripheral Vision In AI Models - MIT News

AI Applications in Finance

⭐ Large (and Deep) Factor Models - Bryan Kelly, Boris Kuznetsov, Semyon Malamud, and Teng Andrea Xu

⭐ Stock Closing Price And Trend Prediction With LSTM-RNN - Journal of Artificial Intelligence and Big Data

Microsoft Tailors AI For Finance Teams In Specialized 'Copilot' Strategy - Reuters

Can Transformers Transform Financial Forecasting? - HAN University of Applied Sciences

Combining Transformer Based Deep Reinforcement Learning With Black-Litterman Model For Portfolio Optimization - Young Shin Kim and Hyun-Gyoon Kim

Transformer for Times Series: An Application To The S&P500 - Pierre Brugiere and Gabriel Turinici

Infrastructure & Middleware

⭐ Delivering Digital Infrastructure In The AI Age - White & Case

⭐ NVIDIA Could Pay Up To $1B To Acquire AI Infrastructure Startup Run:ai - SiliconANGLE

⭐ India Plans 10,000-GPU Sovereign AI Supercomputer - The Register

NVIDIA CEO Calls For Sovereign AI Infrastructure - EnterpriseAI

Indosat To Integrate NVIDIA's Blackwell Platform Into Its AI-Cloud Infrastructure In Indonesia - Economic Times

Empowering Large Language Models With Specialized Tools For Complex Data Environments: A New Paradigm in AI Middleware - Mark Tech Post

🚀 Level Up

Sign up to the Premium Fintech Blueprint and in addition to receiving our free newsletters, get access to:

All Long Takes with a deep, comprehensive analysis on Fintech, Web3, and AI topics.

Archive Access to an array of in-depth write-ups covering the hottest fintech and DeFi companies.