Fintech: New York Community Bancorp halts trading, raises $1B capital injection

NYCB announces a strategic equity investment of $1.05 billion from a consortium of investors, led by former U.S. Treasury Secretary Steven Mnuchin's Liberty Strategic Capital.

Hi Fintech Futurists —

Today’s agenda below.

BANKING: New York Community Bancorp Continues its Eventful 2024.

LONG TAKE: Dissecting Monzo’s new $5B valuation and 9MM UK customers (link here)

PODCAST CONVERSATION: Saving DeFi from financial hacks, with Quantstamp CEO Richard Mauilding (link here)

CURATED UPDATES: Paytech, Neobanks, Lending, Digital Investing

To support this writing and access our full archive of newsletters, analyses, and guides to building in Fintech & DeFi, subscribe below.

Digital Investment & Banking Short Takes

Banking: New York Community Bancorp Continues its Eventful 2024

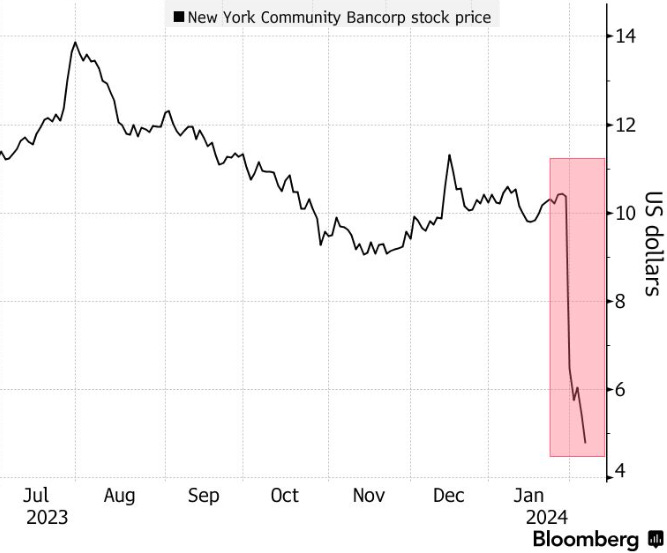

New York Community Bancorp (NYCB), a bank holding company with assets exceeding $100 billion, continued its tumultuous start to 2024 with a series of dramatic events this past week. Let’s recap what got us to this point. Earlier in the year, we wrote about NYCB's struggles at the end of 2023. The bank reported a significant loss in the fourth quarter, amounting to $250MM+ or a 27-cent loss per share, starkly contrasting with analyst’s expectations of a 29-cent profit per share. Additionally, the bank experienced a significant increase in provisions for credit losses, jumping from $62MM to $552MM. The pain was further exacerbated by a 70% cut in its dividend, from 17 cents per share to 5.

These difficulties originated from (1) NYCB's extensive involvement in commercial real estate loans and (2) the acquisition of a considerable volume of loans from the failed Signature Bank. This acquisition pushed NYCB's assets beyond the $100 billion threshold, subjecting it to tighter regulatory scrutiny and requiring increased capital reserves against potential future losses. Consequently, Moody's downgraded NYCB's credit rating to "junk" status, leading to an unsurprising fall in NYCB's stock price and raising serious concerns about the bank's operational viability moving forward.

Keep that context in mind. After markets closed on February 29th, NYCB dropped a series of announcements and disclosures. First, it revealed a $2.4 billion charge for goodwill impairment – representing the premium paid over the fair market value of assets acquired in a business purchase, encompassing things like brand value, customer relations, and intellectual property. An impairment charge comes about when the value of the goodwill no longer reflects its current worth. Though this adjustment is a bit of accounting gymnastics and doesn't hit cash flow or operational funds, it does impact the overall value of the company and directly impacts its bottom line. In NYCB's case, this move increased its fourth-quarter loss from $252 million to roughly $2.7 billion.

Next, NYCB disclosed a "material weakness" in its internal control over loan reviews, an announcement broadly interpreted by the investment community as an indication that the bank might be facing more problematic loans than initially thought. Finally, and perhaps not too surprising given the first two announcements, NYCB announced that CEO Thomas Cangemi would be stepping down, and Executive Board Chair Alessandro DiNello would be taking his place. Predictably, this trio of disclosures sent NYCB's shares crashing – dropping 26% and 23% over the next two trading days.

The narrative took another turn on the morning of March 6, with reports emerging that NYCB was in talks with various firms to secure a financial lifeline. This triggered a further 42% drop in the bank's stock, leading to a temporary trading suspension by the New York Stock Exchange. However, by the time trading resumed, NYCB had announced a strategic equity investment of $1.05 billion from a consortium of investors, led by former U.S. Treasury Secretary Steven Mnuchin's Liberty Strategic Capital.

While some of the deal terms are still yet to be disclosed, many were made available by NYCB in a post-announcement investor presentation. Aside from deal size, a significant restructuring of the board, further reduction in dividend, and a new CEO (second in one week) were announced.

So where does that leave us, and what are the broader implications of these recent events? From the perspective of financial stability, New York Community Bank is in a stronger position than the week prior, thanks to a substantial boost in cash that has enhanced its capital ratios. Moreover, Moody's is now contemplating an upgrade to the bank's credit rating, indicating an improvement in its financial health.

For current NYCB shareholders, the impact of an equity injection is less clear – likely the “best of a bad bunch.” Although this move significantly dilutes the value of existing shares, it is a better outcome than the bank potentially failing and being taken over by the FDIC. Additionally, while Mnuchin can be a polarizing figure, he and Otting have been successful in this type of thing before - acquiring, transforming, and profitably selling the failed mortgage lender IndyMac (although, not without some foreclosure practices controversies along the way). If they manage to revitalize NYCB, shareholders will certainly benefit.

For the broader market, the whole situation once again shines a light on the difficulties facing the commercial real estate (CRE) sector. While NYCB's situation is primarily tied to its concentration of commercial real estate loans made to rent-stabilized properties in New York City (properties which are governed by strict regulations on rent increases, limiting landlords' ability to generate additional revenue to repay loans), the difficulties facing the sector span the entire CRE landscape. From January 2023 to January 2024, delinquency rates for all types of commercial properties rose by 59%. Federal Reserve Chair Jerome Powell's remarks to the Senate Banking Committee underscore this point, mentioning that more bank failures should be expected in the near future due to vulnerabilities in CRE loan portfolios. This was not the intended effect of interest rate increases, but has become a systemic shock to real estate, banking, and government debt as a whole.

Looking ahead, the exposure of banks to CRE loans will continue to be a hot topic. Effective management of these loans — through rigorous financial assessment of borrowers, a deep understanding of market trends, and proactive risk mitigation — will be essential. Additionally, regulatory agencies and policymakers are likely to keep a close watch on this area, possibly introducing new guidelines or regulations to safeguard the sector's stability. Banks' ability to adapt to market changes, efficiently manage risks, and innovate in their lending practices will play a pivotal role in ensuring their resilience and the financial system's health.

👑 Related Coverage 👑

Blueprint Deep Dive

Long Take: Dissecting Monzo’s new $5B valuation and 9MM UK customers (link here)

Monzo Bank was founded in London by Tom Blofield, a fintech entrepreneur and ex-CTO of competitor Starling Bank, which launched in 2014. In 2015, alongside an entourage of former colleagues and senior managers from Starling, Blofield jumped ship to form his own neobank.

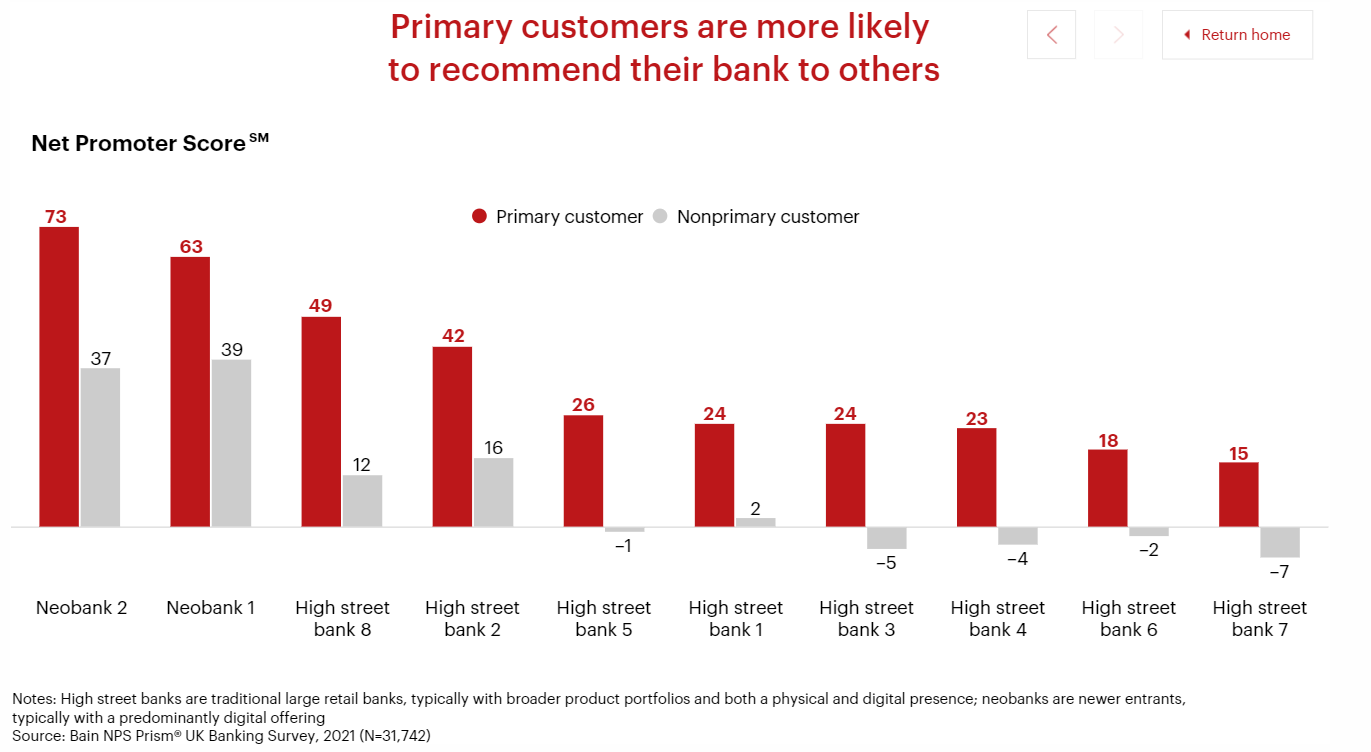

Like many fintechs, Monzo launched with the aim of providing transparent and convenient banking. At the time, customers were increasingly dissatisfied with the opaque pricing models and clunky digital experiences offered by incumbents — a problem that still hasn’t been fully solved. Research by Bain shows high street bank customers remain 3x less likely to recommend their bank to others compared to neobank clients.

🎙️ Podcast Conversation: Saving DeFi from financial hacks, with Quantstamp CEO Richard Ma (link here)

In this conversation, we chat with Richard Ma - CEO and co-founder of Quantstamp, a leading blockchain security company. Richard has over 10 years of experience in the financial industry, including roles as a quantitative strategist, derivatives trader, and portfolio manager.

Under Ma’s leadership, Quantstamp has grown into a leading provider of security audits for blockchain protocols and smart contracts. The company’s mission is to secure the decentralized internet of value, and it has protected $100B in digital asset risk from hackers. More than 300 startups, foundations, and enterprises work with Quantstamp to keep their innovative products safe.

Curated Updates

Here are the rest of the updates hitting our radar.

Paytech

Musk: X Close to Landing NY and CA Payment Licenses - PYMNTS

PayPal launches payment suite for SMEs - Finextra

Apple releases a new API called FinanceKit - Fintech Nexus

Neobanks

⭐ US neobank Dave achieves profitability over Q4 2023 - Fintech Futures

MoneyLion roars ahead with positive earnings - American Banker

Lending

NatWest to axe BNPL option less than two years after launch - Fintech Global

Metropolitan Commercial Bank exits BaaS - BankingDive

Digital Investing

⭐ BaaS vendor Synctera lands additional $18.6m Series A cash injection - Fintech Futures

Deel Is Acquiring Payroll Company PaySpace - Yahoo FInance

🚀 Level Up

Sign up to the Premium Fintech Blueprint and in addition to receiving our free newsletters, get access to:

Wednesday’s Long Takes with a deep, comprehensive analysis.

‘Building Company Playbook’ series, offering insider tips and advice on constructing successful fintech ventures.

Enhanced Podcasts with industry leaders, accompanied with annotated transcripts for deeper learning.

Special Reports

Archive Access to an array of in-depth write-ups covering the hottest fintech and DeFi companies.

Join our Premium community and receive all the Fintech and Web3 intelligence you need to level up your career.

This is a really interesting and informative post. Well written and easy to understand.

As an experienced investment banker, I've closely followed the turbulent 2024 for New York Community Bancorp (NYCB). The bank's commercial real estate and Signature Bank portfolio exposure have proven major liabilities, leading to losses, a dividend cut, and junk credit status.

NYCB's asset growth past $100 billion has brought heightened regulation and capital reserve requirements, exacerbating its financial distress from mounting credit loss provisions.

In my Substack advising aspiring bankers, I emphasize prudent risk management and diversification - lessons NYCB's aggressive, concentrated strategy has underscored as a cautionary tale.

Moving forward, NYCB must comprehensively review its operations to chart a path to stability and profitability. Proactive steps to shore up its finances and restore confidence will be crucial to weather this crisis.

The NYCB case highlights how regional banks must maintain prudent risk practices and adequate capital, even facing competitive pressures. Failure to do so can result in the turmoil NYCB now faces.