Analysis: SharpLink's $425MM to build the Ethereum MicroStrategy with Joe Lubin

SharpLink, backed by Consensys and major funds, launches the first public ETH treasury strategy.

Gm Fintech Architects —

Today we are diving into the following topics:

Summary: We discuss how, SharpLink (SBET), backed by $425MM in PIPE financing from Consensys and major crypto funds, aims to become the “MicroStrategy of Ethereum” by maximizing ETH yield per share through staking, restaking, and other on-chain financial primitives. In the era of user-generated content, Ethereum enables anyone to create digital financial assets — its infrastructure has led to over $250B in stablecoins, $200B+ in DeFi assets, and adoption by leading fintechs and asset managers. We explore whether ETH can access Bitcoin's demand engine — driven by ETF inflows, MicroStrategy’s leveraged treasury strategy, and its store-of-value appeal. Notably, Ethereum’s programmability offers additional levers, such as participating in ecosystem tokens and infrastructure assets.

Topics: Ethereum, Bitcoin, Solana, MicroStrategy, SharpLink (SBET), Consensys, Circle, Stripe, Coinbase, Uniswap, Aave, Sky, Jupiter, Pump.fun, BlackRock, Franklin Templeton, Wisdom Tree, ParaFi Capital, Galaxy Digital, Pantera Capital, Arrington Capital, Ondo, GSR, Electric Capital, Hivemind Capital, Primitive Ventures, Republic Digital, RSports Interactive, EigenLayer, Ether.Fi.

To support this writing and access our full archive, see subscription options below starting at $3/month. Premium subscribers have access to Fintech IPO primers (e.g., Circle and Chime) and the detailed strategies to build successful fintech and DeFi startups.

Long Take

User Generated Finance

Movies used to be made by movie studios and distributed by movie theaters. This required large capital outlays and material intermediation to bring the product to the masses. Now, anyone with a TikTok app can become a superstar by shooting videos or using AI.

Books used to required the entire publishing value chain for an author to be discovered, edited, and distributed through book stores. To become an author meant that you had traversed the labyrinth of publishing houses and won. Now, anyone can post missives on social networks and reach millions of people.

The manufacturing and issuance of financial products used to require high fixed costs and capital investments, made by carefully licensed people and regulated firms. Each one would be a monumental effort. But since 2017, I would argue, we have entered the era of user-generated finance. Anyone can launch a digital asset with financial characteristics, currently going at the pace of 500,000+ tokens per month.

That doesn’t mean they are all good assets. Not every tweet and TikTok are equivalent to the Godfather trilogy! But the trend is clear.

At the core of this change in how people interface with money and economics is Ethereum. While other chains had invented digital scarcity (Bitcoin) or remixed Ethereum’s core ideas (Solana), decentralized finance was born on Ethereum and continues to be one of the most profound technological platform shifts to hit the financial service industry.

The World Computer

I’m biased.

Having worked at Consensys, the Ethereum Labs company, between 2019 and 2023, we had a front row seat to everything from tokenized assets, central bank digital currencies, sidechain payment networks, stablecoin accounts, onchain aggregated swaps, staking and bridging, and worked with every bank, DeFi protocol, and wallet you can imagine. It doesn’t always pay to be early to market, but the direction of travel in regards to how Ethereum would open up the global manufacturing of financial product — and by extension start to solve the unbanked and underbanked problem — was exactly how things are playing out.

Now, Ethereum’s operational and strategic bets are beginning to pay off as the United States turns all the way risk-on for Crypto and AI from the very top.

The network’s valuation peaked in the beginning of 2022, before the flurry of poor financial engineering across Crypto and the associated human fraud brought things down. Yet when we zoom out on a 5-year horizon, it is still a 100x performing asset. Over the last 2 years, however, ETH has struggled to break out relative to Bitcoin, while also lagging the younger entrant, Solana.

Solana has taken advantage of the desire for memetic capital markets by Gen Z, earning its spot as an even more psychedelic Robinhood casino by providing semi-centralized, but very fast execution. Whereas ETH was Nintendo, Solana was the Playstation. Or maybe ETH was Facebook and Solana was Snapchat. So the story went. As we covered more deeply here, Ethereum chose to scale its platform through multiple composable Layer 2 chains, which in turn splintered marketing attention and shifted value into new platforms.

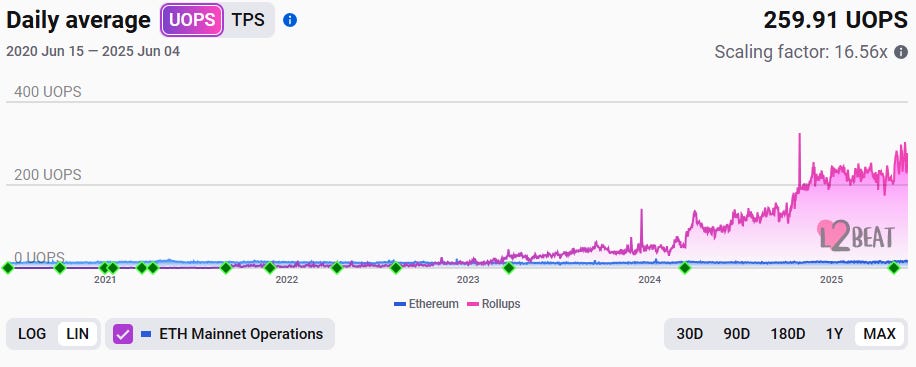

While transaction throughput was achieved, economic value accrual faltered and social incentives splintered. These things are being addressed by a re-structuring of the Ethereum foundation, a focus on tangible accomplishments, and a prioritization of DeFi product-market fit. The Ethereum L1 will scale, the experience inconsistencies between L2 will be ironed out, and ETH will absorb increasing value as usecases proliferate — accelerated by companies like Coinbase, Stripe, and Robinhood. Unlike single-purpose chains, Ethereum is positioned to settle and secure thousands of new highly performant networks and their emergent use-cases.

It is important to highlight just how successful the actual digitization of financial services — across multiple categories — had become.

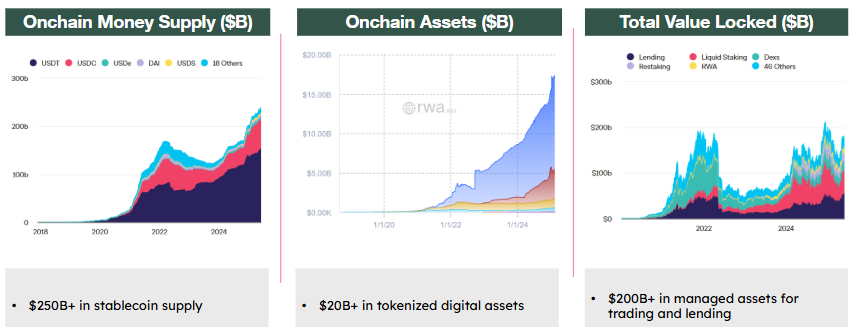

Over $250B of dollar-pegged cash equivalents have been created. Circle has just had a blockbuster IPO, landing at a $15B+ marketcap. The most successful fintechs in the world, like Stripe, are leaning into a stablecoin strategy. DeFi protocols like Uniswap (trading), Aave (margin), and Sky (stablecoin) have been a run-away success on Ethereum with total managed assets at over $200B. High throughput Solana version of these ideas, like Jupiter and Pump.fun, have been massively commercial as well, generating hundreds of millions in revenue.

Tokenized treasuries and private credit have been making their way onchain as well, positioning BlackRock, Franklin Templeton, Wisdom Tree, and other large asset managers at the heart of Crypto market growth.

All of the above are evidence of onchain economic activity and a modern financial sector build to support it.

I think of it as *operating activity* on a computational blockchain.

The Demand Engine

Bitcoin has been able to hit a different growth lever from both Ethereum and Solana.

Unlike Ethereum, and despite various efforts, you cannot really build much software around Bitcoin, and therefore you cannot build an application platform with lots of businesses on it. And you don’t need to! The BTC story is about displacing Gold as a store of value and becoming the most valuable digital commodity — $2 trillion done, and another $18 trillion to go to reach parity. BTC targets money, not the GDP which money is used to measure.

However, Bitcoin does have a healthy sector trying to financialize the coin and place it into asset allocations. Bitcoin miners have created enormous data centers composed of state of the art GPUs, effectively subsidizing the path that companies like NVIDIA took to pivot from video games, to crypto, to machine intelligence at scale. Coreweave, the largest GPU neocloud now trading at $60B, started out as a Bitcoin miner before securing contracts with Microsoft to deliver inference and training.

A healthy Bitcoin mining sector remains in place, with companies trading at up to 8x on revenue. We had previously covered these firms in detail here.

While the return profile of dedicated hardware miners can be debated, their operations create a natural need for financial firms that service them. Bitcoin must be stored, bought and sold, borrowed and levered, and rehypothecated.

Another key financial lever that has driven demand for Bitcoin are the ETF products. ETFs are important because they open up the floodgate of automated asset allocation from wealth managers and institutional investors. While we previously suffered the GBTC trust wrapper, the SEC had been made to relent and opened the floodgates to ETF inflows.

Today, we see about $150B of assets in spot Bitcoin ETFs, and only $7B in spot ETH ETFs. This highlights the opportunity ahead as Wall Street begins to process the connection between application, technology, and protocol in Web3.

The last and increasingly meaningful lever for Bitcoin financial demand is MicroStrategy and its digital asset treasury strategy. We have covered MicroStrategy and its incredible rise to a $100B of marketcap here previously, highlighting the company’s $35B of financing through convertible notes and various equity instruments, thereafter deployed into Bitcoin.

Another must-read on the topic is this article from VanEck. It has helped us narrow in on a couple of key mechanisms for the success of the MicroStrategy approach.

Equity Premium above NAV: MSTR’s shares often trade 100%+ over the value of its Bitcoin. The premium is an extra pool of equity capital that the company can tap by selling new shares. It exists because investors price in future BTC buys, regulatory ease of holding stock over spot BTC, and Michael Saylor’s ability to promote his activities.

At-the-Market (ATM) Common-Stock Sales. Shares are sold at the prevailing market price, cash is used to buy more BTC, and the extra coins raise “Bitcoin yield” (BTC per share). Dilution is offset, and sometimes more than offset, by the added BTC backing.

Convertible Notes. These are low-coupon unsecured bonds with embedded call options on MSTR. Investors accept low coupons payments on the debt MSTR’s high equity volatility makes the option portion valuable. Saylor can therefore borrow billions cheaply, buy BTC, and leave principal repayment far in the future. You can see VanEck’s calculations of the converts pay-off function relative to the price of the stock.

STRK Perpetual Convertible Preferred. An instrument with an 8% coupon and perpetual maturity. It functions like a high-yield bond plus an out-of-the-money but non-expiring call on MSTR. Dividends can be paid in cash or stock; payment in stock dilutes common shareholders but conserves cash.

Volatility Harvesting via Structured Securities. Saylor designs instruments that speculators can hedge and arbitrage. High realized and implied volatility make MSTR’s converts and preferreds attractive to option-hedged buyers.

The powerful loop is the interaction of the premium, volatility, and capital-raising capacity. As BTC rises, MSTR experiences bigger unrealised gains, which leads to a larger premium to holding BTC and therefore makes it cheaper and easier to issue more equity or converts, leading to more BTC bought and capital appreciation. Notably, the same loop runs in reverse during a prolonged BTC draw-down.

From an operating perspective, MicroStrategy’s financial engineering aims to maximize its “Bitcoin Yield”, which is the ratio of BTC relative to MSTR shares. Any of the above levers — selling common shares, issuing converts, or issuing preferreds — can raise cash to buy BTC (numerator) or, less desirably, repurchasing stock can shrink share count (denominator).

The more Bitcoin that MicroStrategy has acquired, the more capital is required for each incremental basis-point of yield, making the strategy progressively harder to sustain. And right now, MSTR has over 2% of the supply of all Bitcoin. This creates an opportunity for new entrants to offer a better risk/return profile while replicating some of the parts of this machine. As a result, we have seen a number of companies enter the space.

And only one company has launched to focus exclusively on Ethereum.

The Ethereum Financial Demand Machine

We have discussed how Ethereum has been working to fix the various problems that have led to middling financial performance by targeting (1) operating activity, and (2) inflows through ETFs. The final leg of the stool is SharpLink — ticker SBET.

Consensys and a number of large crypto funds — ParaFi Capital, Electric Capital, Pantera Capital, Arrington Capital, Galaxy Digital, Ondo, White Star Capital, GSR, Hivemind Capital, Hypersphere, Primitive Ventures, and Republic Digital — have committed to a PIPE (“Private Investment in Public Equity”) of $425MM to be used by SharpLink in order to build the MicroStrategy of Ethereum.

The underlying company, SharpLink, is a digital performance marketing firm that focused on sportsbook and casino customer acquisition through a global affiliate network and niche web domain strategy. While there is still a remaining business, SharpLink had sold a material portion of its operations for $22MM to RSports Interactive in 2024. Prior to that, it had gone public through a transaction in 2021 by a merging with Mer Telemanagement Solutions, which had been public since 1997.

All this to say that SBET is a vehicle with a $20MM marketcap that has now received a $425MM infusion to build out a financial demand investment strategy for Ethereum. ParaFi and Galaxy Asset Management will play key roles in treasury strategy, and Joe Lubin, founder of Ethereum and Consensys will become the Chairman of SharpLink. In this role, Joe will be able to meaningfully amplify ETH as an asset again, and have a vehicle for its monetization.

The core playbook of raising equity and volatility-linked debt in order to finance the purchase of appreciating crypto assets is available to all digital asset treasury companies. SharpLink has the advantage of being the pure-play ETH bet, and as a result is likely to try and maximize ETH yield per share in the way that Microstrategy targets Bitcoin. Given that ETH is a smaller marketcap of $300B relative to BTC at $2T, volatility of the underlying asset will be higher, thereby offering an attractive set of potential instruments to volatility hunters in the future. We also see more potential for capital appreciation.

This doesn’t mean the absence of downside risk as all blockchain-related protocols have meaningful technological and financial risk. But to the extent the approach has worked for MicroStrategy, it could work for SharpLink.

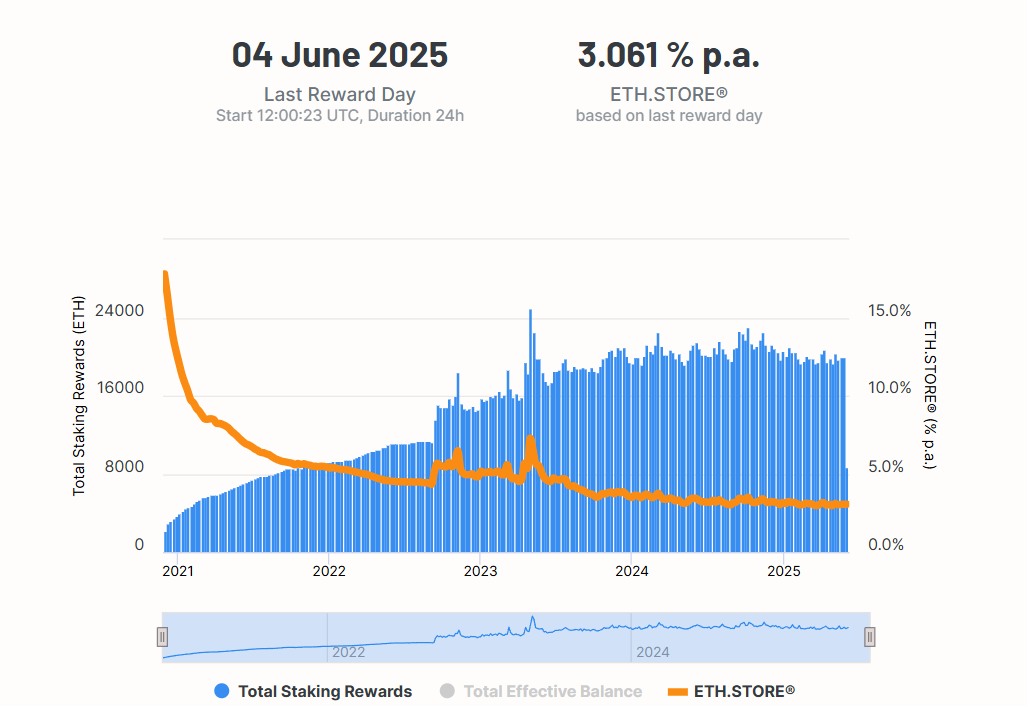

Additionally, there are several levers that SharpLink has which are not available to MicroStrategy. Ethereum does not use hardware mining and proof of work for validation of blocks, but rather proof of stake, which generates a nominal yield on staked assets — currently floating around 3% as a function of the asset amount of participants.

A simple calculation would suggest $425MM times 3% per year, which yields $10-15MM of annualized revenue immediately, apart from any capital appreciation.

On top of this, Ethereum has a re-staking ecosystem from EigenLayer, Ether.Fi, and others, where the staked ETH can be used again to secure additional networks and earn an additional 1-5% depending on market conditions and levels of assets.

Additional yield could be found by participating in collateralized lending markets like Aave for another few dozen basis points, as well as through leverage markets that issue stablecoins against ETH itself — we highlight these markets in the screenshots above.

Separately, unlike a Bitcoin treasury strategy, an Ethereum-focused approach should be not limited to holding only ETH. The protocol hosts several hundred thousand ERC-20 tokens, many of which have created material value all on their own. Like YouTube attracting content producers that generate content, Ethereum attracts capital to generate additional capital. Another example would be Apple making money not just from selling iPhones but also monetizing its App Store.

Ownership of strategic assets that function as launchpads, exchanges, or payment systems can be highly correlated to the performance of ETH, but also capture alpha from additional operating performance. Some portion of the treasury — the staking rewards for example — could be allocated into higher risk foundational projects that generate meaningful revenue and return value back to Ethereum. Coinbase, and its launch and monetization of the Base protocol, is one of the best examples of putting this to practice.

While the risks remain material, including volatility, regulatory flux, and execution complexity, the opportunity is also profound: to build a capital-efficient machine that captures Ethereum’s monetary premium, staking yield, and financial network effects. If Bitcoin is eating gold, Ethereum is attempting to rewire global finance — and SharpLink is positioning itself as one of the first public proxies for that ambition.

🚀 Postscript

Become a paid subscriber to access our series of IPO primers and start-up builder playbooks for only $3/per week.

Sponsor the Fintech Blueprint and reach over 200,000 professionals.

👉 Reach out here.Check out our AI newsletter, the Future Blueprint, here.

Read our Disclaimer here — this newsletter does not provide investment advice

Also - would be interesting to see a piece on WorldCoin, Midnight or any of the other projects chasing KYC/AML - we need a decentralized ID system. My hunch is Saylor sees that and will eventually develop Orange into that.

Great read Lex.