Analysis: Understanding the $100B+ Crypto Treasury company boom

Over $100B in BTC and $6.9B in ETH now sit in public company treasuries

Gm Fintech Architects —

Today we are diving into the following topics:

Summary: We examine the rise of crypto treasury companies — publicly traded entities designed to hold and accumulate crypto assets like BTC, ETH, and TAO — as a bridge between traditional capital markets and decentralized finance. MicroStrategy leads this trend with $70B in Bitcoin, while newer players like SharpLink, The Ether Machine, and xTAO aim to replicate the strategy for Ethereum and AI-related tokens, using financial engineering to gain exposure and capital. The sector attracts both retail momentum and institutional capital, offering unique instruments for crypto exposure despite execution and market risks.

Topics: MicroStrategy, The Ether Machine, xTAO, Bittensor, SharpLink Gaming, Bitmine, BTCS, Dave, DYNX, SBET, BMNR, Perplexity, CleanSpark, Bitfarms, Cipher Mining, HIVE Digital, Marathon, Riot Blockchain, Hut 8 Mining, Iris Energy, Coreweave, Galaxy, Tesla

To support this writing and access our full archive of newsletters, analyses, and guides to building in the Fintech & DeFi industries, see subscription options below.

Thank you for your time and attention,

Lex Sokolin

Our Ecosystem: AI Venture Fund | AI Research | Lex Linkedin & Twitter | Sponsors

Long Take

Treasures

Let’s check in on crypto treasury companies.

What are they again?

There are over 100 public companies whose stated strategy is to buy crypto assets, whether chain coins or protocol tokens, and wrap them in an equity entity that trades on a public market. The largest of these is MicroStrategy, which has successfully used the capital markets to issue equity, borrow debt, and buy $70B of Bitcoin.

However, this playbook has extended beyond Bitcoin and into Ethereum, and longer tail assets like Solana, Hyperliquid, Bittensor, and others. For example, we have written about why this could be productive for Ethereum in particular below.

Recently, another large entity launched with $1.6B in commitments, called the Ether Machine. Of this funding, roughly $700MM comes from contributions in kind, another $800MM from net new funding, and $170MM from an already publicly traded SPAC vehicle $DYNX.

Under Generative Ventures, we have recently invested in a treasury company called xTAO. The public entity holds $5MM of equity and $22MM of financing, with the stated goal of buying and staking $TAO, the currency of the Bittensor network, which is one of the larger crypto AI ecosystems.

Certainly in many ways, this wave reminds us of the SPAC boom.

SPACs were shell companies designed to create a public listing financed by a PIPE (private investment into public equity), which could take private companies to market faster. As a result, we saw many Series B and C stage companies, with $50-250MM of revenue, attempt their path to market while avoiding the IPO route.

The result, combined with a catastrophic risk-off shift at the end of the Covid era, was downside volatility. Many of the SPACs contained companies that were not ready for the public markets. They were too small, and venture investors had priced them too aggressively. On the other hand, there were also many good companies that launched, which were simply mispriced for a while.

Dave — a US neobank — is one such example:

There was nothing wrong with the company, other than the market narrative. There is nothing wrong with SPACs, unless they are used poorly on the wrong targets. We saw this opportunity in our podcast with the Dave founder. A more brave investor would have made 50x on this trade.

Similarly, crypto treasury companies take onchain assets to the public equity markets.

Most hedge funds, RIAs, or other large traditional investors don’t have the mandate or skill-set to use crypto exchanges and custodians. If you run a family office, endowment, index fund, or some other Wall Street contraption, you are not going to jump into a Binance account or throw $10MM into a bridge into Hyperliquid. While for many retail investors, those things are not “hard”, priorities are simply different.

Equity wrappers make new types of assets accessible and satisfy the demand of the largest stock market. And while in Web3, we are all overwhelmed by the amount of tokens available, equity markets are still fairly under-penetrated by crypto exposure.

Further, there is the trade opportunity — as exhibited by MicroStrategy — of monetizing the momentum of a stock into issuance of additional instruments that grow the underlying portfolio. Metrics like ETH or BTC *per share* are being used by this crop of companies to highlight the efficiency of accumulating the underlying asset.

And this is an important point. Not all of these vehicles are crypto native and know how to use the protocols in decentralized finance — staking, yield generation, borrowing, liquidity provision — in order to enhance returns. But some are, and their ability to press the right buttons at the right time means that they will be more effective at the core mission.

Are crypto treasury companies effectively just exposure to the underlying crypto asset? Yes, obviously. If Bitcoin or Ether go down 50%, then the stocks whose value is loosely pegged to those assets will also go down. But until we have the full marriage and integration of public, private, and crypto markets on a single global connected chain, there will continue to be opportunities in capital structure. Arbitraging capital market structure is what the private equity industry has been doing since forever.

Let’s dive into the current state of this market.

Ethereum Treasuries

The destination website that collects all the Ethereum treasury companies is here. It also includes the underlying ETH holdings of the protocols that are running applications on top of the network. While not comprehensive, the database shows much of the relevant activity.

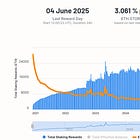

For example, we can see that there are $20B in ETH holdings through ETFs and $6.9B of ETH holdings in treasury companies and protocols.

If we break down the individual participants, here is the data.

The largest players are The Ether Machine ($DYNX with Andrew Keys), SharpLink Gaming ($SBET with Joe Lubin), and Bitmine ($BMNR with Tom Lee). They trade at slightly different premia to the underlying holdings depending on various factors, which include (1) timing of offerings and purchases of assets, (2) timing and considerations of transaction closing, as in the case of $DYNX, (3) and the market’s impression of accumulation efficiency.