Analysis: Understanding the $1B MoneyLion acquisition by Gen Digital

From SPAC Bust to Buyout

Gm Fintech Architects —

Today we are diving into the following topics:

Summary: The neobank landscape has evolved dramatically since the SPAC boom and subsequent crash, with many fintech companies like MoneyLion enduring public market turmoil but adapting successfully. MoneyLion, originally valued at $3B during its SPAC debut, is being acquired by Gen Digital for $1B, highlighting how strategic buyers are leveraging underpriced fintech assets. Gen Digital, known for cybersecurity products like Norton and Avast, aims to integrate MoneyLion into its "financial safety" offerings, though the strategic fit appears more opportunistic than intuitive. We discuss the economics and rationale of the acquisition.

Topics: MoneyLion, Gen Digital, Norton, Avast, SoFi, Wise, Dave, Nubank, Payoneer, Block, Chime, Acorns, Robinhood, Revolut, Coinbase, Credit Karma, Ant Financial.

To support this writing and access our full archive of newsletters, analyses, and guides to building in the Fintech & DeFi industries, see subscription options below.

AI newsletter

Want more Blueprint? Head over to our AI sister publication.

Our latest article is on Gemini 2.0, Google’s most advanced AI model yet, which marks the start of what Google is calling the "agentic era." Gemini 2.0 introduces multimodal outputs, tool integration, step-by-step reasoning and much more, bringing us closer to a true universal AI assistant.

Long Take

The big neobank rollup

A few years ago, all the Fintechs went SPAC into the Covid night.

Then those SPACs collapsed under the weight of public market FIG investors marking down venture capital hopium by 95%, while interest rates shot through the roof. But now in 2024, the narrative has flipped. Interest rates are good because they generate revenue for the neobanks with licenses! And despite user metrics dropping post-Covid as we collectively breathed in the fresh air, those metrics are ticking back up. Looks like *Digital* wasn’t just a fad.

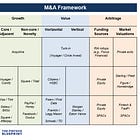

At the time of this collapse, we suggested a $50B roll-up strategy for under-priced SPAC fintechs that combines all of their users into one mushy finance super-app. The core is customer acquisition, and the satellites are the various products distilled down into their embedded finance APIs. Savings, trading, investments, insurance, whatever. Put it all into the Google advertisement machine.

Here is our key research into the idea:

Long Take: The $2.2 billion Acorns SPAC and a $50 billion fintech roll-up strategy for public funds

For just $50B in 2022, you could probably have put together some version of Robinhood, Coinbase, SoFi, Plaid, and the long tail of other smaller companies. The total number of users would rival JP Morgan, and the technology stack would be far more modern. But alas, Fintech Blueprint didn’t have the $50B lying around, and nobody would lend it to us.

Things have recovered and this opportunity has shrunk. Below is a chart of the Fintech Index from F-Prime. We are now roughly on part with the heady days of 2022, but quite far above the numbers of last year.

While NVIDIA and Bitcoin are obviously the better investment pick this year, the Fintech sector has done admirably well overall.

You can see this in the excerpt below, showing SoFi, Wise, Dave, and MoneyLion. One could add Payoneer, Nubank, and Block to this list of early 2020s graduates.

Not everyone round-tripped their full value. Most SPACs traded between $1-10B and then fell 50-80%. Dave and MoneyLion have recovered to about $1B in public market capitalization each, and have strong underlying economics. We talked to the CEO / founder of Dave here, and to the CMO on MoneyLion here. Going public had hit them hard, but they persevered and rebuilt the underlying businesses without getting distracted entirely by the market price.

So it was nice to see that the neobank rollup dream is still alive!

Gen Digital, an $18B public company behind cyber safety products Norton and Avast is purchasing MoneyLion for $1B in cash and additional incentives denominated in its stock. The original SPAC value of MoneyLion was $2.9B, which of course means investors lost money. But we think this is due to the quality of market pricing, rather than the quality of the asset.

Let’s pull the deal apart.

Neobank Economics and Strategy Shift

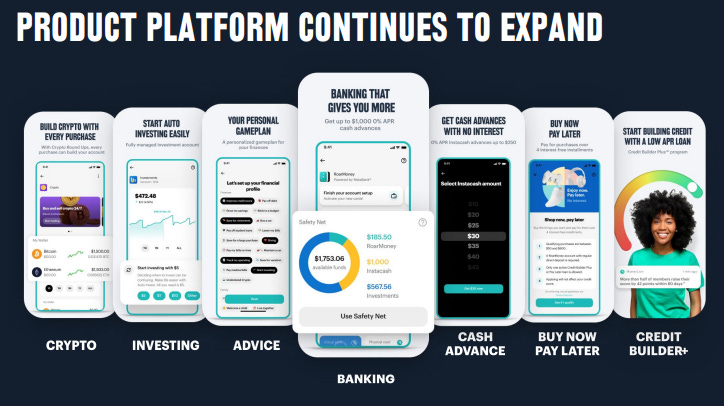

If you want to go back to the SPAC documents that valued MoneyLion at $3B, this is the key presentation.

It was positioned as a US neobank with options to build into trading and crypto. For 2021, this was the correct story given that Robinhood, Revolut, and Coinbase were the most fully realized commercial companies in the space. Chime, Acorns, and SoFi closely followed. The echo of Ant Financial in China, with its incredible traction as a financial super app, was still a credible destination.