Analysis: What Circle Payment Network can learn from Facebook, Plaid, & Wise

Circle wants to be SWIFT and Visa combined — but so did everyone else.

Gm Fintech Architects —

Today we are diving into the following topics:

Summary: We explore the tension between early-stage excitement and late-stage skepticism surrounding stablecoin infrastructure, using Circle’s launch of the Circle Payments Network (CPN) as a case study. While Circle positions itself as the orchestration layer connecting major fintech and crypto payment players, this "network of networks" narrative echoes past efforts by Plaid, Facebook Libra, Ripple, and Swift, all attempting to centralize fragmented financial flows. Circle’s ambition is to evolve from a stablecoin issuer into a SWIFT–Visa hybrid, but its $10B+ valuation depends on proving this broader infrastructure play beyond mere net interest margin. However, history shows the recurring challenge of sustainable aggregation in payments, as each wave of innovation fragments and re-bundles financial networks. Ultimately, despite Circle’s progress, the long-term future likely favors decentralized, internet-scale financial protocols over centralized gatekeepers.

Topics: Circle, USDC, Coinbase, Fireblocks, Flutterwave, Bridge, Stripe, Visa, Plaid, Facebook Libra, Diem, Ripple, XRP, Digital Asset, Canton Network, Odos, Ethereum, Uniswap, Coinbase, Securitize, Ethena, Ondo Finance, Payoneer, Transferwise, SWIFT

To support us and access the full archive of IPO primers, financial analyses, and guides to building in the Fintech & DeFi industries, see subscription options below. The current price is a $2/week if you subscribe annually.

Long Take

Double standards

It is hard to make sense of the excitement I sometimes feel about fintech trends happening in early stage as a venture capital investor, vs. the skepticism I feel when applying those very same trends to large companies, even to large companies that have only recently gotten out of their startup phase and moved into their operating phase.

Take, for example, the stablecoin sandwich companies, or as we tend to call them — the stablecoin orchestrators. They are using modern crypto rails for money movement, and as a result are attacking a large market in payments and remittance.

This is something we have written about in detail below.

It’s a great early-stage investment theme. The potential is that a business can turn into an issuer of $100B of assets and generate $10B in profit, like Tether. Or, that they can build a new network to take on Visa, or get acquired along the way. And to date, it is one of the main ways that Fintech has started to integrate crypto infra into its distribution footprint. Aside from selling you tokens.

But now take Circle.

The company has just published a white paper called the Circle Payments Network. It proposes a connectivity and messaging layer for stablecoin transaction orchestration between key Fintech and Crypto infrastructure companies, from Fireblocks to Flutterwave.

Circle puts itself into the middle of nearly every money movement activity you can think about, literally. It’s not an empty promise. The company is integrating both fintech-first and crypto-first enterprise users of USDC at substantial scale. Below is our visualization of the network based on the following announcement. At a glance, this is a trillion of volume or more.

We will dig into the details shortly.

However, remember the timing. Circle is about to IPO. Its financials point to a major distribution deal with Coinbase, which takes half of its interest income. Market share against Tether is flat or declining. The company makes $1.6B in revenue but keeps a $100-200MM of adjusted EBITDA, while targeting a $10B+ market cap. See below.

This is tough to do, especially if rates go down, unless you can paint a bigger picture beyond the tokenized net interest dollar play.

And that bigger picture has to be (1) that stablecoins are eating all of Fintech and TradFi, and (2) that Circle itself is the best bet and strategic to the United States, and (3) that they will not only have issuer revenues but also the revenues of the entire payment industry network.

In that story, you’re not buying Circle, a $45B pool of dollars with technology risk. You are buying the future version of SWIFT and Visa combined.

But you’ve heard this before from Plaid, Facebook, Ethereum, and many others. Should we believe it?

How it Works

Historically, Circle primarily mints the USDC stablecoin. Institutional players come to Circle’s window, give it dollars, and receive USDC. Similar processes happen with various exchanges that need to hold USDC for trading pairs. Circle then takes the dollars and puts them into a large BlackRock separately managed account that invests in short-duration fixed income.

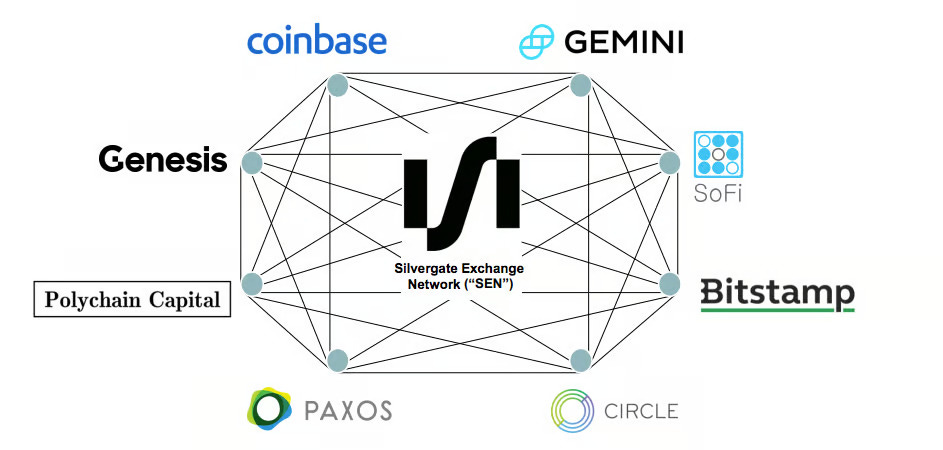

But there is much more complexity in building around stablecoins. Coinbase built out an entire payment processing suite years ago. Various packagers and re-packagers have cleverly integrated across card networks to support retail on-ramping and off-ramping, or created their own FX businesses or bank accounts in multiple jurisdictions. The crypto-banks, like Signature and Silvergate, had their own networks. For example, here’s the Silvergate Exchange Network, which connected liquidity between funds and market venues until it died — or was killed — post-FTX.

We are now in the world of implementing payments fintech in the last mile. That means integration and connectivity are even more thorough. People are building bridges between local banks, OTC desks, liquidity providers, market makers, crypto exchanges, and onchain venues across different chains and DeFi protocols. When we say liquidity is splintered, that literally means the money is disconnected and sitting in lots of shallow markets. When attaching those pools of money into payments flows, a best execution engine — or a messaging layer that can route between different locations — becomes imperative.

When we say people are building bridges, let us remind you literally of a company called Bridge that Stripe bought for $1B, and which has an eerily similar diagram.

Here’s the Circle version. For payments nerds, you’ve probably seen this before.

We quote the main workflow below and make the image enormous so you can read it.

A sender requests wants to make a payment and goes to the CPN, which sends out the request to the network of participating institutions, which then comes back with a potential transaction back to the sender for approval, meanwhile looping multiple times (steps 6-11) through the network for compliance and approval reasons. Eventually, money is able to move to the receiver.

If you think this is more complicated than a simple transaction onchain, you are right. There, you put in a wallet and click sign.

Why is it more complicated? Because financial institutions are custodians of client assets, and bear a regulatory burden that prevents them from being criminals and running away with the money, as well as making sure their own clients are not criminals. As a result, the network’s design is laced with institutional friction.

Having this friction slows down onchain activity, but radically speeds up the off-chain on- and off-ramping.

There was a period in 2019 when our industry was launching private permissioned chains for financial institutions — think Quorum, Ripple, Digital Asset, and R3. Now, companies like Circle are layering on permissioned participation credentialing to create networks that can use public chains. This is a move forward in terms of availing ourselves to modern financial infrastructure. It is a move backward in terms of creating walled gardens to allow financial institutions to participate. Circle becomes the gatekeeper of who is allowed to get processed smoothly.

If successful, Circle can undercut a meaningful portion of the stablecoin orchestration industry. Take the $1B in marketcap that Bridge earned for itself is still a meaningful valuation increase for a $5-10B company.

The network would make life easier for any merchant or business that wants to use stables, and harder for any start-up trying to beat Circle on size and reach.

The Nature of Networks

And yet, it just feels like we have heard it all before.

Here’s Fireblocks, a CPN partner talking about networks of networks.

Who is the network and who is the network of networks? It is confusing in that both Fireblocks and Circle will point to being the one that aggregates the other.

Where does the value accrue? And why are people using this terminology?

This word salad was coined by Visa in a famous strategy deck that circulated around the time when Plaid was being acquired by Visa. The key exhibits are below. The main thrust is that Visa was happy to be the integration point for lots of different commercial and payment networks — it was the meta aggregator of all money movement, including the emerging Fintech categories.

Notably, Plaid was using this payments story to raise its valuation from $5B to $15B in the Visa negotiation. Similarly, Circle needs to lift from $5B to the next frontier.

Let’s hammer the point home.

Here is what Swift, the messaging network of 10,000+ financial institutions, does in terms of money movement. Does the diagram look familiar?

Surely there are some networks here that go through a centralized infrastructure.

Maybe some of you remember Facebook Libra, and the network it was going to establish, powered by its own stablecoin.

The participating tech and financial firms were going to contribute assets that would then earn interest, and be used as financial collateral for a global currency integrated into and distributed by the Facebook Diem wallets. Congress killed it on sight and tortured Zuckerberg in public for trying — those were simpler times.

Or remember Ripplenet? The original idea behind the XRP coin?

Ripple’s primary revenue source became the issuance of their own mega coin, which they then were able to translate into money movement commercialization. But the initial idea is looking pretty familiar.

Digital Asset, which turned into Canton Network, is also touting a unification of market venues into a single pool of liquidity.

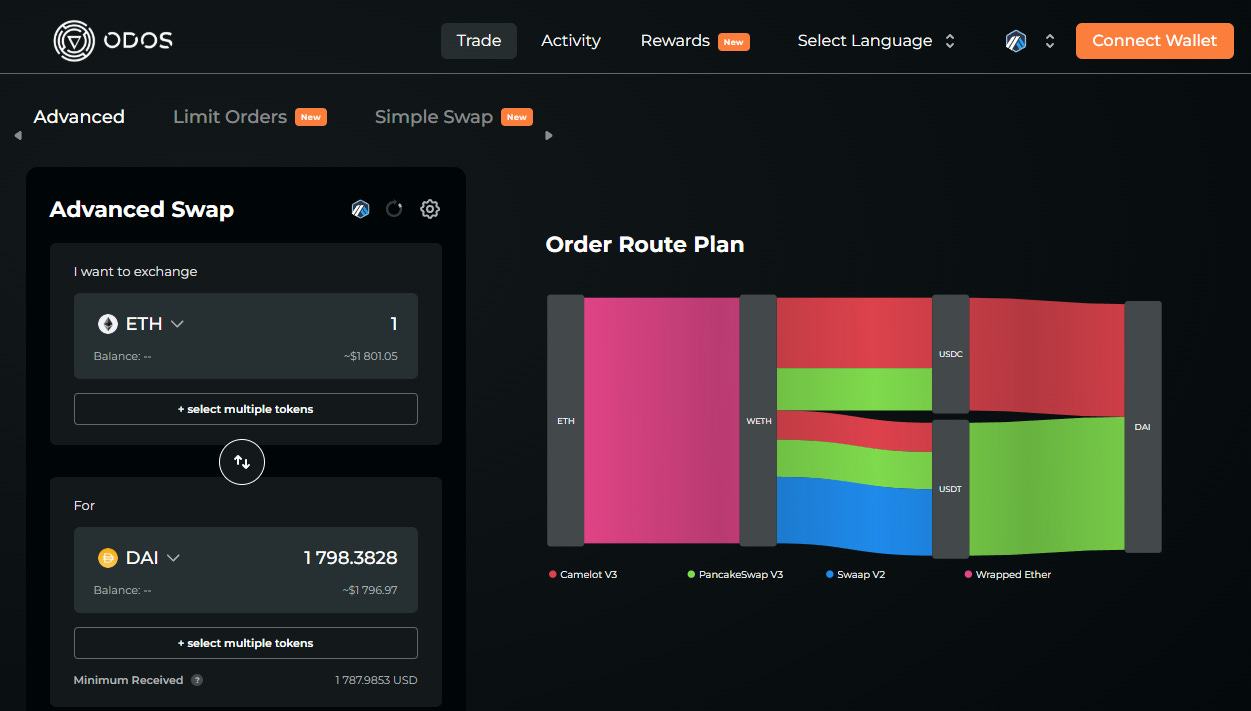

Other onchain aggregators have the same story. Take Odos, the best execution trading engine, for example.

And what is the very purpose of something like Ethereum?

Wasn’t the original Web3 network supposed to unify all financial flows in the way that the Internet unified all media flows? We were supposed to get away from fragmentation and unite all asset classes and industries on a single global commercial layer that supported anything and everything that economics needed.

Instead, now we have this.

And the Layer2 networks have their own Layer3 networks. These have sucked in applications like Uniswap and exchanges like Coinbase.

Securitize and Ethena are launching their own chain. Ondo Finance is launching its own chain. All the product companies also want to own their own liquidity and transaction engines.

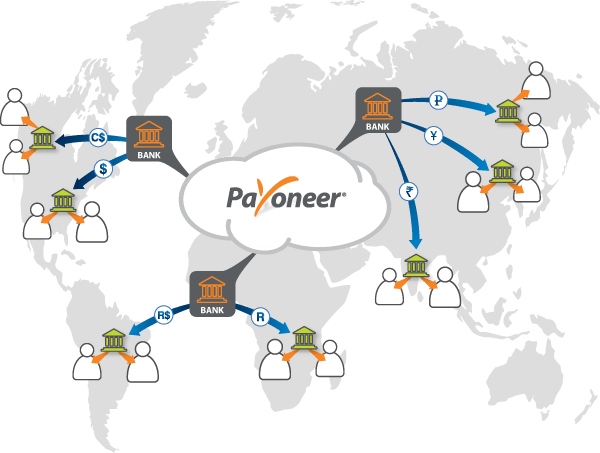

If we go back further in time, before all this crypto nonsense, we have companies like Payoneer, telling us how a private version of the correspondent banking system would be more affordable, and how a compliant messaging system helps deliver payment services. Look familiar again.

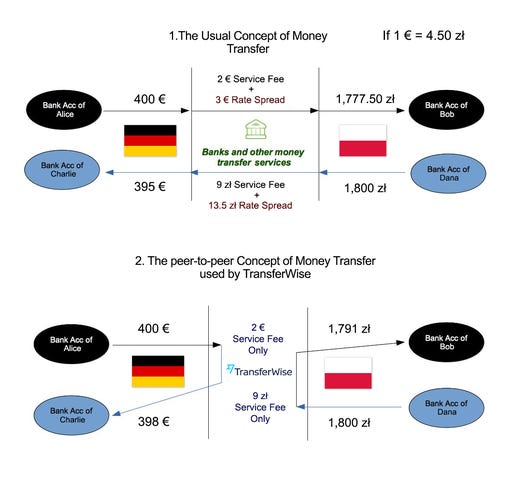

And the same thing for Transferwise.

At some point, we should stop and notice the pattern.

What Circle is doing is commercially viable and important. It joins a long queue of companies trying to aggregate the networks where commerce, and thereafter payments, happen.

No Stable Equilibrium Available

With every new wave of technological progress, there are new frontiers. Those frontiers begin to include economic activity, and require the tendrils of money to be extended into them to function.

This creates disaggregation and economic leakage out of prior systems. People do not want to use the old unstable currencies, and prefer M-PESA or USDT or whatever next-generation nuclear AI coin comes next. As the leakage becomes expensive, aggregators start to bundle things back together. And once the aggregators reach a medium size, older players try to reconnect the new stuff to the old machines.

Everyone claims to be on top of the other.

We think that a commercial, centralized model for such standards is a tough sell in the long run. Capital will shift towards the most efficient uses. Yes, Visa and Mastercard remain the exception. But end of the day, this is what crypto has been built to do — Internet-scale financial orchestration.

🚀 Postscript

Sponsor the Fintech Blueprint and reach over 200,000 professionals.

👉 Reach out here.Check out our AI newsletter, the Future Blueprint, 👉 here.

Read our Disclaimer here — this newsletter does not provide investment advice

Just a matter of time. Keep pushing forward 🙌