Blueprint: eToro valued at $3.5B, no $10B SPAC; Polygon & Immutable GameFi zkEVM network; $270MM for Southeast Asian BNPL Kredivo

There is still growth, young Padawan

Hi Fintech Futurists —

Hang in there, today’s agenda below.

INVESTING: eToro valued at $3.5 bln in funding round, months after ending SPAC deal

GAMEFI: Polygon, Immutable Partner for New zkEVM Ethereum Gaming Network

CREDIT: Southeast Asian credit fintech Kredivo scores $270M Series D

LONG TAKE: Can Klarna, the BNPL category creator, rise to its market challenge? (link here)

PODCAST CONVERSATION: Predicting the market using a machine learning competition built on a decentralized science platform, with CrunchDAO CEO Arnaud Castillo (link here)

To support this writing and access our full archive of newsletters, analyses, and guides to building in the Fintech & DeFi industries, subscribe below.

In Partnership

It’s no secret that synthetic identity fraud (SIF) is a major issue all businesses face right now - with various studies establishing annual losses anywhere from $6 billion for online lenders to $20 billion for financial institutions overall.

Join thought leaders from Branch, Guidehouse, and Persona on Thursday, March 30 to learn why synthetic fraud continues to be such a threat and how to minimize SIF risk both immediately and going forward.

Fintech Nexus USA will bring together the top minds in fintech to cover a range of topics, including digital banking, fraud, blockchain, embedded finance, fintech investing, and more. 5,000 attendees will engage in 20,000+ double opt-in meetings this May 10-11 in NYC. It’s the can’t-miss event of the year!

Short Takes

INVESTING: eToro valued at $3.5 bln in funding round, months after ending SPAC deal (link here)

Retail stock and crypto trading platform eToro secured $250MM in a new funding round, valuing the firm at $3.5B. The round came from ION Group, SoftBank Vision Fund 2, Spark Capital and other investors. The structure of the round is an Advanced Investment Agreement (AIA), whereby investors pay in advance for shares that are then allocated at a later date, often with a discount. Two years ago the agreement was made for these shares, assuming the following conditions: (1) the fintech had not pursued a SPAC transaction or (2) raised any capital.

eToro had initially gone down the SPAC route, looking to go public at a $10.4B valuation in March 2021 via a merger with Acquisition Corp V. It was a simpler time!

However, in January 2022 its valuation was cut by more than 15% to $8.8B. Ultimately, the SPAC was called off before the July 2022 deadline, due to regulatory challenges regarding SPACs involving in companies with significant crypto business. Despite the valuation haircut, operating metrics continue to be impressive. Funded accounts at the end of 2022 are up to 2.8MM out of a total of 31.4MM registered users, up from 1MM in 2020. The company is EBITDA profitable, generating over $400MM in the past five years.

eToro completes with other digital investing platforms, like Robinhood and has been fighting to increase market share. Over the past year, the company has expanded its offering to include US stocks and ETFs, expanded eToro Money to the entire EU, and acquired Gatsby, a commission-free stock trading for a younger demographic. The valuation haircut is in line with the rest of the industry, so we are not reading much into the new numbers other than reflecting normalized multiples — and perhaps that other brokers will be valued in these ranges going forward.

We have covered both the SPAC and the business model extensively before, check out below for more detail.

👑Related Coverage👑

Interested in Sponsorship?

To support the Fintech Blueprint and reach our 150,000+ Substack and LinkedIn audience of builders and investors, learn more below or contact us here.

GAMEFI: Polygon, Immutable Partner for New zkEVM Ethereum Gaming Network (link here)

Polygon and Immutable, two popular protocols in the Layer 2 (L2) space, are teaming up to create a new network specifically geared towards Web3 gaming. The network will be powered by Polygon’s upcoming zkEVM mainnet network, which is due to launch in beta today. Immutable’s ImmutableX scaling network will work alongside the new Immutable zkEVM network.

Are these two competitors, or are there natural synergies to bring into a partnership? Immutable has developed key infrastructure for Web3 gaming using zk-proofs, as well as a sizeable developer base interest in building Web3 gaming. On the other hand, Polygon’s new zkEVM chain enables cheaper and faster transactions, while still allowing support for dApps on Ethereum mainnet, given its compatibility with Ethereum smart contracts. A joint solution would combine the performance and cost of an L2, interoperability with contracts on Ethereum mainnet, and a robust Web3 gaming infrastructure and developer base.

Web3 needs a new killer use case given the disenchantment in the space. Gaming is one of the avenues to potentially reach the next billion users — though note that such gaming incorporates digital ownership and financial transactions. Whether the Immutable / Polygon infrastructure is sufficient to pull in a spike in developers and applications will be the next test. Certainly the venture capital fund subsidies from the protocols are likely to help.

👑Related Coverage👑

Food for Thought: Lessons for banking and finance from video game interface design

Long Take: Sizing up Roblox, Minecraft, and Fortnite as places for financial economies

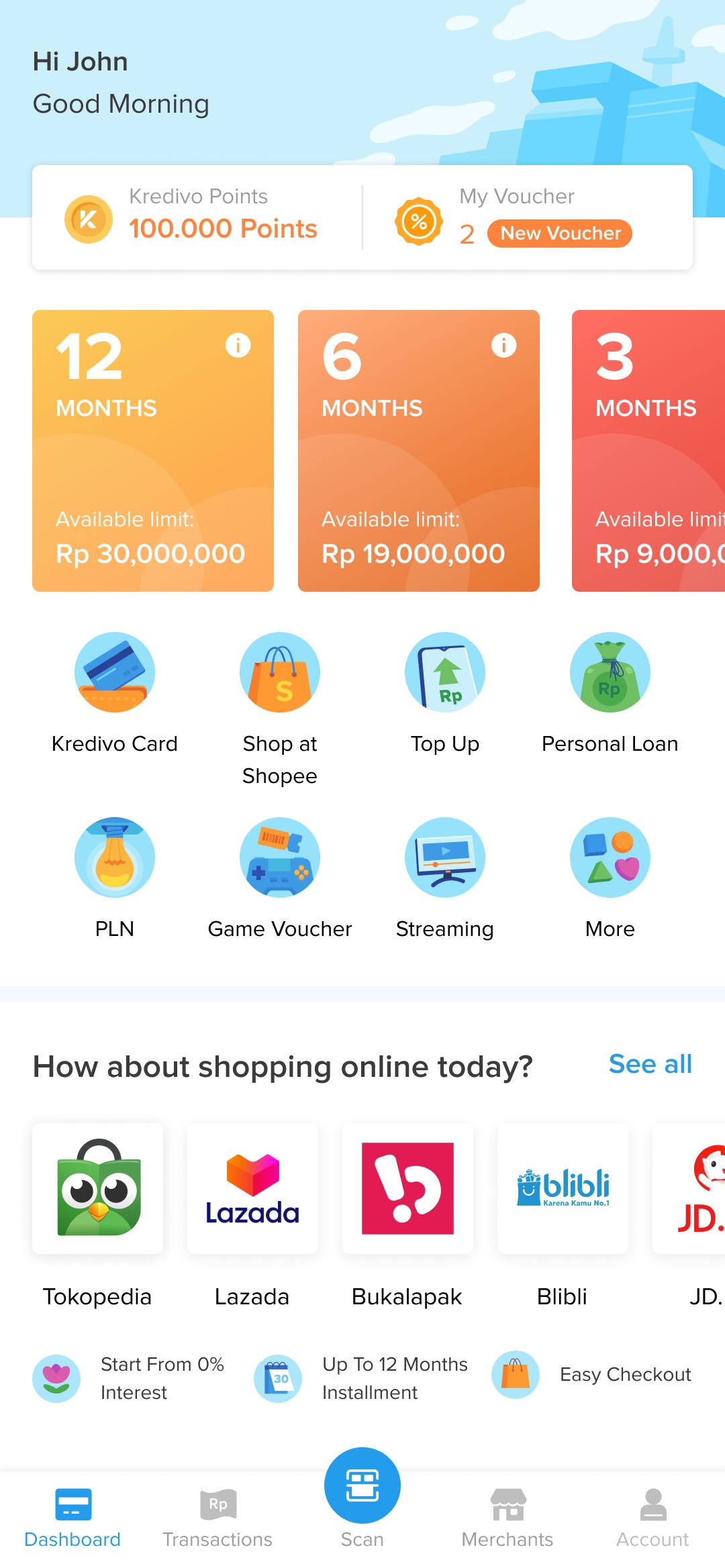

CREDIT: Southeast Asian credit fintech Kredivo scores $270M Series D (link here)

Kredivo Holdings raised $270MM in a Series D round, bringing total funds raised to $400MM in equity and $1B in committed debt facilities for its loan book. Kredivo provides a range of products, including BNPL, personal loans, credit, and banking services. As with eToro, Kredivo also almost went public via a SPAC worth $2.5B last year, but pulled out due to market conditions. The company’s CEO reported that the private valuation has gone up 4-5x in every round, so perhaps geography plays a role in pricing.

The company is one of the leading fintechs in Southeast Asia, and reportedly drives 3-4% of total GMV (gross merchandise value) for its top e-commerce merchants in Indonesia.

This is a sizeable amount for a single company, given that credit cards in general account for 15-20% of GMV, and the user base of the app is comparable to the total credit card population of Indonesia — currently around 8MM unique card holders. Kredivo has grown by focusing on underbanked consumers, using a range of data points from telcos, e-commerce accounts, and bank accounts to determine credit worthiness.

Kredivo is shaping up to be a leading fintech force in Southeast Asia, driven by the novel mechanisms for assessing credit worthiness. A significant portion of the world remains underbanked, and there are both economic and ethical benefits to get people access to a financial system. Account ownership has risen to over 60% in the developing world by 2021, and we see the combination of fintechs and Web3 addresses being able to meaningfully close the gap. If you don’t have mega banks or government solutions, technology flows in like water and solves the problem.

Deep Dive: Can Klarna, the BNPL category creator, rise to its market challenge? (link here)

The Buy Now, Pay Later (BNPL) business model has fundamentally changed the e-commerce shopping experience across the world.

Led by the Swedish company Klarna, the BNPL model has been rapidly growing in popularity, particularly among millennials and Gen Z, who are looking for more flexible payment options. Klarna has expanded its services globally and now operates in over 20 countries, with partnerships with major retailers such as H&M, ASOS, and Adidas. Does that mean that Klarna and its BNPL business model is here to stay? We explore its most recent financials, competition, and emerging threats and opportunities.

Podcast Conversation: Predicting the market using a machine learning competition built on a decentralized science platform, with CrunchDAO CEO Arnaud Castillo (link here)

In this conversation, we chat with Arnaud Castillo, founder and CEO of CrunchDAO. CrunchDAO is a research team of data scientists and quants that leverage the power of collective intelligence and Web3 to produce and sell next-generation predictive financial insights.

During the discussion, Lex and Arnaud touch on decentralized asset management, data science, portfolio-builder, and web3 organization. In this conversation, Arnaud shares his background in finance, including his experience working at Lehman Brothers and Deutsche Bank, and his work in consulting and entrepreneurship.

Rest of the Best

Here are the rest of the updates hitting radar.

PAYTECH - Fintech Startup Rain Raises $116 Million To Speed Up Hourly Workers’ Pay Cycles

EMBEDDED FINANCE - Credable, a digital banking infra startup that wants to build Unit for emerging markets, gets funding

BAAS - Monite raises another $5 million bringing in a total of $10 million in seed funding

NEOBANK - A $500 million term sheet in 12 hours: How Rippling struck a deal as SVB was melting down

INVESTING - Archax Launches Primary Raise Platform

Shape your Future

Wondering what’s shaping the future of Fintech and DeFi? At the Fintech Blueprint, we go down the rabbit hole in the DeFi and Fintech industries to help you make better investment decisions, innovate, and compete in the industry.

Read our Disclaimer here — this newsletter does not provide investment advice and represents solely the views and opinions of FINTECH BLUEPRINT LTD.

Want to discuss? Stop by our Discord and reach out here with questions.

Later this week, we will share our Short Takes on the latest Web3 and Digital Investing news, reviewing several companies. If you’d like us to look at any specific item, feel free to share your thoughts in the comments below. We will provide our best analysis in response to your requests.