Blueprint: Railsbank in a fire sale; Scroll zkEVM live on testnet; Paytech Pagos gets $34MM

Plus Revolut is profitable now

Hi Fintech Futurists —

You are the best, today’s agenda below.

EMBEDDED FINANCE: Former UK Fintech Darling Railsbank Close to Sale as Problems Pile Up (link here)

L2: Scroll’s zk-EVM Layer 2 goes live on Ethereum’s Goerli testnet (link here)

PAYTECH: Pagos raises $34M as the demand for ‘payment intelligence’ rises (link here)

LONG TAKE: Building Company Playbook #4: Building Fintech & DeFi software products (link here)

PODCAST CONVERSATION: Modern spend management systems for CFOs and employees, with Payhawk CEO Hristo Borisov (link here)

In Partnership

Fintech Meetup: Don’t Miss 3,000+ attendees from 1,000+ organizations for 30,000+ double opt-in meetings. With 40% CEOs, this is the fintech event you need to be at. In-person at the Aria, Las Vegas March 19-22.

Upcoming VIP Video Conference: Women in FinTech 2023. FT Partners’ third annual Women in FinTech VIP video conference will take place on March 8, 2023 – International Women's Day. This live panel will feature Jackie Reses, CEO & Chair of Lead Bank (Moderator); Céline Dufétel, President & COO of Checkout.com; Shivani Siroya, Founder & CEO of Tala; Jamie Ikerd, COO of Built Technologies; and Cristina Vila Vives, Founder & CEO of Cledara.

Short Takes

EMBEDDED FINANCE: Former UK Fintech Darling Railsbank Close to Sale as Problems Pile Up (link here)

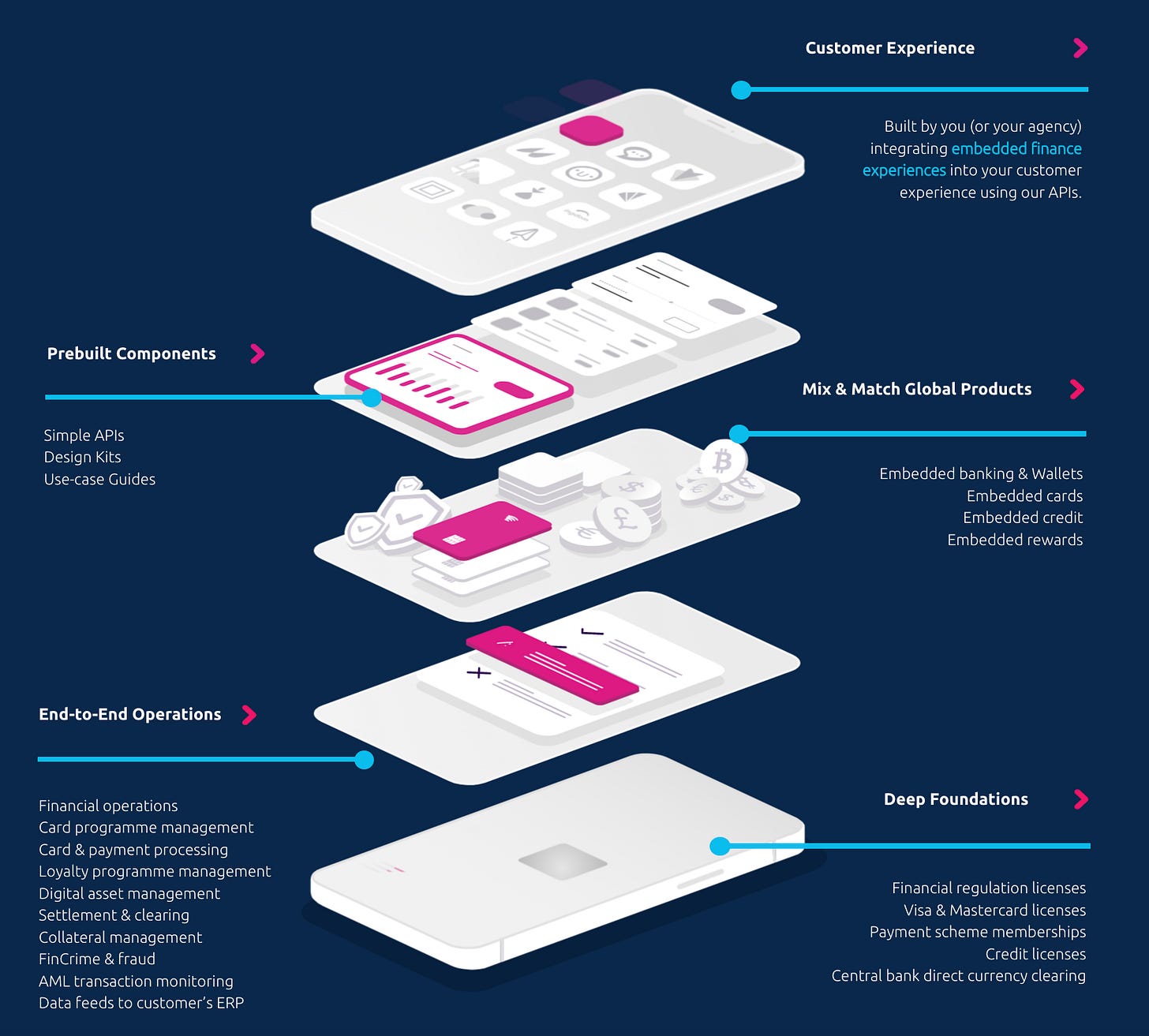

Railsr, formerly Railsbank, was once an example of UK fintech leadership — a “rails” bank if you will. The company offers embedded finance solutions, letting companies integrate various financial operations and consumer experience add-ons, like loyalty programs and rewards into their business.

The fintech is approaching a sale through a pre-pack administration, which is a type of bankruptcy where a buyer has already been lined up. Restructuring firm Alvarez and Marsal will be working with Railsbank on the process.

In 2021, Railsr had raised over $100MM from investors, nearly getting unicorn status. A further $46MM was raised in October 2022, including a $20MM debt facility.

However, after an extensive audit by the Financial Conduct Authority over the past several months, there are concerns that Railsr has been violating AML and terrorist-financing laws to support its business, with the Bank of Lithuania preventing its local unit from taking on new customers last month. As a reminder, Lithuania has begun to be more strict in its permitted banking activities.

Railsr had been unsuccessfully exploring a sale to Nigerian paytech Flutterwave. With that falling through, it is looking for a buyer for a pre-pack administration sale. Selling using this process can help preserve the value of assets and save jobs, instead of the traditional administration where a company identifies a buyer post its collapse. The company has around GBP 25MM-50MM in revenues, and 300 employees, which would suggest GBP 50-100MM of expense. That’s both an economic whole and a reputational risk in a down market.

👑Related Coverage👑

Interested in Sponsorship?

To support the Fintech Blueprint and reach our 150,000+ Substack and LinkedIn audience of builders and investors, learn more below or contact us here.

L2: Scroll’s zk-EVM Layer 2 goes live on Ethereum’s Goerli testnet (link here)

The L2 wars rage on as Scroll’s zkEVM launches on the Goerli testnet, moving into its alpha testing phase in preparation for Mainnet later this year. Scroll is competing against optimistic rollups, like Optimism and Arbitrum, and zero-knowledge (zk) roll-ups, Starkware, zkSync, Polygon zkEVM and ConsenSys’ zkEVM. All these launches make the L2 space a hotpot for very technical competition.

Scroll differentiates in its approach to setting up its zkEVM. A zk-EVM protocol can be built in a way that utilizes the same code as Ethereum applications, making it easier to port applications, but significantly harder to code, since EVMs use a different programming language (Solidity) and logic to zero-knowledge proofs.

Alternately, you can use a programming language designed for zk proofs, and then translate it to Solidity. This has the drawback of making it harder to port applications (dApps) from Ethereum to the platform. Scroll opted for the former, hoping that the ease of dApp portability, and building for developers on Scroll, will pay dividends in the long-run. For context, Polygon is working on the same type of zkEVM, zkSync is in between the two, and Starkware is working on the alternate approach.

There’s still plenty of work to do — these L2 networks are not all yet fully launched or decentralised. Scalability is a multi-year effort to accomplish, and while there are current competitors already in play, there is not yet a clear winner. We expect an interconnected, multi-chain world where L2s specialize against their particular niche (e.g for gaming) and attract applications of that kind, while settling on Ethereum or another dominant L1. We have not yet seen an L2 token design that we love, so this is another avenue for capturing market share in the future.

👑Related Coverage👑

PAYTECH: Pagos raises $34M as the demand for ‘payment intelligence’ rises (link here)

Payment intelligence infrastructure startup Pagos has raised $34MM in Series A funding, led by Arbor Ventures. Pagos assists with payments processes for companies, streamlining payment data, such as commerce and fraud data, and displaying it in a single UI. This allows firms to get an organized view of their financial flows, helping them to understand business dynamics across churn, risks, and costs.

The fintech integrates with payment processors, such as PayPal, Stripe, WorldPay and Adyen, and then outputs APIs to give businesses a a view of all payments data and metadata. The offering also includes custom recommendations about organizing the payment flow to improve performance. Pagos typically serves online native payment heavy companies — like payment service providers and marketplaces. The company’s clients including enterprises like Adobe and Warner Bros.

Global digital payments is arguably the largest category of fintech — revenues are expected to reach $14.7T by 2027. Payment infrastructure vendors are also still receiving reasonable funding — e.g., Streamline recently raised $4MM for its B2B payment product suite, and Kushki raised $100MM at a $1.5B valuation last year.

Despite being one of the fintech sectors with the most attention, F-Prime estimates that payments startups have still captured less than 7% of their relevant economic opportunity. And as commerce continues to become more digital, so will the adjacent payments space.

Long Take: Building Company Playbook #4: Building Fintech & DeFi software products (link here)

In this premium edition, we focus on the process of creating new products, and how to approach software development.

In the Building Company Playbook #4: Building Fintech & DeFi software products we discuss:

First, we define what products are, how to think about them from a financial services perspective and a fintech perspective, and how to create MVPs based on user research.

Next, we look at the most popular product development methodologies of Agile and Waterfall, and match them to appropriate use cases.

We also explore the development of Web3 protocols and artificial intelligence, and how those differ relative to building conventional software.

Last, we discuss the trade-offs between internal and external development teams, and how to navigate this successfully.

Podcast Conversation: Modern spend management systems for CFOs and employees, with Payhawk CEO Hristo Borisov (link here)

In this conversation, we chat with Hristo Borisov, CEO and co-founder of Payhawk. Founded in 2018, Payhawk is a leader in B2B payments and expense management.

The company's mission is to become the world's biggest bank without holding a single dollar. Businesses from 27 countries actively use Payhawk credit cards and payment products to save time and money managing their company expenses.

Rest of the Best

Here are the rest of the updates hitting radar.

PAYTECH - Varo, Stripe said to be raising new funds at much lower valuations

PAYTECH - Cashfree Payments acquires one-click checkout company, Zecpe

INVESTING - Sequoia and Andreessen Horowitz invested more in fintech than any other sector in 2022

INVESTING - Wealthfront to Offer Trading of Individual Stocks, Fractional Shares

ROBOADVISOR - BlackRock Sells Robo-Advisor To Ritholtz Wealth Management: Report

WEALTHTECH - ORCA, India's First One-Stop Platform for Learning, Analyzing, and Investing in Capital Markets, Launched

CRYPTO - UK banks HSBC, Nationwide to ban crypto purchases with credit cards: Report

Shape your Future

Wondering what’s shaping the future of Fintech and DeFi? At the Fintech Blueprint, we go down the rabbit hole in the DeFi and Fintech industries to help you make better investment decisions, innovate, and compete in the industry.

Read our Disclaimer here — this newsletter does not provide investment advice and represents solely the views and opinions of FINTECH BLUEPRINT LTD.

Want to discuss? Stop by our Discord and reach out here with questions.

Later this week, we will share our Short Takes on the latest Web3 and Digital Investing news, reviewing several companies. If you’d like us to look at any specific item, feel free to share your thoughts in the comments below. We will provide our best analysis in response to your requests.