Blueprint: Tazapay payments in 170 markets; GHO stablecoin on testnet as BUSD halts; Lithuania tightens fintech supervision

Also playbooks on how to build companies in written and podcast form

Hi Fintech Futurists —

You are the best, today’s agenda below.

STABLECOINS: Ready to GHO? Aave Launches Native Stablecoin on Ethereum Testnet (link here)

PAYTECH: Sequoia Capital Southeast Asia backs cross-border payments startup Tazapay (link here)

FINTECH: EU’s Fintech Hub Tightens Supervision After Massive Expansion (link here)

LONG TAKE: Building Company Playbook #3: Creating a B2B fintech go-to-market strategy (link here)

PODCAST CONVERSATION: Creating a B2C fintech marketing strategy (link here)

Here’s that handy upgrade button to access the Long Takes — a rigorous view on the future of our industry. Level up your Fintech and DeFi knowledge. 👇👇👇

In Partnership

Fintech Meetup: Deadline to Get Tickets is Feb 24th! Don’t Miss 3,000+ attendees from 1,000+ organizations for 30,000+ double opt-in meetings. With 40% CEOs, this is the fintech event you need to be at. In-person at the Aria, Las Vegas March 19-22.

Short Takes

STABLECOINS: Ready to GHO? Aave Launches Native Stablecoin on Ethereum Testnet (link here)

DeFi lending platform Aave has launched stablecoin GHO on the Ethereum testnet, bringing it one step closer to going live. A reminder — stablecoins are tokens pegged to a value of a particular currency or asset, providing users with the ability to use a non-volatile asset for interacting with DeFi and Web3 generally. See more here.

Stablecoins come in various designs. Assets like USDC are fiat-backed, whereas others like DAI and GHO are collateralized by native crypto assets, like protocol tokens. GHO will be pegged 1:1 with USD, and can be minted by users using a basket of tokens as collateral, as long as that collateral is more valuable than the minted GHO. The process is similar to general borrowing on Aave — a user deposits collateral, the protocol mints GHO, and provides it to the borrower. The collateral is then locked and accrues interest, until the position is repaid. Once repaid the GHO is burnt and the collateral returned.

Creating a stablecoin was a natural step for Aave. First, lending fees are captured by the DAO treasury. Second, the AAVE token has more utility because of (1) voting on which assets can be utilised as collateral, and (2) powering a staking mechanism that allows stkAAVE token (staked Aave) holders to borrow at a discounted rate. This staking mechanism also comes with its own risk, acting as an insurance pool for loan insolvencies in the case of market shocks. A portion will be used to protect the protocol, with staked users being slashed as a result. Risk is risky!

We like GHO — stablecoins provide real benefits, especially as regulators pursue companies like Paxos, who are powering the Binance BUSD stablecoin, potentially qualifying as an unregistered security. There will be fewer cash equivalents as a result of SEC actions, which constricts consumer choice — keeping them “safe”, which may be alright in the context of Terra/Luna. Still, we think onchain DeFi mechanisms are more anti-fragile than custodial approach.es

We also note that Aave and Maker are now head-on competing for the plethora of Web3 native financial and leverage services. Meanwhile, Compound has been moving closer to real world assets, and treasuries are starting to pop up onchain too. These are divergent paths.

👑Related Coverage👑

Interested in Sponsorship?

To support the Fintech Blueprint and reach our 150,000+ Substack and LinkedIn audience of builders and investors, learn more below or contact us here.

PAYTECH: Sequoia Capital Southeast Asia backs cross-border payments startup Tazapay (link here)

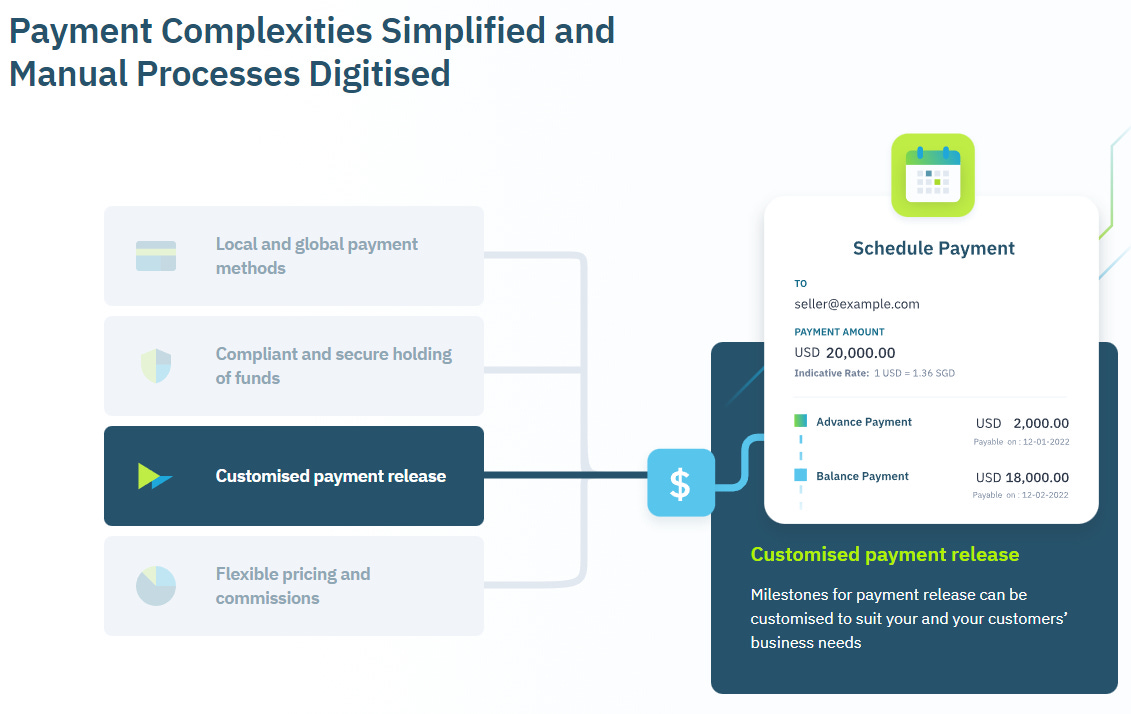

Tazapay is one of the latest fintechs in South-East Asia to raise capital, closing a $17MM Series A round, led by Sequoia. Tazapay combines card and real-time payments into a single solution for merchants who sell overseas. Building networks — especially ones that integrate into large commercial footprints — continues to be one of the holy grails of payments companies.

The product has coverage across 170 markets for card payments and 85 markets for local payments collection. Merchants can avoid setting up local entities to accept payments from those countries, while operating globally. Both B2B and B2B2C businesses can use Tazapay for their services.

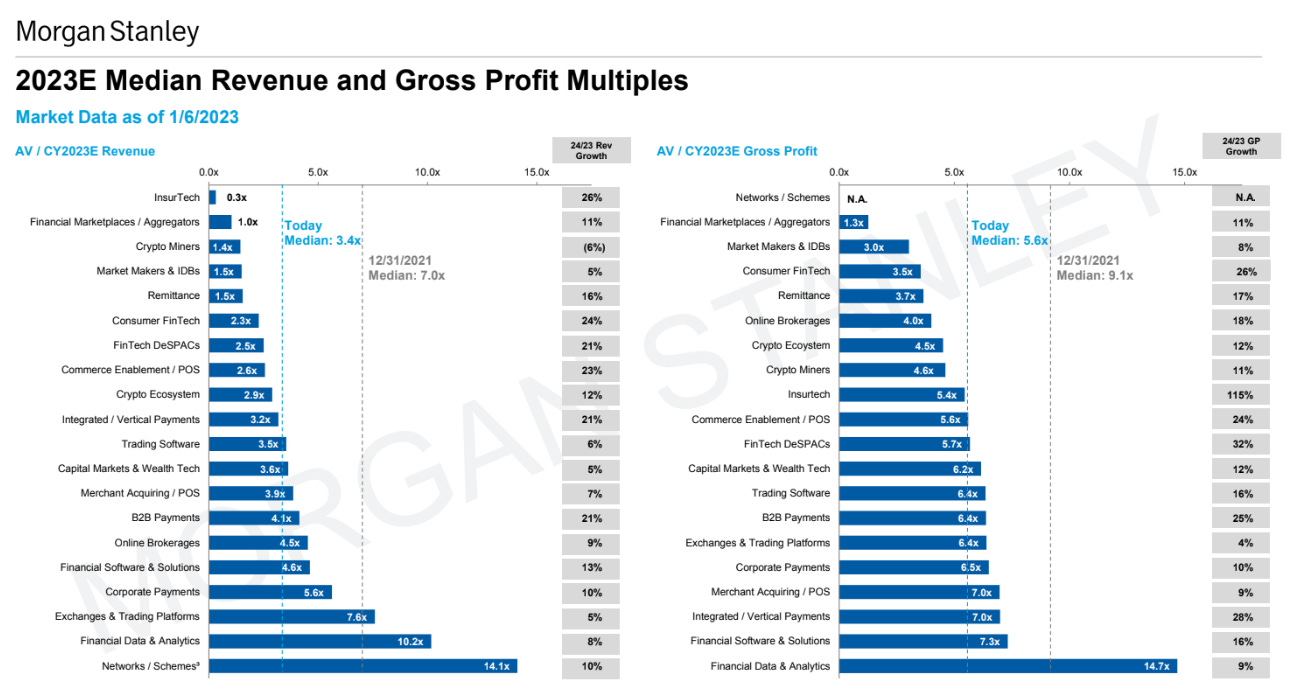

Local real-time payments help businesses expand and capture value of the global markets without the need for, sometimes impossible, setting up shop abroad. We are reminded of other companies like Checkout.com and Rapyd. Last December, Checkout wrote down its own valuation from $40B to $11B, reflecting the lower revenue multiples in the market. Rapyd was worth about $15B a year ago. We expect Tazapay to outcompete Western companies in its own geography, which is a large market to conquer.

👑Related Coverage👑

FINTECH: EU’s Fintech Hub Tightens Supervision After Massive Expansion (link here)

Brexit has hurt London as the heart of European fintech and finance, and that’s in addition to tanking the UK economy.

Other members of the European Union competed to snap up the role as the fintech hub, including Amsterdam, Frankfurt, Paris, and Lithuania. Lithuania in particular pushed hard to provide simplified English-language licensing for fintechs in the EU, issuing 138 payment and electronic money institution licenses in the past 6 years, more than any of the 27 other members. It’s the Delaware of Europe.

But, perhaps Lithuania has been too loose in the licensing, generating an outsized risk for the country. E.g., in 2021, Finolita Unio was used to funnel over $107MM out of Wirecard AG before the paytech collapsed. In response, the Bank of Lithuania revoked the license less than a month after the news became public. Now, it is revoking more licenses, imposing fines, and suspending operations for other fintechs.

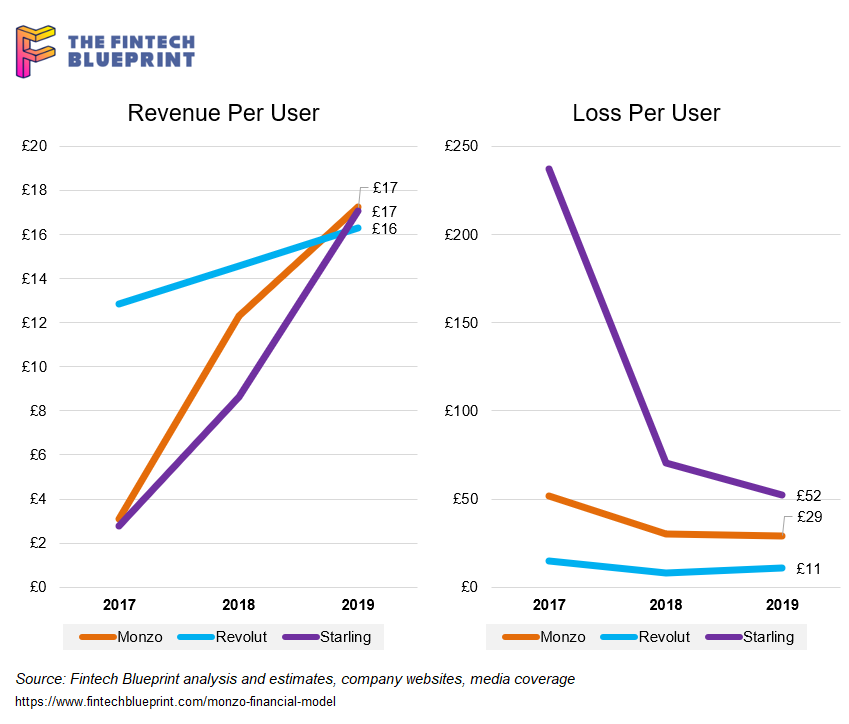

Lithuania has a population of 2.8MM — about a quarter of London alone — and yet has managed to be ranked 4th in the Global fintech ranking. It is a case study of commitment to powering innovation, giving companies like Revolut their start for taking deposits, instead of paying fees to create pre-paid cards. On the other hand, ineffective guidelines and regulation can lead to grift and fraud. We have seen this in the early waves of Chinese digital lending companies, as well as the early ICOs in 2018. The US is also struggling with the fallout of neobanks and banking-as-a-service providers going through the latest market cycle. This is a repeating dialectic.

👑Related coverage👑

Long Take: Building Company Playbook #3: Creating a B2B fintech go-to-market strategy (link here)

Today we continue our Build It Series to discuss B2B company creation.

In particular, we are interested in the differences in go-to-market strategy, the roles of sales and marketing teams, and ways to organize yourself around the sales and customer success process. We also discuss the difference between selling Cost vs. selling Revenue, frameworks for short and long sales cycles, and the importance of persuasion. We review several different companies, from IBM to SigFig, as examples of deploying these strategies.

Podcast Conversation: Creating a B2C fintech marketing strategy (link here)

In this conversation, our Editor-in-chief Lex Sokolin continues his Build It Series, focusing on the differences between B2C and B2B strategies, and on the implementations of some foundational marketing principles.

He discusses branding and the two ways of doing it right. Then he dives into the various programs that can be implemented to generate demand, from content, to social media, to paid acquisition. Finally, he touches on the importance of CAC and LTV, in particular during a year like 2023.

Rest of the Best

Here are the rest of the updates hitting radar.

DIGITAL ASSETS - Coincover raises $30 million

INVESTING - Asset-Map raises $6 million in Series B funding

INVESTING - Conquest Planning Secures $17.8M in Series A Funding

INVESTING - Goldman Sachs AM Closes $2.5bn Growth Equity Fund

INSURTECH - Brookfield Reinsurance to acquire Argo in $1.1 billion transaction

Shape your Future

Wondering what’s shaping the future of Fintech and DeFi? At the Fintech Blueprint, we go down the rabbit hole in the DeFi and Fintech industries to help you make better investment decisions, innovate, and compete in the industry.

Read our Disclaimer here — this newsletter does not provide investment advice and represents solely the views and opinions of FINTECH BLUEPRINT LTD.

Want to discuss? Stop by our Discord and reach out here with questions.

Later this week, we will share our Short Takes on the latest Web3 and Digital Investing news, reviewing several companies. If you’d like us to look at any specific item, feel free to share your thoughts in the comments below. We will provide our best analysis in response to your requests.