Blueprint: Telegram wallet and exchange; X1 smart card raises $15MM & adds stock trading; Teampay gets $47MM for corporate spend

Cashflow and commerce are king

Hi Fintech Futurists —

You are the best, today’s agenda below.

DEFI: Telegram To Build Crypto Wallet, Decentralized Exchange Following FTX Collapse (link here)

DIGITAL LENDING: X1 gets 50% valuation boost, aims to give consumers a way to buy stocks via credit card reward points (link here)

PAYTECH: Spend management platform Teampay expands partnership with Mastercard, raises $47M (link here)

LONG TAKE: Generative AI creates the surreal search engine of our dreams (link here)

PODCAST CONVERSATION: How to blow up a $32B crypto exchange, with Binance Labs MD of Token Engineering, David Shuttleworth (link here)

Here’s that handy upgrade button to access the Long Takes — a rigorous view on the future of our industry. Level up your Fintech and DeFi knowledge. 👇👇👇

In Partnership

New customers are key to driving business growth. But the easier it is for users to become customers, the more fraud you may face.

Register for this online event on 12/13 to learn how Persona, an identity solution offering configurable infrastructure for KYC, AML, KYB, and more, helps top Fintech companies like Square and Brex assess risk for different customers and configure their identity verification methods to match.

Fintech Meetup: The Next Big Q1 Fintech Event! We’ve built a whole new tech enabled event experience, and we think you’re gonna love it. Meet with anyone for any reason using our incredible tech-powered meetings program that connects 3,000+ attendees to 30,000+ double opt-in meetings. Plus 200+ sponsors, 250+ speakers, exhibit hall, and more. At the Aria, Las Vegas March 19-22.

Short Takes

DEFI: Telegram To Build Crypto Wallet, Decentralized Exchange Following FTX Collapse (link here)

Instant-messaging platform Telegram announced it is building a decentralised exchange (DEX), non-custodial wallet, and other decentralised tooling. Telegram isn’t new to the crypto space — their first attempt was to with The Open Network (TON) blockchain, which was abandoned in May 2020 after being classified as a security by an SEC lawsuit following a $1.7B token sale. It has since been picked up by other developers and rebranded as Toncoin. The second was with Fragment, an auction platform was used to sell $50MM worth of Telegram usernames.

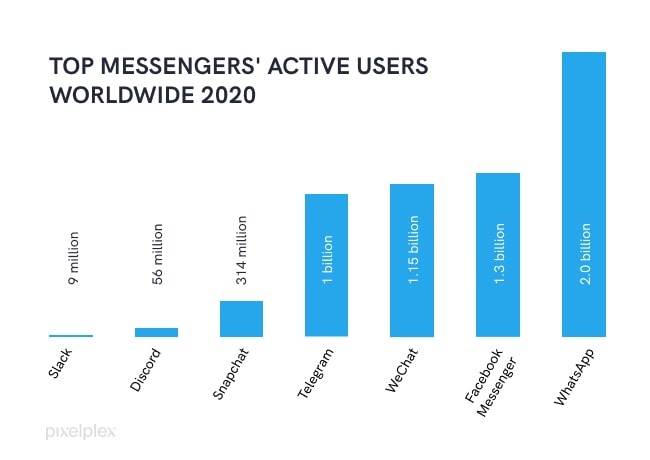

Supposedly motivated by the recent collapse of FTX, Telegram founder Pavel Durov wants to remove reliance on third parties in crypto and stresses the need for decentralization. If Telegram has a native wallet and exchange, users will have custody over their own digital assets and can move them around. Given the app has 700 million active users and that it is already central as a communication layer within the crypto ecosystem, anything it rolls out is likely to have high mind-share.

There are many companies using the collapse of FTX to market their industry position — that would be the cynical view. We don’t know whether Telegram’s tools, or the TON blockchain, will provide any tangible benefits over other solutions already on the market. That said, we recognize that social media moguls keep coming back to the idea of a super-app, like Alipay, which combines a large attention footprint with financial capability. Telegram, but with a wallet, certainly would do that. That also seems to be Elon’s plan in regards to Twitter.

👑 See related coverage 👑

DIGITAL LENDING: X1 gets 50% valuation boost, aims to give consumers a way to buy stocks via credit card reward points (link here)

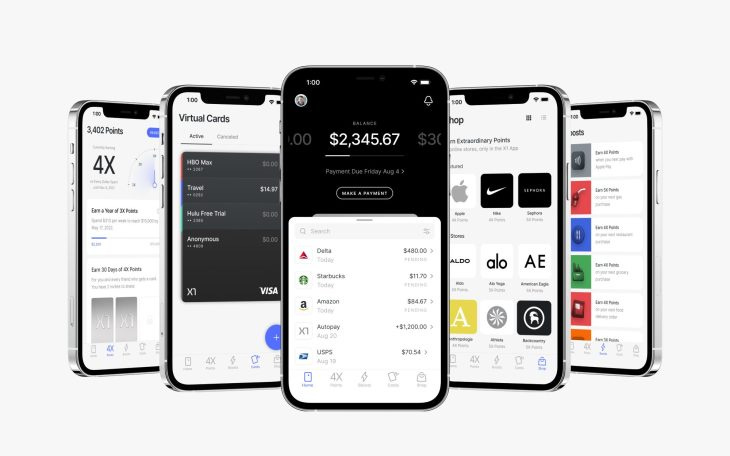

X1, a smart credit card startup, raised $15MM at a 50% valuation boost to its previous Series B in July, when the company raised $25MM. The offering is an income-based credit card, which allows people with low credit scores to benefit from rewards based on their salary. This method of underwriting customers is still fairly unusual in the space, with Tomo Credit adopting a similar model where credit is offered based on cashflows rather than credit scores.

X1 is claims to be profitable, with $3MM in monthly revenue ($36MM ARR) in 13 months after going live in private beta and launching their card in mid-September. With over 600,000 people on the waitlist, X1 has been able to ramp up quickly with gross merchandise value (GMV), i.e spend, climbing about 10% a month to reach $60MM in November. There are no annual fees, no late or foreign transaction fees, users can track subscriptions, and create auto-expiring virtual cards for free trials.

X1 makes money through interchange fees on purchases, and by incentivising users to shop in the in-app shopping portal with featured affiliate partners. It is a bit surprising though to see them making 5% of GMV in revenue.

Beyond fundraising, X1 also announced an investing offering for cardholders to buy stocks directly with their reward points. This puts X1 into psychological competion with Robinhood, M1, and Public — as a platform leading to a broader financial experience. So far $10MM in reward points have been given out by X1.

We like the combination of commerce and finance here. It’s novel and pushes profitability closer to real-life spending, where consumers are happy to pay for things and willing to share value with financial providers. But we are also wary of attempts at blitzscale yet another payments experience, especially one which relies on credit. And selling stocks seems quite tangential to growing commercial adoption.

Interested in Sponsorship?

To learn more about how to support the Fintech Blueprint and reach our 150,000+ Substack and LinkedIn audience of builders and investors, learn more below or contact us here.

PAYTECH: Spend management platform Teampay expands partnership with Mastercard, raises $47M (link here)

Corporate spend platform Teampay raised $47MM in Series B funding, with $35MM in equity and $12MM in debt, bringing total funds raised to $65MM. The funds are expected to be used to further develop Teampay and Mastercard’s partnership — having launched “Catalyst” last year, a corporate card with spend management features.

Using Teampay helps companies implement workflows for their employees’ spending. Policies can be implemented that automatically approve or deny expenses and the solution integrate with chat tools, provides real-time reporting, automated invoice processing, and virtual cards specific to a vendor or amount of funds. These features, coupled with Teampay’s low-code platform, make it easy for organisations to manage finances and better align on decision making.

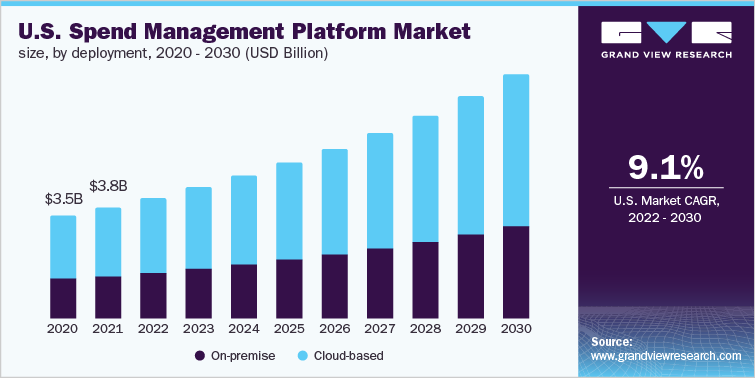

This story highlights how saturated the corporate spend space is, but investments keep rolling in. We’ve seen Moss raise $86MM in January, Spendesk raise $11MM in July 2021, and Ramp raise $550MM in debt and $200MM in equity at an $8.1B valuation. In 2021 over $2.8B has reportedly been invested in corporate spend management companies, and in the first half of this year $1.6B was invested.

Given that the total addressable market is estimated at $16B of revenue in 2021, there is still plenty of room for competition. Teampay plans to expand into accounts payable solutions and cross-border payment functionality. Deeper integrations around money movement, or ownership of features across the entire CFO suite for “horizontal differentiation” per the chart above are potential growth vectors.

👑 See related coverage 👑

Long Take: Generative AI creates the surreal search engine of our dreams (link here)

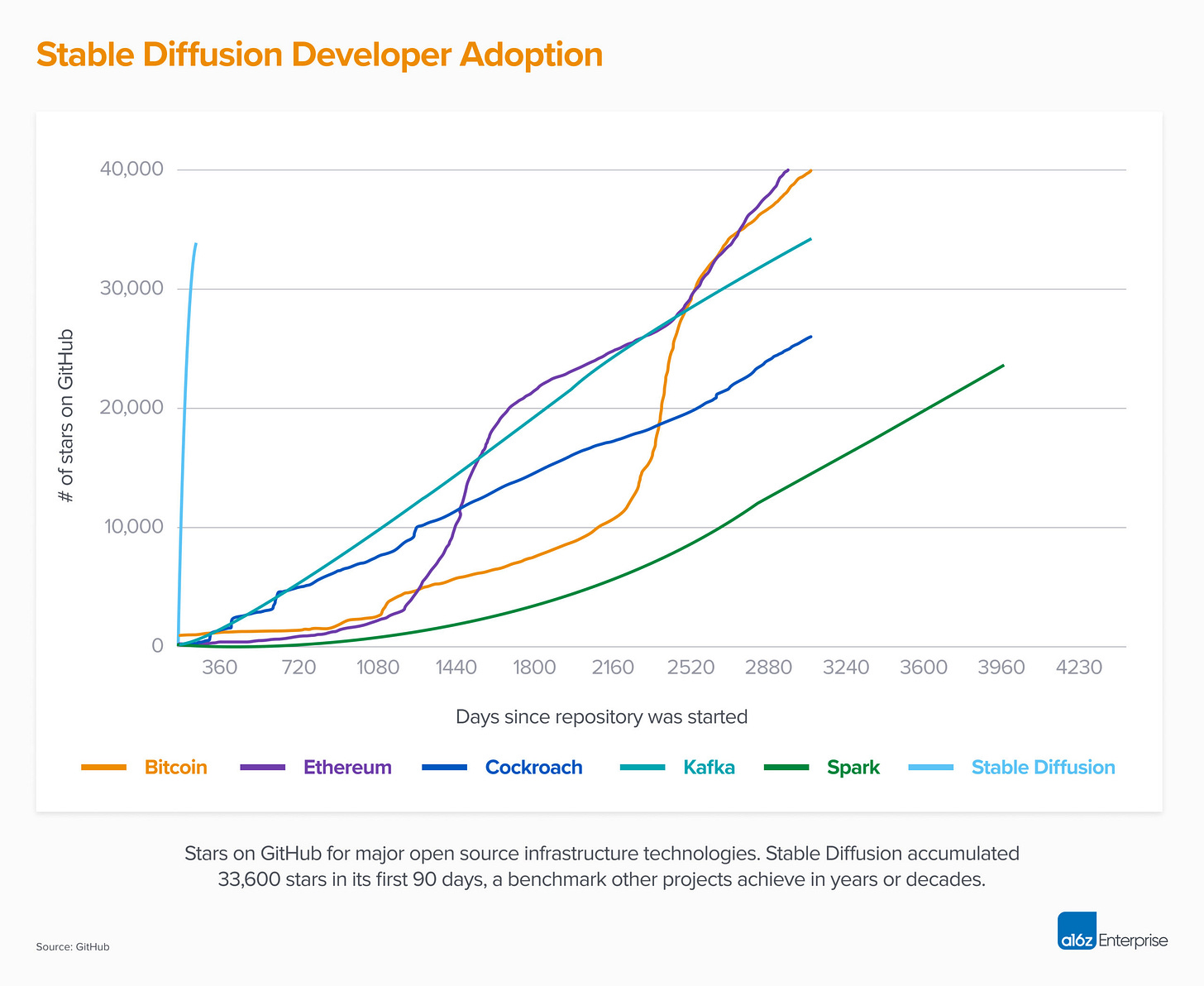

We catch up on the $150MM and $100MM fundraises from Jasper AI, a generative content assistant, and Stability AI, the company behind Stable Diffusion.

The analysis puts into perspective how long it takes to train a single human agent, with an average of 13 years of education and 20 years to just enter the workforce, relative to the progress machines are making at mimicking human labor. We also look at the state of the markets in AI funding, valuation, and examples of trading multiples. Last, we attempt to extend our hypothesis about what the purpose of generative AI really is. Beyond “shallow labor” in DAOs, we come up on the idea of a search graph of our surreal desires.

Podcast Conversation: How to blow up a $32B crypto exchange, with Binance Labs MD of Token Engineering, David Shuttleworth (link here)

In this conversation, we chat with David Shuttleworth, the managing director of token engineering at Binance.

Prior to this, David was a Senior DeFi Economist at ConsenSys, where he focused on mechanism design, tokenomics, and protocol design. David’s experience is extensive and includes leading the development of the Medical Advanced Analytics team at GlaxoSmithKline and was a data scientist at various stage startups in FinTech and predictive analytics.

Rest of the Best

Here are the rest of the updates hitting radar.

NEOBANK: Monzo chief says UK digital bank will turn a profit in 2023

OPEN BANKING: Open Banking Assists Charity Yet Again as UNICEF Norway Integrates Neonomics Payments

LENDING: CRED acquires CreditVidya

PAYTECH: Jingle Pay Improves UAE Financial Inclusion With Mastercard Partnership

PAYTECH: BT and Barclaycard Payments announce increased offer to give business customers

BAAS: Banking-as-a-Service (BaaS) Adoption in the US Catalysed by Temenos and Mbanq Partnership

INVESTING: HSBC launches discretionary digital platform

Shape your Future

Wondering what’s shaping the future of Fintech and DeFi? At the Fintech Blueprint, we go down the rabbit hole in the DeFi and Fintech industries to help you make better investment decisions, innovate, and compete in the industry.

Read our Disclaimer here — this newsletter does not provide investment advice and represents solely the views and opinions of FINTECH BLUEPRINT LTD.

Want to discuss? Stop by our Discord and reach out here with questions