Creativity and courage are the vaccine -- from molecular technology, to digital workspaces, to solving for global health data

Hi Fintech futurists --

Happy Monday! This week, we look at what positive innovations could arise from the pressure cooker of the pandemic. I touch on health care data and privacy, molecular technology, digital work- and play-spaces, and their financial implications. Channeled productively, the next decade could see advances in these fields that we can't yet imagine.

These opinions are personal and do not reflect any views of ConsenSys or other parties. Still, you should check out ConsenSys Codefi for software powering digital assets, financial enterprise blockchains, decentralized finance, and crypto payments here.

Thanks for reading and let me know your thoughts here!

Weekly Fintech & Crypto Developments

If you’ve found value over the years from my newsletter, now is the time to give back by purchasing a premium subscription.

A free "Futurist" tier includes the weekly Long Take, which you are seeing here.

A premium “Architect” tier include an additional 12 key weekly updates with graphs and analysis on Fintech bundles, Crypto and Blockchain, Artificial Intelligence, and Augmented and Virtual Reality. You can see example 1, example 2, and example 3.

Click below to subscribe.

Long Take

This is temporary. This is permanent.

Which is it? How is it both?

We know that this too shall pass. We people have been through it before. Worse, far worse. From the bubonic plague, to smallpox, to other pandemic travesties, nature has eaten at us in its angry hunger. Today, we fortress far more securely than our predecessors -- with Netflix and Amazon.

When disease left us alone, we carved ourselves into pieces with swords, guns, and bombs. Then we carved the atom into the land and sea. We burned our trees, slicked the waters with oil, and melted the ice. We made hamburgers and french fries from fields of corn. We did it for the Flag, and its glory. We did it for money, for power, for status, for sex. And we will keep doing it for the thousands of years to come.

Pretty grim stuff right?

But all coins have two sides. Yes, I'll take the N95 mask any day of the week over the plague doctor or a gas mask. But I'll also gladly take the below examples instead! We humans are ingenious. Our woes become our greatest strengths -- exploration, curiosity, beauty, origin story. When suffocated, we learn to breathe another way.

Crisis is fuel. There is no question that in the short term there are some absolutely incredible shocks to absorb for our world.

I won't belabor the doom narrative this time around, but let's highlight some key issues.

Unemployment claims in the US are spiking to an absolute historic 3.8 million. That's about an annualized $200 billion of salary and consumer spending, already gone.

The Senate passed a $2 trillion stimulus bill, giving wide ranging powers to the executive branch with minimal oversight, and leading to a Roosevelt-type opening for the creation of social welfare programs by ... the Trump Republicans (!).

Mortgage applications starting to collapse by 30% despite historically low rates, as people begin to hoard savings for the Long Sick.

BlackRock -- the $7 trillion asset manager and not the levered up investment banks -- will help the US government with its support of the bond markets for a fee of $8 million per year.

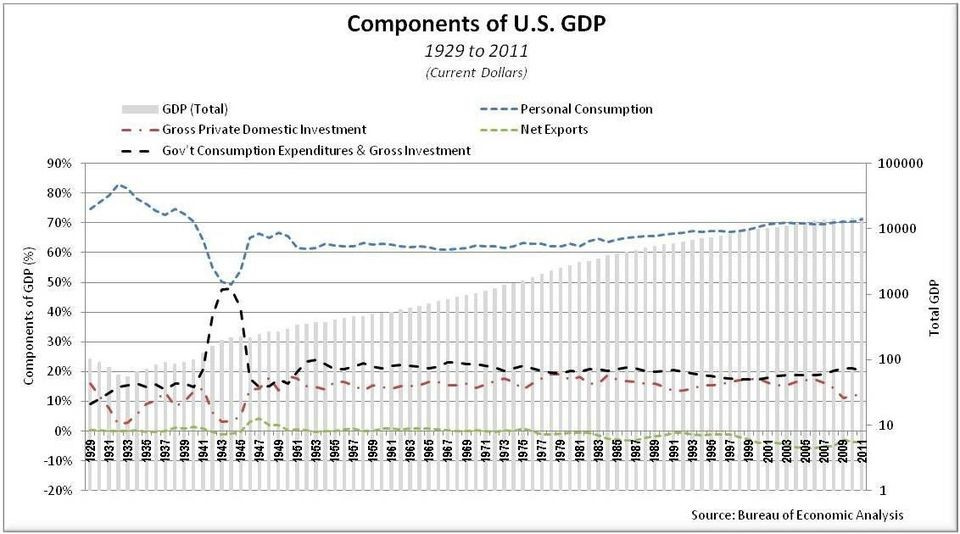

There is a lot to say about how these variables will impact spending and macroeconomic outlook. For example, 70% of our economy is historically driven by consumer demand, which has been largerly turned off. Similarly, we can talk about BlackRock's systemically important role, and whether there really is any space for active management when multi-trillion asset managers are entering a quasi public-private partnership. Should all our infrastrucutre resemble Fannie Mae?

But I am tired of this, as I am sure you are too. Let's talk instead about the world on the other side of Coronovirus, the innovation we see starting to bubble up, and how to adjust our thinking to this emerging reality.

Data and surveillance on the razor's edge of privacy

A number of countries, like South Korea, Singapore, and Japan have been able to get ahead of coronovirus -- at least for the moment -- by quick testing, mapping of digital data sharing, and quick reporting. See for example this map which pin-points precisely the location of recent cases in South Korea:

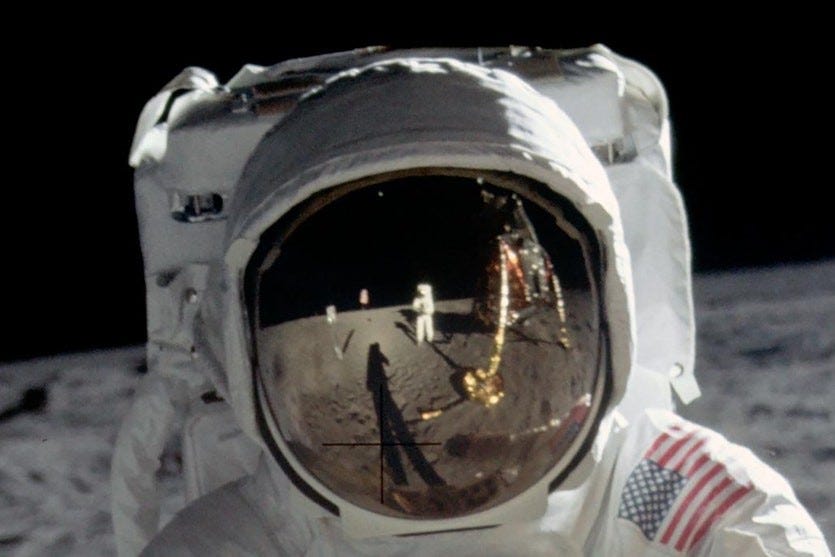

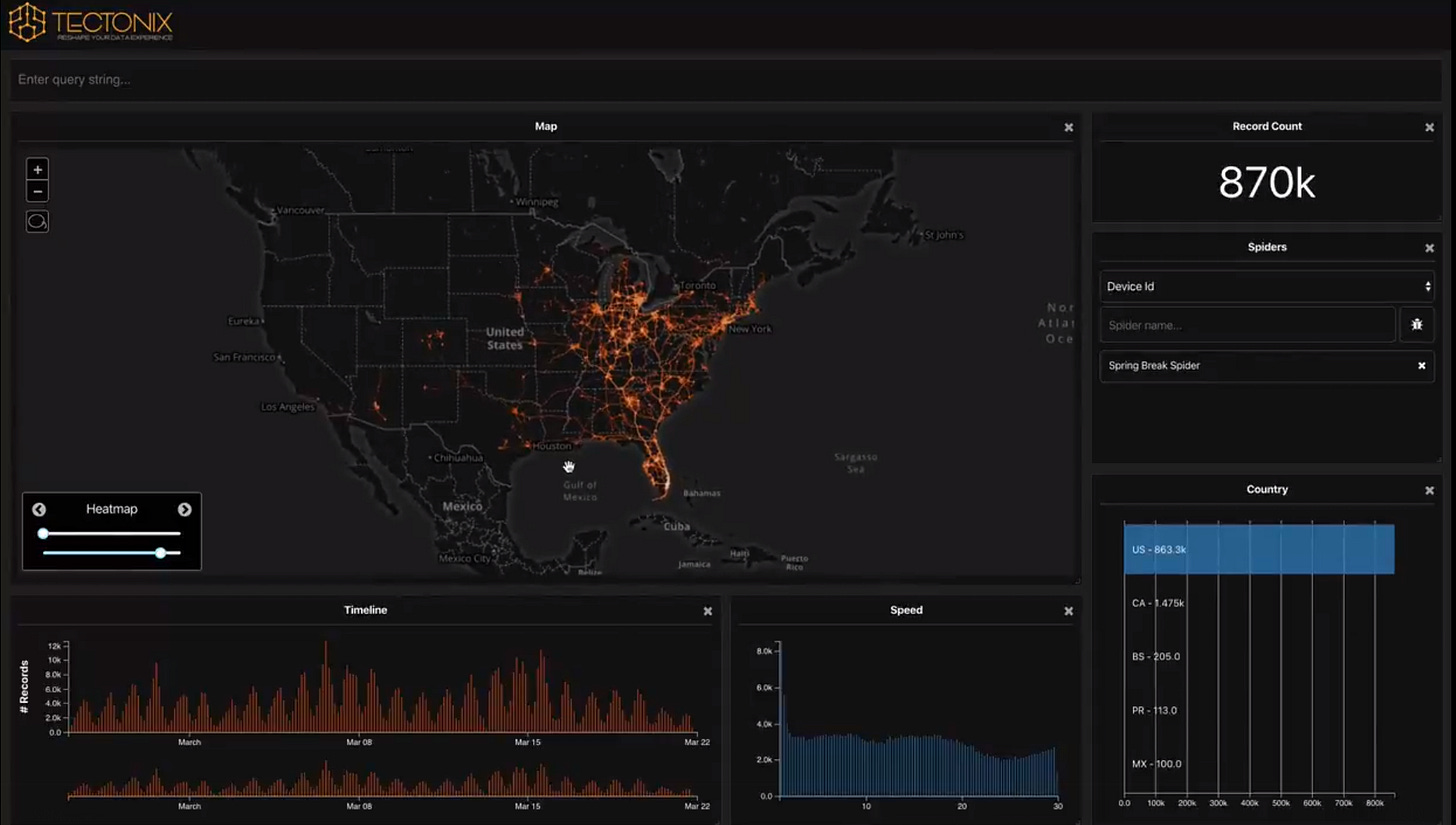

It's not that Americans don't have some of this data! Check out this visualization of cellphone tracking to see how potentially infected persons traveled all over the country from a Florida beach. What we don't have is quick coordination between self-testing, a willingness to self-flag, and a centralized data base of information.

This is a trade-off between privacy and the social good, and I would remind the reader that "rights" and especially "property rights" do not exist in the abstract. They only exist when backed by the State, and they only matter when someone else's rights start to bump up against yours. In times of crisis, individual rights will be compressed -- as evidenced by all of us staying at home. The extent to which people are willing to give up certain perceptions of freedom is largely dependent on cultural background.

From a financial services point of view, would you be willing to use a data aggregator to tell the government your real-time net worth statement? Instead of relying on tax returns, we could live in a world where some algorithm has access to the unit economics of every single individual in the country, and then distributes universal basic income to those who qualify. Would this algorithm be housed at the Federal Reserve? At BlackRock? Or in Plaid? Perhaps it could be housed on a blockchain, and allow for both systemic information sharing and privacy preservation.

Molecular technology revolution driven by the need for diagnosis

We might have a place to put data, and a willingness to put the data there. But how do we get that data in the first place? Science fiction has predicted nanobots decades ago. Tiny cell-sized robots should be floating in our bloodstream, detecting and diagnosing our full health profile in real time, and combating diseases as an artificial immune system. Today, we appear to be quite far from truly useful cell-, molecule-, or DNA-sized data generators. However, the pressure to diagnose billions of people in real time to save hundreds of millions of people, is a pretty good catalyst for innovation.

Companies are racing to build COVID testing kits that could be installed in airports, hotels, and other public areas, and making such solutions fit on microchips. The current trend of telemedicine, where a doctor sees patients through a video conference, could be integrated into digital medical units that read molecular structures or perform more complex imaging work and diagnosis through artificial intelligence. Of course, we have to be vigilant that this is not just snake oil medicine, but real technology. That said, when Bitcoin mining became a sufficiently large industry, specialized chips (i.e., ASICs) were developed for the purpose and now power most mining activity. Simiarly, NVIDIA graphics cards were the tool of choice for processing machine learning-based image recognition, and generated a massive amount of enterprise value for NVIDIA as AI became commercialized.

If applied to medical challenges, analogous progress could be made in molecular data crunching. Folding@home is using spare computer processing capacity to simulate proteins at scale. Could we see resources to such projects increase expotentially? Companies like Molecular Assemblies are going even further, printing DNA itself for uses as novel as data storage. The coronovirus may unintentionally open up a door to fantastical biotechnology.

The digitization of our work and play spaces, and emerging digital markets

We will not be stuck at home forever. But the limitations of fully physical businesses in times of quarantine have been laid bare. If you are a financial institution IT department using remote desktop software, this shut down has been brutal for you. If you are a compliance officer that argued against social media and chat tools like Slack or Zoom, this shut down has proven you wrong. Insider trading is a problem, but it pales in comparison to death from disease.

To that end, digital workspaces will continue to blossom. It is hard to imagine reversing the trend of remote productivity once the quarantine ends. People are learning to gather in digital spaces and create a real sense of community. The lifeblood for this change is live video and 5G networks. As a result, we should pay careful attention to companies like Huawei, who say they are using this time to double down on innovation and lay down our telecom infrastructure. Will the West keep up in understanding that connectivity is connection?

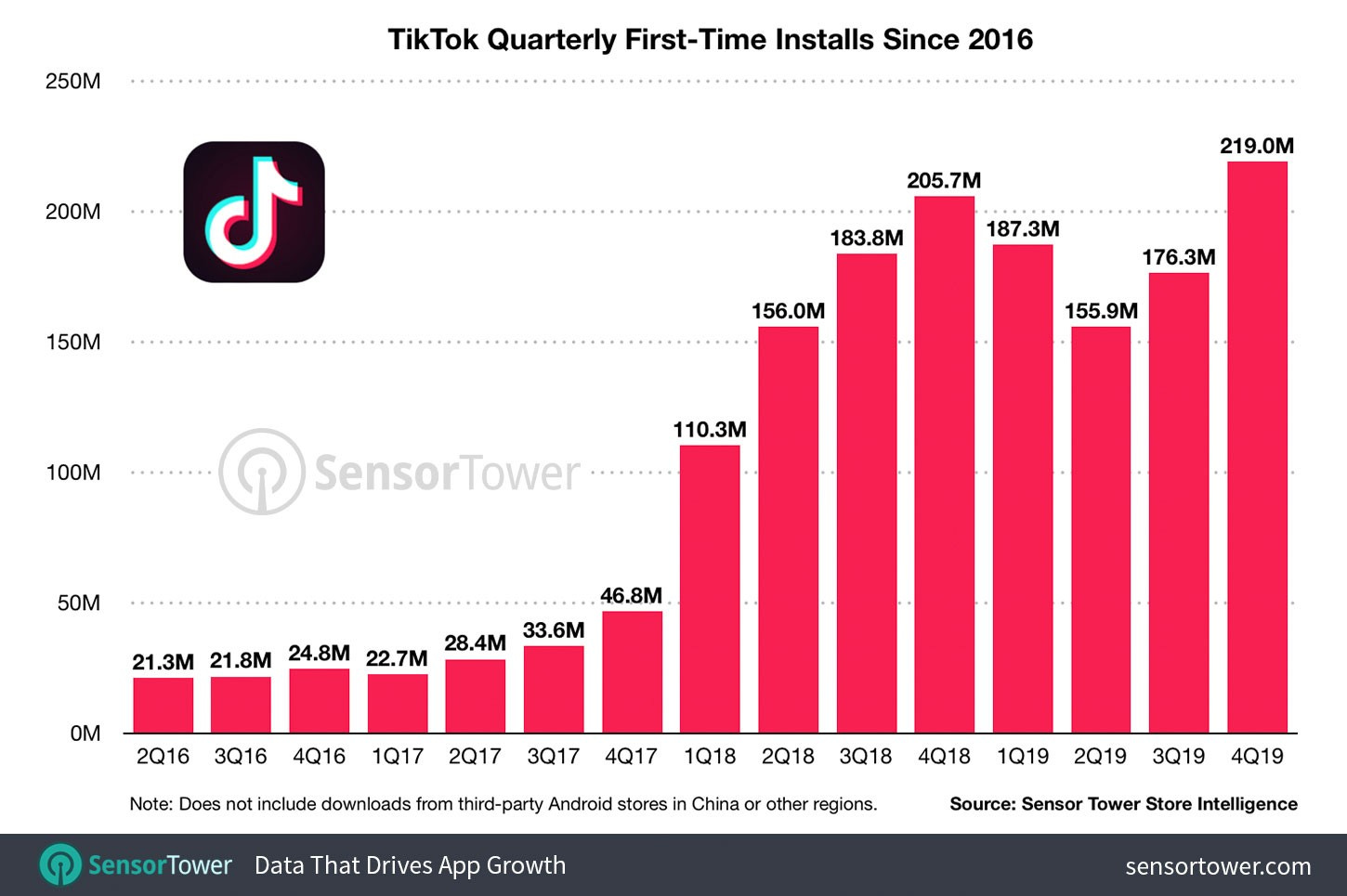

Digital play-spaces are important to follow as well. While the Olympics and the national sports leagues are furloughed, video entertainers and game streamers are seeing record attention and engagement. Virtual reality spaces are becoming increasingly populated, after failing to achieve traction in earlier years. All of a sudden, "presence" is not just an industry buzz-word, but something people really crave in a digital environment. I would expect to see AR/VR picking up both users and developers in the new world. I also point you to Twitch, YouTube, and TikTok as trends to watch.

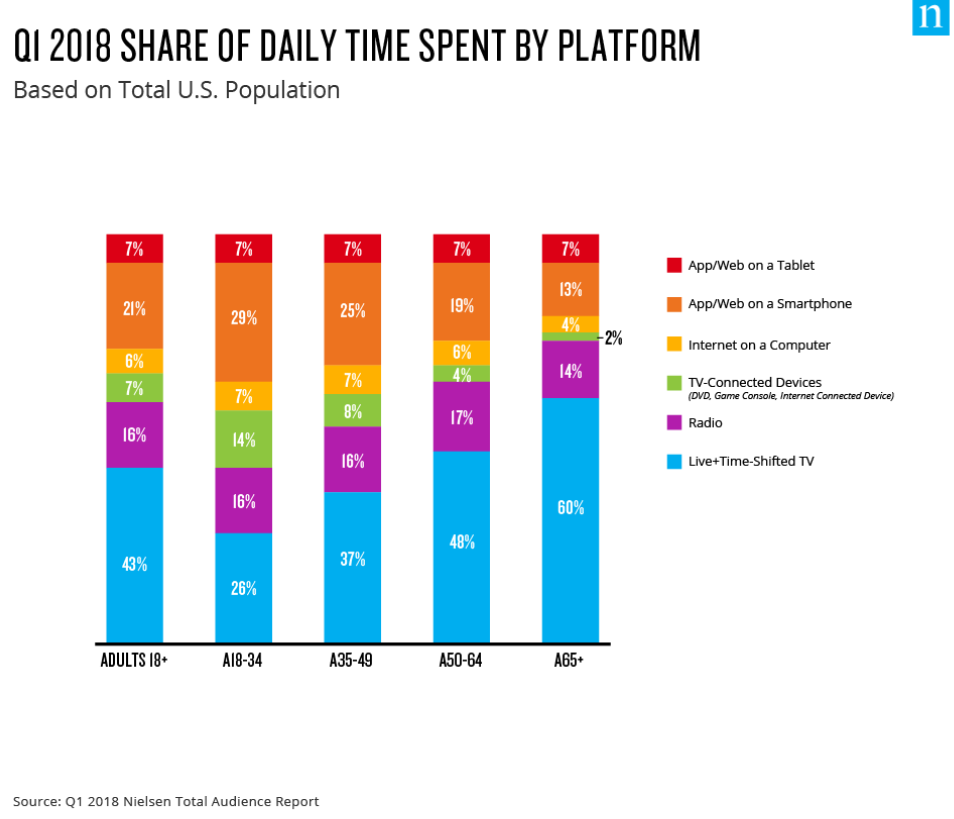

At the root of the attention economy is the following question -- how do people spend their time? Nearly half the day (10+ hours) goes to consuming media, and increasingly that media comes from the digital web rather than from broadcast TV. Younger generations engage more with apps like TikTok than older generations, but the trend is universal. Digital personas, activities, and brands are emerging exponentially on the platforms in fashion. Picking and investing in the right platforms for the right audience is the difficult balance.

I expect more people will flock to these digital town squares, and spend the time to learn their interfaces and community values. This will harden digital assets into things that can be anchored to economic systems and markets. Projects like Decentraland, The Sandbox, and CryptoVoxels have built out virtual real estate titling and gameplay, which all sit on the Ethereum programmable blockchain. This implies their assets can be connected to decentralized finance, which in turn implies payments, banking, trading, leverage, and derivatives.

More generally, embedded finance will benefit from our increasing digital upskilling. Instead of going to the branch or the office to buy financial product, we will have access to it at the point of sale. In large part, this vector is already mature with companies like Affirm and GreenSky leading the way. However, I also see the embedding of financial professionals through video conferencing into more complicated financial decisions. If we are more comfortable trusting a stranger over the web after our coronovirus Zoom marathons, that behavior can spill over to financial services more broadly. From compliance background checks, to signing corporate minutes, to applying for a commercial mortgage, surely we can do all this nonsense remote!

The natural, physical limit is still there

Ten years ago, I would have taken a maximalist view on digitization. But today, during this pandemic, I have had a very different experience. Some people are locked in their homes with little to do, and seek connection and digital squares!

Others, like me, have young kids that require care and schooling. There is a world of difference between the amount of time I would have spent on trying out VR headsets then, and the amount of free time I have for early adopting now. If you have kids, they need you in a physical, not in a digital way. My family is spending much more time connected to each other, and much less time looking for digital upskilling or entertainment.

Every generation, at every stage of their life, will have a different experience of current events. I would advise the reader not to extrapolate too far from their own journey in a normative way, but to emphasize with the diversity of challenges we must now overcome. At the end of the day, people will still eat, sleep, socialize, and dream -- no matter where you put them.

Looking for more?

Check out ConsenSys Codefi for software powering digital assets, financial enterprise blockchains, decentralized finance, and crypto payments.

Want to send me a note? Reach out here anytime.