DeFi: $14B Ondo launches L1 chain for tokenized assets with industry backing

The protocol manages $650MM of assets

GM Fintech Futurists,

Today we highlight the following:

DIGITAL ASSETS: $14B Ondo launches L1 chain for tokenized assets with industry backing

CURATED UPDATES: Financial Institutions and Adoption; DeFi and Digital Assets; Blockchain Protocols; NFTs, DAOs and the Metaverse

To support this writing and access our full archive of newsletters, analyses, and guides to building in Fintech & DeFi, subscribe below (if you haven’t yet).

And make sure to check out our sponsor — your engagement helps us immensely.

Fintech Meetup

It’s time to get ready for a huge 2025: join thousands Fintechs and FIs for the ecosystem event of the year on March 10-13 at the Venetian, Las Vegas.

You’ll be part of the industry's largest, most productive, and highest-rated meetings program. Don’t miss your chance to connect in over 60,000 meetings with banks, credit unions, fintechs, investors, and professional services firms. The event will feature a carefully-curated agenda packed with insights into the future of fintech. You’ll hear from industry visionaries like Kathleen Peters, Chief Innovation Officer at Experian, Eric Sager, COO at Plaid, and Kate Walton, MD & CCO at Merchant Payments, JPMorgan Chase & Co.

Whether you’re a start-up pitching for investment, an exhibitor unveiling cutting-edge AI solutions, or a financial institution developing the next-gen digital platform, Fintech Meetup 2025 is THE place to be this Q1.

DIGITAL ASSETS:

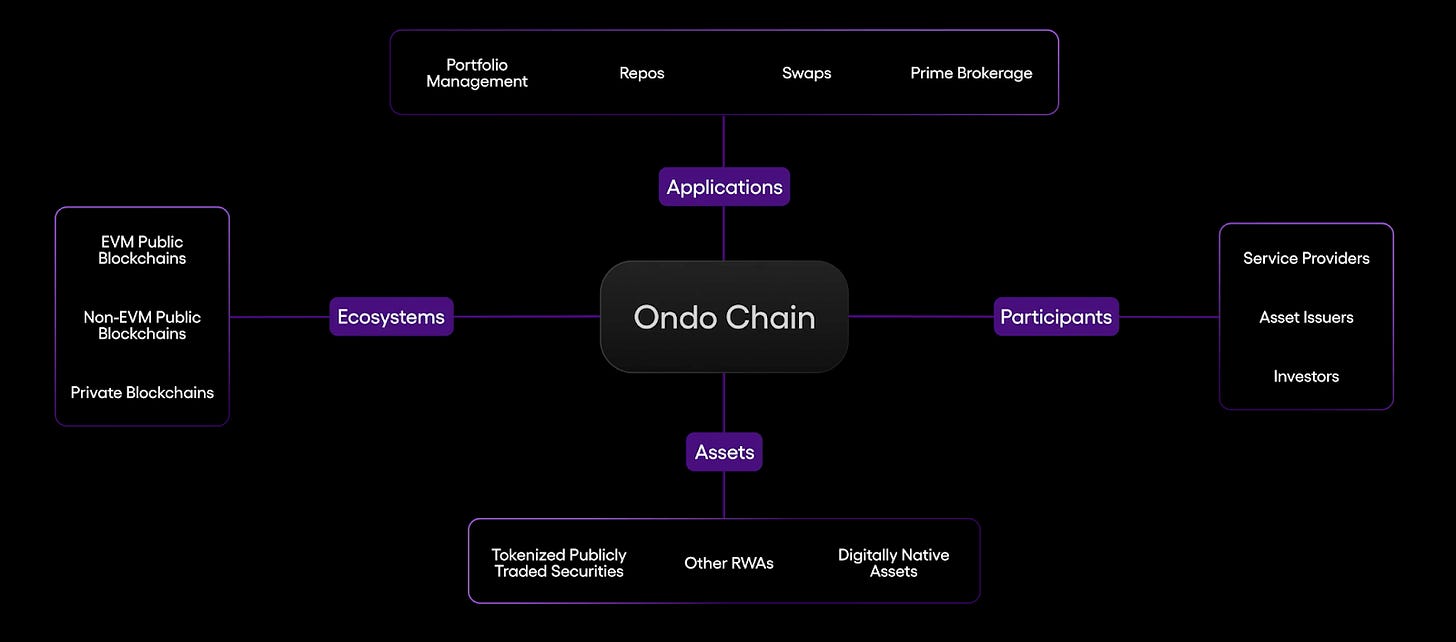

Ondo Finance, a firm focused on tokenising fixed income assets from the traditional finance world, is preparing to introduce Ondo Chain, a blockchain designed to bridge the gap between traditional finance and decentralised assets.

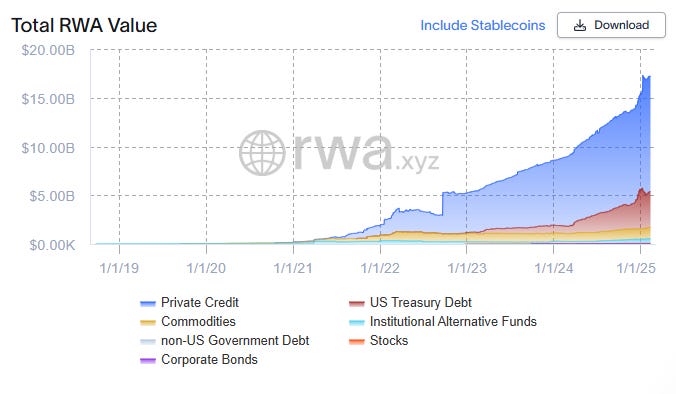

The launch is part of a broader push to bring institutional capital into the digital asset space while addressing longstanding concerns around security, compliance, and volatility. It is not the first attempt and it's likely not the last — we have seen similar efforts from Quorum, Canton Network, R3, Provenance, and Hyperledger dating back to 2018. On the public side, we see nearly $20B of onchain RWA assets form a variety of providers.

How does Ondo work?

Unlike fully permissionless blockchains, Ondo Chain will operate a permissioned validator system, meaning that only select financial institutions will be authorised to confirm transactions. The objective is to create a network that offers the transparency of blockchain technology while maintaining the security and compliance standards of regulated firms.

Ondo’s design uses staking for cryptoeconomic security. However, rather than staking a protocol’s native asset, such as ETH in the case of Ethereum, it allows institutions to stake tokenized securities — such as government bonds, equities, or other regulated financial instruments.

It addresses one of the core concerns for financial institutions considering blockchain adoption — transparency around asset backing. Ondo Chain incorporates proof-of-reserve, allowing users to verify that tokenized assets on the network are fully backed by equivalent real-world holdings. To do this it relies on oracles — blockchain-based services that fetch and verify data from external sources, such as financial institutions or auditors. The mechanism is designed to prevent a scenario in which a blockchain-native asset claims to be backed by traditional securities but lacks the corresponding reserves.

This is a problem that has undermined confidence in many parts of the crypto industry, lest we forget the Terra or FTX collapses.

Ondo Chain comes with bridging capabilities, a feature that enables assets to be transferred between different blockchain networks. This is useful for institutions that need liquidity across multiple ecosystems, rather than being confined to a single chain, or for institutions that are unsure about which chain to deploy.

With regards to traction, Ondo has secured strategic partnerships with several financial institutions, including asset managers Franklin Templeton and Wellington Management, as well as Google Cloud and consulting giant McKinsey.

Despite the positive developments, the market reaction to the news was muted. Ondo’s native token, ONDO, fell 6% following the announcement, perhaps reflecting that the market is not impressed by the RWA narrative and the many similar efforts have ended in the Proof of Concept labyrinth. Additionally, ONDO is trading at $14B, which is a pretty wild premium relative to its market competitors based on $650MM of assets on the platform.

Usually asset managers are worth 2% of their AUM. Ondo is showing up as 2000%.

So, what makes this exciting? There is a legitimate growth opportunity.

Ondo Chain allows public accessibility while maintaining institutional-grade compliance by restricting validator participation to approved financial institutions. Traditional finance blockchains like R3, Hyperledger, and Canton rely on private, closed ecosystems that limit access and interoperability. This openness allows for broad participation and accessibility that previous efforts were not able to deliver. Ondo is designed to integrate with DeFi markets through its integrations with Ethereum, L2s, and other blockchains — a significant difference to the more siloed systems of the past.

Taking a step back, we are also seeing a trend amongst other large decentralized applications, like Uniswap and Hyperliquid, creating their own blockchains.

This provides greater customization, as is the case with Ondo and its validator system but also allows projects to have greater control over governance and revenue capture. See for example, how Coinbase makes money on Base. Uniswap similarly uses Optimism to scale up its Ethereum L2.

That said, running an L2 is not a fit for all dapps as it requires significant public participation and technical development to make it work. However, it could mean that Ethereum loses dominance over specialized applications in the long run, particularly when it comes to DeFi. Hyperliquid rose to an $8B valuation by going it alone.

Overall, we like this move from Ondo finance to bring fixed income to DeFi. The use cases are extensive, with plans for onchain prime brokerage, wealth management, cross-chain token issuance, stablecoin distribution, and yield.

However, the path from wrapping up BlackRock funds into tokens and running an enormous market venue in a global manner is a long one.

👑 Related Coverage 👑

Advertise with the Fintech Blueprint

To reach 200,000 decision makers in financial services, Fintech, and Web3, reach out to discuss sponsorship opportunities today.

🔥🔥🔥 Contact us to discuss options 🔥🔥🔥

Fintech 101: Neobanks

We are using the many years of Blueprint analysis archives to build out definitional introductory content for our key coverage pillars, starting with Neobanks.

Neobanks did not emerge in a vacuum. Their rise is tied to a sequence of financial crises, regulatory shifts, and technological advancements that reshaped how consumers interacted with money. While the idea of branchless banking has been discussed since the late 20th century, the 2008 financial crisis was the catalyst that set the stage for their arrival.

Curated Updates

Here are the rest of the updates hitting our radar.

Financial Institutions and Adoption

⭐ Cedar Money Raises $9.9 Million for Cross-Border Payment Solution Using Stablecoins - PYMNTS

Trump-backed World Liberty Financial is loading up on crypto. Here’s why - DLNews

United States of Bitcoin? These States Are Considering BTC Reserves - Decrypt

Semler Scientific to raise $75M to fund Bitcoin buys as paper gains near $30M - CoinTelegraph

Goldfinch Prime: A New Leader In The Emerging RWA Opportunity - CoinTelegraph

DeFi and Digital Assets

⭐ Why Arthur Hayes is underwhelmed by Trump and eyes Bitcoin slide to $70,000 - DLNews

Token trading infrastructure provider Reservoir raises $14 million in Series A funding - The Block

Blockchain Protocols

⭐ Analog reaches $300 million valuation in $5 million round ahead of token launch - The Block

⭐ Humanity Protocol valued at $1.1 bln after latest fundraise - Reuters

⭐ Berachain Begins $1.1 Billion BERA Airdrop as Mainnet Launches - Decrypt

Olas launches first-ever AI agent store with $13.8M backing - VentureBeat

Partnr Launches to Connect Consumer Crypto with On-Chain AI Agents - DLNews

New Layer 1 network developer Pod raises $10 million in seed funding - The Block

Top Ethereum researcher argues for staking cap to fix ‘broken’ tokenomics - DLNews

NFTs, DAOs and the Metaverse

⭐ Superlogic raises $13.7M at a $200M valuation to help consumers use reward points toward cool ‘experiences’ - TechCrunch

Inside the Trump family’s $16bn crypto empire - DLNews

Gaia is Building ‘Living Knowledge Systems’ for AI Agents - Decrypt

Sony's Soneium Releases First Music NFT Collection With Coop Records’ NUU$HI Drop - Decrypt

🚀 Level Up

Sign up to the Premium Fintech Blueprint and in addition to receiving our free newsletters, get access to:

Long Takes with a deep, comprehensive analysis.

‘Building Company Playbook’ series, offering insider tips and advice on constructing successful fintech ventures.

Special Reports

Archive Access to an array of in-depth write-ups covering the hottest fintech and DeFi companies.

Join our Premium community and receive all the Fintech and Web3 intelligence you need to level up your career.