DeFi: Grayscale's Spot Bitcoin ETF success; Biden administration's new US crypto tax rules

New crypto tax rules could change the face of DeFi in the US, while Grayscale beat the SEC in its Spot Bitcoin ETF battle

The Fintech Blueprint is a newsletter authored by me, Lex Sokolin, and a small group of brilliant researchers who focus on frontier technologies impacting the future of financial services. I am glad you are here. Was this email forwarded to you? You deserve your own:

👉subscribe here.

Gm Fintech Futurists —

Today we highlight the following:

POLICY: Biden Administration Unveils New Crypto Tax Reporting Rules (link here)

DEFI & DIGITAL ASSETS: Grayscale Victory Against SEC Clears Path for Spot Bitcoin ETFs (link here)

CURATED UPDATES

To support this writing and access our full archive of newsletters, analyses, and guides to building in the Fintech & DeFi industries, subscribe below.

POLICY: Biden Administration Unveils New Crypto Tax Reporting Rules (link here)

A newly proposed U.S. Treasury Department rule looks to require crypto exchanges, both centralized and decentralized, crypto payment processors, and some digital wallets to report the exchanges and sales of digital assets on their platforms to the IRS. The tax reporting form, named Form 1099-DA, is primarily aimed at simplifying the process for taxpayers on crypto gains, an area fraught with complexity. However, it will also have the effect of requiring digital asset brokers to abide by the same information reporting rules as brokers of other financial instruments, like stocks and bonds, potentially greatly increasing the KYC barriers for accessing DeFi in the US.

The proposal came as part of the 2021 Infrastructure to Investment and Jobs Act – a $1T bill that included the provision of increased tax reporting requirements for all digital asset brokers and for digital asset transactions greater than $10k. U.S. government revenue from these new rules is estimated at nearly $28B over the next ten years.

While the rules may help crypto users to comply with tax laws, it will likely have a considerable impact on the operations and accessibility of DeFi applications. Protocols like Uniswap would be deemed a broker under the rules, requiring a new user interface for U.S. citizens requiring individual transaction tracking and reporting. MetaMask users would no longer have the anonymity of a self-custodial wallet. All multisig users would be deemed brokers, exposing the identities of (also known as “doxxing”) many anonymous investors and DAO leaders.

The financial, economic, and cultural effects of these rules are widespread, but also difficult to enforce. Feedback on the proposal is still open until October 30th and the rules will not come into effect until the 2026 tax season, providing ample time for appeal. We expect nearly all affected parties have will begin planning operational changes to comply, appear to comply, or attempt to circumvent the new rules. Given that this applies to the biggest companies in crypto, from Coinbase to ConsenSys, we expect forceful pushback, particularly on the definition of a digital asset broker as that definition may have even wider implications.

👑 Related Coverage 👑

🤝 In Partnership with the American Fintech Council

The 7th annual AFC Policy Summit serves as a pivotal gathering for industry leaders, regulators, academics, consumer groups and policymakers to exchange ideas, explore emerging trends, and shape the future of responsible financial technology. Each year, the summit brings together the most influential voices in the space.

The AFC Policy Summit will take place on November 14, 2023 in Washington D.C.

By registering today you will receive the lowest price that will be offered. There is limited capacity, so don't delay!

DEFI & DIGITAL ASSETS: Grayscale Victory Against SEC Clears Path for Spot Bitcoin ETFs (link here)

Grayscale Investments, an asset manager holding 3.4% of the circulating Bitcoin supply, has won a legal fight against the SEC over its bid to establish a Bitcoin exchange-traded fund (ETF). In 2022, the SEC turned down Grayscale's proposal, asserting that an ETF linked to Bitcoin lacked the necessary mechanisms for detecting fraudulent activities.

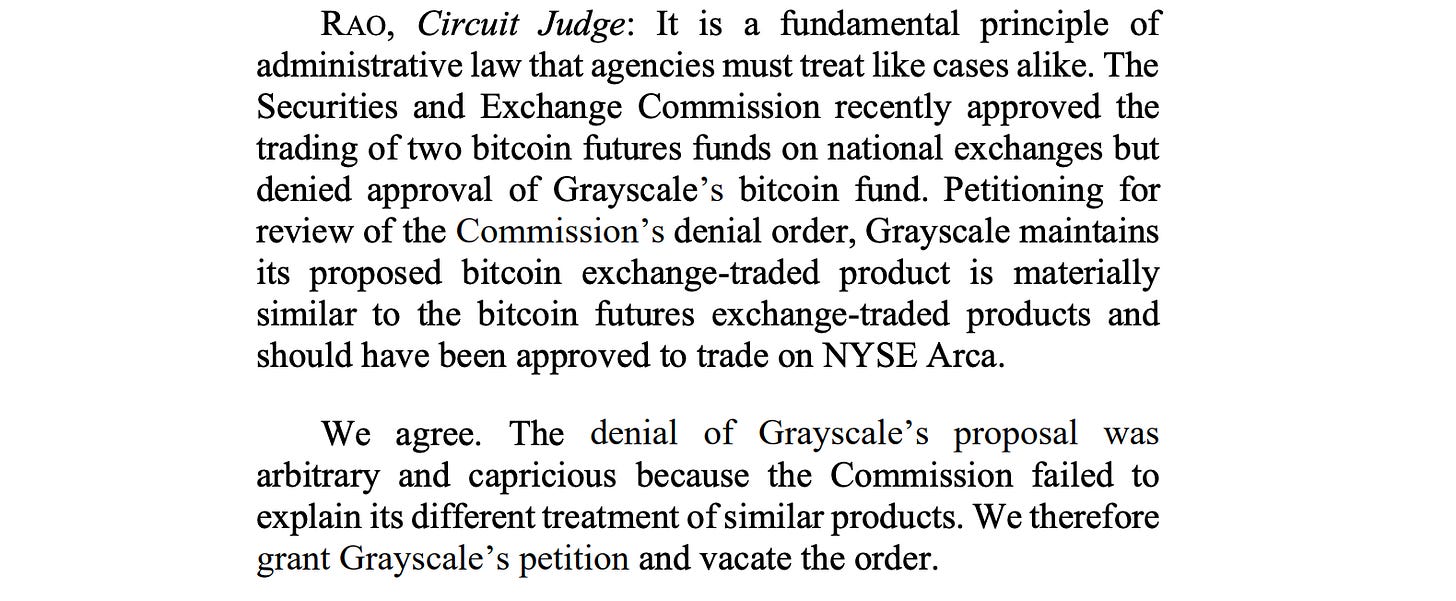

In response to the rejection, Grayscale sued the SEC for rejecting its product while approving two similar Bitcoin Futures ETFs last year. The DC Circuit Court of Appeals sided with Grayscale, affirming that "the denial of Grayscale's proposal was arbitrary and capricious." This marks another significant courtroom setback for the SEC.

Currently, the Grayscale Bitcoin Trust (GBTC) is the largest Bitcoin fund, allowing US investors to access Bitcoin through stocks instead of crypto exchanges. However, people generally lean towards a Bitcoin Spot ETF over a fund like GBTC, as ETFs closely mirror the actual value of Bitcoin, while trusts lack this precision.

In ETF operations, Authorized Participants (APs) facilitate ETF share creation and redemption, maintaining the balance between market price and net asset value (NAV). Through an arbitrage mechanism, if an ETF trades at a premium, APs would create new ETF shares and then sell these newly created shares in the market, aligning the price closer to the NAV. Whereas in GBTC's setup, shares can be traded at a premium or discount compared to the actual Bitcoin price without a set mechanism to address this. This structural difference is what makes ETFs preferable to the fund structure under which GBTC currently operates.

In fact, since March 2021, GBTC shares have consistently traded at a discount, at one point hitting a 45% markdown from the underlying asset value. Purchasing GBTC at a discount means receiving fewer BTC than spot buying with the same USD amount. Plus transaction fees of 200 basis points for the privilege of holding the instrument.

The broader idea is that the Bitcoin Spot ETF goes beyond mere price alignment; it's about leveraging the ETF standard to participate in the investment management value chain. As we stated in our long take, a BlackRock or Fidelity ETF with a 25 basis points fee and $50B in assets sounds pretty feasible to us as a destination. With the court’s decision, we just got a lot closer to that destination.

👑 Related Coverage 👑

Curated Updates

Here are the rest of the updates hitting our radar.

Financial Institutions and Adoption

⭐ Elon Musk’s X Obtains License To Enable U.S. Crypto Payments - The Defiant

Gemini Opposes Genesis Bankruptcy Plan: 'Woefully Light On Specifics' - CoinDesk

Binance Delists Sanctioned Russian Banks From Peer-To-Peer Service - CoinDesk

Visa And Mastercard Distancing Themselves From Binance Unlikely To Hurt the Crypto Exchange - CoinDesk

Prime Trust Filing Reveals Cascade Of Failures That Led To Bankruptcy Filing - Decrypt

Tornado Cash Arrests Spur Privacy Debate - Blockworks

DeFi and Digital Assets

⭐ dYdX Community Votes On Appchain Migration and V4 Deployment - The Defiant

⭐ Aave Launches sDAI Pool As MakerDAO Weighs Reducing Yields - The Defiant

Friend.tech Revenues Plummet 90% As Social App Hype Cools - Decrypt

Robinhood’s Crypto Wallet Adds Bitcoin And Dogecoin - CoinDesk

Lido Set To Complete Final Token Unlock - The Defiant

DEX Traders Turn To Telegram Bots To Gain An Edge - The Defiant

Blockchain Protocols

⭐ Base Set To Receive 118MM OP Tokens Over Six Years In Governance Agreement - The Block

Shiba Inu’s Highly Anticipated Shibarium Bridge Is Now 'Fully Functional' - CoinDesk

NFTs, DAOs and the Metaverse

⭐ OpenSea Unveils Standards For Redeemable NFTs - The Defiant

Doodles And Crocs Announce Exclusive Footwear Collaboration - NFT Now

$PEPE Multisig Mysteriously Transfers Out 16 Trillion Tokens, Investors Concerned - NFT Now

⭐ Shape your Future

Curious about what is shaping the future of Fintech andDeFi?

At the Fintech Blueprint, we go down the rabbit hole to help you innovate and compete.

Sign up to the Premium Fintech Blueprint newsletter and get access to:

Wednesday’s Long Takes on Fintech and Web3 topics with a deep, comprehensive analysis

Office Hours, monthly digital roundtable discussions with industry insiders

‘Building Company Playbook’ series, offering insider tips and advice on constructing successful fintech ventures

Enhanced Podcasts with industry leaders, accompanied with annotated transcripts

Archive Access to an array of in-depth write-ups, spanning across 15+ topics and encompassing over 50 Fintech and DeFi brands