DeFi: How US Equities have come on-chain via Robinhood, Superstate, and Dinari

OpenAI is a token on Arbitrum

GM Fintech Futurists,

Today we highlight the following:

DIGITAL ASSETS: Dinari, Robinhood, and the Race to Bring Stocks On-Chain

CURATED UPDATES: Financial Institutions and Adoption; DeFi and Digital Assets; Blockchain Protocols; NFTs, DAOs and the Metaverse

To support this writing and access our full archive of newsletters, analyses, and guides to building in Fintech & DeFi, subscribe below (if you haven’t yet). For $3 per week, you get institutional-level research delivered to your Inbox.

In Partnership

Persona is a digital identity platform that has stopped over 75 million AI face spoofs in 2024 alone. Fight fraud and convert users, whether you’re processing loans, issuing credit cards, automating account openings, or any other use case. Make sure to check out Persona below.

DIGITAL ASSETS: Dinari, Robinhood, and the Race to Bring Stocks On-Chain

Tokenized equities just crossed a regulatory Rubicon: the U.S. is now open for business.

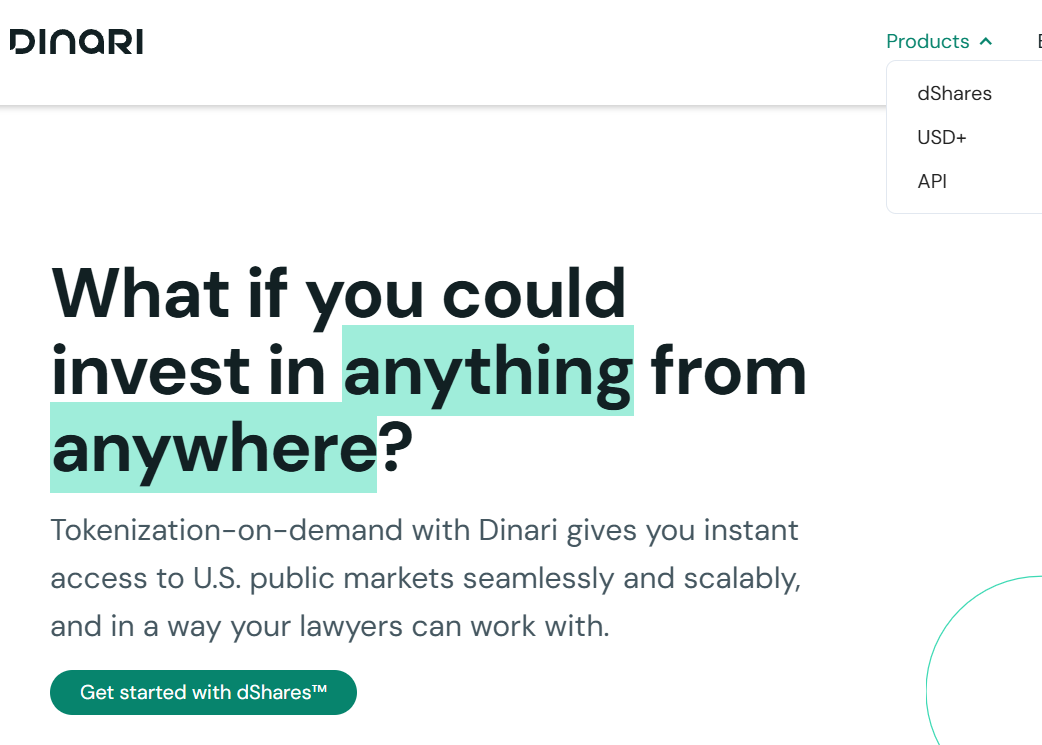

Last week Dinari, a tokenization platform, received the first-ever SEC and FINRA approval to operate as a broker-dealer offering tokenized stocks. BitGo has been quick to partner with the firm, enabling developers to provide access to tokenized stocks, cryptocurrencies, and stablecoins through a single platform.

This news comes less than a month after Superstate's Opening Bell platform launched, enabling public companies like Upexi to issue shares directly on-chain. Backed Finance are also debuting tokenized stocks on ByBit, Kraken and Solana, whilst Robinhood is building its own stock tokenization service on Arbitrum.

We are going to see OpenAI private stock trade around as a token on an Ethereum L2.

When it rains, it pours.

What was once a speculative category for offshore wrappers and synthetic assets is quickly becoming the real thing: U.S.-compliant, on-chain equity integrated into crypto rails and fintech interfaces.

Dinari’s approval on June 26 marked a milestone. It was the first green light from U.S. regulators for a firm to directly offer tokenized representations of real stocks to the public. Dinari’s “dShares” are backed 1:1 by publicly traded equities held in custody, and can be integrated via API into wallets, trading apps, and neobanks. Notably, Dinari is not building a retail app of its own. It is building infrastructure — the same strategy Stripe used with payments, applied to tokenized equity. This means that any app that offers brokerage or wallet functionality could soon allow users to buy real stocks that settle on-chain and live in token form.

Upexi, a small-cap Nasdaq-listed company, announced it will tokenize its own shares using Superstate’s Opening Bell. The company’s investor base includes crypto-native funds, and its treasury will hold over $100 million in Solana tokens.

Upexi will become the first public company to issue its shares for simultaneous listing on both Nasdaq and a public blockchain, enabling 24/7 trading, instant settlement, and the eventual programmability of equity itself.

These developments signal the beginning of a major unlock.

Regulated tokenized stocks are no longer a gray area in the US. Crypto exchanges like Coinbase and Kraken, as well as fintech platforms like Robinhood or Revolut, can now pursue this market without regulatory overhang. Typically, equities live in T+2 settlement windows, wrapped in legal disclosures and legacy brokers, on traditional custodians and distributed by platforms like Robinhood. Now, they can be minted, held, and traded like any digital asset.

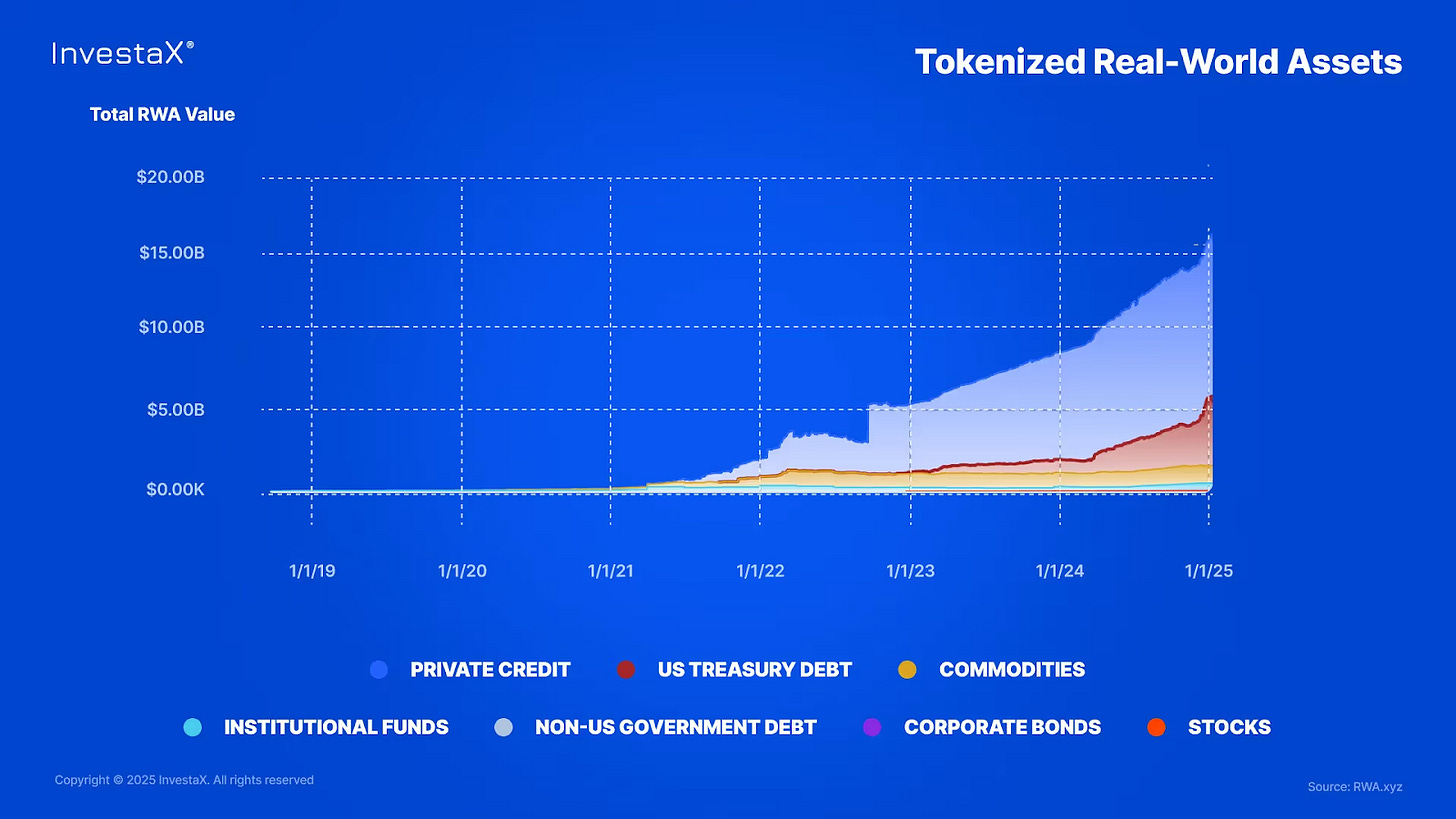

That said, liquidity for tokenized stocks is shallow, and standards for on-chain cap table interoperability are just emerging. The subsequent challenge lies in scaling integration, educating users, and building market depth if the $62 trillion in US equities is to come onchain.

When equity becomes programmable, it stops being a financial endpoint and starts becoming an input: a building block for staking, governance and collateral. Tokenized stocks will not just appear on crypto exchanges. They will sit inside wallets, power smart contracts, and live in the same digital layer as USDC, ETH, and NFTs. A decade from now, the distinction between a Robinhood account and a wallet holding Superstate-backed shares may be finer than we think.

👑 Related Coverage 👑

Advertise with the Fintech Blueprint

To reach 200,000 decision makers in financial services, Fintech, and Web3, reach out to discuss sponsorship opportunities today.

🔥🔥🔥 Contact us to discuss options 🔥🔥🔥

Analysis: Programmable money comes to Fiserv and Shopify

Programmable money is evolving. We examine Shopify’s integration of USDC payments via Coinbase’s Base Layer-2, leveraging programmable payment flows like escrow-based captures and refunds that mirror legacy e-commerce logic.

Meanwhile, Fiserv’s upcoming launch of FIUSD on Solana, backed by Paxos and Circle, shows how core banking infrastructure is bridging to blockchain, with 24/7 settlement and embedded compliance tools. The broader trend is clear: the future of money lies in programmable logic and real-time interoperability, with stablecoins acting as the foundational layer for both fintechs and legacy players.

Curated Updates

Here are the rest of the updates hitting our radar.

Financial Institutions and Adoption

⭐ Fannie Mae, Freddie Mac ordered to consider crypto as an asset when buying mortgages - AP

OCC Green-Lights Crypto Activities for Banks - CoinDesk

Mastercard teaming up with Fiserv’s FIUSD stablecoin program - MarketWatch

Bank of Korea deputy chief says desirable to introduce stablecoins gradually - Reuters

Societe Generale becomes first major bank to launch dollar-pegged stablecoin - Reuters

DeFi and Digital Assets

⭐ Newest 'Star' in Sky Ecosystem Launches With $1B Tokenized Credit Strategy - CoinDesk

Veda raises $18 million from CoinFund, Coinbase Ventures, GSR and others to scale its DeFi infrastructure - The Block

Bitcoin DeFi Project Elastos Debuts BTC-Backed Stablecoin BTCD - CoinDesk

Crypto firm for Deutsche, State Street launches private stablecoin contract - Coin Telegraph

Blockchain Protocols

⭐ Kalshi valued at $2 billion in latest funding round, CEO says - Reuters

Goldman and Citadel Securities join $135m funding round for blockchain startup - FN London

Zama raises $57M in series B to bring end-to-end encryption to public blockchains - Coin Telegraph

Inference Labs Raises $6.3M to Secure AI Agents Through Verifiable Inference Protocol - The Block

Digital Asset Raises $135 Million to Bolster Canton Network Blockchain - PYMNTS

NFTs, DAOs and the Metaverse

⭐ Moonbirds NFT sales surge after Yuga Labs sells IP - Coin Telegraph

The playbook for bringing millions of football fans to Web3: AMA with 0xFútbol - Coin Telegraph

🚀 Level Up

Sign up to the Premium Fintech Blueprint and in addition to receiving our free newsletters, get access to:

Long Takes with a deep, comprehensive analysis.

‘Building Company Playbook’ series, offering insider tips and advice on constructing successful fintech ventures.

Special Reports

Archive Access to an array of in-depth write-ups covering the hottest fintech and DeFi companies.

Join our Premium community and receive all the Fintech and Web3 intelligence you need to level up your career.

Interesting times. There's a cost to be incurred here by Robinhood or Superstate to develop the network. Given Robinhood's size and stature, might be easier for them. To start with, the bid-ask spreads might be a lot higher given the shallow liquidity. Might provide arbitrage opportunities between on-chain and off-chain, or even between different chains, since the liquidity will likely remain fragmented (on each protocol).