Hi Fintech Architects,

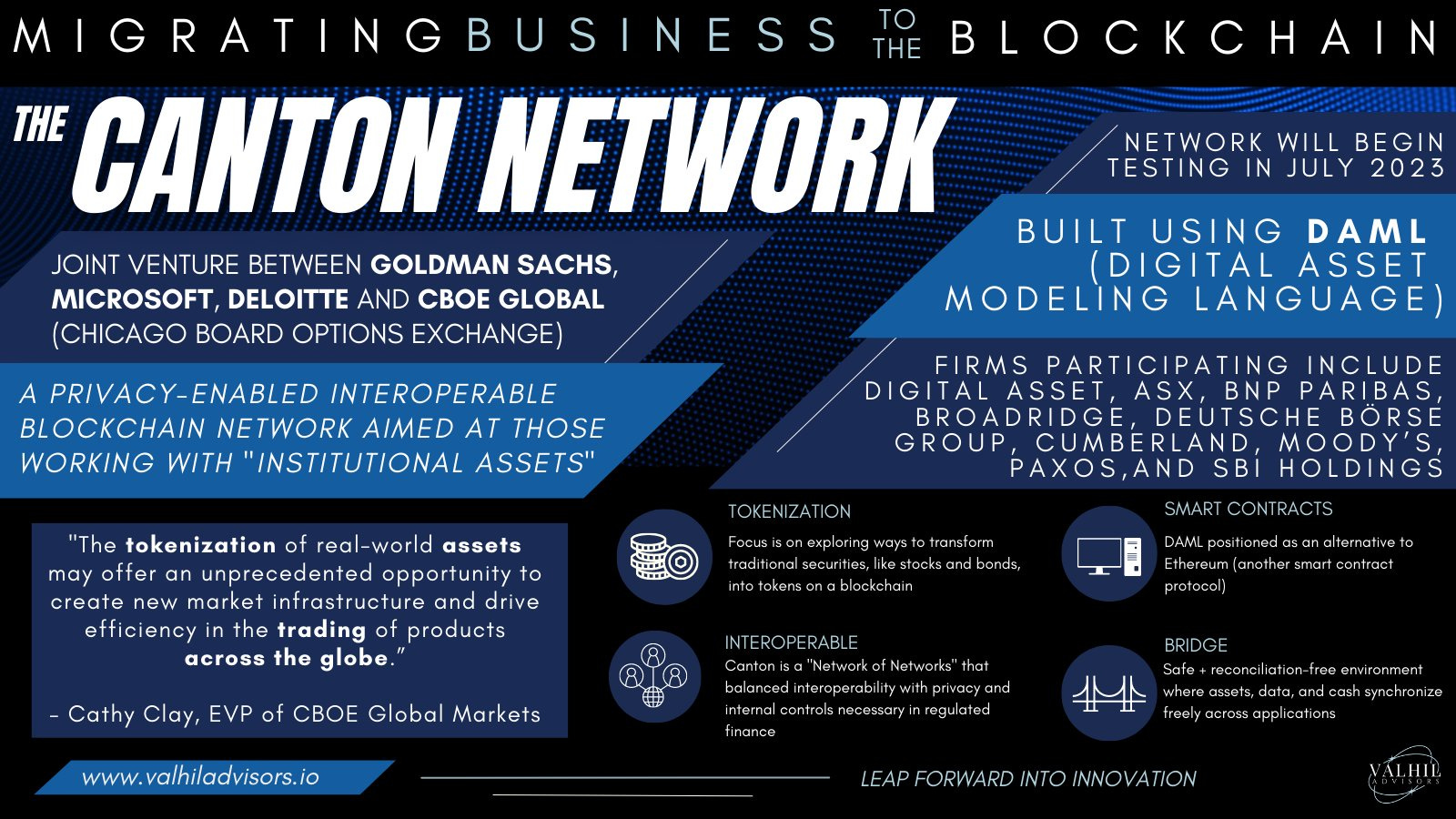

In this episode, Lex Sokolin speaks with Yuval Rooz, CEO and co-founder of Digital Asset, about the company’s transformation from its early institutional blockchain experiments to launching the Canton Network - a purpose-built, privacy-enabled smart contract platform designed for financial markets.

Rooz shares insights into why Digital Asset was inspired by Bitcoin’s financial principles rather than its technical assumptions, highlighting the importance of rethinking blockchain infrastructure rather than replicating flawed legacy models. He also unpacks the hard lessons from high-stakes projects like the Australian Stock Exchange overhaul, emphasizing why large-scale financial infrastructure must evolve incrementally to succeed.

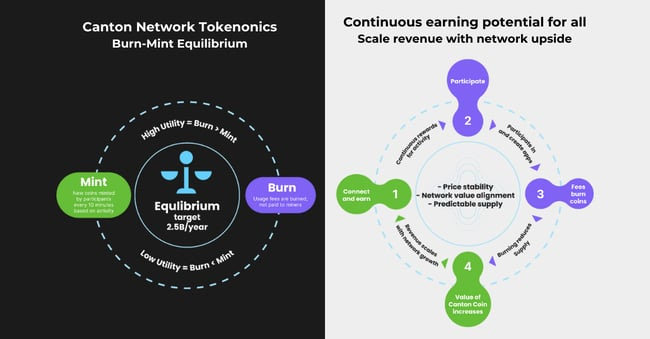

Finally, the conversation dives into Canton’s unique tokenomics, where 70% of block rewards go to the developers and users who create economic activity on the network, challenging traditional validator-centric models and aligning incentives more fairly for long-term ecosystem growth.

Notable discussion points:

Canton’s innovative tokenomics: Unlike Ethereum, where validators capture most of the rewards, Canton allocates 70% of block rewards to developers and applications, creating sustainable alignment.

Lessons from ASX: Rooz reflects on the failed ASX blockchain migration, advocating for iterative upgrades rather than “big bang” infrastructure transformations.

True tokenization: Rooz critiques superficial on-chain IOU models, asserting that real tokenization must place the asset’s books and records natively on-chain to unlock the benefits of DeFi and composability.

For those that want to subscribe to the podcast in your app of choice, you can now find us at Apple, Spotify, or on RSS.

Background

Before founding Digital Asset and launching the Canton Network, Yuval Rooz built a strong foundation in quantitative finance and venture investing. He began his career at Citadel, where he worked in algorithmic trading, and later joined DRW Trading in Chicago, a prominent proprietary trading firm. There, he helped lead strategic investments through DRW Venture Capital (DSW), gaining exposure to early institutional interest in crypto markets.

Notably, Rooz collaborated closely with Eric Saraniecki and Don Wilson - two key figures in the crypto and trading space - and was involved in evaluating infrastructure opportunities around Bitcoin and financial market digitization. These experiences, along with his exposure to early crypto market making at Cumberland Mining (a DRW subsidiary), shaped his conviction that blockchain could fundamentally improve financial services by eliminating redundant intermediaries and enabling real-time, trust-minimized settlement systems.

👑Related coverage👑

Topics: Digital Asset, Canton Network, DRW, ASX, Ethereum, Bitcoin, Plaid, DAML, fintech, web3, tokenization, digital assets, financial infrastructure, DeFi, onchain

Timestamps

1’28: From Wall Street to Web3: Yuval Rooz on Founding Digital Asset and the Birth of the Canton Network

4’29: Rethinking Blockchain: Rejecting Ethereum’s Assumptions to Build a Better Financial Infrastructure

8’18: Getting Banks to Say Yes: Bridging Blockchain Innovation with Regulatory Reality

12’43: Blockchain at Scale: Lessons from the ASX Project and Why Incremental Innovation Beats Big Bang Deployments

21’27: Agile by Design: How Canton Aims to Bring Continuous Delivery to Decentralized Blockchain Networks

23’50: Beyond the Hype: Why Crypto Needs Pragmatism, Not Just Vision, to Integrate with Financial Institutions

27’08: From DAML to Canton: Building Scalable, Privacy-First Infrastructure for Real-World Finance

30’52: Redefining Tokenization: Real On-Chain Finance at Scale with Trillions in Assets on Canton

35’34: Solving the Tokenization Gap: Bridging Legacy Infrastructure with Decentralized Architecture

39’13: Seeding Web3 with Real Assets: Canton’s Strategy to Power DeFi with Institutional-Grade Infrastructure

41’33: Custom Rules, Shared Rails: How Canton Balances Decentralization with Regulatory Flexibility

44’30: Aligning Incentives: How Canton’s Tokenomics and Fair Launch Redefine Value Creation on Chain

49’35: The channels used to connect with Yuval & learn more about Digital Asset and Canton Network

Illustrated Transcript

Lex Sokolin:

Hi everybody, and welcome to today's conversation. We are lucky to have with us today, Yuval Rooz, who is co-founder and currently CEO of Digital Asset. Digital asset is one of the earliest entrants in the blockchain space for financial institutions. But the product has taken many turns and evolved in what is now the Canton Network. work. So I'm excited to learn more about Digital Asset and about that evolution, as well as from Yuval about his experiences in the industry. Welcome.

Yuval Rooz:

Thank you Alex. Thanks for having me.

Lex Sokolin:

My pleasure. So let's start at the beginning of your co-founding of the firm. What is it in 2014 that pulled you in this direction? What was interesting about that moment?

Yuval Rooz:

I think that from a background perspective, prior to starting Digital Asset, I was working at Citadel, and then right before Digital Asset, I was working for DRW trading out of Chicago.

And a lot of people in crypto specifically know DRW from creating Cumberland Mining, which was probably one of the first institutional crypto market makers out there. And my co-founder, Eric, is actually one of the guys who started Cumberland. And at that time, I was running for DRW VC, which is the venture arm of DRW. So, when DRW was looking into trading, making markets in Bitcoin, we were looking at investments related to the space. And the more we looked into the technology or the idea that you could actually run financial services without so many intermediaries that are not necessarily providing added value throughout the chain. We started thinking, is there a role for the technology more broadly within financial services? And that's, you know, the initial draw to leave DRW together with Eric to build some of the infrastructure that would enable that.

Lex Sokolin:

Who else was involved at that moment? How did it all come together?

Yuval Rooz:

It all got started with Don Wilson, myself and Eric. We later on met with Shaul Kfir, who at that time ran a crypto broker dealer in Israel called Bits of Gold, and in his studies in the Technion in Israel, was actually in the team that was working on creating zero knowledge proofs. He's one of the guys who wrote libSNARK, which is used a lot in Zero Knowledge. So, he had a lot of both experience in crypto, but also technical knowledge that was extremely valuable. So, we have added him on board. And then I think Digital Asset became very public later on when we made some hires. But that that stuck kind of core team that started the company.

Lex Sokolin:

In this moment. You know, Bitcoin is still a very uncertain asset, although people are now able to make money from it and is a very direct and obvious way that with mining you would be making money from participating in the asset class. You're literally getting paid for it. And here you are. You know, Ethereum is sort of maybe coming into the picture. You tell me if that was available in any sort of inspiration. But here you are saying we're going to rip out blockchain from Bitcoin and put the whole finance industry on it, you know.

Can you tell us about that very earliest idea and value proposition and the market's reaction to it and the counterparties that you had. Like how were you perceived in that early time?

Yuval Rooz:

Yeah, I think that that's a really good question. And it's a very good opportunity to explain why we at Digital Asset and as a result, Canton Network landed where we are. I think that when I think so, first of all, Ethereum was not in existence when we when we got started. And I actually think that when you think about Ethereum, Ethereum really mimicked Bitcoin. But for a platform of applications, meaning it took a lot of the assumptions of Bitcoin. And I'm happy to kind of talk about those, like the fact that the miners or the validators of transactions get to see what they are validating, the fact that, you know, you don't have privacy, you just have pseudo anonymity. The fact that it is the miners or validators in Ethereum that earn all of the reward, like there's a lot of very similar thinking between Ethereum and Bitcoin, which I actually think is the biggest problem in Ethereum.

And as a result of that, everybody else who have copied Ethereum is that it kind of took a single use case blockchain, Bitcoin, and tried to copy a lot of the assumptions into what I would call an application platform, which is, to me, not necessarily a good thing. We you said rip out the blockchain from Bitcoin. That's not what we've done. We were very much inspired by Bitcoin. The fact that you could create a financial platform with characteristics like you don't need necessarily intermediaries to send value from point A to point B, the fact that you could actually have financial ledgers that are available 24 over seven. The fact that you could settle assets in real time, the fact that you have no reconciliation across financial players, those are all, I would say, characteristics of Bitcoin that were very inspirational for us. But we asked a very fundamental question, which was if you wanted to do something similar to Ethereum. And I'm not saying, again, Ethereum was not in existence. If you wanted to do something similar, meaning, can you actually build a decentralized financial infrastructure for many assets and applications.

What are the fundamental building blocks that will be needed to make that successful? So that's where I draw the distinction. We did not just take, you know, some of the built-in assumptions of how the technology should work from Bitcoin and said we need to replicate that. We were just inspired by the financial characteristics and then set ourselves to kind of think, what would it really take to build such financial infrastructure.

Lex Sokolin:

Right. And I think what I'm doing is parroting some of the industry characterizations at the time, especially, you know, when you had this kind of sharp distinction between, let's say, quote unquote, serious companies going after large financial institutions, which include a digital asset, it included at the time, ripple and so on, R3 and then on the other side of the equation, you had the internet, people with open source and their dog coins and Ethereum and all of that. And so Digital Asset was one of the leading players that got a lot of kind of engagement and investment and traction on this idea from big banks. How did you do that? How did you get the banks to say yes. And then what is it that they said yes to?

Yuval Rooz:

I think the second part of your conversation is probably the best, mainly because I'm not sure that people knew what they were saying yes to at that time. But starting with, how do we get banks to say yes. I think it's very similar to today. I think that when you look at some of the early days of crypto, which is now changing for the better, you know, it was like, we don't need the banks, we don't need intermediaries, we don't need clearing and settlement. Everything should settle real time gross settlement. We don't need privacy. We don't need all of those things. And I think when you go to talk to organizations that have fiduciary responsibility, that are regulated, whether they like it or not, it's not really relevant. When you go to regulators and you say, we don't need all of those things that have been created over many years, and a lot of times there is a lot of rules or regulations that necessarily haven't adjusted to times and therefore are not necessarily the most efficient.

But at the end of the day, there is good intention for the most part behind some of these things. And you say, oh, you just need to throw all of it away. First of all, it just doesn't sound serious. And second of all, it kind of prevents you from working with those organizations. So, I think that what has worked well for a digital asset over the years is not saying, hey, I just want to replicate the financial ecosystem and just put it on a blockchain. It is saying, I think we can do things better. I think we can remove a lot of intermediaries that don't necessarily add value across the value chain, but we also have a lot of appreciation for the regulation or the responsibilities that you have to deal with. I'll give you just maybe a very simple example that I sometimes find that people don't even appreciate. But like one of the early assumptions and it's still is an assumption in the world of blockchains, is that data has to be fully replicated on Ethereum, on Solana, on most of the permissionless chains, the model is inherent and you go to some jurisdictions, for example, Switzerland, which will tell you data cannot be replicated outside of Switzerland.

Actually, if you go and talk to cloud providers, they do all of their high availability within Switzerland. Why? Because that is the law. So, if you come to the world of regulation and again, whether you like it or not, and you come with these broad statements without understanding the subject matter, I think you're going to run into resistance. And even if you don't run into resistance later on when the rubber will hit the road and you would actually have to do things at scale, you're going to have, you're going to meet people that are going to say, this just doesn't work. So, I think that that's a very long answer to kind of explain, you know, how we've approached the problem, but also why I think we've received positive feedback from some of the people that we've talked to.

Lex Sokolin:

You know, a lot of the large existing industry has very big sets of requirements. And I remember in the early days, going to a digital asset presentation in New York, where I think it was somebody on your product team that was talking about these extremely large and detailed requirements and trying to build around them.

You know, you had Blythe Masters involved at that stage as well, which I'm sure opened lots of doors to the big banks. There was the engagement with the Australian Stock Exchange, where an entire capital markets exchange said yes. Redo me. If this works, we'll switch over to completely new blockchain rails. And I think a lot of the industry was seeing this as the path, like it was going to happen by 2020, that equities were going to trade on chain. And you know, at the time I was, you know, on Ethereum at consensus, where I ran the fintech and DeFi product teams, and we had a huge enterprise push with enterprise, Ethereum and Quorum into this space in many ways, kind of from the signals that companies like Digital Asset were sending out into the world. Can you talk to me about again, like securing and closing down those technology projects? Like what were they who bought them, how were they priced? And then maybe a little bit of a preview of how they went.

Yuval Rooz:

Listen, I think that generally speaking, when you do a very large tech transformation, You need to have someone who is willing to take risk in order to create change that most people don't see. I mean, when you look at the incentive structure at large organizations, for the most part it's not aligned with disruptive innovation. Most publicly traded companies want to have, you know, predictable earnings. They want to know what their cost is. What is their revenue. And they're not designed, generally speaking. I mean, we see a lot of large organizations talk about innovation. But generally speaking, I would say it's innovation around the edges rather than like really, really disruptive innovation. And therefore, to do these types of projects, you do need to find that that individual or a set of individuals that can actually see the vision and they want to optimize for something beyond just, you know, the earnings of the next quarter or after. They want to create a transformation because they believe that they can actually create an idiosyncratic type of change for their organization.

Right. And in order to do that, first of all, I can kind of going back to the previous question. You need to understand their business. You need to understand, you know, where they make their money, where they spend their money. You need to understand how this technology could change it and how we would change it. And I would have to say you mentioned the project in Australia. I mean, those were early days. Most of the technologies were not even built. So there, you know, I give a lot of credit for the individuals at the time that were willing to take that kind of risk. I think that the lesson learned from me is taking on such projects before the technology is ready and at the same time trying to, as you mentioned, move an entire equity market from the ground up over a weekend is not something I wish on myself and anybody else ever again. And, you know, there's definitely a lot of lessons learned there.

Lex Sokolin:

Can you give any specifics in terms of, you know, how many projects like that you were working on and then like what it was like to build a team around that? You know, like, what's the cost of a project like that? And then where did it work and where did it not work?

Yuval Rooz:

Yeah, there's a lot. So, I mean, how do you price a project like that? There are many other service providers that provide these kind of technology solutions. So, I mean, there were ways of thinking about it. There was some innovation to do it slightly different than what was, generally speaking, available. We had to build a whole team locally of people that actually understand the Australian market, which from an equity perspective. Those that know equity markets would know that the Australian market is very different. Then the rest of the world. It really started by how do we analyse really all the all the small details of how the Australian market works? You know, we're talking about I cannot share from our customer's perspective. I have seen numbers being quoted in the hundreds of millions of dollars. I can tell you that Digital Asset did not receive those sums. We had a fairly lean team in Australia. And, you know, we've built more around people that understand Australian markets. And then the rest of the core technology was built in Switzerland, which is where most of our R&D takes place.

And maybe, maybe lets ask one more question, being more specific. I think that if you kind of understand what the project was with Australia, It was literally, with the exception of trading, replacing all the infrastructure related to clearing and settlement of Australian equities. And it was doing all of that over a weekend. Right. So, you can imagine that if you're turning the project to look like, you know, a space shuttle launch, meaning everything needs to be perfect over a very short window of time, you can imagine that the planning and the execution of something like that has to be perfect. The reality is that my view is that doing a migration of an equity market shouldn't be compared to a launch of a space shuttle, and that's saying that it's not as important or you shouldn't get things right. But the fact that when you're launching a space shuttle, there's either the space shuttle goes to space or nothing else. It's kind of like a binary outcome, where migrating an equity market from one technology to another could actually be broken into multiple components.

You don't actually have to migrate the whole thing in one go. And I think that, to me is the biggest lesson learned is that we really push our customers now, even when they have a very grand ambition, is to do those migration and incremental steps. And I think that the reason for that is multiple one. I've just learned that when you tell your investors, when you tell your employees, when you tell your customers to wait for so long, they lose interest. We live in a world where people don't have patience. They want to see results. And when I say results, the results could be really small. So, the fact that you are capable of just continuously ship and deliver, you keep your constituents engaged. And that's a very positive thing. Second of all, I think that when you do these very big bang approaches, you end up making perfection be the enemy of good because so many things have to work perfect. You end up delaying that time instead of just doing things that are good.

They're not that the consequences of having an issue would not be so catastrophic. So, you actually can-do things much faster. And also, the last thing, which is related to what I just said, is you learn by actually delivering when you actually let people use the technology, when you let people operate the technology, you learn. And if you think from moving from traditional, you know, traditional database now to doing things using smart contracts and DLT, you can imagine that there's a lot of lessons learned from actually using the technology. So I think that that, hey, let's actually put our hands on the technology in production use. It brings a lot of lessons learned that could have later on reduce a lot of risks from the project.

Lex Sokolin:

That makes me think, fairly or unfairly, about the example of the cathedral in the bazaar, right? Or agile product development versus waterfall product development, where on the one hand, you can have the chaos of open source, where lots of people come in, lots of people come out and there's sort of like loose coordination through a social layer and markets and, you know, over time things kind of clump together to be bigger and bigger and bigger, you know, and I think one of the advantages that the public blockchains had was not that they encouraged it, but they certainly allowed for people to lose money.

There are billions of dollars’ worth of hacks, fishing, you know, DeFi, smart contract exploits and so on that behave as risk capital in order to steel man the public chains. On the enterprise side, it's always been so much harder because you do have these customers that you know for whom the margin of error is like zero. You can't make any mistakes. You're not allowed to have any phishing or any crime or any hacks. Right? Like we can't have that as a financial institution. And so you do get stuck in this kind of big bang, huge delivery of something that's really, really complicated. And then you've got the dynamics of people who approve the project over the years, you know, leaving that firm. And the whole thing becomes just a kind of a complicated mess.

Yuval Rooz:

That's a really good point. And I think that maybe it's a good kind of like transition into Canton. So, since we launched Canton, exactly. To your point, one of the things that we are trying to do and purely as a market participant is how do you get now a fully public chain that is truly decentralized to behave as much as agile as possible from a development perspective? Because I agree with your point about public chains, and I actually really like your comment about risk capital.

I think it's a very good one. But even in public chains, I think that I'm seeing there still is this waterfall approach. And then and then what ends up happening is that some of these releases end up becoming almost terrifying, right? They become like this, like such a big event. One of the things that we're trying in Canton is really to have continuous upgrades, as if we are all doing agile development on a fully decentralized network. And I think a big part of it is to create this muscle memory of, hey, there's still a lot to do, there's a lot to develop, and we need to get used to as a decentralized network. To keep on improving the network rather than to wait to like this multiyear kind of like events where we do like this massive upgrade.

Lex Sokolin:

Let's leave the enterprise era and kind of close it out. Right. I think we have the answer, which is that it wasn't up to financial institutions to innovate. There are adopters of technology that's ready, and largely they're adopters of technology that's already profitable and works.

They're not super good at, at least in my opinion, of doing the R&D, of having that budget, of having that persistence and the way that big tech is. And so, the growth of, at least in my view, most of the crypto world has happened outside of kind of these early efforts and these consortia, you know, whether it was the R3 consortia or the Ethereum Enterprise Alliance consortia, like it's been very challenging looking back at that moment. Do you think there is anything that we as industry players could have done differently to get better hooks into commercialization and into the banks, and to just make more of it real. Earlier on.

Yuval Rooz:

Listen, I think, and I take also responsibility there. I think that this goes back to appreciating the challenges that those that we want to eventually plug into have to deal with. And that's why I was always surprised that crypto just said, we're just going to ignore what financial services are. We're just going to put everything on chain. Everything's going to be on chain.

No privacy. Everything will settle in real time. And life is good, right? Like. And I think that if the industry didn't necessarily and again listen, I think at the end of the day if you want to innovate you need to have bold vision. I don't I don't discount that. But I think what the industry, in my opinion, missed big time is what is the end goal for the sake of what? And it was always life is good. Coins will just go up. And it was like, but why? Like you know it was I never I've always thought that like the fundamental like economics were never kind of like discussed like people would just say, I don't understand why you need to, like, settle it at T plus one. Why can't we just settle everything in real time? Oh, and then, you know, a few years later, people in crypto realize that it's not very capital efficient to settle every transaction in real time. And now you're seeing that exchanges centralized volume.

They don't put everything on chain. And I feel like the industry as a whole never look back at Lex and ask the question you just asked. Right. They would make big statements. Those statements would get invalidated, but nobody would ever go back and say, hey, can we learn from our mistake of making statements that didn't really make sense and think about, how do we not do that again? And I feel like the industry as a whole just moved from one, one kind of like pump story to the next without asking the question you just asked. Which I think that at the end of the day, economics and physics will prevail and things need to have a business reason in order to succeed long term.

Lex Sokolin:

That's human nature, isn't it? I mean, just as an aside, I think the most hilarious development is Ethereum layer twos, batching transactions and settling them back onto the layer one in a way that reminds me like almost directly to uploading, you know, giant like CSVs of data on overnight FTP process, which is the exactly the same thing that big banks get ridiculed for.

And now we've got the same batching mechanism on a bigger scale. But putting all that stuff aside. So those were the early days of digital asset. One of the interesting things that you guys did was DAML, which is a programming language around these financial use cases, which I thought was very forward thinking at the time. And there's been a ton of transformation of the company. I mean, Blythe is no longer with a company. You've got kind of a different vision. You've got a network. Can you walk us through what happened after those early days and what the focus of the company became?

Yuval Rooz:

The way I think about Canton and DAML is that DAML and Canton are effectively two sides of the same coin, in the sense that they have this world view of what does it take to build decentralized finance? One is from a ledger perspective, and one is from a language perspective, but they effectively represent what we say is the same ledger model. DAML was, earlier from a label which was the language. And because there were all these ledgers that were popping very early on, we didn't want to launch Canton until Canton was what we would call ready for prime time.

I think you see the challenge like today. I think that it would be almost impossible for Ethereum to kind of gut renovate its ledger model, to have scalability and privacy built into the ledger. You would effectively have to start from, from zero. And I think that when you go with these products and you think that you're going to put all the financial services, and it's kind of like in the early days it looks like it's going to work, but then you're starting to get to scale and complexity, and you realize you didn't think about a lot of things. You run into challenges, and we've seen multiple ledgers that have run into these problems that, you know, doing like the simple kind of monopoly game on chain. It works really nicely and it's like really easy to do. And then you go like, okay, but now I want it to start to look more and more like the real world and you start running into challenges. So we've kind of been developing Canton behind the scenes very quietly, and in order to monetize and kind of get, you know, developers to understand how to write and think about, you know, distributed ledgers or blockchains.

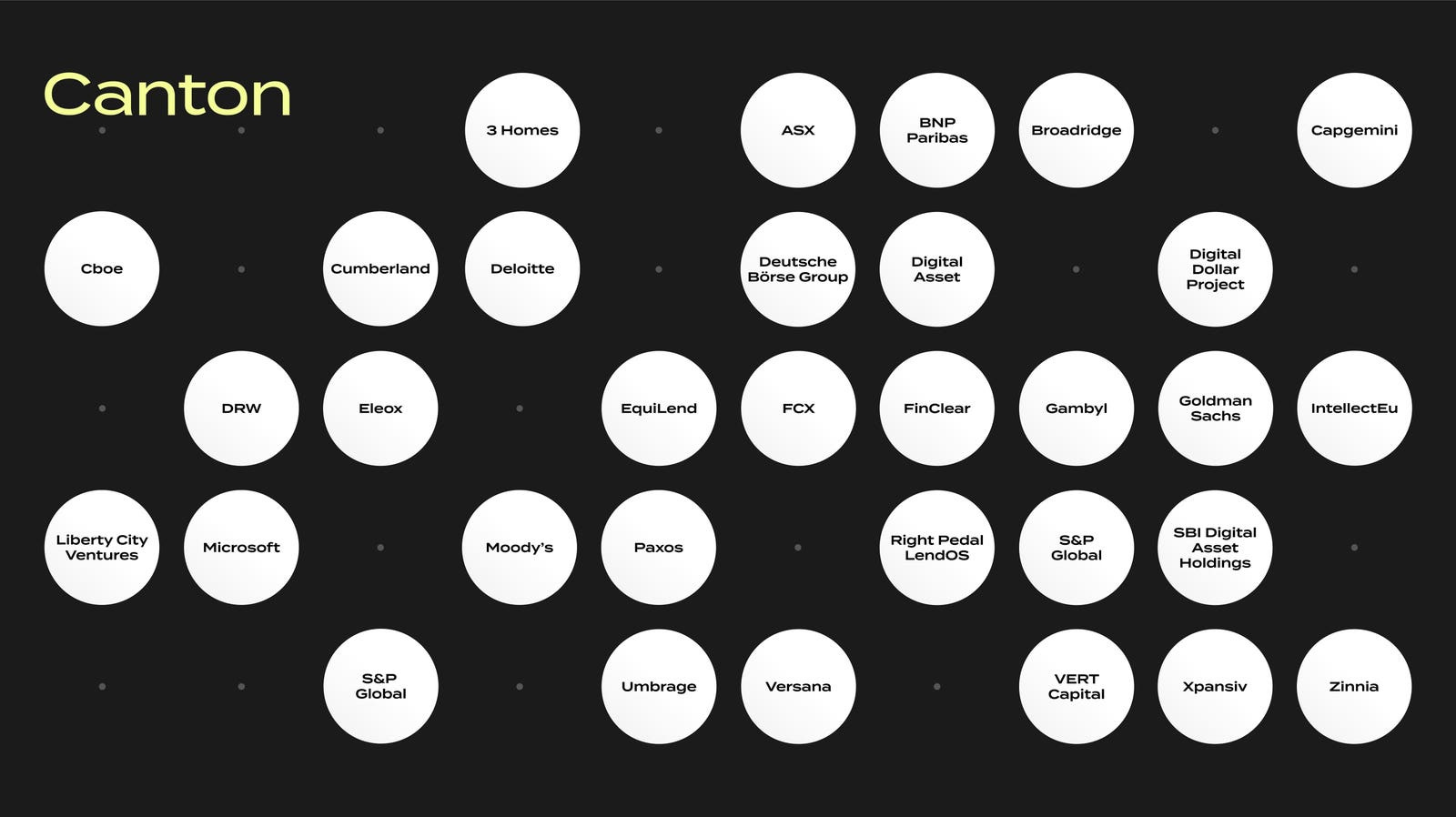

The way that we think about it was to introduce them to DAML. And what we've done in the early days is compile DAML down to different ledgers. And by doing that, we were able to kind of get the mindshare of customers, developers, and quietly behind the scenes. We've been continuing to develop Canton. Then in 2020, we had the first version of Canton, but again, before we wanted to launch it as a fully public network, we wanted to again make sure that it does what we think it could do. So, in 2020, we started onboarding clients that would use DAML just on top of Canton. And that worked really well. I mean, today there's north of 30 enterprises that are using DAML in Canton, and somewhere in mid of last year, we got to the point where we believe we have all the features that are needed to launch a fully public network based on DAML and Canton. And, you know, I think that we've launched it in a very different way. The Tokenomics is very different than other public chains.

I'd say the governance is very different than other public chains. And, you know, going forward, you know, the evolution is going to go in an interesting direction, where now we believe that there are ways for us also to open the ledger for other languages beyond just DAML. So, you're also going to see Canton later on. Be able to have other languages being compiled as smart contracts into Canton.

Lex Sokolin:

Can you talk about the clients that you have? And the use cases that you're powering. And then, you know, any sense of kind of. Volumes through the network?

Yuval Rooz:

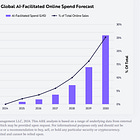

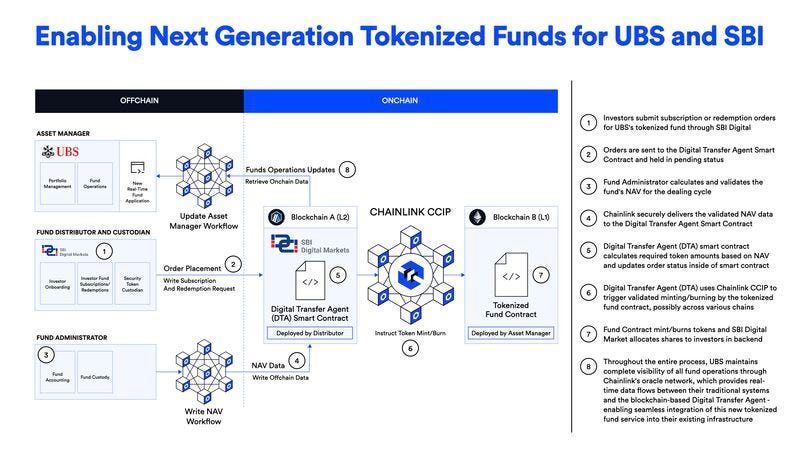

For the most part, I would say that big use cases are very heavily skewed to capital markets all the way from repo. One of our clients have tokenized north of $2 trillion worth of U.S. treasuries. They're processing at around $100 billion of repo transactions every day. And I think by the end of this year, they will be in the multiple hundreds of billions of dollars of repo transactions. We're doing securities lending on chain. We have one of the largest mortgage originators issuing mortgages natively on chain and then settling them when they sell them to other counterparties.

We're doing commodities post-trade at a pretty significant volume of the daily volume in the US. We have a life insurance that does life insurance and annuities natively on chain. Private equity and private credit funds managing the entire lifecycle events. And maybe I'll pause here because I think that, you know, all of those things would fall into the category of tokenization, where I think that we think of tokenization as something very different. I think that most of the tokenization stories that you're seeing out there is really people are still processing transactions and assets in the old traditional way off chain on their legacy systems. But then they put like an ownership token, like an IOU token on chain, and they're saying this is a tokenized something. We don't believe that. That's tokenization. And honestly, we don't see that as a big value to the world. To us, tokenization can we actually make that change. The books and records of an asset. And, you know, this is a whole different conversation on why that matters. But we believe if we really want to transform financial services and really kind of give, you know, make traditional finance operate like some of the DeFi protocols, you cannot do that unless you put the books on records on chain.

And in order to do that, you need the chain to have, you know, the privacy and scalability characteristics for that to even be possible. So, you know, those are the types of use cases from a transaction’s perspective, I would say Canton today is probably top 20. Getting close to top ten chains. From a fee’s perspective, one of the challenges, Lex, is because of the privacy. You don't just get to see everything. But what we're doing right now is we're working with companies like Kaiko, for example, or other market data providers to allow some of the metadata from these privacy projects to surface up. So instead of saying, hey, here are all the parties that are doing the repo transaction, can we actually surface how much repo volume is happening on that use case? So, you kind of surfacing metadata around that activity. And I think that if we were to publish all of the projects into the likes of the Tie or, you know, RWA.xyz, Canton projects would take the top ten RWA projects on those websites.

Lex Sokolin:

I think that's a really important point you're making about what is tokenization and just to kind of reopen up what you're saying. So, I think primarily for regulatory reasons, but I want to be corrected on this. Most things that you see that are real world assets on chain are in fact, like you say, are just tickets to assets that are kept in a traditional ledger or in a CSD, you know, in the way that these securities have to be kept. And what's happening for most of these companies is that, you know, you've got legal paper, maybe you've got an account with some institution that does the actual custody. Maybe you have the regulatory status to be able to hold that security on your own ledger. But, you know, that has to be treated in some particular way that doesn't allow it to be a blockchain. And therefore, like what you're really doing is you're constantly synchronizing a really old school solution with what's supposed to be this immutable, fancy, new futuristic solution, but is, in fact, now you've just introduced complexity, and you can have breaks between the synchronization of the quote unquote tokens and the underlying securities.

Is that really a technology problem or is that a industry structure regulatory problem? And if it's a regulatory problem, you know, how did you get around it?

Yuval Rooz:

So first of all, kudos because you're one of the first people, in my opinion, that was able to state what you just stated. I think I wish more people in the industry would have the appreciation to what you just said. First of all, kudos. Kudos on that. I think I think it's a bit of both, but let's just take this idea of a transfer agent, for example, or a CSD at the end of the day. I think you need to think about it as the reason why those parties exist is because there's also an element that a regulator would want to be able to go to one entity and make sure that they can get the information that they need in order to regulate a market. And I don't think that that is going to change. I mean, you can't expect a regulator which is which generally, generally speaking, is not necessarily a body that has endless amount of resources and has the ability to, like, just go and say like, oh, I'm just going to regulate a decentralized network.

How do you even do that? There's a reason why certain entities have more fiduciary duty than others. And it's really just to help kind of distribute. How do you govern these large networks. And I don't think that that is going to change. That being said, I think that you could still have something like a transfer agent, which their node on the network is going to be the legal ledger of the asset but still be able to operate on a fully decentralized network where they don't become a bottleneck for innovation or composing those assets within other DeFi protocols and other things. Right. So, you could still have something like a CSD, you could still have something like a transfer agent, but that actually operate on a much more modern architecture. And like I said, enable this innovation where I think in today's world it's just that the architecture does not allow it. So, when you're asking me like how did we enable it is again, we didn't come at it from saying, oh, these people just don't provide value.

I wish they were gone. We need to change the regulation to make them disappear. We're asking where is their value to the network and where is the architecture that is currently preventing innovation? And how do we make those two things work together? That being said, I mean, the bonds that we issued with Goldman for the European Investment Bank didn't have a CSD. Actually, the ledger is the CSD. So, I think I think that, you know, I can see both working, but I also like if someone says to me like, what's the value of a CSD? I can see the value. Again, if you're trying to regulate something that has $40 trillion worth of assets. It's easier as a regulator to go to one entity and say, well, I'm holding you accountable to keep things correct. Right. You could still then use this modern architecture to open up for innovation and bring much more value to the markets at a faster pace than you can today.

Lex Sokolin:

That makes sense. And so, what's your go to market strategy is part of it, to try and convert the lower-level players into being adopters. Or are you starting with the top of the value chain and the banks? Because it sounds like you're putting through large institutional volumes. How do you start to unite the industry onto the network?

Yuval Rooz:

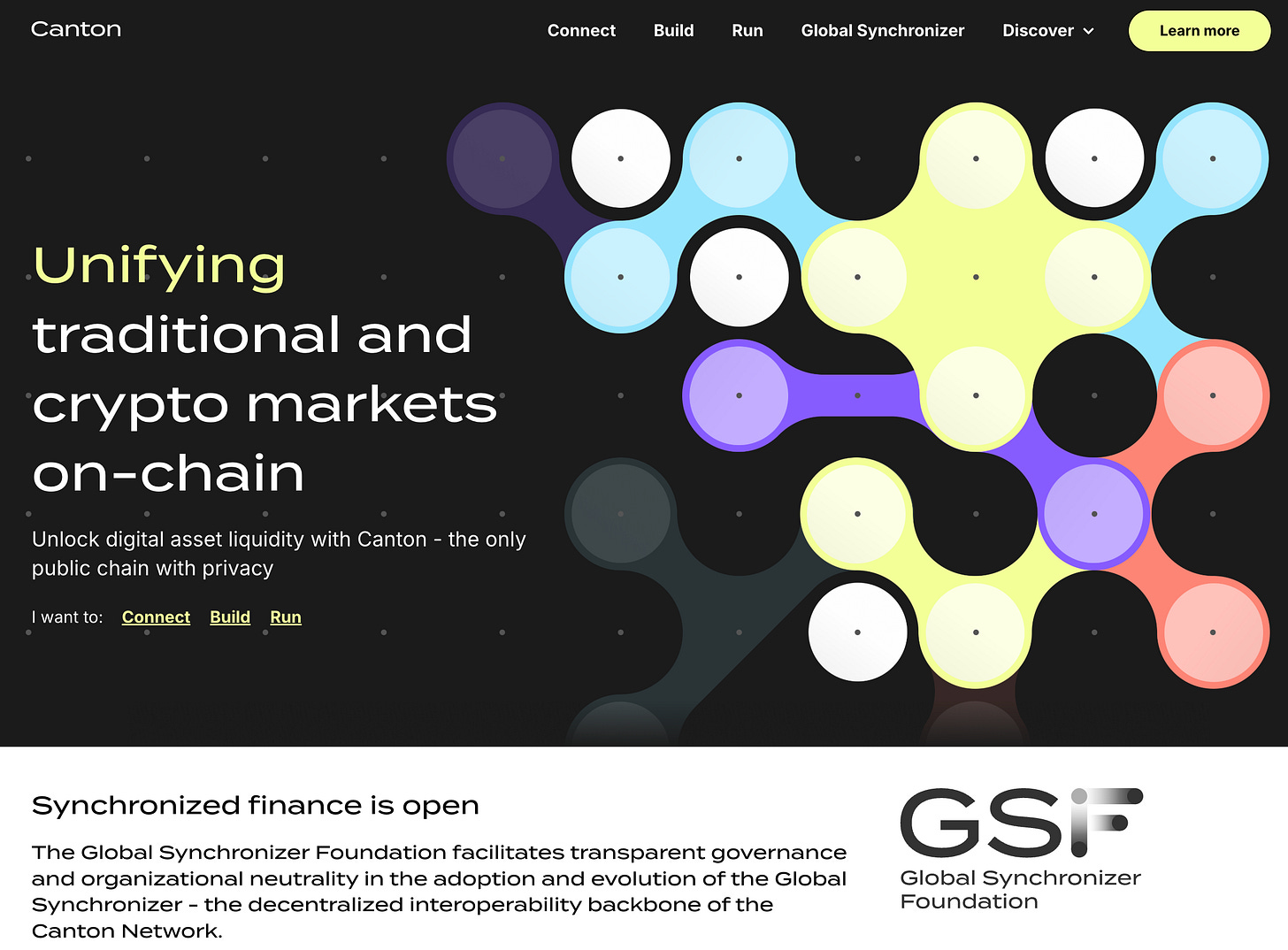

The best analogy that I can think of is if you think about what Plaid did to fintechs, right. Like if you were a fintech in around 2000. You know, post financial crisis. You really need it to have access to a core banking system. But you as a fintech. It was very hard for you to or not even very hard even when open banking was introduced. It would be financially impossible for a small fintech to go and integrate into every core banking system. Just not realistic. So, what Plaid did is they said, you know what? We'll do that work. We'll integrate to all the core banking system. And now if you want to build a fintech, you can just come to plaid through one place.

So, the reason why I'm saying that is our strategy is to find what are the highest quality assets that can fuel kind of like this true Web3 on chain finance. So, if you think about all these DeFi protocols, wouldn't they love to do asset-based lending and have access to US treasuries or to Eurobonds or to gilts like currently. They can only do that on crypto assets because that's all that is truly available on chain. So, the strategy that we're trying to do is we're trying to think, how can you, in a responsible way, bring high quality assets into Canton and then allow people to innovate because they know they can get access to these assets in a very seamless manner? So, you've seen an announcement with Europe earlier recently. Hopefully you will see soon. I mentioned the private equity. We're working with Eye Capital on bringing, you know, all of their assets. We're doing life insurance, annuities, mortgages. So, what we're trying to do is we're trying to go to the source where these really high-quality assets are being generated and then allow people to build really innovative Web3 applications that can consume those assets that now exist on the network.

Lex Sokolin:

How do all these players get permissioned into the network? You are dealing still with the global financial market, different regulatory regimes, and then, yeah, I assume everybody's different.

Yuval Rooz:

That's the quality of Canton. And by the way, that's the reason for the name Canton, right. It's not an access or privacy model one size fits all. Every issuer, everybody who wants to bring assets into the network, think about them as like their own Canton. They get to set their own rules. So, if you are whatever issuer X, Y, Z, you can codify the asset to have whatever properties that you want on Canton. You could issue a stablecoin and you could say, I don't care. You do whatever you want with it, embed it in whatever product. I have no control over this asset. Once it's in your wallet, you could do that. Or you could come and say, well, if I am issuing U.S. treasuries into the network. I have very strict rules of how this can be embedded, and what are the rights and obligations associated with you embedding it.

So that's one aspect which is really a very unique characteristic of Canton is that you don't need to do all kinds of like smart tricks with like multi-sig wallets. You could actually just build the rights and obligation into the asset and know that they will be enforced on the chain. That's one. And then second of all, Canton has a truly open and decentralized governance. The super validators think about them as the miners of Canton are. I think there's 26 now that are all equal to one another. The Linux Foundation is the governance body that facilitate governance. You know, there's all kinds of rules for the network. The rules are determined by those super validators. They can decide that market participants are bad for the network, and they can. There are rules of how to vote in favor or against, you know, so that and they meet on a regular basis. Again, back to my previous comment around muscle memory. I think I think the super validators almost meet like every other week to discuss, you know, topics about the network, how to progress it, what, what is needed, how, how do we change it.

And that's just kind of both from a network perspective, but also from an issuer perspective. How do we kind of bring more and more assets in a responsible manner to the network?

Lex Sokolin:

So I want to close on two things that you had mentioned, one being economics and fees generated by the network. And then second, you mentioned a public launch. Both of those are interesting. I'm sure it's an investor, and I'm curious to understand it from the perspective of, you know, what does a public launch actually mean? Like is there a token that anyone, anywhere can access and purchase? And then in terms of the fees, like how do you charge and to whom do the fees go? In the design of hands on.

Yuval Rooz:

Yeah. Let's start with the latter. So, and I think I mentioned earlier that I think Ethereum copied Bitcoin. And then from there everybody else copied Ethereum. Again, if you think about bitcoin Bitcoin is a single use case chain. And it makes sense that those that secure that use case earn all of the fees for doing as such.

I think that when you start thinking of smart contract chains, it's more of a platform. And I think that because the tokenomics again, go only to the miners or validators you have as an application on the network, there's really nothing that incentivizing you to stick around unless you, you know, want to. And what I mean by that is imagine that you are like the number one DeFi protocol or decentralized exchange, and you're just generating fees and fees and fees and fees for the network, but you don't see any of it. At some point, you're going to go like, you know, I can just launch my own chain. Why do I need those people? There are all the bridges. People have the same wallets. To be honest, if I'm EVM compatible, I'll, you know, it wouldn't be very hard to integrate to all the wallets. So why do I need to stick around? And, you know, you've seen that. I mean, you've seen Uniswap launch their chain.

Like how many chains have been launched by operators of apps in the last year? And I think it's because they don't have anything from a tokenomics perspective that keeping them loyal to the chain where they got started. And I think that that to me was always very particular, because when you look at generally speaking, platform plays and not crypto. There's a very big incentive structure to those that actually bring volume or fees to the platform. You can think of influencers on social network. You can think about interchange on credit card networks. You can think about, you know, app stores like all of those, those that actually bring the value get rewarded. And the platform takes a fraction of the fact that it is running and operating, you know, that platform for you. So, in Canton, it's actually the users and the apps that take 70% of the block reward, where the super validators long term actually gets only 30% of the block reward. Now, it's not to say that the super validators are not important. They're extremely important.

No different than if you didn't have ISPs. The internet wouldn't exist like they do exist. They are important and they do get rewarded. But you know, they don't go on podcasts, they don't go to conferences, they don't think about new business models, they don't spend money on marketing. And they are not the ones that eventually bring the activity to the network. They enable the networks for working to work, but they don't do that work. So therefore, we believe that their job is a commoditized job, and they get rewarded for it. But we believe that most of the reward, the block reward, goes to those that actually make the fees and a network tick. So that's just one thing. And we can, you know, maybe at a different discussion, go specifically how the tokenomics enable it. But that's that to us was a very important part of the tokenomics. Second of all, who gets paid? I mean, apps charge fees, the super validators charge fees to make transfer on chain.

And yes, there is a utility token called Canton Coin that enables all of those transactions with respect to the public launch. Again, given the fact that we wanted to draw, you know, institutional organizations and we don't ever want to be tainted with. You know, we made promises to retail investors and didn't make up for it. We did what Bitcoin did very well in our opinion. Is the value of the token should reflect the utility and what people believe in it. So, last year we did a fair launch. 16 organizations came together. They all had to agree to. Launch the network. And the day that that network got launched, there were zero tokens. And. There's a minting curve. We didn't do a premium. We didn't sell tokens to anyone. So, you know everybody, everybody who owns Canton Coins today unless they bought them. As a secondary after the fact, have done work to earn the tokens that they have today.

Lex Sokolin:

Fascinating. We could definitely go on. And I'm really excited that this vector of innovation has been working out and is really transforming the industry from the inside. I think that's great. So I'm excited to keep up with all the developments coming out about Canton and looking forward to it. And thank you so much for coming on the podcast today. If our listeners want to learn more about you or about the company, where should they go?

Yuval Rooz:

Our website is digitalasset.com. Canton network is just Canton.Network. And yeah, follow me on Twitter, LinkedIn and feel free to reach out.

Lex Sokolin:

Thanks again.

Yuval Rooz:

Thank you Alex.

Postscript

Sponsor the Fintech Blueprint and reach over 200,000 professionals.

👉 Reach out here.Read our Disclaimer here — this newsletter does not provide investment advice

For access to all our premium content and archives, consider supporting us with a subscription.

Share this post