DeFi: MetaMask Card launched with Mastercard, Apple opens up NFC pay

Will millions of people use crypto to pay in the off-chain world?

GM Fintech Futurists,

Today we highlight the following:

PROTOCOLS: MetaMask Card Brings Crypto Payments to the Real World

CURATED UPDATES: Financial Institutions and Adoption; DeFi and Digital Assets; Blockchain Protocols; NFTs, DAOs and the Metaverse

To support this writing and access our full archive of newsletters, analyses, and guides to building in Fintech & DeFi, subscribe below (if you haven’t yet).

PROTOCOLS: MetaMask Card Brings Crypto Payments to the Real World

MetaMask and Mastercard have teamed up to create the MetaMask Card — a debit card that connects directly to the owner’s MetaMask account. The wallet has most recently reported 30 million monthly active users.

The card allows users to spend their digital assets anywhere Mastercard is accepted, bridging the gap between crypto and real-world payment rails. The product is initially available as a limited pilot program to a few thousands users in the UK and European Union, with plans to be fully open within these regions by the end of the year.

Here is what happens under the hood — (1) embedded fintech company Baanx acts as the card issuer, (2) Mastercard provides the payments network, and (3) Linea (an affiliated Layer-2 network) powers cheaper and faster transactions. At launch, only USDC, USDT and WETH will be supported, with the list set to expand in the future.

Users will first delegate eligible tokens to their MetaMask Card, where the funds will remain in self-custody until they are needed for transactions. At that point, the crypto is converted to fiat currency through Baanx, and the purchase is processed and executed as with any normal transaction. For USDC and USDT, the only fee to off-ramp is the Linea gas fee, which is usually a cent or two. Users that delegate WETH or other non-stablecoin tokens will be charged the gas fee plus a swap fee of 0.875% of the total amount.

This is a material step in bridging traditional and decentralized finance.

In the short-term, Web3 users can remain non-custodial while using their onchain funds for commercial activity in the real world. Additionally, users can avoid expensive offramp fees for stablecoins — typically 1-2% — and the associated delays that can take over a day to process. Longer-term, we see this as a stepping stone for self-custodial digital assets savings accounts, enabling users to make the most of on-chain yields for their digital assets, coupled with payment functionality.

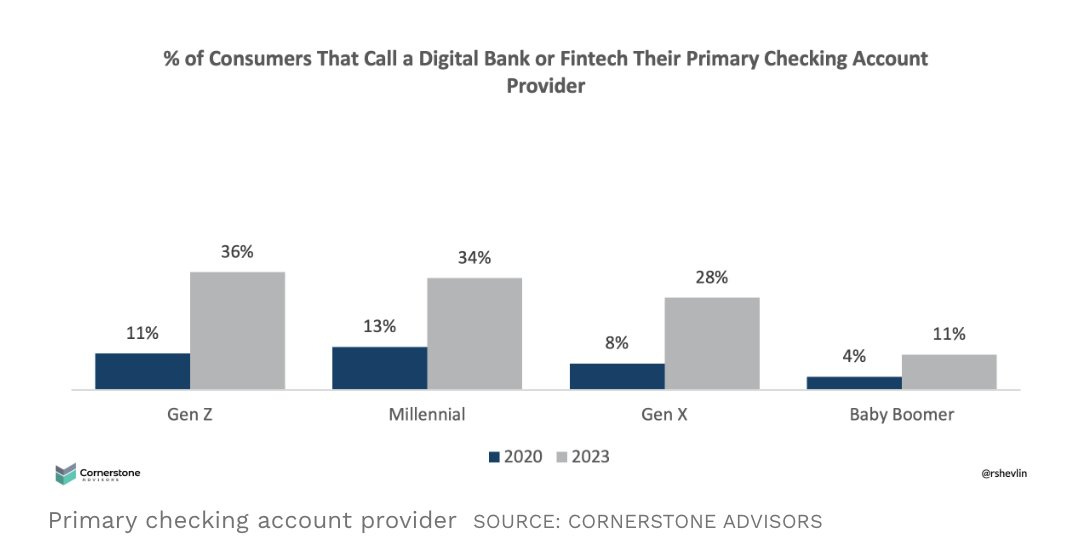

Another way to put it is that primary bank accounts are already transitioning from regular banks to neobanks, and may soon enough end up in DeFi. The rewards of being the primary bank account are substantial.

We expect that this is a new vector of competition for crypto wallets, and MetaMask needs to fend off competition from newer entrants. Of particular note is Coinbase Wallet, which has been able to leverage the user base of Coinbase and its affiliated Base L2 network. This connection draws users, who in turn attract developers that create a growing app ecosystem.

Currently, Base is the second largest L2 by market share (17.2%) and typically the most active with TPS frequently in the high 40s — Ethereum in comparison currently sits at around 12.6 TPS. MetaMask has a similar opportunity if they can effectively draw in their users to use Linea as the default L2. For context, Linea currently sits in 7th in TVL with a 2.33% market share and 15th in TPS at 4.6.

We also see a broader shift to real-world payments connected to digital assets.

Apple’s iOS 18.1 for developers will offer in-app contactless transactions using the new NFC and SE APIs. These APIs enable wallets (fintech, not crypto) to be created for in-store payments, and other items like home keys, hotel keys, reward cards, or event tickets. To incorporate the solution into iPhone apps, developers are required to enter a commercial agreement with Apple, and approved vendors are granted permission to use the relevant APIs.

As a result, we could see companies combining Fintech with DeFi, and launching iOS wallets that support USDC and other stablecoins. Prior to this change, the only payment apps or wallets that used NFC on iPhones were the default Apple Pay and Apple Wallet.

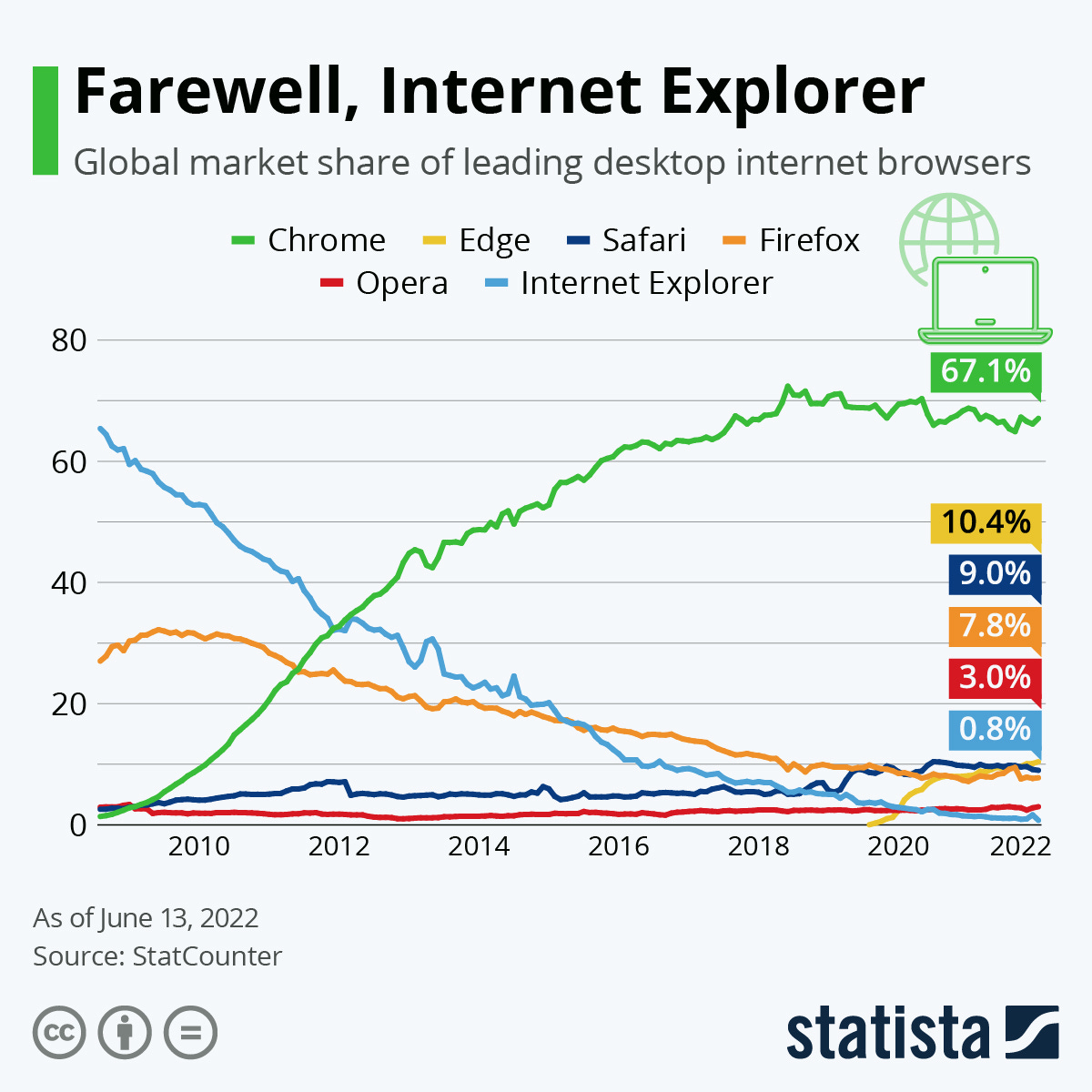

The story brings to mind the anti-trust proceedings against Microsoft in the 2000s, which sought to unbundle the Internet Explorer browser from the Windows operating system. By default, Microsoft pre-installed the browser and office productivity software into its system and made it difficult for competitors to become the primary alternative. Losing this case allowed Chrome and Firefox, among others, to thrive.

Now, new wallets can be added to iPhones, challenging Apple’s monopoly on payment processing within its devices, and providing an opportunity for new wallets to emerge. However, the limitations on what can be built and how it is approved by Apple are still high and onerous.

Overall, this topic is a compelling blend of old and new finance. For Consensys, it could help boost Linea adoption and bring the MetaMask closer to the chain, akin to the strategy deployed by Coinbase. However, whether there is significant demand for users to leverage their stablecoins for commerce remains to be seen.

👑Related Coverage👑

Advertise with the Fintech Blueprint

To reach 200,000 decision makers in financial services, Fintech, and Web3, reach out to discuss sponsorship opportunities today.

🔥🔥🔥 Contact us to discuss options 🔥🔥🔥

Long Take: Will Fintech, TradFi, or DeFi win the $170B stablecoin market?

We explore the resurgence and evolution of stablecoins, highlighting Tether's extraordinary profitability due to rising interest rates and a lack of competition.

The stablecoin market has rebounded to $170 billion, driven by use cases in capital markets, value storage, and payments, particularly in regions like South America, Africa, and Asia. Despite regulatory fears and market consolidation favoring Tether, new entrants like PayPal's PYUSD and projects like Ethena and MakerDAO's Sky ecosystem are innovating in the space. The future of stablecoins lies in their integration with various venues, from crypto exchanges to fintech platforms, and their potential to capture a larger share of global financial assets.

Curated Updates

Here are the rest of the updates hitting our radar.

Financial Institutions and Adoption

⭐ Bridge raises $58m for stablecoin API to enable real world B2B payments - Ledger Insights

Franklin Templeton’s Blockchain Fund Launches on Ethereum Layer-2 Arbitrum - Decrypt

Tokenization Pioneer Centrifuge Unveils Lending Market With Morpho, Coinbase - CoinDesk

Why Coinbase and Ethereum Network Base Are Taking Over Liquid Death Packaging - R\Scene

DeFi and Digital Assets

⭐ Chaos Labs Raises $55M as Demand Grows for On-Chain Risk Management - CoinDesk

Quidax Becomes Nigeria’s first SEC licensed Crypto Exchange - The Block

Solana Restaking Protocol Solayer Closes $12 Million Round Led by Polychain - Decrypt

PayPal USD Surpasses $1B Market Cap Amid Solana DeFi Incentives - The Defiant

Bitcoin Fees Skyrocket After Babylon Launches Native BTC Staking - Decrypt

Blockchain Protocols

⭐ Story Protocol Developer Raises $80M Series B, Led by A16z, for Intellectual Property Chain - CoinDesk

Edge Matrix Chain raises $20 million in funding led by Polygon Ventures, Amber Group - The Block

Blockchain Developer Alchemy Buys BWare, Pushing Into Europe, Adding About 25% to Staff - CoinDesk

NFTs, DAOs and the Metaverse

⭐ OpenSea Expecting SEC Lawsuit Over NFTs Being Securities, Says CEO - Decrypt

Magic Eden Reveals ME Token That Can Be Claimed Through Its Wallet - Decrypt

Telegram Launches New Ways for Creators to Earn TON Tokens - Decrypt

Double Jump.Tokyo Raises Over $10 Million From SBI and Sony Group - Bitcoin.com News

Exclusive: Microsoft-backed Space and Time raises $20 million to merge AI and blockchain - Fortune Crypto

Trump's Latest NFTs Top $2 Million in Sales—With Only 5% Sold So Far - R\Scene

Telegram Game 'Hamster Kombat' Reveals Token Launch, Airdrop in September - Decrypt

Rarible Integrates with Aptos Blockchain and PetraWallet for NFT Trading - The Defiant

🚀 Level Up

Sign up to the Premium Fintech Blueprint and in addition to receiving our free newsletters, get access to:

Long Takes with a deep, comprehensive analysis.

‘Building Company Playbook’ series, offering insider tips and advice on constructing successful fintech ventures.

Special Reports

Archive Access to an array of in-depth write-ups covering the hottest fintech and DeFi companies.

Join our Premium community and receive all the Fintech and Web3 intelligence you need to level up your career.