Digital Wealth: Arta's PFM acquisition echoes Personal Capital strategy

Arta raised $90MM, Personal Capital sold for up to $1B

Hi Fintech Futurists —

Welcome back to Digital Wealth. Today we highlight the following news —

NORTH AMERICA: Money Minx is Joining Arta Financial and Arta Finance Exits Stealth With $90MM In Funding

EMEA: Europe’s Cryptocurrency Investment App SwissBorg Enters The UAE

ASIA PACIFIC: DBS Partners J.P. Morgan Asset Management To Develop Industry-First Personalized Retirement Proposition To Help Singaporeans Better Prepare For Retirement

Thanks as always for your time and attention. To dive deeper into our covered topics, check out the premium options below.

North America News

⭐ 🇺🇸 Money Minx is Joining Arta Financial and Amid $90MM 'A' Raise, 33 Google Executives Join Two Google CEOs And 140 VC Investors To Launch 'Kickass' Robo, Pitching AI, Performance Fees And Private Equity To Accredited Investors - RIABiz, November 25, California

For background, digital family office Arta Finance emerged from stealth with $90MM+ in funding from Sequoia Capital India, Ribbit Capital, Coatue, and brand name investors, including Google CEO Sundar Pichai, former Google CEO Eric Schmidt, and Ram Shriram, a founding board member of Google.

Arta sells alternative assets like PE, VC, private debt, and real estate for minimums starting at $10K, which is competitive relative to other emerging alts-focused wealthtechs. For example, Equi, which raised $15MM in its Series A round in October, has a minimum investment requirement of $350K. The company offers a personalized AI-Managed Portfolios (AMPs), which function like most roboadvisors, augmented with macroeconomic considerations. See for example roboadvisor StashAway, using a similar asset allocation model via Economic Regime-based Asset Allocation (ERAA). Finally, the platform has Arta Pulse, which are networking spaces for members to interact with community and discuss financial opportunities (i.e. SharingAlpha).

Arta also acquired MoneyMinx.com — an asset aggregation dashboard similar to that of Mint.com and Personal Capital. Such destination websites are top of funnel to convert free users into paid investors, but require millions of people to adopt them.

The team for Arta is the main reason we are paying attention. Caesar Sengupta, the ex-head of Google's Next Billion Users initiative, serves as CEO, and seven other Arta co-founders include Google engineers such as Charles Dong, formerly head of growth at GooglePay, and Chirag Yagnik, a former Google research and ML engineer.

This “pedigree” doesn’t mean they will be successful at taking on wealth tech, but it does mean they will get funded for a while. In this way, Arta reminds us of Opto Investments, which also recently emerged from stealth with a $145MM Series A round and has its own rockstar leadership team with Mark Machin as CEO of Opto and Joe Lonsdale as Chairman.

🇨🇦 RBC To Expand Canada Dominance With $10B HSBC Deal - Bloomberg, November 29, Toronto

🇺🇸 $4.5T Financial Multinational Opens the Gates to Crypto Trading - BeInCrypto, November 30, Massachusetts

🇺🇸 Huntington National Bank Launches InvestCloud’s New Find My Advisor Experience - Businesswire, November 29, California

🇨🇦 CapIntel Forges New Strategic Partnership With Aviso Wealth To Provide Credit Union Advisors With New Digital Tools - Businesswire, November 30, Toronto

🇺🇸 MaxMyInterest Integrates With Wealthbox - PR Web, November 30, New York

🇨🇦 Estancia Capital Partners Announces Strategic Investment In InvestorCOM - Businesswire, November 29, Toronto

🇺🇸 Access Softek Launches EasyVest® YourChoice To Provide Community Financial Institutions With An Advanced Digital Investment Solution - Businesswire, November 29, California

EMEA News

⭐ 🇦🇪 Europe’s Cryptocurrency Investment App SwissBorg Enters The UAE - Gulf Business, November 29, Dubai

Crypto wealthtech platform SwissBorg, which has $600MM in AUM, launched in the UAE. SwissBorg raised $52MM from 24,000 investors in the first year of its operation via an ICO — and while this type of coin offering is out of style, we do think of it as a successful crowdfunding. Five years later, the platform has 700,000 users and generated over $150MM in revenues. Recently, the company partnered with Crypto Oasis in the UAE and is raising funds for its Series A.

SwissBorg claims to give full transparency on proof of assets and proof of liabilities trackable in real-time, something deeply necessary during the post FTX era. Currently in Web3, Chainlink Labs has been pushing its proof-of-reserve (PoR) product to force greater disclosure on centralized exchanges, and such oracles are likely to become widely adopted to try and lure investors back into traditional exchanges.

SwissBorg uses Fireblocks for crypto assets and checkout.com for fiat currencies. The company will implement a cryptographic proof mechanism using Merkle trees in regards to reserves, while currently showing some on-chain reserves dashboards via blockchain analytics platforms Nansen and DefiLlama. It’s a start.The company still offers products like “smart yield”, and has a 16% yield on its native token, CHSB. It’s fair to say we have learned that such yield-focused products are unsustainable in the current low leverage environment, and create unnecessary risk. Just see Celsius, where customers thought they were getting yield but in fact were providing leverage for 3AC, or Genesis, who was inadvertently funding FTX funding Alameda.

🇮🇪 Caipiteal, An Investment Company In Ireland, Is Helping People And Families Create Trans-Generational Wealth Through Cutting-Edge Investment Strategies - Digital Journal, November 29, Dublin

🇦🇪 Deep Knowledge Group Conducts Strategic Trip To The UAE To Expand Operations In MENA - EIN Presswire, November 29, Abu Dhabi

🇳🇴 Huddlestock Wins A Long Term Contract With Northern European Central Bank - Market Screener, November 25, Stavanger

Asia Pacific News

⭐ 🇸🇬 DBS Partners J.P. Morgan Asset Management To Develop Industry-First Personalized Retirement Proposition To Help Singaporeans Better Prepare For Retirement - Hubbis, December 1, Singapore

DBS Bank and J.P. Morgan Asset Management announced a multi-year Memorandum of Understanding (MOU) to develop a personalized retirement glide path portfolio for all five million DBS and POSB Bank customers in Singapore. The offering is set to launch in Q3 next year. A glide path defines an asset allocation mix of a target-date fund based on the number of years to the target date, usually retirement. The asset allocation typically becomes more conservative, with more fixed-income assets relative to equities, as a fund gets closer to the target date. The solution will be integrated into DBS's roboadvisor, DBS NAV Planner.

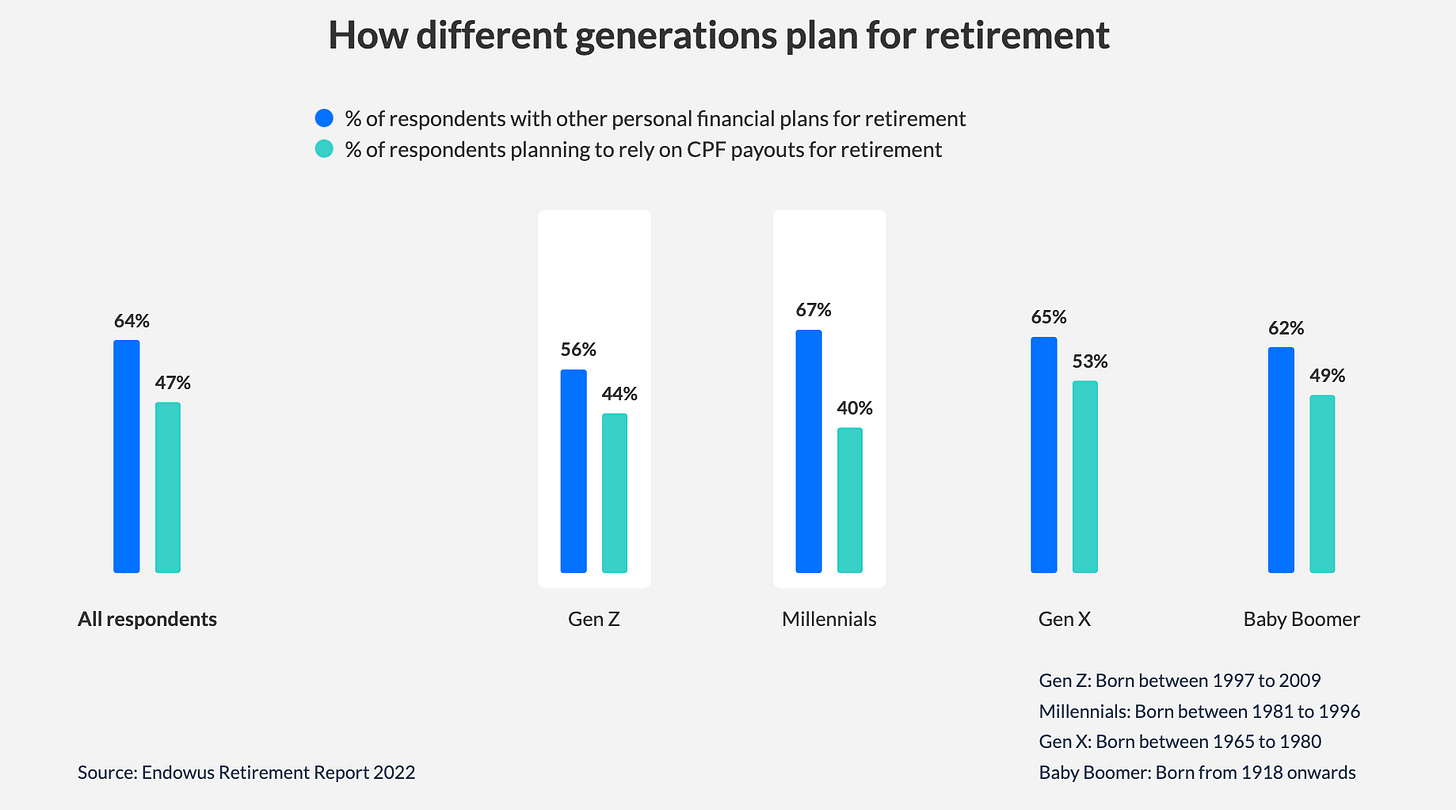

DBS NAV Planner leverages financial information from varios banks and financial institutions to provide a view of financial wellness. It then assesses retirement adequacy, and projects future outcomes offering various retirement investment solutions. You know, the usual financial planning value proposition. The portfolio's regular payouts are structured to complement government schemes such as CPF and Supplementary Retirement Scheme (SRS). Singapore-based roboadvisor Endowus has a similar offering, as well as estate and dividend-withholding tax-efficient holdings.

Singapore has an aging population, with one in four Singaporeans expected to be 65 years or older by 2030 — there's a reason for the Baby Bonus Scheme and Baby Support Grant. Endowus's latest Retirement Report showcases that 52% of Singaporeans do not invest their savings despite inflationary pressures. Most of those who do invest prefer options that yield lower returns than inflation, such as Singapore Savings Bonds (SSB) and bank fixed deposits.

This creates a structural economic crisis — if only software and good planning could save us. Most likely it just shows how rough people’s finances really are.

🇭🇰 HSBC Global Private Banking launches digital DPM in Asia - Private Banker International, November 24, Hong Kong**

🇲🇾 RHB Asset Management Targets RM100M AUM Over Next Six Months Through MyInvest - The Edge Markets, November 29, Kuala Lumpur

🇭🇰 Eddid Financial Announces Investment in Crypto Investment Platform, Q9 Capital - Macau Business, November 28, Hong Kong

Blogs, Webinars, Podcasts

⭐ 🇺🇸 Startup Uses AI To Deliver Custom Investment Portfolios And Usher In "Wealth 3.0" - Forbes, November 30, New York

🇬🇧 We Want Liquidity Data – And Fast, Family Offices Tell Providers - Wealth Briefing, November 30, London

🇨🇦 Growth Through A Comprehensive Wealth Ecosystem - Wealth Professional, November 30, Toronto

🇨🇦 The Bridge To A Hybrid Advisor - Investment Executive, November 28, Toronto

Events & Reports

🇺🇸 2022 Forbes Wealth Summit - Forbes, December 6, Virtual

🇸🇬 Opportunities In Institutionalizing The Digital Frontier - Hedge Fund Asia Digital Assets Summit, December 7, Singapore

🇬🇧Digital Integration In Wealth Management 2023 - Arena International, February 21-22, London

Shape your Future

Wondering what’s shaping the future of wealthtech, Fintech, and DeFi?

At the Fintech Blueprint, we go down the rabbit hole in the DeFi and Fintech industries to help you make better investment decisions, innovate, and compete in the industry. Subscribe now to level up your knowledge and get access to our weekly Long Takes!

Read our Disclaimer here — this newsletter does not provide investment advice and represents solely the views and opinions of FINTECH BLUEPRINT LTD.

Want to discuss? Stop by our Discord and or reach out here anytime.