Digital Wealth: Envestnet partners with Gemini to bring digital assets to 3,000 RIAs; Step & Betterment also launch offerings

Hi Fintech Futurists —

Welcome back to Digital Wealth, the weekly news aggregator for digital investing, asset management, and wealthtech.

Today we highlight the following, focusing on the trend of crypto infrastructure adoption across wealth management, which has become undeniable:

NORTH AMERICA: Gemini Brings Crypto To More Than 3,000 RIAs Managing $1.3T+

NORTH AMERICA: Step Secures An Additional $300MM To Accelerate Growth, Launches Crypto Investing And A National Financial Literacy Curriculum, & Largest Independent Digital Investment Advisor Debuts Crypto Investing by Betterment with Four Diversified Crypto Portfolios

ASIA PACIFIC: Citi, Accel Invest In Digital Asset Manager Started By Former HSBC, Meta Executives

Announcement

Before we dive in, let me remind you of something special. Next week, on Tuesday, 18 October, we are releasing our next Greatest Hits Report, focusing on the Top 5 Fintech Industry Movers of 2022.

In this report we will cover:

The company doing the most meaningful B2C acquisitions and brokerage aggregation

The company dominating in alternatives investing infrastructure

The project pushing forward decentralized governance while partnering with banks

Our Premium Analysis is what makes us special in the Fintech and DeFi space.

We leverage 15+ years of professional experience in the industry to share with you deep, comprehensive, and insightful analysis without shilling or marketing narratives.

Keep in mind that this Greatest Hits Report is exclusive to premium subscribers and if you want to get full access, upgrade your subscription now below.

And with that, back to the regular program.

North America News

⭐🇺🇸 Gemini Brings Crypto To More Than 3,000 RIAs Managing $1.3T+ - PR Newswire, October 6, California

Various financial companies have been forging alliances to bring financial advisors and their clients exposure to investments in crypto and the broader digital asset class. Just to name a few — Ark Invest, Franklin Templeton, Fidelity, and Gemini. Further, Gemini has just announced that it acquired wealth management platform BITRIA, which will be integrated with Envestnet’s Tamarac platform.

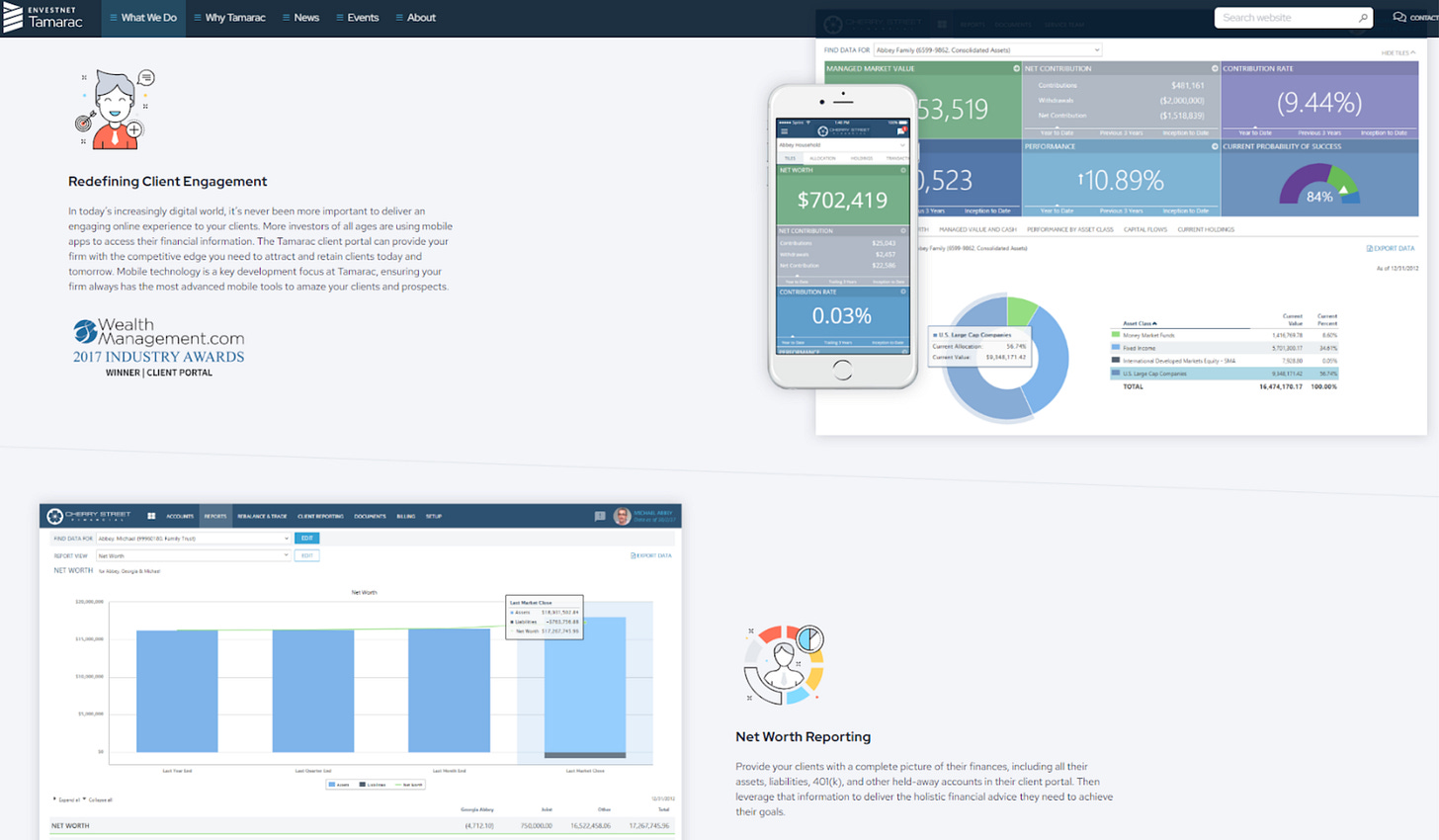

That’s a big footprint, with access to a client base of more than 3,100 independent RIAs managing over $1.3 trillion in assets. Financial advisors using Envestnet | Tamarac will have access the Gemini BITRIA platform, and view client crypto accounts in the Tamarac dashboard, with a unified view of portfolios across all asset classes.

BITRIA already offers SMA construction, account planning, and portfolio rebalancing, and will will eventually be integrated with the reporting capabilities that Envestnet | Tamarac, including the client portal, analytics and benchmarking, goal-based investment planning, and holistic net worth reporting.

In the short term, advisers may find the crypto asset class challenged given the market; but that will likely change over time. For Gemini, getting broad client adoption will be challenging for some of the same reasons, but the RIA market is the right direction. That said, the company may need to revise its fee structure in order to be competitive with mass affluent clients and their fiduciaries.

⭐ 🇺🇸 Step Secures An Additional $300MM To Accelerate Growth, Launches Crypto Investing And A National Financial Literacy Curriculum - Businesswire, October 11, California

This sits on Zero Hash.

👑See related coverage👑

⭐ 🇺🇸 Largest Independent Digital Investment Advisor Debuts Crypto Investing by Betterment with Four Diversified Crypto Portfolios — October 12

This follows on our earlier coverage about the roboadvisor selecting a custodian.

🇺🇸 Financial Titans Invest $43MM In Crowdstreet To Fund Growth And Accelerate Demand For Online Real Estate Investing - PR Newswire, October 10, Texas

🇺🇸 Arch Closes $5MM Seed Round Led By DCG And Upload Ventures To Become “The Blackrock Of Web3” - Businesswire, October 11, New York

🇨🇦 Ledn To Acquire Arxnovum Investments, A Fully-Registered, Canadian Digital Asset Investment Manager - PR Newswire, October 6, Toronto

🇺🇸 BNY Mellon Launches New Digital Asset Custody Platform - PR Newswire, October 11, New York

🇺🇸 Here's How OpenInvest Is Upping JPMorgan's ESG Game And Helping The Bank Partner With More Fintechs - BusinessInsider, October 12, New York

EMEA News

🇬🇧RBC Counts On Technology For UK Wealth Growth After Brewin Deal - Bloomberg, October 11, London

🇱🇺 STOKR Becomes The First Digital Securities Issuance Platform In The EU Supervised As A VASP - PR Newswire, October 11, Luxembourg City

🇨🇭 Digital Private Bank Becomes Reality - Alpian Launches As Switzerland's First FINMA-Licensed - PR Newswire, October 11, Geneva

🇬🇧 Equiduct Expands Range Of Exchange Traded Products Available For Trading On Apex - PR Newswire, October 12, London

🇬🇧 Gemini Enters Europe Through Ireland - PR Newswire, October 12, London

Asia Pacific News

⭐🇭🇰 Citi, Accel Invest In Digital Asset Manager Started By Former HSBC, Meta Executives - PR Newswire, October 7, Hong Kong

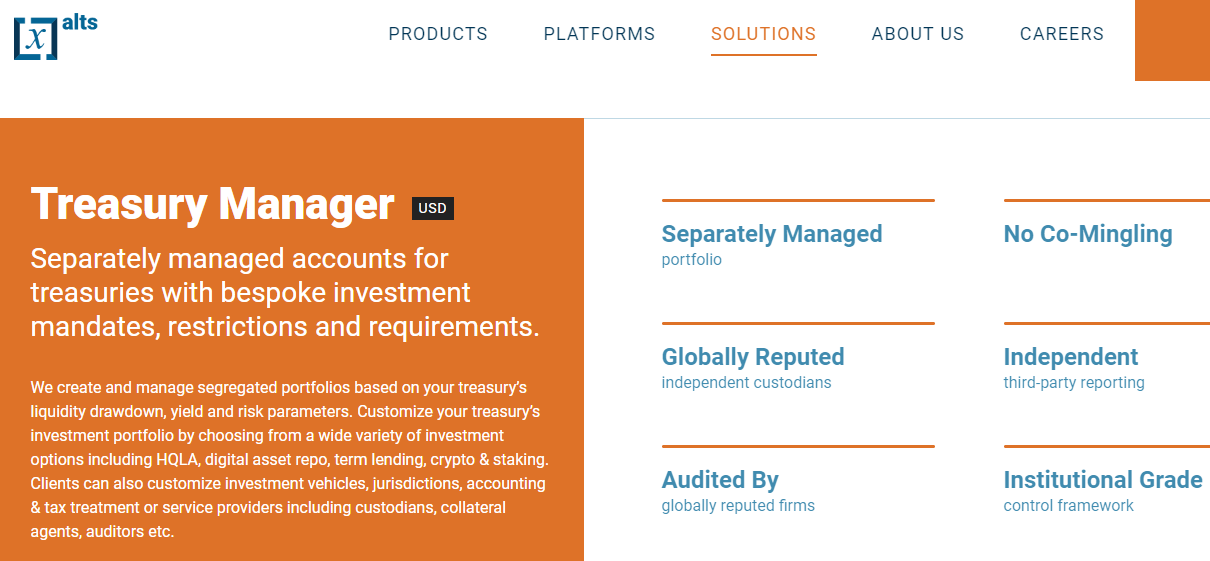

Citi is investing in a digital asset manager, co-leading a $6MM seed funding round in Hong-Kong based Xalts with backers like Polygon Co-founder Sandeep Nailwal, Silicon-Valley based Accel, and Mumbai-based investment firm AlphaGrep. Founded this year by a former trader at HSBC and Meta Asia executive, Xalts’ origin story is still in its infancy.

The company is yet to officially launch its suite of financial products, but are marketing ETPs (e.g., a Crypto Bluechip Index to be rebalanced monthly), Mutual Funds (e.g., a quant-based strategy using macro signals to maximize return for a particular level of volatility), as well as capital markets services like treasury management, tokenization, and digital asset repos. We think it is notable to see such an institutional approach in this geography.

Last week we mentioned that Asia has been seeing some of the highest rates of digital asset adoption, specifically with participation among traditional asset managers and digital asset companies through partnerships or acquisitions. There is a lot of competition in this space, and Xalts still has a long road ahead to deliver at scale.

🇭🇰 Raffles Family Office Rolls Out Integrated Digital-Asset Platform - The Business Times, October 13, Hong Kong

🇸🇬 Pillow Wants To Make Crypto Saving And Investing Easy For New Users - TechCrunch, October 13, Singapore

🇭🇰 Huobi Crypto Exchange Acquired By About Capital Management - Investing.Com, October 10, Hong Kong

🇮🇳 Wright Research Raises $1MM As Seed Capital From Orios Venture Partners - Mint, October 11, Mumbai

Blogs, Webinars, Podcasts

🇸🇬 Behind Citibank SG's Multi-Million Dollar Marketing Push For Its Digital Wealth Solution - Marketing-Interactive, October 10, Singapore

🇸🇬 ‘Resistance To Digital Wealth Management Has Almost Disappeared In Sea’: Bambu CEO Ned Phillips - E27, October 10, Singapore

🇺🇸 3 Tips To Personalizing Wealth Management Marketing - American Banker’s Association (ABA), October 11, Washington D.C.

🇬🇧 Asia’s Crypto Craze Spurs Swath Of Fund Launches - Financial Times, October 6, London

Events & Reports

🇺🇸 Interest, Investment In Robo-Advisors Declining: Report - Barron’s, October 6, New York

🇺🇸 2022 Bank Of America Private Bank Study Of Wealthy Americans - Bank of America, October 11, North Carolina

🇬🇧 Global WealthTech Summit - Fintech Global, November 2, London

🇺🇸 2022 Forbes Wealth Summit - Forbes, December 6, Virtual

Shape your Future

Wondering what’s shaping the future of Fintech and Digital Wealth? At the Fintech Blueprint, we go down the rabbit hole to help you make better investment decisions and innovate and compete in the industry. A premium subscription opens access to:

Weekly Long Takes on Fintech and DeFi operating and investment topics

Unlocks access to the full archives of all Long Takes (see index here)

Weekly Podcast Conversation transcript, illustrated with analysis and charts

Read our Disclaimer here — this newsletter does not provide investment advice and represents solely the views and opinions of FINTECH BLUEPRINT LTD.

Want to discuss? Stop by our Discord and or reach out here anytime.