Digital Wealth: Alts digital money manager Equi raises $15MM on $100MM of AUM

Equi's founders are putting 80% of their liquid net worth into strategies on the platform

Hi Fintech Futurists —

Welcome back to Digital Wealth, the weekly news aggregator for digital investing, asset management, and wealthtech. Today we highlight the following:

NORTH AMERICA: Equi Raises $15MM In Series A Funding

EMEA: Ardian And iCapital® Partner To Broaden Private Markets Investment Access For Wealth Managers

ASIA PACIFIC:

For deeper dives, including Long Take analyses of wealthtech, subscribe below:

North America News

⭐🇺🇸 Our $15MM Series A - Equi, October 3, New York

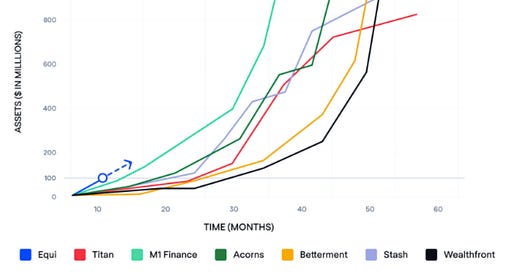

Alternatives digital investing platform Equi has raised $15MM in its Series A round, led by Smash Capital. Equi has grown quickly to $100MM in AUM, when compared some of the traditional roboadvisors. Equi's minimum investment requirement is $350K, down from $1MM when it first launched, and its founders are claiming to put 80% of their liquid net worth into strategies on the platform.

The company preaches that the era of "easy money" and the traditional 60/40 stock/bond portfolio is "dead", and therefore a 50/25/25 actively managed alternative core portfolio, consisting of a 50% allocation of non-correlated alternatives, is a better choice to reduce risk and increase returns. Generally this is true because alternatives have a different return profile from public securities, and endowment-type models outperform under Modern Portfolio Theory given broader asset class exposure — although it is hard to mechanically provide this for smaller accounts. The platform uses 12,600 underlying funds in order to create its portfolios.

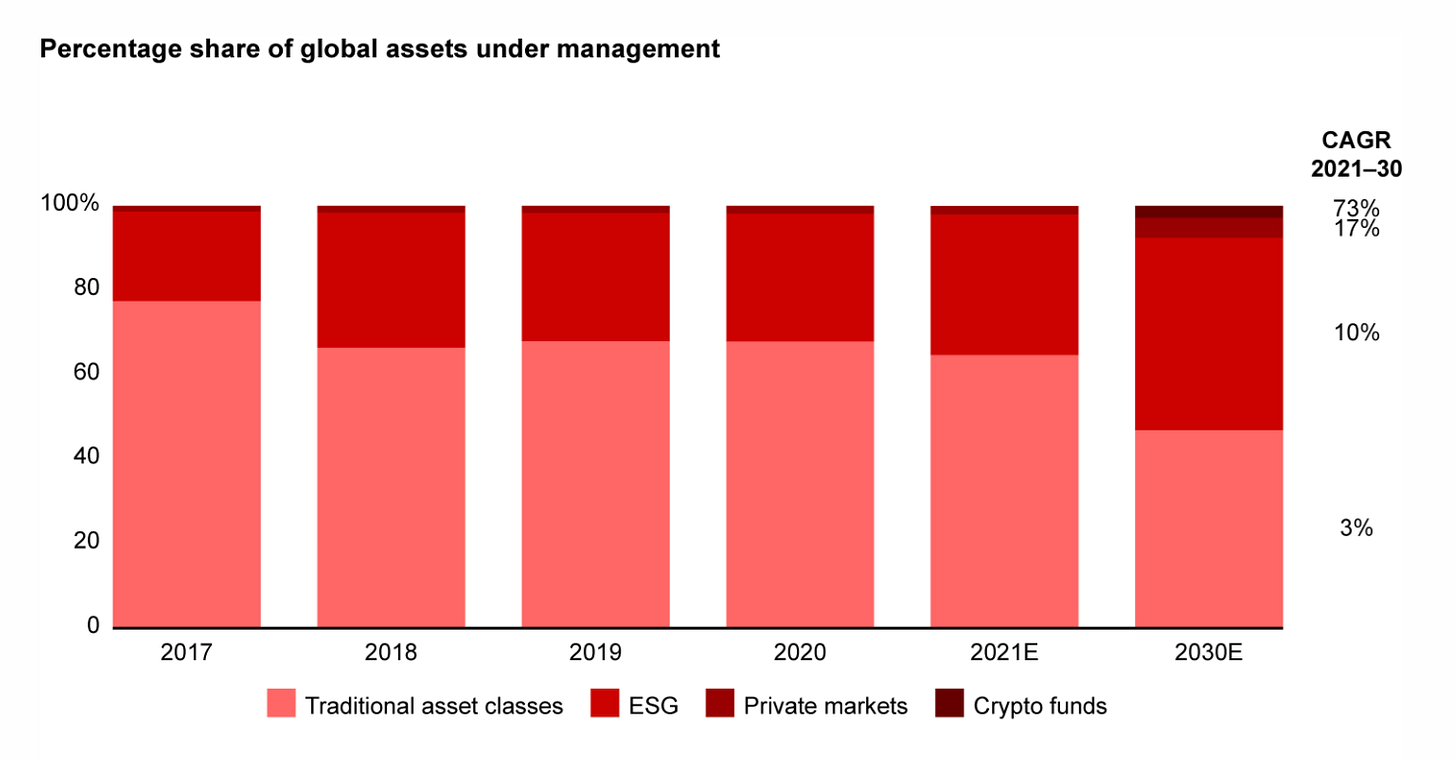

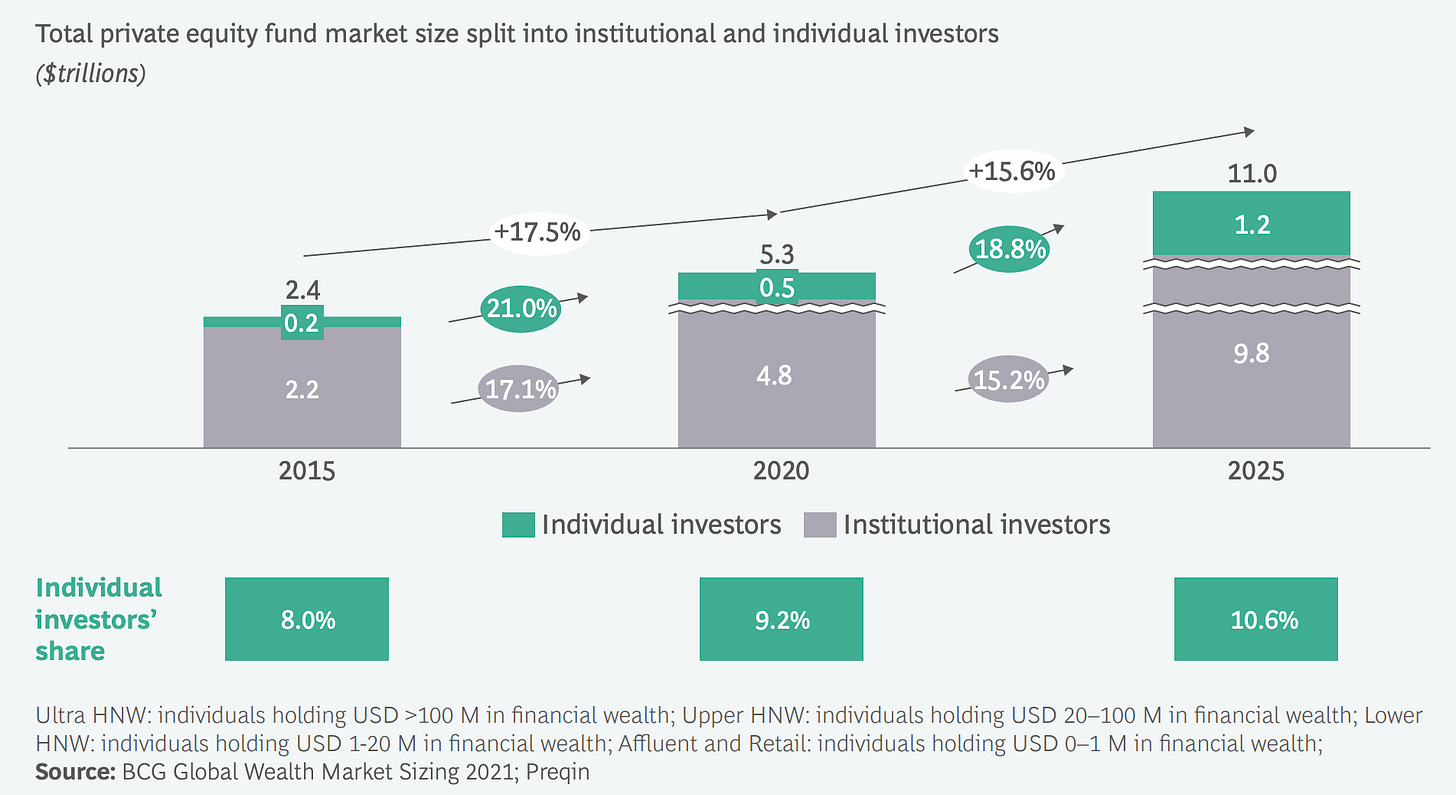

Wealth management reports, the growth of alts fintechs (e.g., iCapital), and the changing macro landscape support the thesis of a democratized alternatives asset class, with Bain predicting that the percentage of global AUM invested in ESG-compliant, crypto, or private markets will increase from 40% to 58% by 2030. Besides alts platform iCapital, there is retail Titan, which aims to mimic hedge fund investments, YieldStreet, which offers private market investments starting at $500, and new platforms such as PM Alpa, which is building an alts investment marketplace. Further, recent regulatory changes are growth vectors, such as the US Department of Labor permitting some types of 401(k) investment plans in private equity.

🇺🇸 Morgan Stanley Wealth Management Announces Updates to Robo-Advisor Offering - Businesswire, October 3, New York

🇺🇸 Merrill Advisor Match Transforms the Way People Find a Financial Advisor - Bank of America, October 4, North Carolina

🇺🇸 ARK Invest And Eaglebrook Advisors Announce Their Collaboration To Make ARK's Actively Managed Crypto Strategies Available To Advisors - PR Newswire, October 3, Florida

🇺🇸 Investing App Stash Adds Crypto Offering, Passes $125MM In Annual Revenue - TechCrunch, October 4, New York

🇺🇸 Asset Management Giant Fidelity Adds to Crypto Offerings With Ethereum Index Fund - CoinDesk, October 4, Massachusetts

🇺🇸 Hamilton Lane And Securitize To Tokenize Funds, Expanding Access to Private Markets For A Broader Set Of Investors - PR Newswire, October 5, New York

🇺🇸 Merit Buys $683MM Triad Financial Strategies - Wealth Management, October 4, Georgia

🇺🇸 Dynasty Financial Partners and Allocate Partner to Give RIAs Access To Venture Capital Investment Opportunities - Businesswire, October 4, California

Another example of private equity making their way into asset allocations.

🇺🇸 Tactive Is Set To Launch New WealthTech Platform This Week - PR Newswire, September 29, Florida

🇨🇦 Wealthtech Firm ClearEstate Partners With Sorrell Private Trust - Wealth Professional, October 4, Ontario

🇺🇸 Kestra Investment Management Deepens Value Proposition With The Launch Of Model Portfolios - Businesswire, October 4, Texas

👑See related coverage👑

EMEA News

⭐🇫🇷 Ardian And iCapital® Partner To Broaden Private Markets Investment Access For Wealth Managers Globally - Businesswire, October 4, Paris

Talk of the devil — iCapital, a B2B fintech for the Alternatives asset class, with $130B+ in assets across 1,000+ funds, has partnered with Paris-based private investment house Ardian. Let’s remind you of iCapital’s partnerships in 2022 alone, excluding its numerous acquisitions and consortium deals: Tikeau Capital, Ares Wealth Management, Morgan Stanley, AXA IM Alts, Mediobanca Private Banking, UBS, Envestnet, Golub Capital, TCW, Bank of Singapore, and Allfunds.

Ardian is a $140B+ private equity powerhouse, across LBOs, infrastructure, and real estate. But it also has an $8B AUM wealth management business launched in 2020, and will be using iCapital to offer wealth managers better access to private markets. The partnership is similar to that of Paris-based AXA IM Alts, in which iCapital’s platform was made available to AXA IM Alts’ network of wealth managers. iCapital’s platform offers funds with investment minimums starting at $25K, due diligence and performance reporting, custodian integration and compliance, and tax reporting.

Besides the growth of alternatives, notice that FNZ, a wealth platform with $1.5T in assets under administration, and iCapital are moving in an alagous trajectory: behemoth-level fundraises (iCapital raised $490MM in 2021, FNZ $1.4B in February) that allow for a non-stop spree of acquisitions and partnerships.

Consolidations will continue until morale improves. Returns to scale look like the key to success in this business. Also notable is that this deal is in Europe.

🇨🇭 Oelfke Brothers Announce New Fintech Group Aimed At Creating Real Access To The Capital Markets - Yahoo Finance, September 29, Zurich

🇬🇧 World’s Largest Digital Asset Manager BlackRock Introduces Blockchain ETF In Europe - BeInCrypto, September 30, London

🇸🇰 Finax Launches The First Pan-European Pension Product for Digital Nomads - Businesswire, October 4, Bratislava

🇰🇼 Kuwait Finance House (KFH) – Bahrain Launches Wealth Management Platform - Trade Arabia, October 4, Kuwait City

🇬🇧 NextGen Introduces Tech solution And Training For Financial Planners - Money Marketing, October 3, Liverpool

👑See related coverage👑

Asia Pacific News

⭐🇹🇭 $3B Crypto Bank Anchorage Digital Pushes Into Asia - Fortune, October 4, Bangkok

Despite the recent rhetoric of tightening regulations across Asian markets, digital asset custodian Anchorage Digital, now valued at $3B, has announced a major international expansion into the East. It will offers digital asset custody to Bitkub, Dream Trade, FBG Capital, GMO-Z.com Trust Company, IOSG Ventures and Antalpha. Management intends to generate 25% of its business out of Asia within the next 18 months.

Anchorage’s credibility with foreign investors comes from being the first digital asset company with a US federal banking charter — a “badge of honor” that signals a higher standard for security, compliance, risk monitoring, asset safekeeping, and fiduciary obligations. Customer service and transaction speed are also notable; the Bitkub Co-Founder says: “What sets them apart from others is the depth of their client support. They offer customized solutions so we can offer enhanced crypto services, with operations available at any time, any day of the week.”

South and Central Asia have recently seen some of the highest rates of digital asset adoption, and a number of asset managers in the region have looked to expand their digital asset capabilities in places such as Singapore, due to its regulatory-friendly laws and access to funding. It’s competitive, but what isn’t?

🇹🇭 XSpring Unveils Digital Asset Platform For Trading - Bangkok Post, October 5, Bangkok

🇮🇳 Dinero Encourages Young Indians To Build Wealth Through Their New Product Dinero Investment Plan - Business Standard, September 29, Mumbai

🇮🇳 ET Money Introduces The First-Of-Its-Kind Great Indian Investment Festival: To Reward Users For Building Good Financial Habits - The Covai Post, September 30, Haryana

👑See related coverage👑

Blogs, Webinars, Podcasts

🇺🇸 RIAs: Your Tech Stack Is in Your Way - Wealth Management, September 29, New York

🇺🇸 Most Americans Are Open to Robo-Advisors But Few Use Them: Survey - Financial Advisor IQ, October 5, New York

🇺🇸 A Third Of Advisors Don't Use Their Firm's Software, Study Says - Financial Advisor, October 3, New Jersey

🇻🇳 Vietnam’s Securities Regulator Warns On Risks Of Unlicensed Wealthtech Apps - DealStreetAsia, October 5, Hanoi

🇨🇦 ‘To Handle Advisors’ Financial Planning Challenges, You Have To Be Meticulous’ - Wealth Professional, September 30, Ontario

🇮🇳 Prominent Bank Of Baroda Leader Examines Rapid Expansion Of The Indian Wealth Market - Hubbis, October 5, Vadodara

Events & Reports

🇬🇧 Fintech Nexus Merge — October 17-18, London — see you there.

🇦🇪 2022 Fintech Surge - GITEX Global, October 10-13, Dubai

🇺🇸 Crypto Wealth Summit - Eaglebrook Advisors, October 10-12, Florida

🇬🇧 Global WealthTech Summit - Fintech Global, November 2, London

🇺🇸 2022 Forbes Wealth Summit - Forbes, December 6, Virtual

Shape your Future

Wondering what’s shaping the future of Fintech and Digital Wealth? At the Fintech Blueprint, we go down the rabbit hole to help you make better investment decisions and innovate and compete in the industry. A premium subscription opens access to:

Weekly Long Takes on Fintech and DeFi operating and investment topics

Unlocks access to the full archives of all Long Takes (see index here)

Weekly Podcast Conversation transcript, illustrated with analysis and charts

Read our Disclaimer here — this newsletter does not provide investment advice and represents solely the views and opinions of FINTECH BLUEPRINT LTD.

Want to discuss? Stop by our Discord and or reach out here anytime.