Digital Wealth: Impact of Betterment's new $48/year minimum fee

If you park only $1,000 at the advisor, that's almost 5% per year

Hi Fintech Futurists —

Welcome back to Digital Wealth. Today we highlight the following news —

NORTH AMERICA: GoLogiq To Acquire Nest Egg For $30MM, Adding Wealth-Building Platform For Gen Zs And Millennials

NORTH AMERICA: Wealthfront Pounces After Betterment Jacks Up Prices On Small Investors, But Betterment Claims Last Laugh -- 'Thousands' Of New Customers, It Says

ASIA PACIFIC: India’s CoinSwitch Exchange To Add Non-Crypto Products Amid Punishing Taxes On Digital Asset Trading

Thanks as always for your time and attention. To dive deeper into our covered topics, check out the premium options below.

North America News

⭐🇺🇸 GoLogiq To Acquire Nest Egg For $30MM, Adding Wealth-Building Platform For Gen Zs And Millennials - Globe Newswire, January 10, New York

Data analytics company GoLogiq announced the signing of a binding letter of intent to acquire retirement-focused roboadvisor Nest Egg Investments in an all-stock transaction valued at $30MM. The transaction will supposedly build upon GoLogiq's recent $320MM merger agreement with fintech ecosystem GammaRey, which claims to offer its own commodity-backed digital currency, a digital wallet, and a trading platform.

Nest Egg was an acquisition target of GammaRey, and is getting swept up as part of the transaction. The IRA roboadvisor, still in beta and not open to the public, claims to allow users to set savings goals and automatically invest in a portfolio of ETFs tailored to their specific goals and risk tolerance, as well as provide tools to track progress and readjust investment strategies.

Something’s a bit off here for us. Check out the disclosure on the site, which looks like it was pulled with errors from Stash Financial.

Broker check doesn’t return a Nest Egg Securities, although there is a Nest Egg Investments, which is affiliated with a different company with a similar brand, “my bank Nest Egg”. Buying a landing page without a clear regulatory entity and established technology for $30MM doesn’t make any sense — unless the stock in which that consideration is paid isn’t particularly valuable.

Which maybe is the case? GoLogic trades at $70MM in OTC equity markets, but is somehow issuing $320MM to GammaRey, of which $30MM is going to Nest Egg? The entire things looks pretty unreal to us.

So why did we spend the time to pull it apart? Because in 2010, Lex founded a roboadvisor called NestEgg Wealth, and we want to protect the good reputation of nest eggs everywhere. Stay clear here.

⭐🇺🇸 Wealthfront Pounces After Betterment Jacks Up Prices On Small Investors, But Betterment Claims Last Laugh -- 'Thousands' Of New Customers, It Says - RIABiz, January 9, California

Roboadvisor Betterment has replaced its annual fee of 25bps with a new subscription fee of $4/month for accounts under $20,000. Alternatively, customers with less than $20,000 in assets can bypass the fee if they elect to set up a direct deposit of $250 into their accounts. This economic change comes after Betterment acquired crypto roboadvisor Makara, partnered with Gemini to offer customized crypto portfolios, and launched its crypto offerings.

This recent move strikes us as a counter to the spirit of digital investing. It also seems punitive to the company's customers, many of whom likely have assets in the lower single thousands. If you have $1,000 in assets and pay $50 per year in fees, that’s a good 5% of AUM! Unfortunately, such dynamics are typical in the wealth industry, and all firms struggle to serve small clients at scale. In older wealth management firms, this is because the fixed costs are high, and the marginal costs of servicing are high. Technology is meant to solve this by absorbing all the marginal cost into the initial build of the platform.

The way we interpret this price raise is either (1) people are price insensitive about a $4 monthly minimum like other subscriptions -- which is fine but bad for the customer -- or (2) Betterment has seen much more profit from direct deposit customers and therefore is pushing them aggressively into that behavior, or (3) they are fine losing small accounts and firing the small customers that they were founded to serve. Maybe their marginal servicing infrastructure is not zero cost, meaning that between data aggregation for net worth assessments, trading fees, and other embedded fintech services, the marginal customer actually costs them a few dollars per month as a run rate.

When Betterment was growing rapidly in its early stages, that could have been interpreted as an investment into a hyper-growth footprint. Now, it's just cost, and as fintechs generally become less valuable based on multiples, they are forced to squeeze more economics from the customers it has. By shifting its focus from client growth to profitability, Betterment may be looking to make its balance sheet more attractive for an IPO — either more revenue or less cost.

🇺🇸 Fidelity Launches BDC To Expand Alts Offerings - Globe Newswire, January 10, Massachusetts

🇺🇸 J.P. Morgan Wealth Management Introduces QuickDeposit For Investments - J.P. Morgan Chase & Co., January 10, New York

🇺🇸 Crypto Conglomerate DCG Closes Wealth-Management Business - CoinDesk, January 5, Connecticut

🇺🇸 Advisor360° Acquires The Wealth Management Technology Assets Of Agreement Express - PR Newswire, January 10, Massachusetts

🇺🇸 Onramp Launches SMA Solution for Advisors, Asset Managers - Think Advisor, January 5, California

🇨🇦 Mackenzie Investments Onboards CapIntel's New Link Offering, A First-To-Market FinTech Tool For Wholesalers And Financial Advisors - Businesswire, January 5, Toronto

EMEA News

⭐🇬🇧 OneDome Acquires CMME Mortgages - BestAdvice, January 11, London

🇸🇪 Swedish FSA Grants Binance 7th Regulatory Approval In EU - PR Newswire, January 11, Stockholm

🇩🇪 Scalable Capital Surpasses One Million ETF And Stock Savings Plans - ETF Express, January 10, Munich

Asia Pacific News

⭐🇮🇳 India’s CoinSwitch Exchange To Add Non-Crypto Products Amid Punishing Taxes On Digital Asset Trading - Yahoo Finance, January 11, Bengaluru

Indian crypto exchange CoinSwitch Kuber, which raised $260MM in funding last year, has announced its expansion into non-cryptocurrency investment products. The platform, which has 19MM+ registered users, will now offer traditional investment options such as fixed deposits, ETFs, mutual funds, stocks, bonds and US equities.

This launch comes as a response to the Indian government's imposition of a 30% flat tax on all crypto income and a 1% tax on transactions exceeding 10,000 Indian rupees. Visits to Indian exchanges Wazir X, CoinDCX, CoinSwitch Kuber and ZebPay fell 80% between February 1 – October 31. App downloads fell 93%. There’s taxes, and then there’s death.

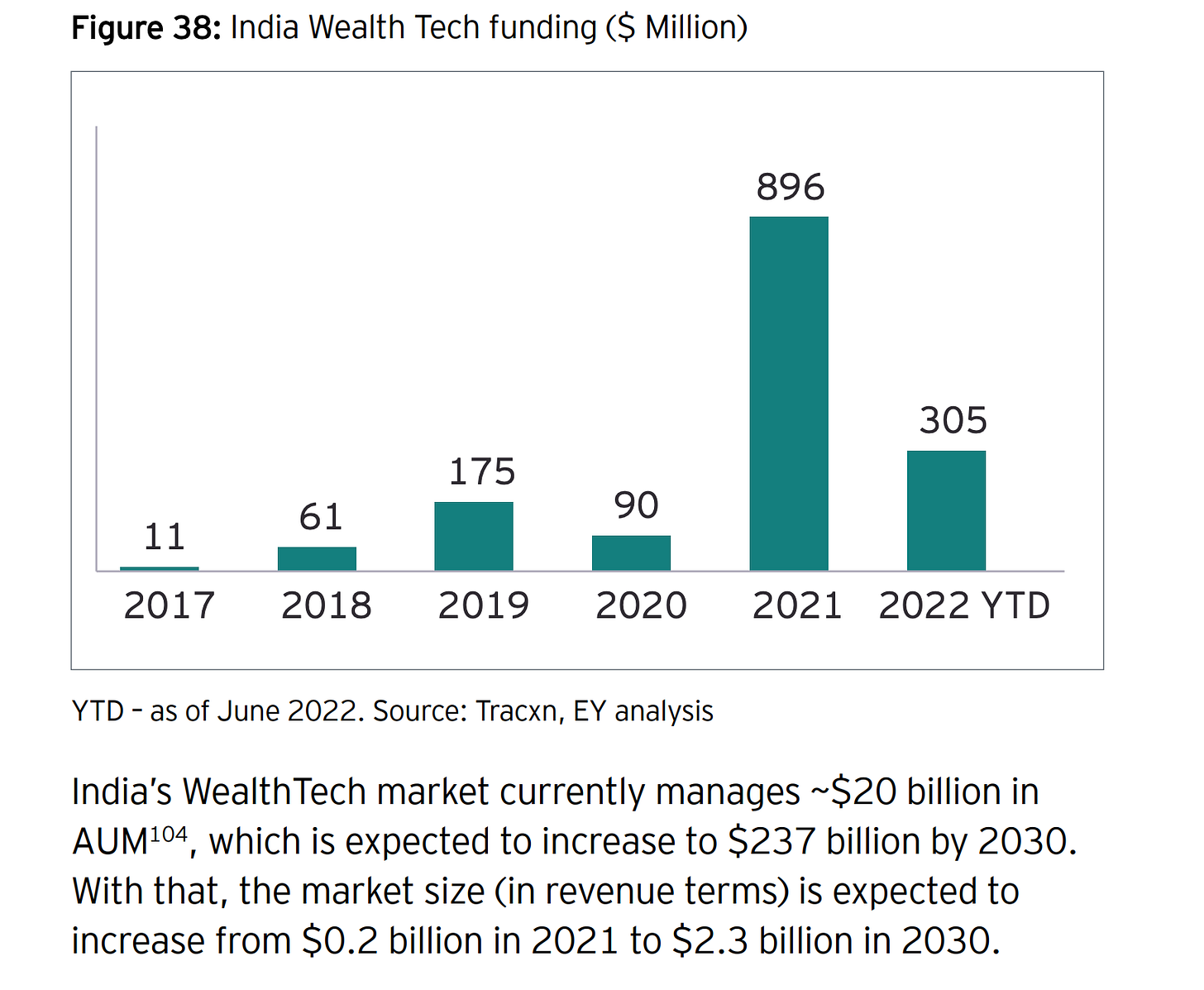

CoinSwitch's decision to expand into non-crypto investment products may be the silver lining to regulatory strategic headwinds. The wealthtech sector in India is projected to grow from $20 billion in 2021 to $230 billion by 2030. The government has also been supportive of the growth of the wealthtech industry through initiatives such as a regulatory sandbox and allowing e-commerce entities to sell mutual funds from their platforms. Barriers to entry have been lowered for new players in the market.

With this in mind, CoinSwitch will face increased competition from both established players such as Zerodha, which acquired an AMC license and will likely also target the passive fund investing space, and startups such as Dezerv, which achieved $120MM in AUM on its platform within a year of launch. The other thing to note is that the behavioral profile of traders and investors is quite different.

🇮🇳 Fintech Start-Up BankSathi Raises USD $4MM As Pre-Series A Round - Techgraph, January 9, Bengaluru

🇮🇳 CTBC Bank Selects TCS BaNCS To Digitally Transform Its Banking And Wealth Landscape - Techgraph, January 4, Mumbai

🇮🇳 Centricity Wealthtech Announces People Centric Policies - Business Newsweek, January 10, New Delhi

Blogs, Webinars, Podcasts

🇺🇸 Wealth Management – 2023 Outlook - Alvarez & Marsal, January 6, New York

🇭🇰 The Era Of The Digital Investment Platform And Its Role In The Independent Wealth Industry - Hubbis, January 5, Hong Kong

🇺🇸 Cover Story: Robo-Advisors vs Actively Managed Funds — Who Wins? - The Edge Markets, January 9, California

🇺🇸 Now More Than Ever, Advisors Need A Marketing Makeover - Financial Advisor, January 10, New Jersey

🇮🇳 Decoding The Wealth Management Market In India: Trends & Building Blocks Of A Successful Model - Inc42, January 7, Delhi

Events & Reports

🇺🇸 Wealth Management Edge - Informa Connect, May 21 - 24, Florida

🇬🇧 Private Banking & Wealth Management London Conference & Awards 2023 - Arena International, June 14, London

🇬🇧 Digital Integration In Wealth Management 2023 - Arena International, February 21-22, London

Shape your Future

Wondering what’s shaping the future of wealthtech, Fintech, and DeFi?

At the Fintech Blueprint, we go down the rabbit hole in the DeFi and Fintech industries to help you make better investment decisions, innovate, and compete in the industry. Subscribe now to level up your knowledge and get access to our weekly Long Takes!

Read our Disclaimer here — this newsletter does not provide investment advice and represents solely the views and opinions of FINTECH BLUEPRINT LTD.

Want to discuss? Stop by our Discord and or reach out here anytime.