Digital Wealth: reAlpha gets $200MM for AI-based real estate investing

Also discount brokerage eToro has acquired portfolio management provider Bullsheet

Hi Fintech Futurists —

Welcome back to Digital Wealth, the weekly news aggregator for digital investing, asset management, and wealthtech.

Today we highlight the following news —

NORTH AMERICA: reAlpha Secures $200MM Financing Facility from Churchill Real Estate

EMEA: eToro Acquires Portfolio Management Provider Bullsheet

ASIA PACIFIC: Dezerv. Becomes The Fastest Company In The Wealth Tech Category To Hit 1000 Crore Mark In Financial Assets Managed

Our premium subscribers get deeper analysis on news like this. Check it out!

North America News

⭐🇺🇸 reAlpha Secures $200MM Financing Facility from Churchill Real Estate - Businesswire, November 1, Ohio

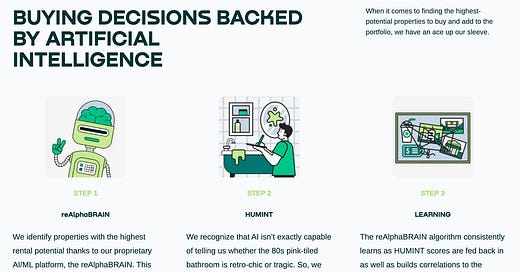

reAlpha, a digital real estate investing platform focused on the short-term rental (STR) market, has secured a $200MM financing facility from Churchill Real Estate. The company assesses the quality of STR investment by looking at rental income quantitatively. The company’s AI engine identifies properties with the highest rental potential by scoring them on 25+ factors. After this analysis, the platform gets freelance analysts to score the property on the same factors, such as neighborhood appeal and renovations. Those scores are then used to train the machine learning model for improved accuracy.

reAlpha recently launched an in-house brokerage, reAlpha Realty, to expand the Company's pipeline through referral programs with outside brokerages and developers. This will eventually help investors buy equity in specific properties. For context, home equity wealthtech Nada, which raised $8.1MM in funding in July, allows retail investors to buy and sell fractions of the real estate market via its Cityfunds (e.g., Miami).

The real estate asset class, and the financing around it, is a large revenue generator for consumer banks, and we are excited to see more fintech companies enter the space in novel ways. There are few comparable deals to reAlpha's $200MM investment, but some warning signs do exit — real estate tech brokerage Compass raised $1.5B from VCs (of course, SoftBank was involved), and went public with a valuation of about $8B.

The market cap has now fallen to less than $1.1B, with the share price dropping by 85% since its IPO. The drop in valuation is unsurprising as fintech revenue multiples have dropped by 90%, with the UBS Global Real Estate Bubble Index indicating an end to the housing boom driven by interest rate increases.

👑 See related coverage 👑

🇺🇸 J.P. Morgan Launches Hybrid Robo-Advisor - Barron’s, November 1, New York

🇺🇸 Oppenheimer Selects +SUBSCRIBE To Power Alternative Investment Platform - PR Newswire, November 1, New York

🇺🇸 TIFIN's Wealth Division Announces The Industry's First AI Platform For Client Personalization - PR Newswire, November 1, New York

🇺🇸 Pluto Launches Automated Investing Platform To Truly Democratize Trading - Businesswire, November 1, California

🇺🇸 Morningstar Launches Direct Indexing Combining Market-Leading Technology And Investment Management - PR Newswire, November 1, Illinois

EMEA News

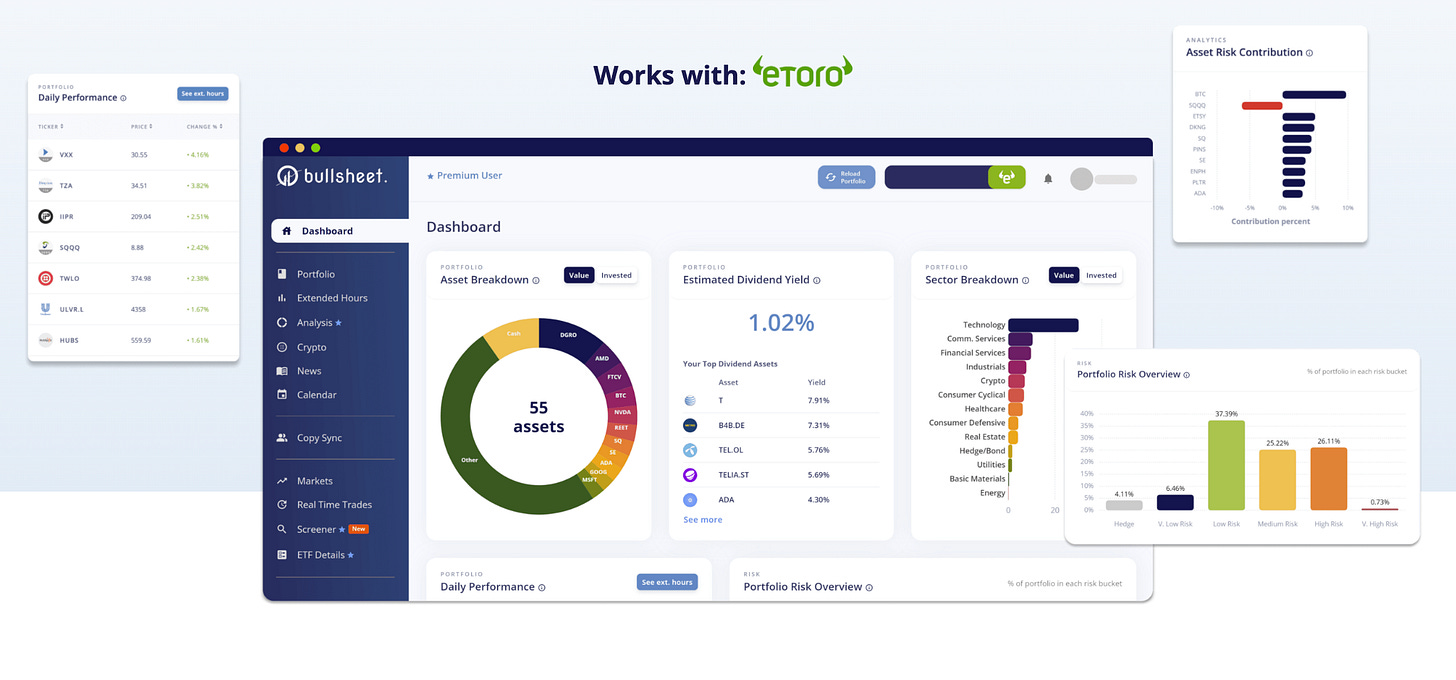

⭐🇮🇱 eToro Acquires Portfolio Management Provider Bullsheet - eToro Press Release, October 31, Tel Aviv

Digital discount brokerage eToro acquired portfolio management provider Bullsheet for an undisclosed amount. The deal comes just a few months after its recent acquisition of options trading platform Gatsby, which we covered back in August. Instead of dealing with the public markets, eToro is rightly going shopping.

Developed in 2020 for eToro users only, Bullsheet offers additional automated features for users when analyzing their portfolio. Some of the current features, or “additional superpowers” as they call them, are (1) monitoring portfolios after trading hours; (2) tracking earnings and dividend payment dates via a calendar feature; (3) getting the latest articles for stocks you hold on a news dashboard; and (4) tracking what other traders are buying/selling in real-time. These are a good phsychographic fit for eToro customers.

Self-directed investors tends to lean towards digital brokerage platforms that offer investing autonomy and affordable features. However, that can sometimes have devastating effects, especially for momentum based / meme trend investors (we’re looking at you, $AMC). And, at times when investor confidence is low, many brokerages have a hard time motivating anyone to trade, regardless of what user-friendly features exist. This translates to lower volume and lower valuations. In a year with eToro cutting 6% of their workforce and getting their valuation cut in half after abandoning plans to go public, it’s still encouraging to see the firm investing in future growth.

👑 See related coverage 👑

🇬🇧 Wealthtech Sidekick Raises £3.33MM To Build Modern Investment Manager - Private Banker International, October 31, London

🇦🇪 Mashreq Partnered With FinIQ To Enhance Client Experience With An Integrated Wealth Management Platform - Zawya, October 31, Dubai

🇸🇪 Brokerage-As-A-Service Provider Bricknode Partners With Tuum - Fintech Global, November 1, Skövde

🇬🇧 Intuitive Online Wealth Management Platform Launches For 'Prillionaires' - Newsfile, October 31, London

Sponsorships

Are you interested in sponsoring the Fintech Blueprint and reaching our 50,000+ Substack audience, or our 10,000 podcast monthly listeners? Check out various options to work together below.

Asia Pacific News

⭐🇮🇳 Dezerv. Becomes The Fastest Company In The Wealth Tech Category To Hit 1000 Crore Mark In Financial Assets Managed - The Print, October 31, New Delhi

Invite-only wealthtech Dezerv has announced that it has achieved a milestone of $120MM (Rs 1000 crore) in clients AUM on its platform within a year of launch. In August, Deserve raised $20.7MM in a Series A round led by Accel Partners. The startup also raised $7MM in a seed round, bringing total funding to $28MM since its launch last year.

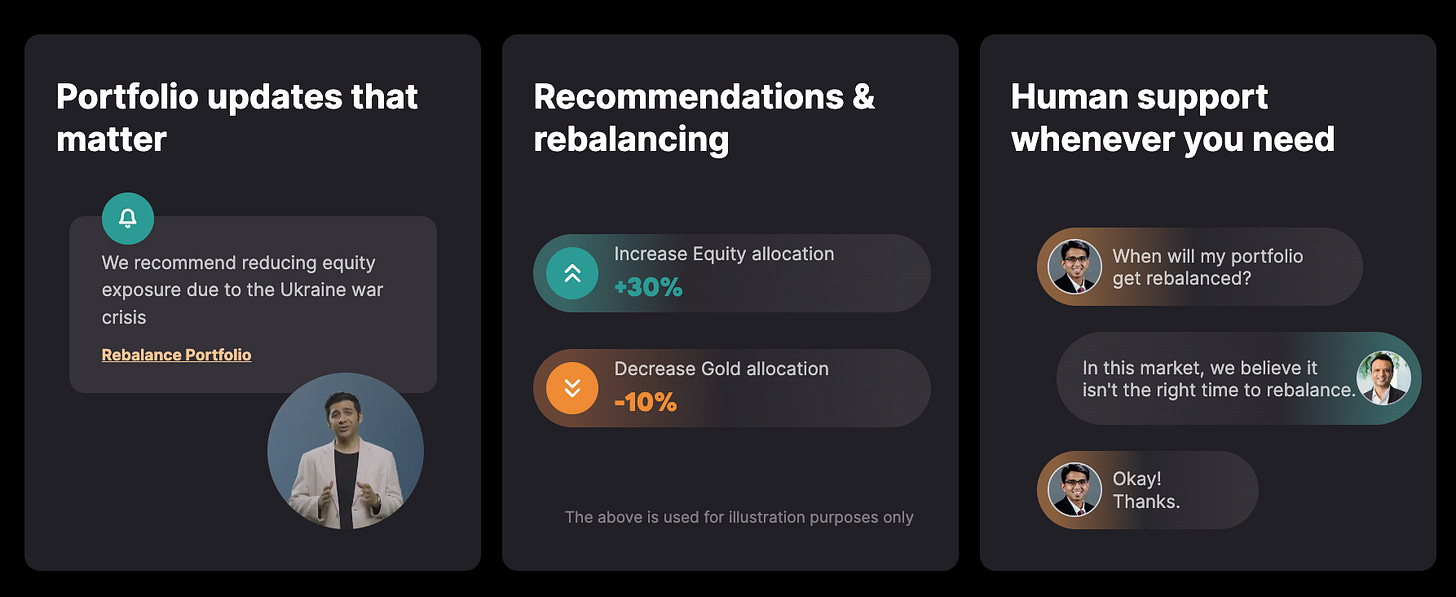

Dezerv provides advisory and investment services, mainly targeting senior working professionals and HNWIs, across assets such as large-cap index funds, fixed-income securities (e.g. high yield bonds), and alternatives (e.g. private equity). The platform asks various questions to gauge an investor's risk appetite and financial position. Questions range from age and post-tax income, to how much of a temporary drop in portfolio value the user could handle. The usual roboadvisor stuff, about a decade later.

The 5-year aggressive option targets a 16% return per year by allocating 55% into actively managed equity funds, 30% into index funds, 12% into high fixed return credit funds, and 2% into gold. Note that the balanced portfolio, which is the safest of the lot, still suggests a 13% return per year. Within the app, portfolio managers create a personalized mutual fund recommendation for the client using the Integrated Portfolio Approach™ (IPA), which blends Markowitz's Modern Portfolio Theory, the Black-Litterman Model, and aspects of behavioural finance.

It's not surprising to see Dezerv grow its AUM so quickly, considering how active India's wealthtech sector has been this year. Take wealthtech Scripbox, for example, which has acquired ten companies and grown its AUM from $215MM to $1.5B in the past two years. Or look at roboadvisor Savart, which plans to increase its AUM to $1B by the end of 2023.

Digital wealth is all wealth management globally.

👑 See related coverage 👑

🇲🇾 Kenanga Investment Bank To Build Wealth Super App With Antchain Technology - Finextra, October 31, Kuala Lumpur

🇭🇰 Hong Kong To Authorise Virtual Asset ETFs - Fund Selector Asia, October 31, Hong Kong

🇸🇬 Singapore-Based Digital Marketplace Alta Acquires Hg Exchange - Yahoo News, October 31, Singapore

🇸🇬 Singapore’s Tokenize Crypto Exchange Opens Platform For Institutional Investors - Forkast, November 1, Singapore

🇮🇩 Bank Central Asia Taps Avaloq To Upgrade Wealth Management Services - Fintech Futures, October 31, Jakarta

Blogs, Webinars, Podcasts

🇨🇦 The Future Of Wealth And Asset Management - KPMG, November 1, Toronto

🇮🇳 How Wealthtech Start-Ups Are Creating A Roadmap For Millennials To Invest Better - Financial Express, October 29, Uttar Pradesh

🇺🇸 Institutional Investors Not Backing Down On Digital Assets: Survey - Think Advisor, November 1, New York

🇸🇬 The Four Trends Driving Change In Wealth Management - The Business Times, November 3, Singapore

🇨🇦 Why Future-Focused Young Adults Still Need Financial Guidance - The Wealth Professional, November 2, Ontario

Events & Reports

🇿🇦 Africa Fintech Summit 2022 - Africa Fintech Festival, November 3-4, Virtual

🇺🇸 2022 Forbes Wealth Summit - Forbes, December 6, Virtual

Shape your Future

Wondering what’s shaping the future of Fintech and Digital Wealth? At the Fintech Blueprint, we go down the rabbit hole to help you make better investment decisions and innovate and compete in the industry. A premium subscription opens access to:

Weekly Long Takes on Fintech and DeFi operating and investment topics

Unlocks access to the full archives of all Long Takes (see index here)

Weekly Podcast Conversation transcript, illustrated with analysis and charts

Read our Disclaimer here — this newsletter does not provide investment advice and represents solely the views and opinions of FINTECH BLUEPRINT LTD.

Want to discuss? Stop by our Discord and or reach out here anytime.