Digital Wealth: VRGL gets $15MM from FINTOP, Dynasty, and Northwestern Mutual for digital client tools

VRGL is named after Virgil, the ghost of the Roman poet who guided Dante through the Inferno

Dear Fintech Futurists,

Welcome to our Digital Wealth issue, the weekly news aggregator for digital investing, asset management, and wealthtech.

Is there something in the investing world you would like us to cover in more detail? Share your ideas below:

North America News

⭐🇺🇸 VRGL Announces $15MM Series A Fundraising Round Led By MissionOG And FINTOP Capital - Businesswire, August 30, Texas

Wealthtech VRGL raised $15MM in a Series A funding round, led by MissionOG and FINTOP Capital. The company is named after Virgil, the ghost of the Roman poet who guided Dante through the Inferno — Virgil is known as a symbol of logic and intelligence that assists others on their journey. In this spirit, VRGL helps financial advisors guide clients with quantitative views of their portfolios. The poetry of numbers!

This “Client Acquisition, Proposal Management, & Retention" platform helps end users extract information (e.g., transactions, market values, gains and losses, and fees) from PDF statements, with no needed interaction from an advisor to speed up onboarding. If clients wish to go beyond statement extraction, VRGL offers an analytics suite, including (1) Performance, which assesses performance against statistically derived benchmarks, (2) Risk, which uses calculations such as scenario and historical multi-factor analyses, (3) Diversification, which analyses asset and factor-based exposure across all accounts, (4) Taxes, in which VRGL provides a tax optimization solution and (5) Fees, which unravels layered fees.

According to Grand View Research, the wealth management software industry will grow at a CAGR of 14% till 2030, and hybrid advisor tools like this are the sweet spot. Bain similarly highlights that the rise of new wealth management tech and digitally native customer segments opens an opportunity to reorient business models from advisor-focused to a customer-first approach. As another example, we recently covered Eton Solutions and its $38MM Series C funding round, geared towards the asset management in the UHNW market and its expanding wealthtech tooling.

We think that the investors in this round are strategics that will either use this software (Dynasty, Northwestern Mutual) or fintech B2B insiders (Fintop Capital). A play like this needs very large scale, to the tune of $100-500B in AUM to make real money.

🇺🇸 Goldman Sachs Finishes Deal For NextCapital - Private Banker International, August 30, New York

🇺🇸 Truist Wealth Expands Its Digital Investing Capabilities With Truist Invest - IBS Intelligence, August 30, North Carolina

🇺🇸 Concord Wealth Partners Reveals New And Improved Comprehensive Financial Planning Website - PR Newswire, August 31, Virginia

🇨🇦 CapIntel And NEI Investments Partner To Power Better Experiences For NEI’s Wholesalers, Advisors, And Clients - Businesswire, August 29, Toronto

🇺🇸 Groundfloor Launches Next Round Of Financing On Wefunder - Businesswire, August 31, Georgia

🇺🇸 NDVR Introduces New Socially Responsible Investing (SRI) Capabilities For High Net Worth Clients - PR Newswire, August 30, Massachusetts

🇺🇸 Equisoft Launches New Solution To Help Wealth Professionals Perform Investment Product Due Diligence - PR Newswire, August 30, Pennsylvania

EMEA News

⭐🇬🇧 Startup PM Alpha Launches Digital Marketplace For Wealth Management Industry - Finextra, August 31, London

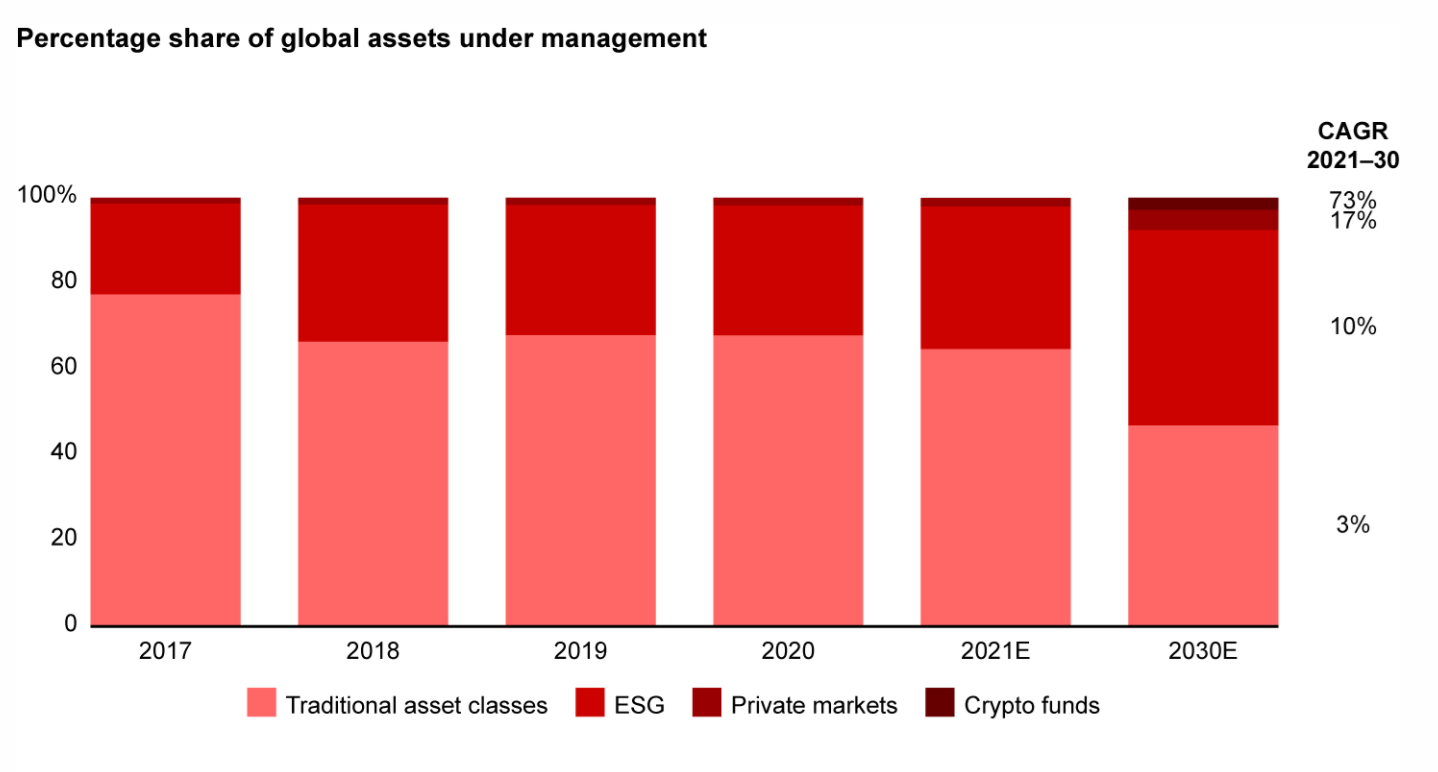

Private Markets Alpha (PM Alpha) is an online platform for access to private markets, such as alternative credit, VC, and PE, and has raised £1MM through private fundraising. The company offers investment strategies and due diligence for asset managers and advisors, investment products for private banks and wealth managers, and access to fund managers for multi-family offices.

It is also building out an alternative investment marketplace and a community of international distribution partners. Creating a large scale, liquid marketplace for private assets is the dream, but faces significant regulatory and technical hurdles. Even at the lower end of crowdfunding, e.g., Wefunder and Crowdcube, there are challenges to scaling up into retail brokerage territory. We think firms like iCapital are best positioned to convert their platforms into market and data venues.

Still, a Delio Group report suggests that wealth management firms allocate 30-50% of their wealth to private markets, and 70% of clients seek access to illiquid investments.

🇳🇴 Wealth Tech Firm Infront Acquires Assetmax - Altfi, August 26, Oslo

🇬🇧 Moneyfarm Nears £2.5B In Assets As Female Investor Numbers Double - Altfi, August 25, London

🇬🇧 St. James Place (SJP) To Launch Mobile App - FT Adviser, August 31, Cirencester

🏴 Abrdn Faces FTSE 100 Ejection - FT Adviser, August 25, Edinburgh

Curated sponsorships

We work with select companies to deliver brand awareness to our 100,000+ digital finance audience. See our prior partners here, and reach out here with interest.

Asia Pacific News

⭐🇦🇺 Wealthtech Super Fierce Reports Topping $116MM In Fees Saved For Users - Crowdfund Insider, August 28, Sydney

Super Fierce is an Australian platform that targets women, supporting them with investment decisions. The platform compares 500+ super funds and assists in switching, creating meaningful savings in fees over the investment horizon. Super (superannuation) is a pension fund, consisting of compulsory employer contributions, employee contributions, and sometimes additional Government contributions.

The platform finds super accounts, analyzes positions, and shows if savings on fees are available. The platform then provides three fund categories: lowest cost fund, sustainable fund, and lowest cost of existing funds, with the impact of each on retirement balance, fee savings, and charitable contributions. If a user wants to implement the changes, it costs a one-time fee of $365. The average target fund fees are 0.22% per year.

For context, 5.7MM Australians have more than one super account, which may cost them $2.6B in fees each year. The $57T global pensions industry is the last bastion of the investment industry to experience disruption and innovation, but we do see signs like Penfold in the UK and the overall growth in digital advice and digital assets. Women-focused roboadvisors are also an interesting and recurring category — think Daily Worth, or Ellevest — though most have either pivoted out of the original positioning, or shut down.

🇸🇬 Endowus Surpasses $2B In AUM - Fintech News, August 25, Singapore

🇸🇬 Kristal.AI Triples Global AUM In One Year, Crosses $1B Milestone - Fintech News, August 25, Singapore

🇮🇩 GoTo Group Acquires Indonesian Crypto Exchange For $8.4MM - Tech In Asia, August 30, Jakarta

Blogs, Webinars, Podcasts

🇬🇧 Is No-Code Technology The Future Of Wealthtech? - Fintech Global, August 31, London

🇬🇧 Robots Or Humans For Financial Advice: Which Do Consumers Prefer? - Finextra, August 30, London

🇮🇱 eToro’s Yoni Assia: How Digital Finance Could Bridge The Next Big Wealth Gap - World Economic Forum, August 31, Tel Aviv

🇺🇸 The Role Of Self-Service In Wealth Management: A Tool For Mutual Benefit - EPAM, August 26, Pennsylvania

Events & Reports

🇳🇴 Storebrand: Transforming Asset Management Through Technology - FinTech Magazine, August 31, Lysaker

🇺🇸 Wealthverse Summit - Eve Wealth, September 8, California

🇺🇸 Boston Fintech Week - Boston Fintech Week, September 27-29, Massachusetts

🇺🇸 Crypto Wealth Summit - Eaglebrook Advisors, October 10-12, Florida

Shape your Future

Wondering what’s shaping the future of Fintech and Digital Wealth? At the Fintech Blueprint, we go down the rabbit hole to help you make better investment decisions and innovate and compete in the industry. A premium subscription opens access to:

Weekly Long Takes on Fintech and DeFi operating and investment topics

Unlocks access to the full archives of all Long Takes (see index here)

Weekly Podcast Conversation transcript, illustrated with analysis and charts

Read our Disclaimer here — this newsletter does not provide investment advice and represents solely the views and opinions of FINTECH BLUEPRINT LTD.

Want to discuss? Stop by our Discord and or reach out here anytime.