Digital Wealth: Private equity tokenized by Securitize, accessed via Onramp

Structural barriers have traditionally limited access to private markets, but companies like Securitize and Forge are changing this

Hi Fintech Futurists —

Happy Thursday! Today we highlight the following —

NORTH AMERICA: Securitize Partners With Onramp To Streamline Private Equity Investing

EMEA: Allfunds Launches Dedicated Alternatives Division

APAC: PAG-Backed Nuvama Wealth Buys Wealthtech Startup Pickright

GEOGRAPHIC NEWS CURATION

Based on your feedback, we know that many of you are interested in reviews of companies or projects highlighted by our community. Leave a comment below with a company of your interest and we’ll do a deeper take on it later!

Currencycloud makes it easier, quicker, and more transparent to move money across borders. The Fuse Partner Programme for fintechs, banks and professional services firms brings together cutting edge cross-border payments technology, people and businesses to drive faster routes to market.

Join the likes of Moov, Thought Machine, and Accenture and take your business to the next level through a partnership with Currencycloud.

Digital Wealth Short Takes

⭐🇺🇸 Securitize Partners With Onramp To Streamline Private Equity Investing - PR Newswire, March 21, New York

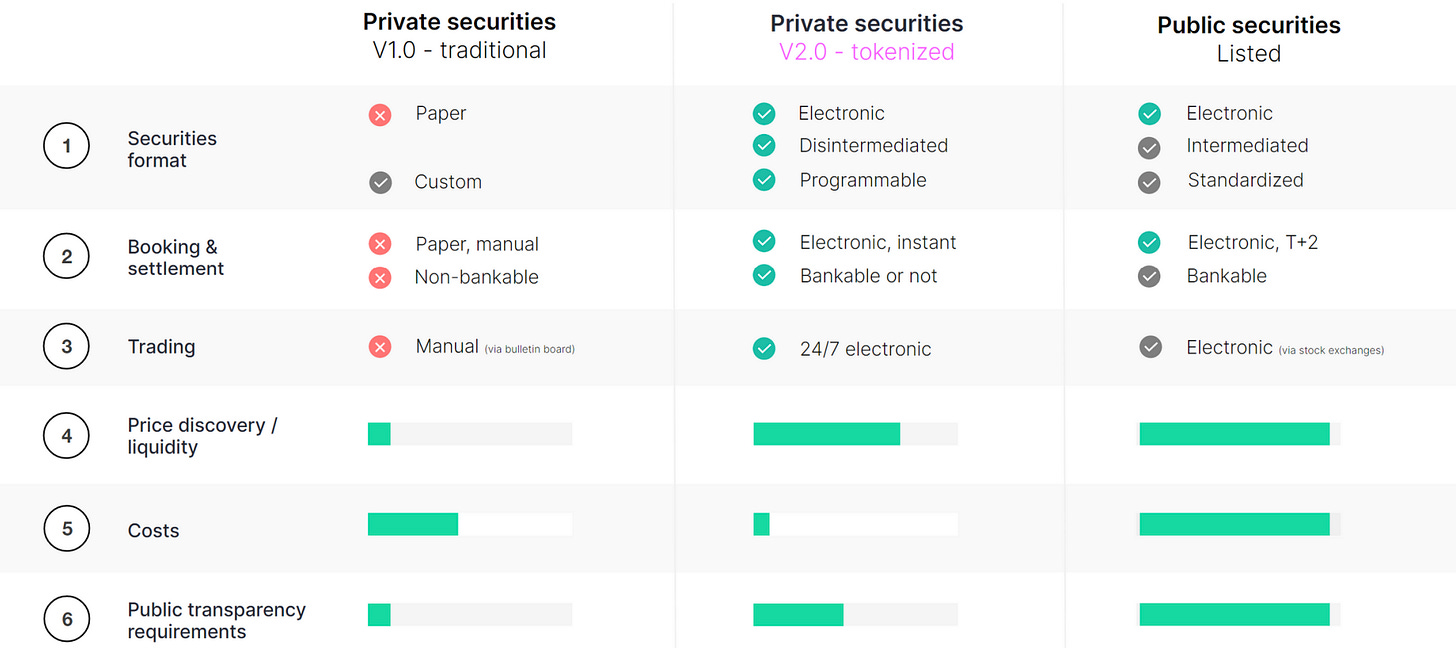

Digital asset company Securitize and wealthtech Onramp Invest unveiled four tokenized private equity feeder funds from investment firms such as Hamilton Lane. Securitize's platform provides tokenization management services to issuers, simplifying the process of capital raising, asset management, and trading.

Not all digital assets are created equally. Among others there are coins, protocol tokens, application tokens, CBDCs, and real-world assets (e.g., stocks and real estate) that have been tokenized. Onramp has historically helped RIAs access crypto assets — here we see an extension to tokenization of existing asset classes.

Onramp clients can access private markets through Securitize's tokenized feeder funds, with the first two feeder funds offering access to Hamilton Lane's Equity Opportunities Fund V. The minimum investment is $20,000, with each share valued at $1,000. The fund primarily invests in software tech, healthcare, consumer discretionary, and industrial sectors, and Securitize has tokenized the feeder fund on the Polygon blockchain.

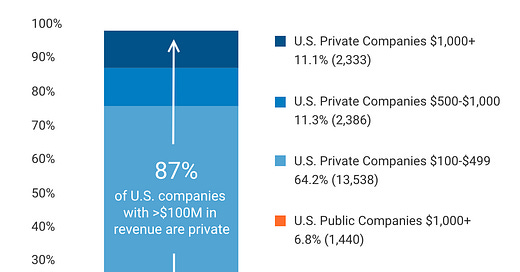

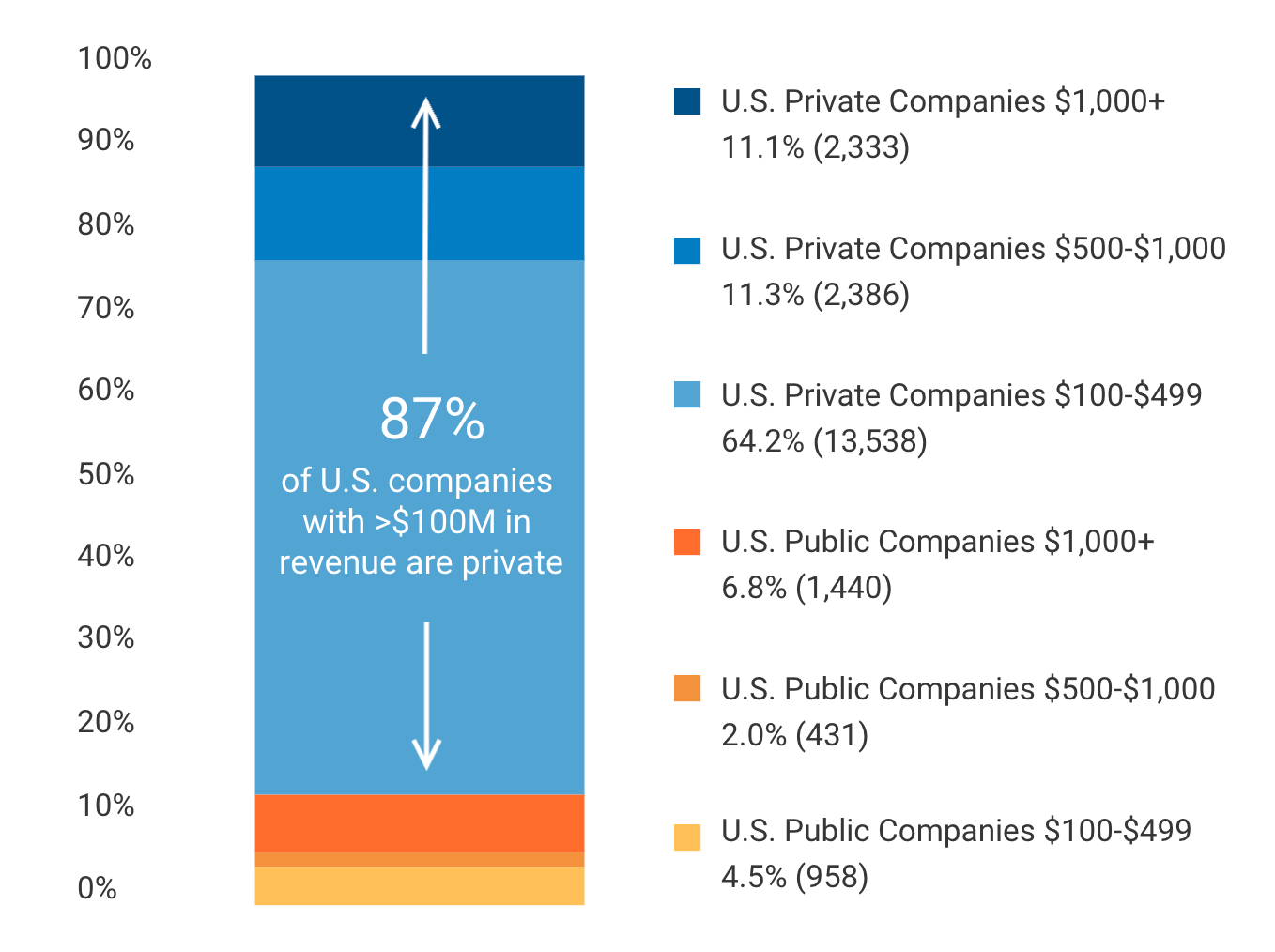

In the US, there are 2,800 public companies generating annual revenues over $100MM, and another 15,000 private businesses of similar size. These private businesses require funding for growth and attracting talent as much as their public counterparts. Tokenization of private equity is an infrastructure upgrade for these markets and their access to capital. On the other end, it also helps increase the audience of investors that can access these returns, and supports the digital wealth companies that distribute new products.

We would be interested to see more tokenized real world assets, digitized into APIs, and plugged in directly into roboadvisors and neobanks.

⭐🇪🇸 Allfunds Launches Dedicated Alternatives Division - Investment Week, March 21, Madrid

Allfunds, the Spain-based B2B wealthtech with €1.3T+ in assets under administration, is launching Allfunds Alternative Solutions. In the last 18 months Allfunds has been busy — partnership with Banco de Brasil and iCapital, multiple acquisitions (Web Financial Group and instiHub Analytics) and most recently, the Euronext M&A buyout that almost was. The intention behind launching a new division is clear — ride the alts wave and grow AUM.

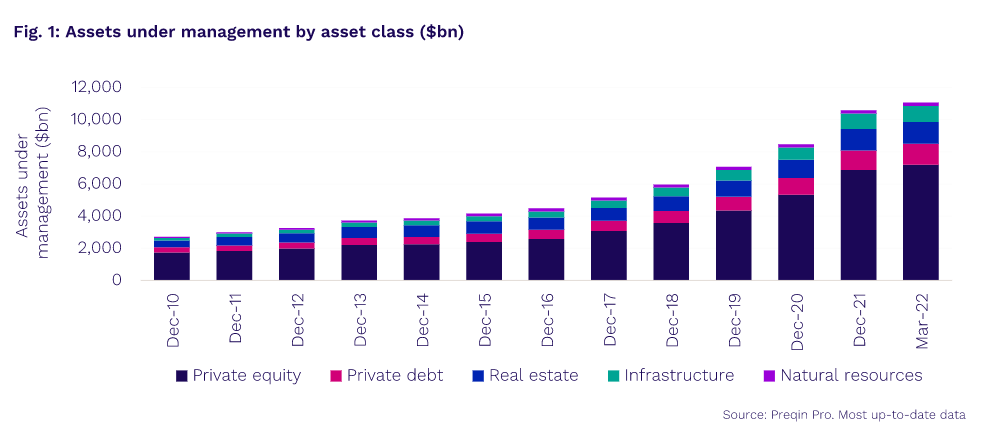

The high-rate macro environment has led to volatility across sectors, including in the bond market. Alternatives, however, remain an appealing asset class. According to Preqin, an investment data company for alts, as of 2021, AUM across alternative asset classes has grown from $7.2T to $13.3T. Wealth managers continue to see strong flows into assets such as private debt, private equity, venture capital, collectible art, and digital real estate, among others.

These products are potentially less volatile than public markets, and offer significant upside potential. Or, at least, they have lower liquidity, and therefore force investors to ride out the volatility over the long term. In all cases, these assets are powerful for diversification.

Wealth managers with digital distribution channels are making alternatives more accessible to investors as entry minimums come down, which in turn catalyzes companies focused on related data, analytics, and investment recommendations.

One of the biggest areas of growth is building liquidity and access for private markets, especially as retail investors generally have a shorter time horizon than institutions. We wonder whether such increased liquidity may actually make these securities feel as volatile as their public market counterparts, and generate issues for managers requiring “patient capital”.

⭐🇮🇳 PAG-Backed Nuvama Wealth Buys Wealthtech Startup Pickright - Silicon India, March 21, Mumbai

Nuvama Wealth, a wealth management firm formerly called Edelweiss Wealth Management, has purchased a 74% stake in Pickright Technologies, a SEBI-registered wealthtech startup. Pickright Technologies provides investment portfolios based on an individual's risk appetite and financial goals and offers Investpacks, i.e., investments in stocks, ETFs, mutual funds, gold and fixed deposits.

With a customer base of 800,000, Nuvama offers a range of investment products, including stocks, insurance, funds, derivatives, and primary markets. Historically, Indian investors have preferred investing in physical assets, such as gold and real estate, rather than capital markets. However, the pandemic has reshaped investor preferences, increasing interest in the capital markets. This shift is apparent from the 63% surge in active dematerialized (demat) accounts, a digital record that tracks the ownership of tradable assets, including stocks, bonds, and mutual funds, which increased to 89.7MM in FY22.

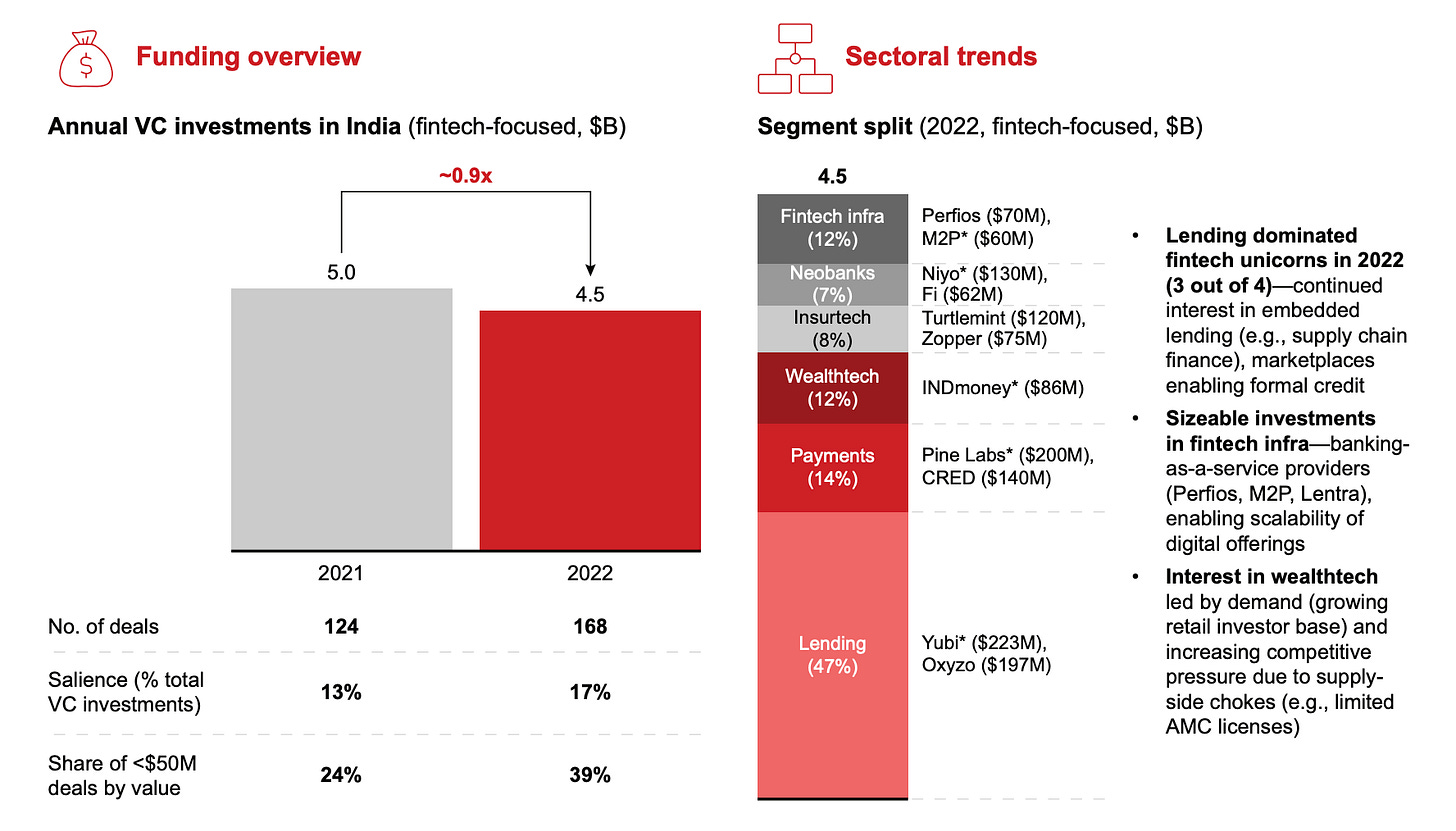

We have also observed three significant trends in the Indian wealthtech sphere. First, there has been consolidation, as more prominent wealthtech players acquired many of the 34 deals in 2021. Second, there is favourable regulation, as the Securities Exchange Board of India (SEBI) has supported the growth spurt in wealthtech and enabled e-commerce companies to offer mutual fund products. Last, India's HNWIs remain underserved. Wealth management firms currently manage only 9% of the HNW wealth in India, suggesting $2.8T in untapped assets.

As the market becomes more saturated and as Scripbox, ETMoney, Groww, Wealthy and IndMoney mature, we expect to see more wealthtechs tailored to HNWIs. The shape of those companies is likely to resemble what we see in other geographies — bundled investing, banking, lending, and payments.

Curated News

North America News

🇨🇦 Canadian Fintech Wealthsimple Introduces Private Credit Fund For Retail Investors - Crowdfund Insider, March 22, Ontario

🇺🇸 reAlpha Asset Management Inc. Launches Fractional Ownership Platform For Short-Term Rentals - Businesswire, March 20, Ohio

🇺🇸 Praxent Introduces Accelerator App, Helping Wealthtechs Speed Time To Market - Businesswire, March 20, Texas

🇺🇸 Pontera And AssetBook Announce Integration To Help Advisors Comprehensively Manage The Retirement Saver’s Full Portfolio - Businesswire, March 21, New York

🇺🇸 Wealthtechs Confluence, Fundguard Partner Up - Fintech Global, March 20, Pennsylvania

🇺🇸 Linqto Surpasses $200MM In Total Investments And Announces Lowest Accessible Entry Point In Private Equity - PR Newswire, March 22, California

🇺🇸 Envestnet Data Aggregation Delivered Substantial ROI For Financial Institutions - Crowdfund Insider, March 20, Pennsylvania

EMEA News

🇦🇪 Sygnum Bank Middle East Launches In Abu Dhabi - Emirates News, March 22, Abu Dhabi

🇦🇪 Accelex Introduces First Fully Automated Document Acquisition Solution for Private Markets - CNW, March 22, London

Asia Pacific News

🇮🇳 Wealthtech Addepar Expands To India With Pune Office - Crowdfund Insider, Pune, March 21

🇹🇼 HSBC Taiwan Wins 5 Wealth Magazine Awards - Taipei Times, Taipei City, March 17

Blogs, Webinars, Podcasts

🇬🇧 How Will Generative AI Impact Wealth Management? - Fintech Global, March 21, London

🇮🇱 The Future Of Wealthtech: Integrating Traditional Finance And Fintech Innovations - Finance Magnates, March 16, Tel Aviv

🇬🇧 Why The Independent Model Is Powering Industry Growth - WealthManagement, March 22, London

Events & Reports

🇺🇸 Envestnet Summit 2023 Elevate - Envestnet, April 26 - 27, Colorado

🇺🇸 Wealth Management Edge - Informa Connect, May 21 - 24, Florida

🇺🇸 Finovate Spring - Informa Connect, May 23 - 25, California

🇬🇧 Innovation In Wealth Management - Professional Wealth Management, June 8, London

🇬🇧Private Banking & Wealth Management London Conference & Awards 2023 - Arena International, June 14, London

Shape your Future

Wondering what’s shaping the future of wealthtech, Fintech, and DeFi?

At the Fintech Blueprint, we go down the rabbit hole in the DeFi and Fintech industries to help you make better investment decisions, innovate, and compete in the industry. Subscribe now to level up your knowledge and get access to our weekly Long Takes!

Read our Disclaimer here — this newsletter does not provide investment advice and represents solely the views and opinions of FINTECH BLUEPRINT LTD.

Want to discuss? Stop by our Discord and or reach out here anytime. Leave a comment below on what you think and what we should cover next.