Fintech: Can Musk's X Money power $8B in payments and save X/Twitter?

Providing the financial rails for the attention economy

Hi Fintech Futurists —

A quick comment on the markets. There is a lot of damage in risk-on assets right now, from DeepSeek crushing OpenAI and its infrastructure-heavy business model, to Bitcoin and the rest of crypto taking an enormous tumble, with many of the long-tail coins being completely wiped out. The proximate reason is the tariff war, which would drive inflation via supply-chain constraint, which in turn would lead to higher interest rates, and less money to splash around.

Buckle in for a rough Q1. We think the next 6 months are likely to be highly unpleasant. By Q3, our view is that this volatility will settle and the new normal will take over. The fundamentals of the future have not changed — more GDP will come from software and machines, financial services are largely digital and global, and you need to upskill and keep up with the trends. So we will keep showing up and learning about the world.

Today’s agenda below.

FINTECH: X Money wants to power $8B in U.S. creator payments

ANALYSIS: Learning from the $500B AI crash and 1873 Railroad Bond panic (link here)

CURATED UPDATES: Paytech, Neobanks, Lending, Regulation & Policy, Digital Investing

To support this writing and access our full archive of newsletters, analyses, and guides to building in Fintech & DeFi, subscribe below (if you haven’t yet).

And make sure to check out our sponsor — your engagement helps us immensely.

Fintech Meetup

It’s time to get ready for a huge 2025: join thousands Fintechs and FIs for the ecosystem event of the year on March 10-13 at the Venetian, Las Vegas.

You’ll be part of the industry's largest, most productive, and highest-rated meetings program. Don’t miss your chance to connect in over 60,000 meetings with banks, credit unions, fintechs, investors, and professional services firms. The event will feature a carefully-curated agenda packed with insights into the future of fintech. You’ll hear from industry visionaries like Kathleen Peters, Chief Innovation Officer at Experian, Eric Sager, COO at Plaid, and Kate Walton, MD & CCO at Merchant Payments, JPMorgan Chase & Co.

Whether you’re a start-up pitching for investment, an exhibitor unveiling cutting-edge AI solutions, or a financial institution developing the next-gen digital platform, Fintech Meetup 2025 is THE place to be this Q1.

Digital Investment & Banking Short Takes

X Money wants to power $8B in U.S. creator payments

There’s been a lot of chatter about Twitter / X getting plugged into Visa to offer payments. We have been tracking this trend for a while now, ever since Musk took over the social network, and before it was clear that X loses money but wins elections.

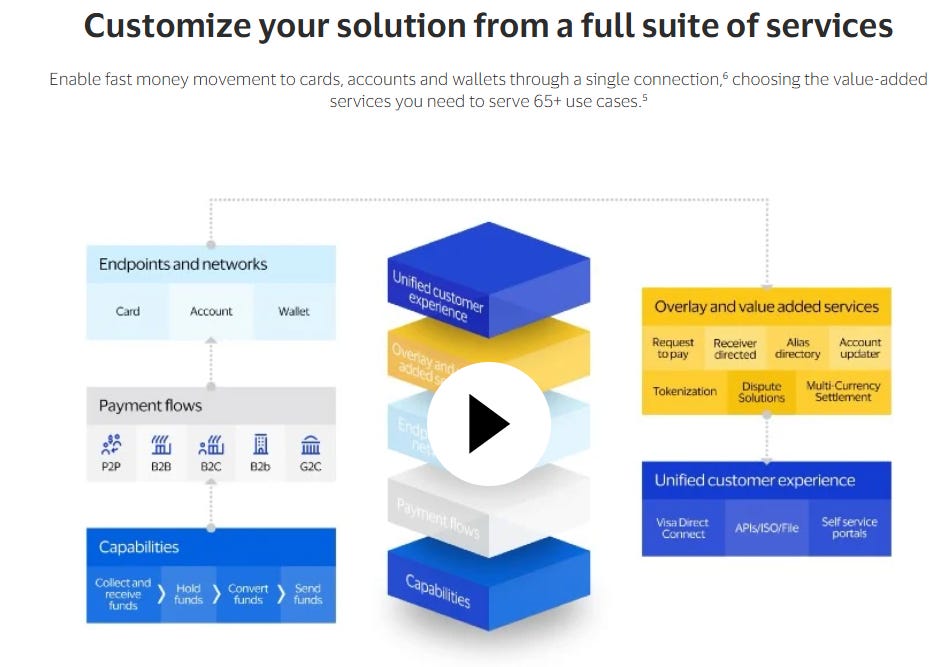

The platform still has 350MM monthly users and last week announced X Money. Officially debuting later in 2025, the service will equip users’ X accounts with a native digital wallet and a peer-to-peer payments solution. The initial user experience will enable: (1) linking your bank account or debit card to X, (2) instantly depositing funds, and (3) transferring money between accounts. Powering this setup is Visa Direct, which enables the on/off ramps to X Money and facilitates payments across Visa’s network of cards, wallets, and bank accounts around the world.

Above is the product visualization of Visa Direct, and we can assume X will get a bunch of this out of the box.

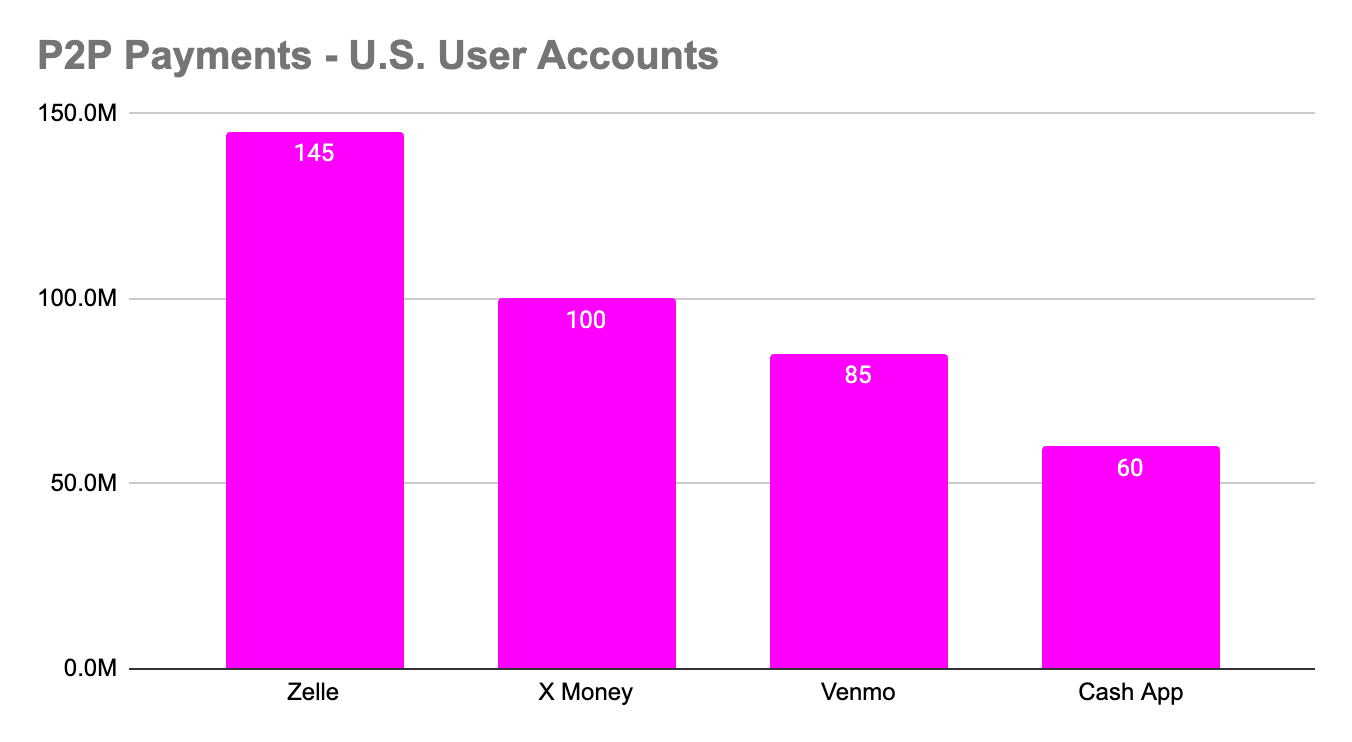

While the technology is in place, Musk is still awaiting regulatory approvals, which it has only obtained in the US so far. The rest of the world — approximately 80% of users, along with nine US states including New York — likely won’t have access yet. Still, X Money can reach roughly 100MM users in the US alone, positioning it ahead of both Venmo (85MM) and Cash App (60MM) but behind the P2P interbank network Zelle (145MM).

A payments entrepreneur at heart, Elon Musk hasn’t been shy about his plans to mold X into “the everything app,” similar to the superapp strategy of Revolut, and inspired by ecosystem apps like China’s WeChat or Singapore’s Grab. In an interview back in 2022, Musk hinted at commerce, high-yield savings, and debit cards as part of an embedded payments service in X.

But in contrast to its competitors, X already owns a critical component of the digital wallet strategy — identity. In addition to identity, X also holds precious user attention.

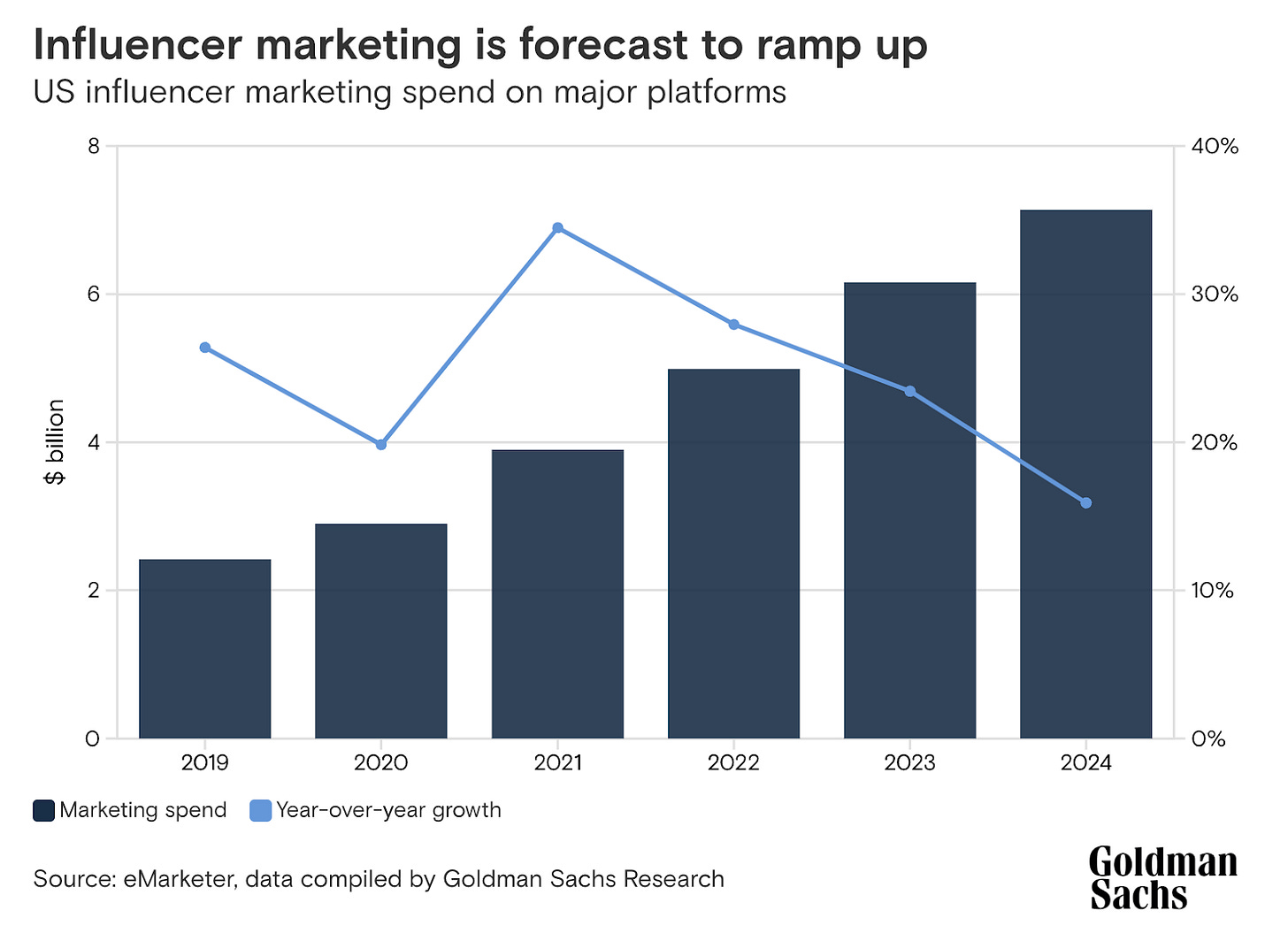

We’ve previously discussed how communities, creators, and their fans’ expression of identity power X’s attention economy, forming a fertile base for advertising, commerce, and other financialisation to take place. It is therefore no surprise that X Money’s primary use case is enabling creators to get paid for monetized content. In the US, annual marketing spend to influencers amounted to $7.5B last year.

According to a recent survey, almost 45% of X users interact with influencers on the platform. For users in more niche community-led industries like crypto, this number is probably closer to 90%. This makes it a good edge case to consider where X Money may be headed.

It’s common for content creators to get paid by emerging projects for posting long-form promotional content to followers. This creates a mini economy of its own, where demand for attention is satisfied by “key opinion leaders” or KOLs, with value accruing to those with the highest mindshare — nothing new here. In the old world, we would call these people “financial advisors” or “equity research analysts”, but with much stronger conflicts of interest.

Platforms like Kaito take this one step further, providing a leaderboard for different creators’ mindshare on X in various sub-communities, measured in the number of “Yaps”. Narratives in crypto move fast and therefore so does the ranking. A new protocol with low visibility would need to quickly pay top Yappers to post about a topic while it’s hot. This is in part why markets have been so recursive and schizophrenic.

Now imagine being able to do this instantly and natively within the X ecosystem, fully compatible with your preferred payment method — that’s the opportunity that X Money opens up. Adding stablecoin support to the X wallet is a natural next step as winning mindshare will require speed and instant settlement. Similarly, AI agents equipped with wallets will outcompete others — the top Yapper over the past six months is aixbt!

For users, we expect that the financialization of attention will result in certain kinds of content eventually being filtered through. In essence, this is an advertisement of financial products at scale, with various gamification levers taken from the attention economy playbook. Musk has made Twitter / X less interesting to advertisers, and therefore revenue has to come from the website’s users. Adding payments into the mix gives X a revenue stream for the financialization of the information on its platform.

👑 Related Coverage 👑

Long Take

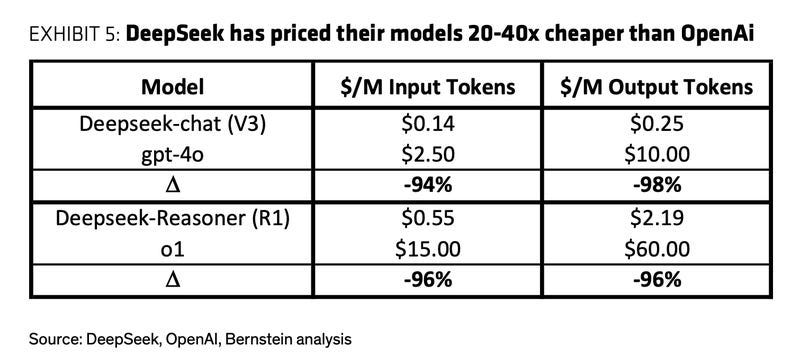

We examine the recent $500B market cap loss for NVIDIA and OpenAI, triggered by the emergence of DeepSeek, a Chinese AI model rivaling OpenAI’s capabilities at a fraction of the cost. DeepSeek’s reported $6M training expense — compared to OpenAI’s hundreds of millions — challenges the economic efficiency of large-scale AI investments, raising concerns about the sustainability of GPU demand.

Additionally, CoreWeave and other GPU cloud providers have taken on $11B in debt to finance data center expansion, creating systemic financial risk if AI demand fails to meet expectations. Historical parallels, such as the 1873 railroad bond collapse, illustrate the dangers of over-leveraged infrastructure investments without clear revenue streams.

Curated Updates

Here are the rest of the updates hitting our radar.

Paytech

⭐ Treasury Dept. gives Elon Musk's team access to federal payment system - ABC News

Brazilian paytech PagBrasil lands Payment Institution licence - Fintech Futures

US transportation paytech AtoB raises $130m in equity and debt funding - Fintech Futures

Neobanks

⭐Fintech startup Cushion shuts down after 8 years and over $20 million in funding - Techcrunch

Ozuma debuts crypto neobank in Europe with Striga - The Paypers

Lending

Amazon to Acquire Indian Digital Lending Firm Axio to Expand Credit Solutions - Crowdfund Insider

Plumery Launches Digital Lending Delivering Loan Application to Disbursement in Under Three Minutes - FF News

Inside Citi Pay’s strategy to take over BNPL - Modern Retail

Digital Investing

Robinhood helping UK investors gain easier access to US markets - Finextra

Best Robo-Advisor Cash Management Accounts of February 2025 - Investopedia

Trump Media Expands into DeFi with Truth.Fi Launch - CoinTrust

🚀 Level Up

Join our Premium community and receive all the Fintech and Web3 intelligence you need to level up your career. Get access to Long Takes, archives, and special reports.

Sponsor the Fintech Blueprint and reach over 200,000 professionals.

👉 Reach out here.Check out our AI newsletter, the Future Blueprint, 👉 here.

Read our Disclaimer here — this newsletter does not provide investment advice