Fintech: Nirvana, AI insurance for trucks, gets $57MM; BitGo acquires HeightZero to bring TradFi to crypto

Nirvana Insurance uses a combination of AI, IoT, and telematics to develop advanced risk models for commercial truck fleets.

The Fintech Blueprint is a newsletter authored by me, Lex Sokolin, and a small group of brilliant researchers who focus on frontier technologies impacting the future of financial services. I am glad you are here. Was this email forwarded to you? You deserve your own:

👉subscribe here.

Hi Fintech Futurists —

You’re the best, today’s agenda below.

AI: AI insurance startup Nirvana rocks a $57MM Series B (link here)

WEALTHTECH: BitGo acquires HeightZero bringing TradFi wealth management capabilities to digital assets for RIAs (link here)

LONG TAKE: How Wise disrupted $150T of Cross-Border Payments and earns $1B in revenue (link here)

PODCAST CONVERSATION: Embedding Web3 infrastructure into Web2 platforms, with Bastion Co-Founders Nassim Eddequiouaq and Riyaz Faizullabhoy (link here)

CURATED UPDATES

To support this writing and access our full archive of newsletters, analyses, and guides to building in the Fintech & DeFi industries, subscribe below.

Digital Investment & Banking Short Takes

AI: AI insurance startup Nirvana rocks a $57MM Series B (link here)

Nirvana Insurance has raised $57MM, bringing its valuation to over $350MM post-money. The insurtech uses a combination of AI, IoT, and telematics to develop advanced risk models for commercial truck fleets. Typically, fleets of trucks operate as small businesses, with 90% of fleets having fewer than 50 trucks. These operators are cost sensitive, due to rising fuel prices, as well as mandatory insurance that can cost between $15-20k annually per vehicle. The insurance challenge is amplified by the process of obtaining quotes, securing policies, and making claims, all of which can prevent trucks from activity for weeks.

Nirvana solves this challenge by leveraging data from truck sensors to evaluate risks and derive custom pricing models for its clients. A 2017 US federal mandate required all trucks to install electronic logging devices, which are now present in 30-40% of all vehicles globally. By collecting data from these sensors, as well as from dashboard cameras, Nirvana is able to determine operator and truck safety with accuracy. Drivers deemed safe are eligible for a 20% discount on premiums, and users generally are able to receive faster quotes, customized for the client’s fleet size. The company also uses dashboard cameras to both file and make claims, speeding up the claims process as well.

Such implementation of AI is one of the near-term areas for generating real business and customer impact. Sensors are becoming more prevalent, and companies can use their data to make quicker informed decisions and customized pricing can adapt their business models that better suit their customer base. The insurance market benefits greatly from deeper quantitative modeling, and the same logic applies to risk models across a broad range of financial offerings. For instance, Nova also raised $45MM last week for leveraging customer bank data to provide a novel mechanism for accessing credit. This is machine manufacturing of financial products.

👑 Related Coverage 👑

In Partnership

5 Key Insights for Your Build vs Buy Decision

For forward-thinking leaders eyeing sustainable growth, investment in an integrated platform for managing fraud, credit, and compliance risks is no longer optional — it's imperative.

Are you ready to empower your organization with cutting-edge technology, such as Generative AI, to not just solve today's problems but anticipate tomorrow's challenges?

In this FREE guide, we discuss:

Building vs Buying a Risk Decision Platform

AI Risk Decisioning: The Foundation of Risk 3.0

Future Proofing your Fraud & Risk Strategy

WEALTHTECH: BitGo acquires HeightZero bringing TradFi wealth management capabilities to digital assets for RIAs (link here)

BitGo, a custodian for digital assets, has acquired HeightZero, a digital TAMP helping wealth managers access the cryptocurrency market, for an undisclosed amount. This comes shortly after its $100MM raise earlier this summer, valued at $1.75B. BitGo has stated that these funds are primarily for growth via M&A, though it has experienced little success in acquisition follow-through. Reminder that last year, Galaxy Digital abandoned a $1.2B deal to buy BitGo, which in retrospect appears favorable for BitGo given its recent valuation. This year, it dodged a bullet by terminating a deal with Prime Trust, which we now know lost its customers’ keys and recently filed for Chapter 11 bankruptcy.

HeightZero targets RIAs by offering tools that allow advisors to add client capital to digital assets like Bitcoin and Ethereum, which can be accessed through a web-based portal. Access is tiered and clients are charged a monthly service fee based on a percentage of AUM. There are API endpoints that also feed into other technology stacks, like TradingView. There are also services that include portfolio rebalancing, statement generation, tax loss harvesting, and automated billing — traditional wealth management features that most institutional clients have not fully adopted when it comes to investing in digital assets. The risk of fraud, market volatility, and custody continue to serve as customer pain points after instances of exchanges not being able to meet client withdrawals. These are concerns that firms like BitGo are hoping to alleviate.

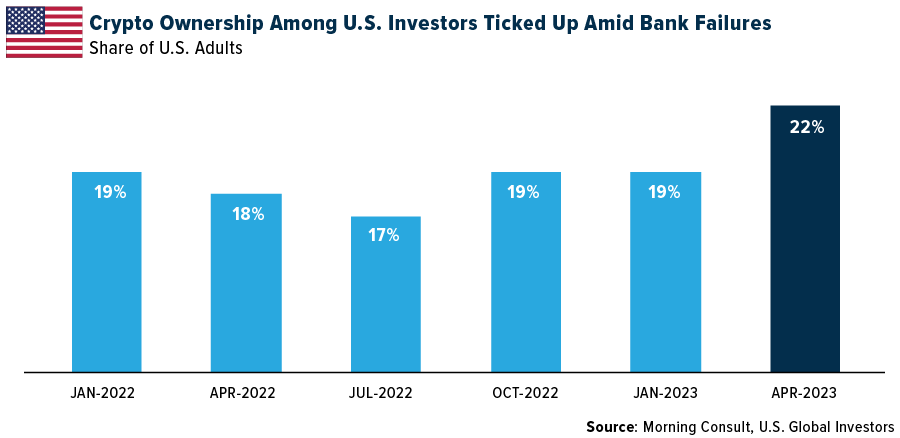

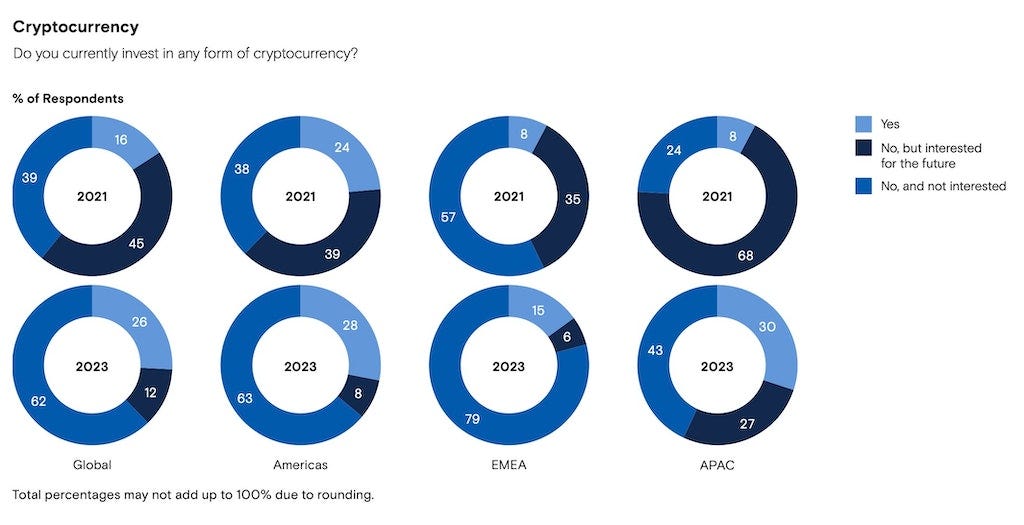

The convergence of capital, innovation, and technology within TradFi and digital assets is important for broader adoption, and while the gap is narrowing, it’s still early and the environment is contradictory. On the one hand, banking debacles such as the collapse of Silicon Valley Bank have altered the perception of what constitutes supposedly “safe” institutions. That has opened the door for digital asset-centric firms like BitGo to grow. On the other hand, despite fairly broad ownership of crypto assets by consumers, crypto industry reputation has been deeply damaged.

Investor interest in digital assets continues to surge, driven mainly by more accessible technology platforms and traditional finance players offering services in digital assets. According to Nomura, 90% of investors consider it important to have the backing of a large financial institution before investing in crypto assets. 96% of them see digital assets as a diversification opportunity alongside traditional investments. Of course, Nomura would say that!

This deal comes at a moment for traditional RIAs and other institutional investors who may have been wary of regulatory oversight in adopting digital assets like cryptocurrencies, especially in the US. BitGo’s acquisition addresses a market need, but success will depend on how well platforms integrate and reassure wealth managers that clients can safely invest in cryptocurrencies as part of their asset allocation.

The SEC’s recent court setbacks offer some favorable tailwinds, as a host of major financial institutions currently await a decision on whether it will allow the issuance of a spot bitcoin ETF. Approvals are anticipated to add approximately $155B to Bitcoin’s market cap ($1T to crypto overall) which will have massive implications. The moment there’s a green light, expect firms with the infrastructure to accommodate institutional demand to benefit. That means they should get prepared today.

👑 Related Coverage 👑

In Partnership

Do you Know Your Customer? How to prevent fraud with biometric identity verification

👉 November 8, 2023 at 2pm ET

The stakes are high when it comes to preventing fraud and protecting customers’ data and identities. However, even for those not legally obligated, implementing KYC measures can be an effective safeguard against fraud and other illicit activities.

In this free webinar, experts from Incode, Customers Bank, and Affirm will discuss how they are leveraging the latest KYC solutions, and effective practices to enhance consumer trust and loyalty while avoiding damaging legal repercussions and reputational risks.

Blueprint Deep Dives

Long Take: How Wise disrupted $150T of Cross-Border Payments and earns $1B in revenue (link here)

Wise launched in 2011 with a bold mission to make moving money across borders instant, free, and convenient.

A decade later, the platform facilitates over $130B annually in cross-border payments from 10MM customers, with prices averaging 1/8th those of traditional banks. This week we uncover the strategy fuelling Wise’s growth and the mechanics behind FX transfers. We particularly touch on the paradox of a zero-fee target while growing profitability, and assess the increasing threat of stablecoins in the FX industry.

How to Reach 195,000 Fintech Professionals

With a 35% open rate and 1 million post views per month, we have an engaged audience of Fintech, DeFi, and AI enthusiasts receptive to your messaging.

👉 Contact us to learn more about our custom opportunities.

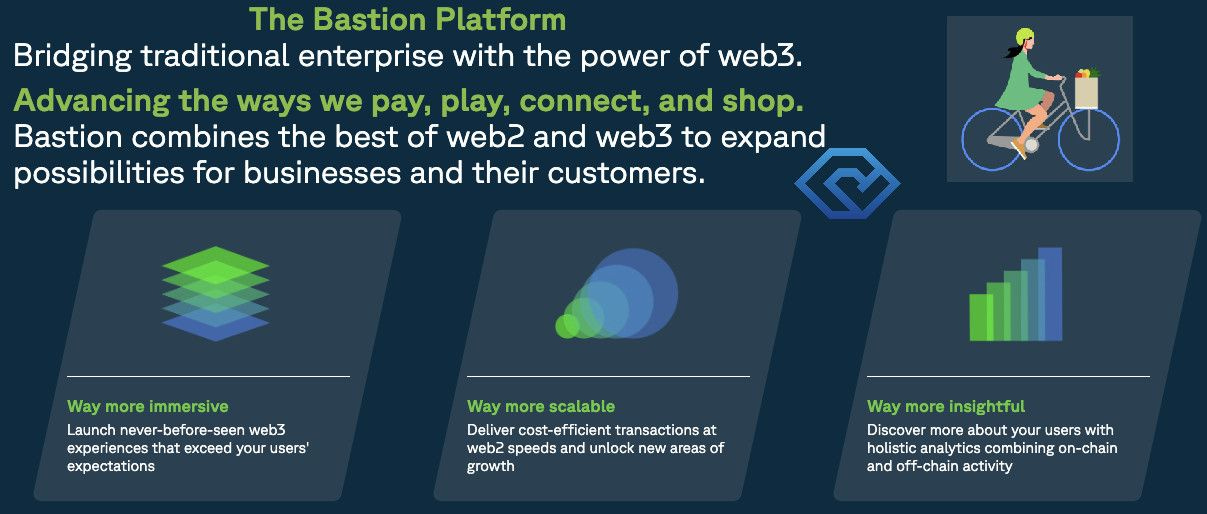

🎙️ Podcast Conversation: Embedding Web3 infrastructure into Web2 platforms, with Bastion Co-Founders Nassim Eddequiouaq and Riyaz Faizullabhoy (link here)

In this conversation, we chat with Nassim Eddequiouaq and Riyaz Faizullabhoy - Co-Founders of Bastion.

Bastion helps companies seamlessly integrate web3 infrastructure into enterprise technologies through a compliant, white-label platform. The Bastion platform focuses on three core pillars: ownership & monetization of digital goods, smart transaction routing, and customer analytics.

Curated Updates

Here are the rest of the updates hitting our radar.

AI

Banking

Payments

⭐ UAE to launch national domestic card scheme - Finextra

BNP Paribas launches fintech for marketplace payments - Finextra

Brazil suspends WhatsApp’s payments service - TechCrunch

Wealthtech

⭐ Armed with $40M in fresh capital, fintech Stash says it’s moving toward an IPO - TechCrunch

Nova Credit raises $45 million - Finextra

Peak XV invests $35 million in wealth and asset management startup Neo - TechCrunch

French VC firm Founders Future just acquired an equity crowdfunding platform, Sowefund - TechCrunch

Financial Operations

Shape your Future

Curious about what is shaping the future of Fintech and DeFi?

At the Fintech Blueprint, we go down the rabbit hole to help you innovate and compete.

Sign up to the Premium Fintech Blueprint newsletter and get access to:

Wednesday’s Long Takes on Fintech and Web3 topics with a deep, comprehensive analysis

Office Hours, monthly digital roundtable discussions with industry insiders

‘Building Company Playbook’ series, offering insider tips and advice on constructing successful fintech ventures

Enhanced Podcasts with industry leaders, accompanied by annotated transcripts

Archive Access to an array of in-depth write-ups, spanning across 15+ topics and encompassing over 50 Fintech and DeFi brands