Fintech: Plaid's Expansion beyond Data to Payments and Real-Time Underwriting

Plaid processes half a billion account connections every day, linking 12,000+ financial institutions.

Hi Fintech Futurists —

Today’s agenda below.

FINTECH: We examine Plaid’s evolution from a data aggregator into a multi-faceted fintech leader now also focusing on credit underwriting, fraud detection, and payments. Plaid powers half a billion account connections daily, linking over 12,000 financial institutions and more than 100 million consumers globally. To expand further, Plaid is leveraging real-time credit data for underwriting, developing anti-fraud tools to tackle a $52B identity fraud problem, and enhancing open banking payments, aiming to reduce reliance on card networks.

LONG TAKE: Stripe and Coinbase embrace Generative AI + our AI investment index

To support this writing and access our full archive of newsletters, analyses, and guides to building in Fintech & DeFi, subscribe below. No more paywalls.

Digital Investment & Banking Short Takes

From Data Aggregation to Credit and Fraud

Plaid is one of the defining companies of the Fintech generation.

We were approached by the Plaid team to do a deeper dive into its recent areas of focus and growth, and were excited to explore it through our point of view.

The company’s roots are in financial data aggregation. The initial value proposition for data aggregation was to power personal financial management software, popularized in the 2000s by Mint.com. Since there was no easy way to transport data from banks to third party user experiences, it was manually scraped from websites or downloaded in an accounting file format. However, Plaid saw an opening for another market opportunity — to deliver user onboarding, authentication, and financial account connectivity to Big Tech and Silicon Valley startups, packaged through APIs.

Builders could create applications that invoked financial data with user permission.

Over time, the product evolved to support other sectors, from auto to real estate, as well as the digital financial experiences of some of the largest financial institutions. Today, Plaid’s infrastructure powers half a billion account connections every day, connecting over 12,000 financial institutions with more than 100 million consumers globally.

As a result, Visa attempted to acquire the company for $5B in 2020. Below, you can see the core rationale for unexplored market opportunity. While the deal was blocked by the DOJ, the possibility of going beyond data into payments and adjacent products had made Plaid a hot commodity.

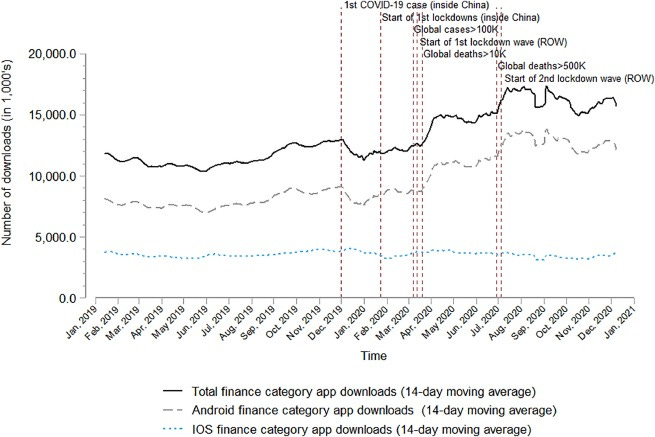

Unfortunately, the macroeconomic climate post-COVID hit Fintechs hard, driving down valuations and funding, and thereby slowing industry-wide growth and expansion. The silver lining is that the pandemic also accelerated the overall adoption of fintech apps, with many people adopting digital behaviors to find ways of managing their financial lives online.

This accelerated the shift to digital finance around the world and sped up Plaid’s plans to move beyond account aggregation into three strategic areas — (1) credit underwriting, (2) fraud detection, and (3) payments. Plaid’s latest Fall release reveals its approach to these segments, each of which is a significant market opportunity. We see Plaid expanding from being a data provider into leveraging its financial network connectivity to power up new types of products.

Let’s take a deeper look at the role Plaid plays in credit underwriting.

Historically, credit decisions rely on pretty static, traditional bureau data. However, lenders are always looking for better information to underwrite with more precision. Financial cash flow data is one such alternate method to assess individuals who may not meet a regular credit check. Today, Plaid powers cash-flow based underwriting by helping lenders assess real-time data on income, spending, and account activity. The company even registered its own Consumer Reporting Agency (e.g., Experian, Equifax), positioning itself as a complement to traditional credit bureaus.

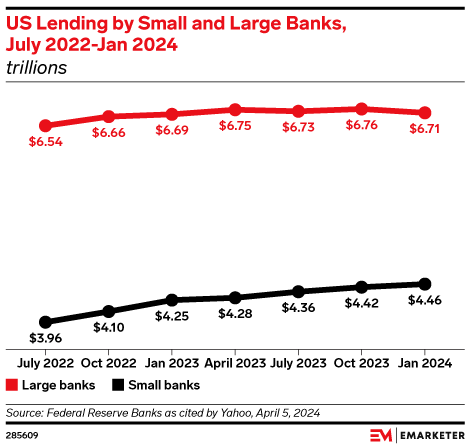

This brings a real-time layer of credit evaluation to the $4 trillion consumer lending industry. Plaid can highlight algorithmic insights, such as identifying risky behaviors like loan stacking, or signaling financial responsibility through account management.

As a result, Plaid could become a key digital lending data player, given that they already work with companies like H&R Block, Rocket Mortgage, Upstart, and Lending Club. One potential outcome is evolution into a next-generation credit bureau, opening up access to a new market for credit for underserved consumers.

Another key effort is fraud prevention.

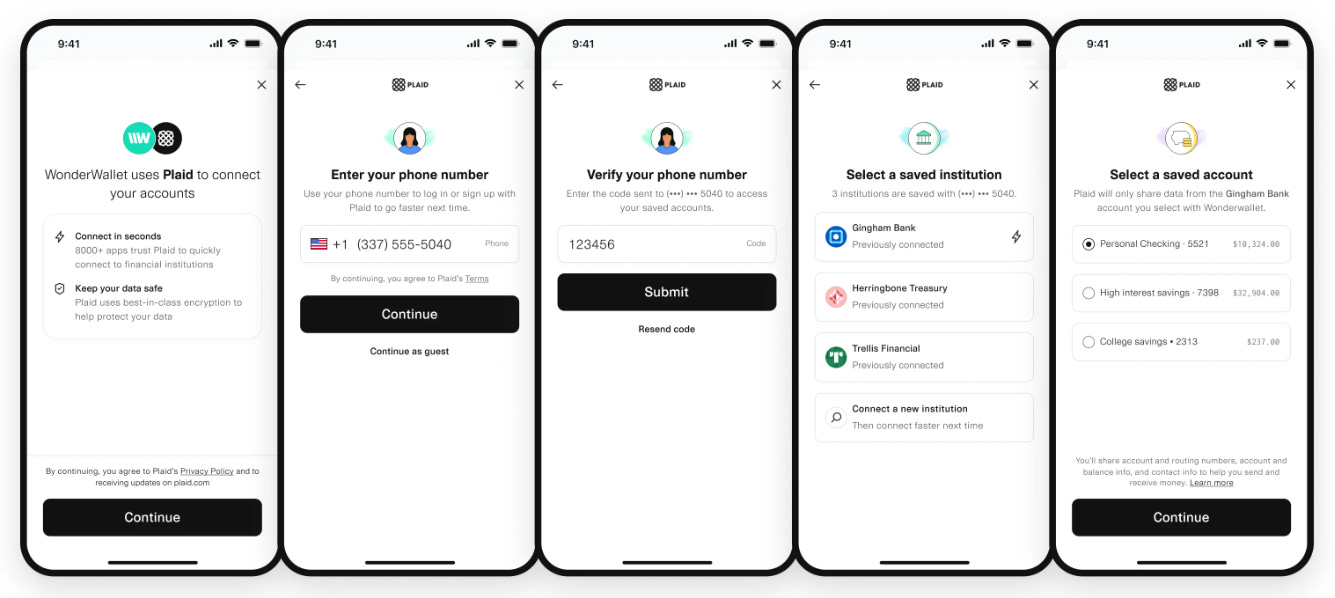

Plaid has built anti-fraud tools for itself since inception, and recently began to productize customer-facing solutions. In 2022, Plaid acquired Cognito and moved deeper into identity verification, which fits well with its customer footprint. At the time we discussed that Plaid could become an identity layer for finance. Today, the company offers a product called Layer that allows consumers, who have already verified and connected via Plaid, to fast-track identity verification and account connecting across connected apps and services.

Fraud prevention is a multi-billion-dollar challenge, with identity fraud alone costing $52B annually and reaching over 40MM people. From the growth of synthetic identities to deepfakes and account takeovers, fighting fraud is becoming more difficult and complex.

Plaid’s anti-fraud tooling is growing. For example, customers can get data breach reports in the Beacon platform, which helps share fraud reports across the network and scan to see if identities were part of a data breach. The company also highlighted machine learning-powered tools to help identity customers fight fraud, including granular scores to understand the risk factors for each user, and a new “Trust Index,” which rolls the risk factors into a single score.

Lastly, Plaid is also betting on open banking / pay-by-bank solutions.

Plaid’s network of 100MM+ connected accounts can compete with the card networks by reducing payment failure rates and lowering processing fees. The company is working with industry heavyweights like Adyen, and targeting account funding and bill pay. Maybe this can make its new network a credible alternative to card-based systems. Certainly, the development of such networks was why the DOJ stopped Visa from acquiring the company.

AI systems can sit on top of large money movement data sets, analyzing network behavior, detecting abnormal transaction patterns, and flagging potential returns in real-time before payments are processed. As a result, companies can offer near-instant payment experiences via the ACH network — e.g., Robinhood can unlock $100M in instant funds on an annual basis, letting investors trade instantly after funding their account.

Emerging real-time payment rails are also creating new opportunities as companies shift their expectations of network performance, and users demand a modern financial experience. FedNow, the faster payments service in the US, has been seeing considerable adoption with nearly 900 participating financial institutions.

The company has moved to support these rails through its Plaid Transfer product, offering Instant Payouts via FedNow and RTP.

Plaid was founded in 2013, more than a decade ago. During that time, financial technology transformed from a niche industry to a global digital behemoth powering payments, banking, lending, investing, and insurance. According to F-Prime Capital, 2023 saw $50B of venture investment, about 10x more than the investment flow in 2015. On a cumulative basis, over $300B was invested in the industry.

Plaid is one of the winners of this trend, especially in horizontally integrating the financial services industry’s disparate data pipes into a more modern package. Further, the CFPB just recently finalized rule 1033, which will further catalyze the opening up of bank data across the United States, bring it up to the level of open banking in Europe, and accelerate fintech trends.

The next leg of growth for Plaid will need to come from delivering deeper value to customers, closer to the core business of manufacturing the financial product. With the right level of investment into AI and insight generation, Plaid could transform its prowess in data and user verification to being an engine for credit underwriting, anti-fraud risk management, and cheaper / faster money movement at machine scale.

👑 Related Coverage 👑

Analysis: Stripe and Coinbase embrace Generative AI + our AI investment index

We discuss how fintech firms like Stripe and Coinbase are positioning themselves to leverage Generative AI and blockchain technology. Stripe is partnering with leading AI companies, like OpenAI, for payment processing while also using AI to enhance fraud detection and improve user experiences. Coinbase is building blockchain-based financial infrastructure to support AI agents, focusing on digital wallets and decentralized finance as traditional systems may not meet AI’s evolving needs.

We explore the potential transition from centralized AI models to decentralized frameworks where blockchain intersects with AI, and provide a quantitative update on our Western, Eastern and Decentralized AI investment index.

🚀 Level Up

Join our Premium community and receive all the Fintech and Web3 intelligence you need to level up your career. Get access to Long Takes, archives, and special reports.