Hi Fintech Architects,

Welcome back to our podcast series! For those that want to subscribe in your app of choice, you can now find us at Apple, Spotify, or on RSS.

In this conversation, we chat with Sarah Levy - CEO of Betterment, the largest independent digital investment advisor. Sarah brings over 25 years of brand building, customer loyalty, corporate strategy and operational excellence to her role, and she has a passion for taking businesses to the next level.

Sarah started her career at Disney and then spent over 20 years at Viacom, home to beloved brands including Nickelodeon, BET, MTV, and Comedy Central. Through a series of senior leadership roles, culminating in Chief Operating Officer, she led global strategy, finance and operations while shepherding global media phenomena, from SpongeBob to The Daily Show with Trevor Noah.

Previously, Levy served as the Chief Operating Officer at Nickelodeon for over a decade, and drove expansion of the brand and business both organically and through acquisitions. This passion for brands and consumer experience is critical in today’s financial services environment where investors have many more choices of where to entrust their resources than they did even a few years ago. Their desire to work with companies that understand them and reflect their values is central to the value proposition that embodies Betterment. Levy is also a Board Member for The Lucius N. Littauer Foundation, Inc. (2012 to Present), ACON S2 Acquisition Corp (September 2020 to Present) and Funko (2019 to Present).

Topics: Fintech, embedded finance, banking, investment, RIA, Tax, roboadvisor, advisory, branding, 401k

Tags: Betterment, Nickelodeon, Disney, Viacom, Schwab, Fidelity

👑See related coverage👑

Fintech: How can Robinhood afford 3% cash back on its new credit card?

[PREMIUM]: Long Take: Everyone should trade the billions in DeFi Structured Products! Or do digital asset derivatives need custodians and regulators?

[PREMIUM]: Long Take: Betterment launches bank accounts into a world that has changed completely

Timestamp

1’10: From Nickelodeon to Betterment: Tracing Sarah Levy's Journey Through Media and FinTech

7’22: Brand Personification and Audience Engagement: Exploring Digital Transformation with a lens on the consumer

13’33: Mission and Brand Resonance: Transitioning Leadership at Betterment

16’50: Initial Impressions and Strategic Directions: Enhancing Betterment's Brand and Services

21’41: Refining FinTech: How Betterment Evolved to Meet the Needs of Modern Investors

24’58: Building Betterment's 401k Business: Strategic Growth and Market Opportunities

34’45: Revamping RIA Economics: Betterment's Innovative Approach to Advisor Services

39’41: Beyond the Super App: Betterment's Strategic Approach to FinTech Diversification

44’12: Focused Growth: Betterment's Strategic Decision to Prioritize Long-Term Investing Over Self-Directed Trading

47’09: The channels used to connect with Sarah & learn more about Betterment

Illustrated Transcript

Lex Sokolin:

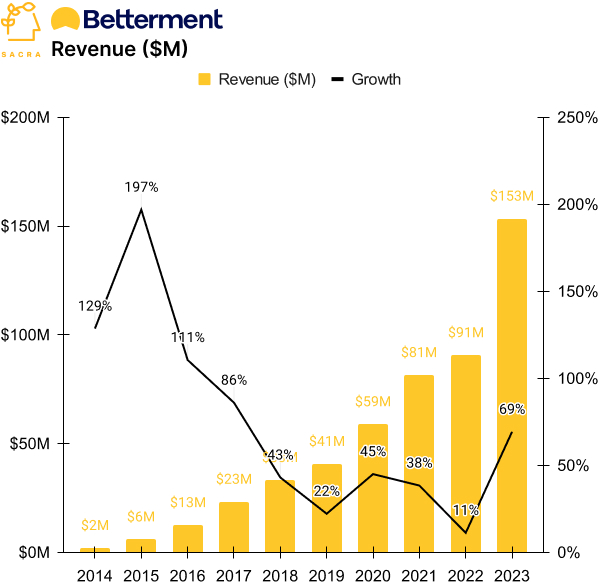

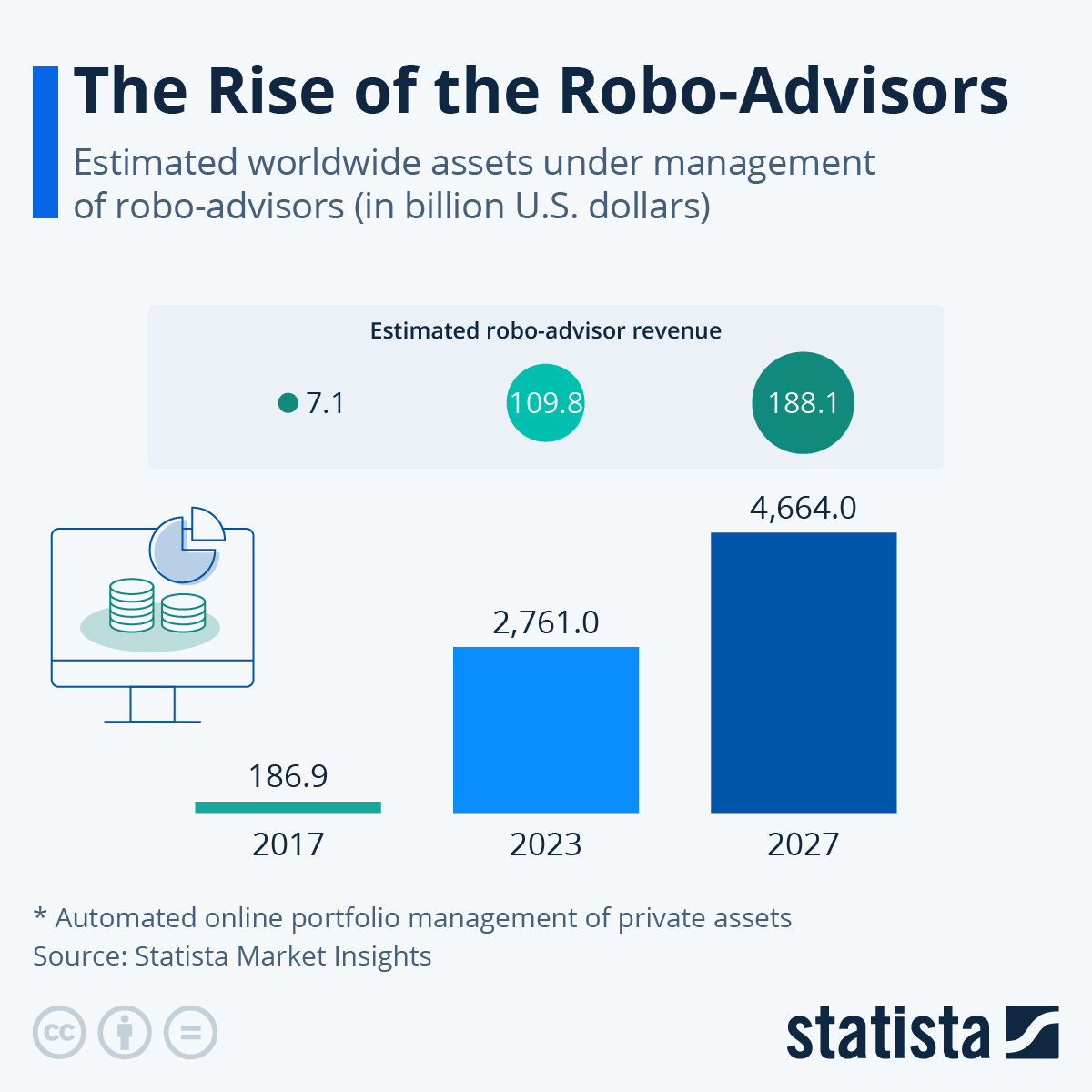

Hi everybody, and welcome to today's conversation. I'm absolutely thrilled to have with us today, Sarah Levy, the CEO of Betterment. Betterment is, of course, the original robo-advisor now with over 45 billion in assets under management. I'm really excited to learn from Sarah about what Betterment is doing now as well as go deeper on her career as the CEO of Nickelodeon and understand the broader market for culture and human behavior. With that, Sarah, welcome to the conversation.

Sarah Levy:

Thank you, Lex. I'm excited to learn from you as well, so let's see where we go.

Lex Sokolin:

You have a fascinating career going from a very senior operating role in a media company, Nickelodeon, to management and wealth management in FinTech. I'd love to understand your early career and especially what were some of the things that attracted you into that space in the beginning, and what were some of the skills and threads that you pulled on and developed over that time?

Sarah Levy:

I started my career in media really because I was looking for something to be passionate about, and I've always believed that what makes a great executive is someone who's infinitely curious and loves what they do. Early in my career, I loved the movie business, I loved television, and I thought, "Wow, if I could work in a business that was my hobby, that would be great." I actually started at Disney and then went to business school and then really grew up, as you said, at Nickelodeon and ultimately Viacom the parent company, which is now called Paramount Global. I spent 18 years at Nickelodeon really starting in the strategy and business development area.

Then that took me in sort of all different directions and when I think about my Nickelodeon and then Viacom experience in sort of two chapters. The first chapter is really growth years, and I think now we think about cable, and we think, oh my God, think about streaming and cable doesn't seem like sexy in a growth business, but that first decade, for me, it really was a growth business. I joined Nickelodeon, not because per se, it was a cable business, but more because I believed in the power of kids' intellectual property. When I worked for Disney, there was this notion that when you tell people what you do, they just smile.

I loved that there was something about the brand that I really connected to. I was attracted to Nickelodeon the brand, and then a lot of the IP that we birthed off of that brand from SpongeBob to Paw Patrol to Teenage Mutant Ninja Turtles, which we actually acquired and re-imagined. It was really about how do you take that IP? Unlike in adult intellectual property with kids, you can imagine worlds, right? You can imagine digital worlds; you can imagine clothing and the theme parks and resorts and all of the extension’s kids playing with toys. Those were all the sort of growth opportunities that I saw.

That actually while I was there, I built, so I was responsible for building all of those, what I'll call off-channel businesses. Then the second decade was more of the transformation years, which was the rise of streaming. This will ultimately get me to sort of how do I land here in FinTech and a digital first brand and business, but transformation years where sort of cable was coming under attack, the business model was really challenged, and the question was sort of how does an incumbent fight back and transform itself in the face of digital challengers? That's how I spent my second decade and ultimately moved from Nickelodeon up to a more expanded corporate role that was multi-brand and multi-demographic.

Lex Sokolin:

It's impossible to summarize 13 years in a couple of sentences, but I'm curious to pick on a couple of the words that you've used starting with brand. Can you talk about what brand meant to you and what brand building is? If you, in your roles had, what were the processes around creating and maintaining that?

Sarah Levy:

Creating a great long-term brand, enduring brand, I would say, is a really, really long game. It starts with the customer, and it starts with really understanding the motivations and whether it's the pain points, whether it's the problem you're solving or the delight you're providing, but what are you bringing uniquely to that customer? At Nickelodeon we had a saying, "What's good for kids is good for business." Just a small example would be we thought about the complexion of kids and how do we reflect kids back as they are? A lot of media shows very glamorous, people think of the Academy Awards, think of, and beautiful people.

I think the thing about kids is they want to see themselves reflected in the content they consume. That was a core principle, to really understand that about kids. Another thing that was important was understanding that parents were a part of the picture there. They were a customer, if not the immediate customer, the adjacent customer. Particularly when kids were young, parents wanted content that was enriched with educational goodness. We spent an incredible amount of time cultivating all of the educational elements and the research. I would say for me, brand building, again, starts with the customer, really understanding them qualitatively as well as quantitatively.

Then from there, building them something that either solves a problem or that they adore, and/or, I should say. Then taking that beyond is, okay, once you do one thing really, really well and they fall in love with you, how do you think about the potential that unlocks for other business growth and expansion and always coming back to that customer, always coming back to the research, always coming back to your only as good as your weakest link.

Lex Sokolin:

I like the phrase that it's once they fall in love with, you because it suggests that there is a you to fall in love with. Do people fall in love with a Walmart? I mean maybe some people fall in love with Costco, but you do have to create these attributes and personify a giant corporate thing into an object that you can have affection for. That's, I'm sure it was especially difficult for one that relates to kids. Going one more step towards the customer, in that role, were there personas for different types of kids? Were there different, how were you splitting the audiences and were there attempts to personalize to different profiles?

Sarah Levy:

Well, the simplest answer started with what I'll call little kids and big kids. You had preschoolers and you had older kids and there was, obviously, a spectrum there in terms of what they could understand and also how as we moved to digital in particular, how self-directed they were versus coming back to the parents. The experience that you created for a preschooler was really, really different. Of course, while I was at Viacom and Nickelodeon, came the advent of the iPhone and the iPad. Imagine the sort of pre-iPhone iPad and post-iPhone iPad, how different that was.

You suddenly found that a three-year-old could navigate the technology in a way that you never imagined. Whereas on television, the remote control really required the parent to change the channel. When you think about the personalization, it went yes to the content, but then it also went to the experience. I think over my time at Viacom, we went from sort of content is king and we just have to create great stories and great characters to content is king and platform is queen. Then you had to start to realize that how you delivered that content was as important and as much a part of the experience as the actual content. That's where you started to stretch the capabilities of the traditional folks who had been employed by the company.

Lex Sokolin:

There's an analogy here that's going to come to robo-advice around digital distribution and the trend of digital distribution starting with the internet and Napster, hit media first. That transition to digital distribution of media, which happened in the mid-2000s and then through your time at Nickelodeon and Viacom, really changed the economics of everything. It transformed where the cash flow went and who got paid and how. Can you talk about that in the context of your tenure there? What were the changes and how did you have to react? Of course, there's obvious analogies to the robo-advisor business, but I'm curious as to how you were able to navigate that.

Sarah Levy:

My love of diversified revenue streams began with cable. The beauty of the cable business as compared or as juxtaposed with the broadcast business is that the broadcast business was an ad-supported medium and cable had dual revenue streams with the subscription revenue and ad revenue. Then the kid’s media business on top of that had a third revenue stream, which was all the products and kind of downstream revenue that came off of the love of the characters. We had an advantage, and we had an incredible margin that was really almost impossible to replicate.

Enter streaming and you have the rise of Netflix, and they basically say, "Look, your consumer experience is no good with cable. You're making us watch the show when it's on and it's packed with advertising, and we can give the user a better experience." But their model had only a single revenue stream. What we're seeing now, if you fast-forward, of course, is that now they're realizing that to expand their target audience, they actually have to add another revenue stream. Now they're re-entering the ad model a decade later, after, I don't want to say putting out of business the OGs, but in some ways, putting out of business the earlier companies that were benefiting from the dual revenue stream picture.

Lex Sokolin:

Absolutely. One last question in this area and that is around maintaining that love of the customer. Were there any examples or any experiences you've had when the brand was about to be negatively impacted, something happened that could ruin the perception of the company? What are the types of things that can occur to lead to that kind of experience or crisis and what's the way to respond to that? How did you see it handled?

Sarah Levy:

Well, I definitely think the move for us from animation into more live action production, when you just start having kids and real kids and real adults on sets, it introduces a whole another level of risk. You can really control an animated character incredibly well, as you might imagine. Definitely, as we grew, we added a lot of real stars into the picture, and that created just new challenges I would say, because you don't know what and who represents your brand is going to do.

Then enter social media and you had to, again, these are the early days of social media, you had to really figure out how much can you control outside of your ecosystem. That became, thankfully, we didn't have any enormous scandals while I was there that were really that brand debilitating. But I think there were also the sort of technology evolution can impact your brand as well and can impact a lot of the partnerships that you build, right? Because we had an incredible power when I started at the company, because we had a huge platform and as technology entered and there was more access basically outside of the walls of our cable network, call it.

It really caused us to think about how do you move to YouTube and how do you allow the content there or not? How dangerous can some of the advertising that sits alongside your content when you've been providing something really, really protected to kids. How do you think about all those things? There were a lot of different vectors of how do you go from a walled garden essentially to this massive content that you have a lot less control over? I think those were some of the thornier times for us.

Lex Sokolin:

It's something that is ephemeral and much more difficult to repair once it's been damaged. I think navigating these types of big platform shifts is really difficult, but let's switch to investment management and Betterment. How did you come across the company and what attracted you to it in the first place?

Sarah Levy:

The company found me. I knew someone who knew a board member. It wasn't a traditional search, and Betterment was at sort of the cusp of the next chapter, I would say, in terms of scale. They were talking to all sorts of potential leaders. The founder, John, was really a zero-to-one guy and built something fantastic and saw around corners. I think I owe him a lot in terms of the three businesses that he set up that I've now been fortunate enough to kind of take from here. But I was first and foremost attracted to the mission.

Our mission is making people's lives better, and this idea that finances sort of sit at the intersection really of everything you do in your life. The values that the company espoused I really loved, and that's kind of where it started for me. The second was brand potential. I grew up around great brands, I built great brands and I had never heard of Betterment when they found me. Unlike you, I wasn't sort of sniffing around the wealth tech area. I had never heard of the company, and I thought, "Wow, this is just an incredible product, an incredible brand with some great core values. No one's ever heard of it."

Maybe not nobody, but certainly in my circles, no one had heard of it. That was really exciting to me. Then the third was just the opportunity to grow and scale something, which is Nickelodeon now is a big brand that everyone's heard of, but when I got there, it was pretty small in my days at Disney, Nickelodeon was barely on the radar. We really did build that brand. The opportunity to do that again was really exciting for me.

Lex Sokolin:

What were the core products that Betterment had at the time when you joined and what state were they in? What scale were they in? What was the AUM? If you could just anchor us kind of in that starting point.

Sarah Levy:

I arrived in the fourth quarter of 2020, so also sort of a funky time to be starting a new CEO gig, right? It was the midst of COVID, everyone was still working from home. The primary business, Betterment was best known really for the retail business, the consumer business, which first and foremost was an easy to use, affordable digital solution that had both savings and investing and that was really what I'll call the core business. Then there were two other businesses that were really, I would say products more so than businesses at the time.

They were the beginnings of a 401k product for small and medium-sized businesses, and then an advisor platform that was really born off of the retail platform. But again, it had been around for a couple of years, but early stages in terms of go-to-market and really connecting with the advisor community. The first thing, oh, to answer your question about AUM, the AUM was about half of what it is now. It was 23 billion and we're now at 45.

Lex Sokolin:

Looking at this picture, what came to mind for you? How did you characterize it? What did you think were some of the big opportunities around it? Were there things that kind of popped out at you as pull this lever and it's going to be amazing? What were your initial reactions?

Sarah Levy:

I think the things that I saw initially were probably sticking closely to my roots, and then my thoughts evolved as I was here and as I learned more about the business. The first things that I saw were perhaps superficial but were really focused on the brand and the experience. I felt that, for example, we needed to be mobile first and we were desktop first. That was sort of an obvious first move to me to sort of double down on the resources we were putting towards mobile and really reorient towards that needs to be the way we look at everything in the first instance.

I looked at customer service right out of the gate and said, it's not good enough and you're only as good as your referral program. We got to fix that, and we brought in somebody great really early on to sort of turn that around. Then I looked at the brand and the sort of what I called the first impression, which was really everything before you became a customer. I felt that our presentation had a lot that we could improve upon in terms of the look, the feel, the warmth, the way we, just all the language that we used.

Both the visual design and the language, I just felt like it could be a more approachable brand. Brand and customer are kind of where I started and less so about investment selection and less so about the three businesses. Then the next thing that happened is that the investors said, "Okay, well we need to raise money." That was something candidly I hadn't done before. I needed pretty quickly a growth thesis beyond the stuff that I was going to operationally improve. I fell pretty quickly in love with the 401k space.

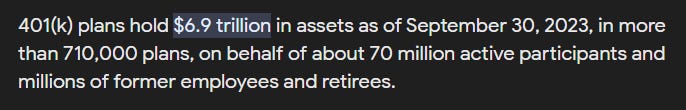

I really thought, "Okay, this is a societal problem that is enormous." There are some interesting regulatory tailwinds that I came to understand at the time, and I really thought there was nobody doing a great job of expanding access to not only small business, but mid-market businesses in the 401k space, and quickly learned that there are 6 million small and medium-sized businesses in this country, and at least half of them, if not more, weren't offering retirement solutions to employees. That just seemed like a great opportunity to both be mission aligned and also go after a big TAM.

Lex Sokolin:

I think a lot of the early robo-advisors, including the stuff that I worked on, we were finance people who thought that the software sitting inside of investment management firms can be liberated and turned into web-to-Silicon Valley-type products. That ended up creating really, maybe technical is not the right word, but certainly more technical products that as a cohort we try to polish into consumer products. It's difficult to really take out that initial seed of, I want to see the numbers, I want the logo to be an analogy for a risk bar. I want to compare portfolios and pie charts and things like that.

This is one of the traps that I think finance people or FinTech entrepreneurs fall into, which is to say that they'll generalize out of their own relationship to finance and their love of quantifying things and making the "right choice." But for the average investor, that's just not the case. That's not the experience that they have. If anything, for many people, their initial experience with financial products is really negative. It'll remind them that they're broke, and they don't have money, or it'll remind them about their mortgage and the lawyer that's calling them.

I think it is really difficult to move that impression from a technical product to a warmer brand. It reminds me a little bit of, I'm based in the UK now, and in the UK, instead of robo-advisors, we have neobanks. If you know the neobank space, you've got the sharp players like Revolut, which is a Robin Hood, I would say spirit animal, and then Monzo, which is kind of Chime. Then you've got Starling, which I think is actually quite closely aligned with the Betterment brand, in terms of how it tries to be more human and appealing.

This is all a big wind up to get your view on what you think Betterment clients feel towards Betterment and how you've changed the persona or the tilt of the brand to be more approachable? But specifically, who is it for? What does it mean? What does it stand for? If you're starting at that place of, we're liberating financial software, now you have it, if you're starting from that place, what is the place that you're going to?

Sarah Levy:

I think the question inherently lends itself most to our retail business, right? Because you're asking about the sort of core retail customer, who at this moment in time is a 40-year-old millennial professional. That's how we think about them. That is someone who is not necessarily a first-time investor, although one of the things that we are most appreciated for by our customers is ease of use and approachability. I think we are a great place to start, but I think my aspiration is that we are a brand and a platform that will grow with you.

One of the insights is that even when I got here, the core customer or the average age was in the after 35, 36, 37, that kind of age. Now, not surprisingly, three years later, we're 40. But the distinction there is important because these are really important life moments. What we're building, what started as expanding access and affordability and ease of use is now becoming more of what I'll call a life partner. The key there is more choice, more account types, more content that addresses merging your family and having a partner or getting married, buying a home, having a child. All of these were not our original customers. Our original customers were out of school brand new.

Maybe they were thinking about, do I do this DIY, or do I do something more managed? Really, what we offered was and continues to be, but I think that is not the sum total of what we are, what we offered was an on ramp for people starting their wealth journey that was affordable and accessible in a way that historically financial advisors. I think what we've come to be known for is really the ease of use, the tools, people love the tax harvesting tools, they love some of the set it and forget it, things like recurring deposits.

But originally, this was a really rigid experience was we assumed that people would come to the product with a whole set of goals and a life plan. For a lot of customers, we learned that was a replication of the advisor experience, but that created a lot of cognitive overhead for people. Some people just wanted to say, "I've got some money now. I want to benefit from the power of compounding and help me get started. I don't want to answer all these questions, because I don't know all the answers."

I think one of the things we've done is tried to really evolve the pathways of how people can both onboard and then grow with us so that there is sophistication there, but you sometimes have to dig a little bit to find the sophistication so that it's un-intimidating in the first instance and warm and welcoming, and then you have an opportunity to go deeper as you get comfortable with the platform and with your own knowledge.

Lex Sokolin:

Let's switch to the 401k business. It sounds like the company's had a ton of growth there. Can you talk about the mana from which you were building this and then what were the organizational capabilities that you'd added in order to grow that?

Sarah Levy:

That's a very insightful question, particularly the second half. The seed of the idea was born before I arrived at Betterment. What happened was, and back to something you said earlier about how a lot of folks in FinTech sort of had a personal pain point, and it was from that personal pain point was born a product. That's really how our 401k began, which is when Betterment got sizable enough to need a 401k or to want to provide a 401k for the employee base, they looked around at what was out there and said, "Wait a minute, we can do better and so let's do better." Basically, built their own.

It was a great insight that what existed in the market was sort of clunky and not delightful and tech forward. I think that was great. What the business sort of missed at the time, and maybe it was also a function of just choices, was there is less of an if you build it, they will come in the B2B space. B2B products do need to be sold. Building a go-to-market for a B2B product is a really different playbook than a retail business. What we've done in the last couple of years is really first of all validated the opportunity. The opportunity in a lot of ways is similar to the opportunity that inspired Betterment in the first place, which is this idea of expanding access.

The businesses just below where the big incumbents play, need something that is more affordable and more scalable and more delightful and just easier. Again, the incumbents didn't have all of that and don't have all of that. There was a great opportunity to sort of expand access, I'll call it one click down in terms of size of business. That's kind of where our sweet spot is just below where the incumbents play. Call it a 25-person business to a 500-person business, but the sweet spot is more like 100 to 150 is where people find that we're really useful to them.

I loved the connectivity for the end user, first of all, because if you think about the big, if you think about Fidelity and Vanguard and Schwab, which is really the model, a lot of those first-time investors come via a 401k via their employer. How do you connect those dots, I think, was an important part of the thesis. It's a big market in its own right, but it connects really seamlessly at the end to our core product. A lot of other monoline folks started to enter the space at a similar time as we did.

But I think ultimately, the need is going to be to connect those finances and it's going to be for a customer to say, "Okay, I have my 401k and then I'm going to open an IRA and then let me introduce a taxable account. Let me think about a financial planner, maybe a 529." From the 401k, can blossom a lot of other use cases. I think that's really the magic for us is in that connectivity ultimately for the end user and in the ease of use for the plan sponsor. I think what we may be missed early on, and I'm not going to say, like declare victory at all, but I do think we've put a tremendous amount more focus on, we really understood the end user, but we understood the plan sponsor or the small business owner less well.

The first thing we did is sort of perfected the end user experience and we then came back around and said, "Yes, but the customer here first and foremost is the business owner who needs something that is easy to understand in a space where they have neither time nor expertise." That's the part that we have more recently built probably in the last 18 months. My goal is for that to be as delightful and seamless, and purpose filled as the experience for the end user.

Lex Sokolin:

Let me dig around a little bit in trying to understand this market. My observation is that there are a number of consumer FinTechs that started out going direct to consumer and then went and were distributed through employers and sort of the HR channel as a benefit, as a financial benefit to the employee. It was always kind of strange to see these companies that had a meaningful footprint all of a sudden become almost inaccessible and had to be accessed through an employer. I'm just trying to understand what that market dynamic was. Then when you look at the robo-advisor space, you've got players like Personal Capital being sold off to Empower and Empower being primarily a retirement platform, whereas Personal Capital started out as a sort of mint-plus investing company.

Or if you look at something like Vestwell founded by Aaron Schumm, I think Aaron came from, I think it was Folio Dynamics, which was an investment type RIA portfolio management platform. It's kind of a consistent shift from finding the financial opportunity, going direct versus not going to the RIAs and to the advisors, but going to the small business owner to offer retirement options to their employees. Is there something about the market size that's attractive about this, or is it, you get more revenue out of there because people are less price sensitive? What is the gravity that pulls companies into the space?

Sarah Levy:

Let me step back both to the space and also to how Betterment intersects with that. One of the things that we're seeing increasingly in the space is the convergence of wealth and retirement. It sort of naturally takes me to our third business, which connects here to the second, which is the advisor-focused business that we have. I think what we have done that is different, I think, than the others. Each of these, we serve three markets, and each one is at least a trillion in market size. There's plenty of room for growth in all three.

Whether that's small business, 401k is over a trillion, the various projections on where robo-advisory will take us is within the millennial generation is over a trillion. Then what I'll call the small RIA space for custody plus is over a trillion. Each of these businesses has deep, deep pools of money to go after. I think what is different about the way we have chosen to attack the market space is that many companies pick a demographic, so call it the millennial professional, and try to add more and more products for that demographic. Think about the super app path that a lot of people talked about that was hot a couple of years ago.

We have sort of flipped it on its head and we've said, "Let's build a great tech stack and off of that tech stack, let's build three different go-to-markets." We actually have shared technology, but three discrete and distinct teams serving retail customers, advisors, and small businesses. The interesting thing about what I call three businesses, but I'll almost put that in air quotes, it's really three customer segments, is that the businesses have an incredible amount of overlap, whether that is in the tools and technology, whether that is in the underlying investment selection or whether that is how you sell and go to market.

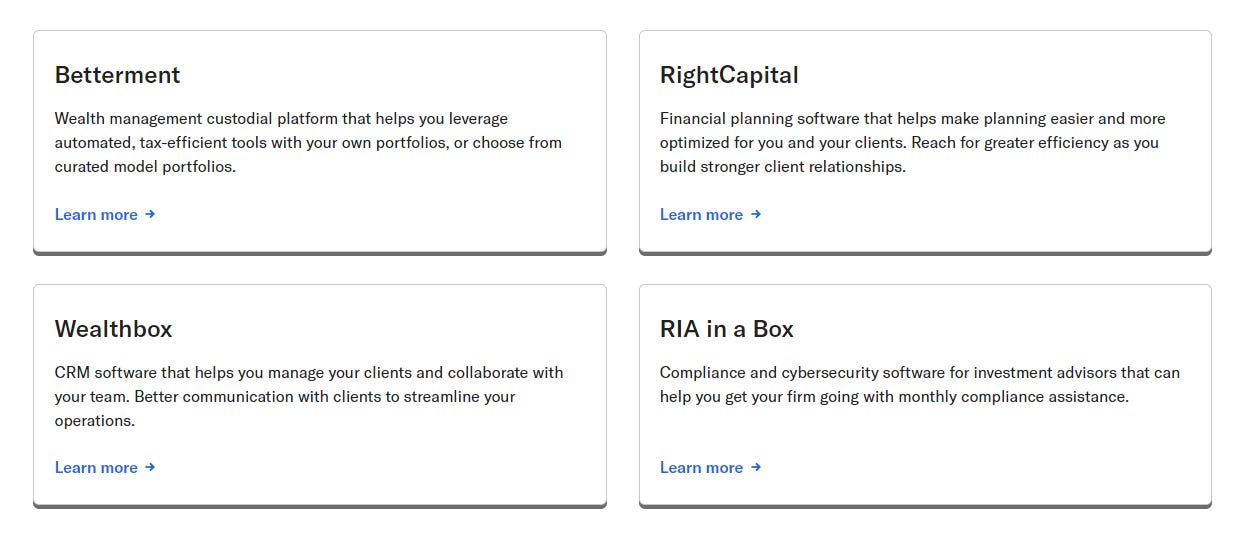

I think the advisor space, which is a place that I'm really, really excited about at the moment, is actually where you can sort of most visualize how it all comes together in the advisor space. Because we are a custodial platform for advisors, we also have a 401k that we sell to advisors. The thing that you're seeing now in the industry is just as the end user has both a retirement account and a taxable account account, so too now does the advisor want to sell.

Either they have a wealth client, and they want to support that client who has a small business by helping them with their 401k, or they have 401k clients for whom they want to use that as lead gen to build a wealth business. What we have now developed is really an end-to-end solution that is a user-friendly platform for advisors, plan sponsors and participants. The set of tools can be accessed by all three groups, but it is really a common tool set. That's where I think we get the incredible leverage and cost advantage as we scale.

Lex Sokolin:

I'm curious as to the economics of the RIA channel. I know last time I looked at it, which, to be fair, was probably 2016, there was the 25 basis points give or take on the consumer channel. Then for advisors, that price point, it depends if they were a planner or if they were a money manager, but often they're quite price sensitive, because they're paying usually five basis points or 10 basis points for their tech stack. But it sounds like you, is it a separately managed account? Is it a custodial account or a subaccount? What's the current economic and product formulation for an RIA that is working with Betterment?

Sarah Levy:

Yes, it's a separately managed account. Just to answer that specific question. We have three products that are interoperable and that we sell together. There's the custodial platform, which I'll call all-in-one custodian plus, which obviates the need for some of the other technology that many an RIA uses. You can plug a couple of tools into the Betterment platform essentially, and then have a full end-to-end suite. Many of these RIAs are actually currently using as many as 10 tools.

We eliminate the need for, call it six or seven, depending how you want to count, out of that stack of 10. Then they have the opportunity to sell 401k's on our platform and then the incremental opportunity where both they and we can make money that is really interesting relative to the incumbents is actually cash. The way the economics work is, it depends on I would say, but it is an AUM wrap fee, but it depends which products you adopt and at what level. Cash is very powerful, because the legacy custodians make all their money on cash, and we pass that value back to the advisor and their client.

What we've seen is an advisor is very willing to pay some sort of a wrap fee on their investing assets and then can bring their customer cash onto the platform without having to sacrifice returns for that customer. I think the biggest challenge has been that many of the competitors market their service as "free," but in fact, there are what I'll call hidden costs. Our costs are just totally transparent and upfront, which is there's an AUM fee on wrap fee depending on the size of your book on the core investing assets. Then, cash we pass back to largely to the customer, but then we keep the difference between our program bank rates and what we pass back to the customer.

Lex Sokolin:

It turned out that people are not as fee sensitive as was expected. I think going down from 1 1/2% management fee to something under 50 basis points is a huge improvement, but end of the day, this is not the thing that regular people are obsessing over. I think it was in the industry there was a obsession of our fee's going to zero, our advisor fee's going to zero, everything's going to be free. But end of the day, that's not the value proposition. People are happy to pay for a good service and a good product.

Sarah Levy:

I mean, everybody always wants things to be cheaper, but I think if your benchmark is 100 basis points for human financial advice, there's a lot of room between the 25 basis points, sort of core price, and 100 basis points. There's a lot of room for various tiers of service, and I think people want great value and people want great service and others are more price sensitive. You have to be able to meet customers kind of where they are with your product suite.

Lex Sokolin:

One of the trends that I think emerged over the last six years, but probably peaked during the SPAC frenzy during COVID was this bundling of FinTech features. You would have someone like SoFi, which built its business around student lending, moving into digital investing on the brokerage side into robo-advice and wealth management into cryptocurrency trading and into banking services with the best yield rate. Then you get that from a SoFi, but then you would also get that on the investing side where you start to open up cash accounts and get yield on those cash accounts.

It felt like a lot of the different FinTechs across these different industries we're kind of converging on the same bundle of stuff, maybe lean into one direction or lean into another direction, but the bundle of financial needs are the same, which is you want to pay, you want to bank, you want to invest, and then you want to, let's say invest for the long term for your retirement. Of course, Betterment added the cash account, added crypto trading and so on. Can you talk about this diversification of financial products and how you think about them coming together into user experience? Then maybe more broadly, is that bundle the destination that you see everyone moving towards or is it more contextual?

Sarah Levy:

I'm not convinced, to me, that was sort of the age of the super app, and personally, I'm not convinced that that's where we land. The reason I'm not convinced is because I think your mobile device can be your super app in some ways, right? It's so easy to move between apps that you're only as good as your weakest link. There is nobody who really has cracked what I'll call excellence across the board in every one of those product segments, because that takes a long time to build.

I mean, someday, sure, but nobody's even close. The way I think about it is we are investing first, and savings is a very clear part of an investing story. It's really just your short-term investing, if you will. I think of saving as an important part of that. Yes, we definitely do hear from customers that they want access to that cash. Some of the things we're thinking about is the sort of historical reality of a savings account and a checking account being these two different things that aren't merged together is a function of both history and regulation that, to me, doesn't make a ton of sense.

I think one of the things I would love to see for us, and I think you will see over time, is more of that accessible cash capability just on top of an investing/savings account. I think that makes a lot of sense, but I think when we think about if your strategy is from a retail perspective, I have one customer type and I sell them one product, how do I grow? Adding customers one-to-one takes a long time and is expensive and it can be done, but it's not easy and it's really a scale game. I think once you do that, what a lot of the monoline competitors are thinking is, "Okay, well now I just have to drive," right?

The way I grow is I have to make more out of those customers. That is definitely a thesis. Not that I don't want to drive, I absolutely do, but I think you have to do it with product excellence. I think of it more as can we be their holistic investing home? Because right now, robo is, I think, a sliver or automated investing. I don't love the term Robo investing anymore. I think it is too narrow. I think we've grown beyond that as an industry as we've added more products and services, but I'm focused more in the investing lane of that expansion. More asset classes, more account types, than I am thinking about trying to solve people's completely end-to-end financial picture.

Then with that expansion of asset classes and portfolios and account types, that also opens you up to grow with your customers and then for your customers to grow perhaps from a retail customer with Betterment to an advised customer with one of our advisors, by way of example, as your needs become richer and more complex. To me, it's more about a lifestyle play in terms of investing and retirement than it is about your budgeting and your planning having to be part of the same app. That's kind of how I'm thinking about it.

Lex Sokolin:

One thing that is sort of notably absent from the product suite, unless I'm embarrassingly wrong, is the self-directed investor from a trading perspective, there's been such an explosion of probably pretty unhealthy behavior, first introduced by Robinhood, but I think culturally, there's this moment where I think a lot of people are getting exposure to investing not from a passive asset allocation point of view, but from a stock picking, cryptocurrency, token picking point of view. That's been reflected in the rise of Coinbase and Robinhood and lots of other trends. Companies like Public and M1, also, I think, do an interesting job of this, but that's a choice in a very different customer segment. Can you talk about the segmentation that leads you not to focus on that, and then whether you have any frustration or any thoughts around the meme investing, the momentum driven stuff that a lot of people are doing?

Sarah Levy:

I think that if I were to jump to the end, which is what is the long term, I think in the long term, if we want to be people's home for all of their investing, that is something we're going to have to offer. I do think that ultimately, what I want to do is I want to be the Schwab or the Fidelity for the millennial generation. I'm not going to get there without having stocks on my platform. That is pretty countercultural to our roots. I think the reason that we get there sort of slower rather than faster is sort of to your point that it's unhealthy behavior.

We did a bunch of research with the target demographic and basically people said, "Look, I set aside 30% of my investing dollars as," and I'll put this in air quotes, "sort of play money, money I'm willing to lose, but 70%, I put in what we'll call serious money." My belief is solving the serious money first, which is long-term, which is good behavior, which is the right habits. There's still so much for us to do in that space that that's where we've started. I will tell you we have introduced; we have built the custodial capabilities to handle single stocks and also to handle mutual funds.

We have built what we call tax smart tooling, so that people can migrate portfolios that they have of held away assets maybe that have big, embedded gains that they can migrate in a sort of thoughtful, tax efficient way onto the platform. Because a lot of times, people hold some of those positions for legacy reasons. They worked at a company, or they inherited a position or something like that, and if they sell them now, they're going to have big tax bill and that's why they don't sell them. We've created an opportunity on the advisor side of our platform for people to sort of unwind those positions in a really responsible way, because you have to understand, there's a lot of asset values sitting in those asset classes.

If we can't accommodate them, then someone's going to have to be multi-custodial by definition, and that's a kooky experience. We have built the capability to hold those asset classes and to sell them responsibly. We have not yet introduced the ability to buy them on our platform. That's sort of the last step of that process. If I'm a betting woman, I don't think we launch that this year, but I would say certainly over the next 24 months, that happens.

Lex Sokolin:

That's fascinating, where the company has gone, and I think your vision for the Schwab or Fidelity for the millennial generation, and probably Gen Z at this time, once you can get them to stop trading meme coins, I think is really insightful and expansive. I definitely agree with your intuition. Sarah, it's been fantastic to have you on the podcast. If our audience wants to learn more about Betterment or about you, where should they go?

Sarah Levy:

You can find us at betterment.com or you can download the app in one of the app stores.

Lex Sokolin:

Amazing. Thank you so much for joining me today.

Sarah Levy:

Thanks for having me, Lex.

More? So much more!

Disclaimer here — this newsletter does not provide investment advice and represents solely the views and opinions of FINTECH BLUEPRINT LTD.

Want to discuss? Stop by our Discord and reach out here with questions.

Like it? Share it!

Share this post